Are Home Prices Going Up or Down? Let’s Break It Down

You’ve probably seen the headlines warning of a housing market crash. But they’re not giving you the full picture. Let’s break down what’s really happening—and what the experts predict for home prices over the next five years. Spoiler: it’s not a crash.

In some areas, prices are leveling off or dipping slightly as more inventory comes online. That’s a natural response to rising supply—not a red flag. The national outlook tells a much more stable story.

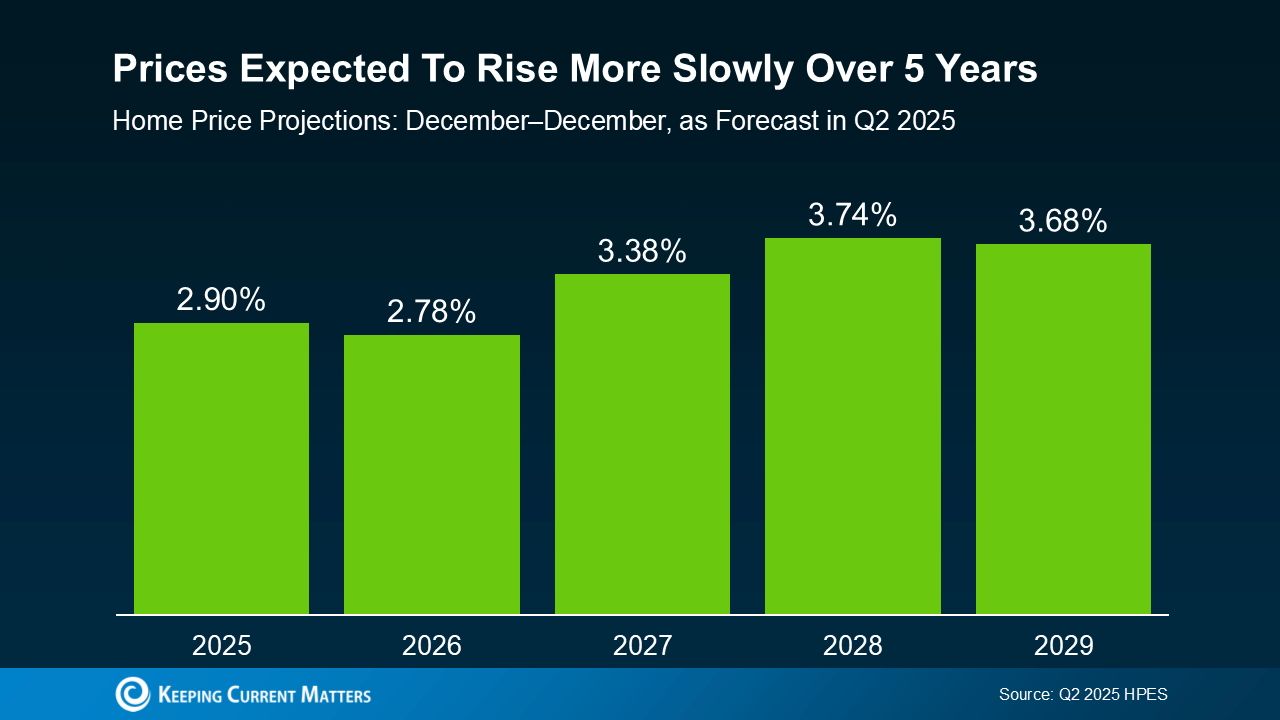

According to the latest Home Price Expectations Survey from Fannie Mae, over 100 housing market experts agree: home prices are expected to rise steadily over the next five years. It won’t be the rapid pace we’ve seen in the past—but slower, more sustainable growth is a good thing. This kind of long-term stability should ease some of the fear stirred up by dramatic headlines. Here’s why the outlook is more balanced than the noise suggests.

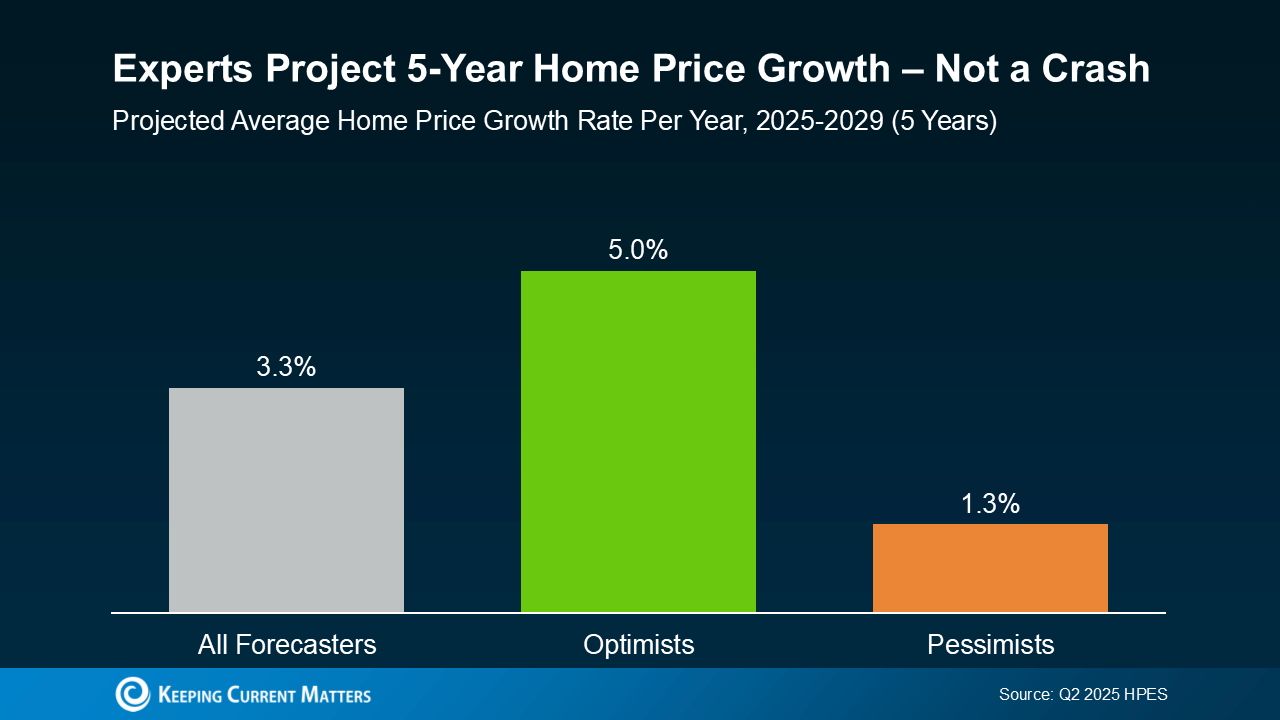

When you dig into the survey results, expert opinions fall into three main groups: the most optimistic, the most cautious, and those in the middle—the overall average.

Here’s how it all breaks down:

- On average, experts project home prices will rise about 3.3% per year through 2029.

- The most optimistic expect growth closer to 5.0% annually.

- Even the most cautious still forecast around 1.3% per year.

So no, the experts don’t all agree on the exact number—but here’s the bottom line: none of them are predicting a major national drop or crash. What they do agree on is a return to steady, more sustainable appreciation.

That’s good news for the market—and for you. Some areas may see prices stay flat or dip slightly in the short term, especially where inventory is growing. Others may outperform the national average due to tight supply and high demand. But overall, this shift toward more moderate price growth is a healthy correction from the volatility of the past few years.

And here’s what really matters: even the most conservative experts still see home prices rising over the next five years. Why? Because foreclosures rates remain low, lending standards are strong, and homeowners have near-record levels of equity. These factors create a solid foundation that helps prevent widespread forced sales—the kind that could trigger a true market crash. So, if you’re sitting on the sidelines waiting for prices to collapse, you may be waiting a long time.

Bottom Line

If you’ve been unsure about making a move, now’s the time to get informed. The data points to gradual, long-term growth—not a crash. Yes, there will be some local fluctuations, but the overall trend is steady.

Curious how that plays out in your neighborhood? National trends are helpful, but your zip code tells the real story. Let’s connect for a quick conversation so you can see what’s happening locally and what it means for your plans.

Categories

Recent Posts

GET MORE INFORMATION