Does Buying a Home in January Really Make Sense?

You might not want to press pause on your homebuying plans this winter. While many buyers assume spring is the ideal time to purchase, recent data suggests January can actually be one of the smartest months for buyers watching their budget.

Surprising? Here’s why January is worth a closer look.

1. Prices Are Usually Softer in January

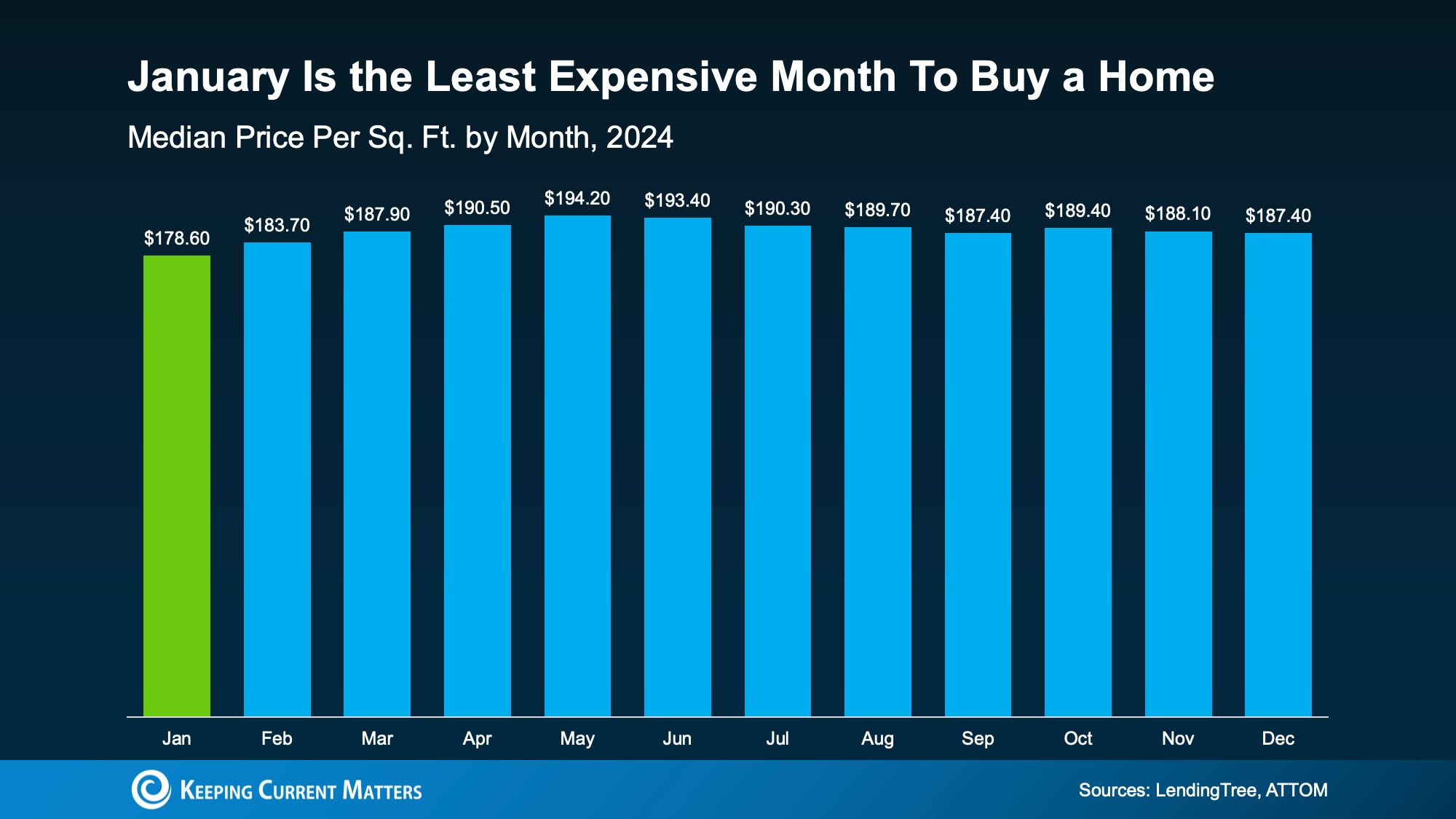

Lending Tree data shows January consistently ranks as the most affordable month to buy a home. Price per square foot tends to be lower than at any other point in the year. Once spring arrives, buyer activity ramps up and prices often follow. That seasonal cycle has played out repeatedly over time.

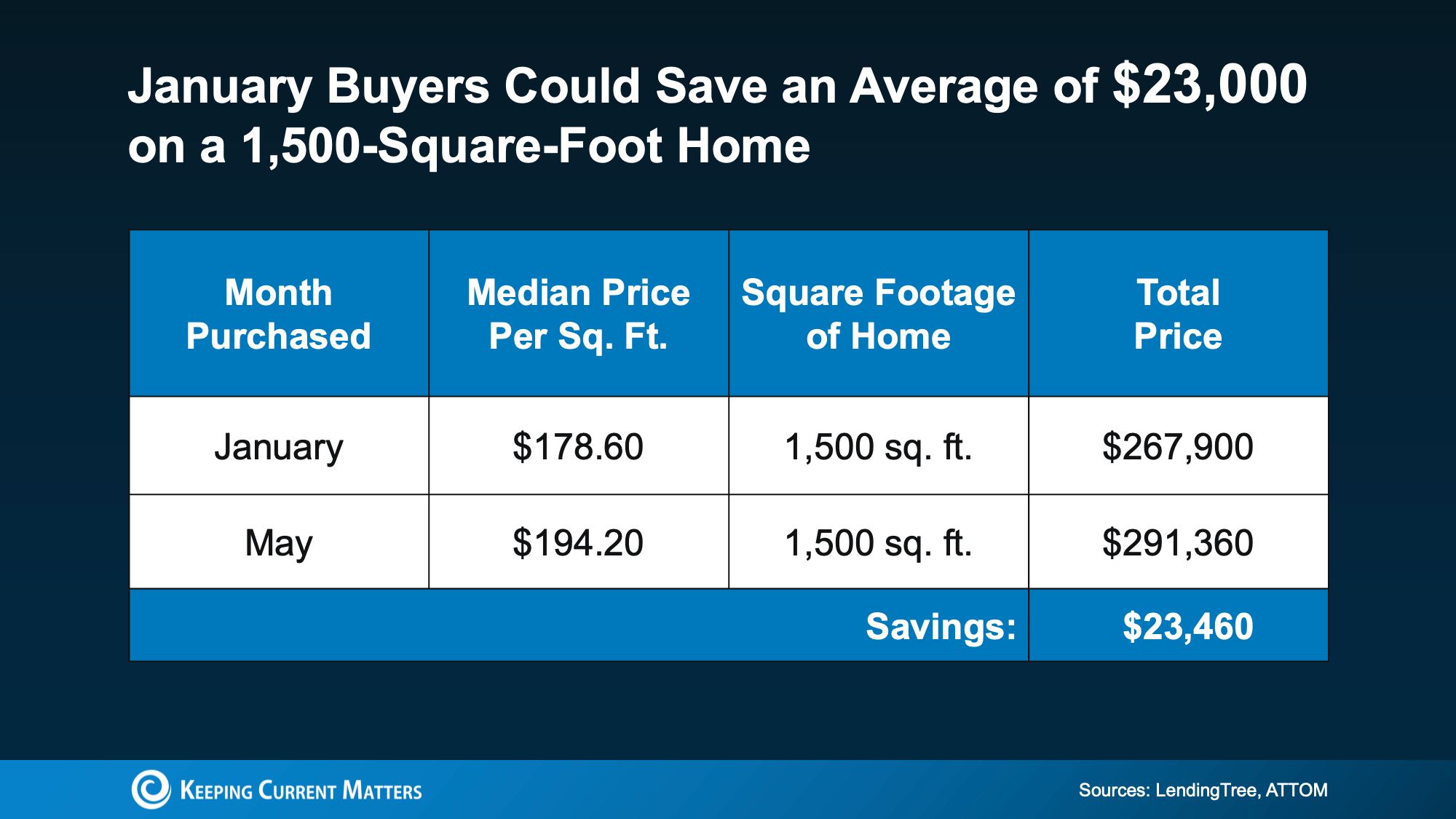

So what does that actually mean in dollars? Looking at the most recent full year of data, buyers who purchased a typical 1,500-square-foot home in January paid about $23,000 less than those who bought in May. And this isn’t a one-off—this pattern tends to repeat year after year (see chart below).

Of course, the exact savings will vary based on the home’s price, size, and type. But the broader trend is clear. For many buyers today, the savings can be meaningful—especially at a time when affordability remains a challenge for many households.

2. Less Competition and More Motivated Sellers

So why do buyers often find better opportunities in winter? Simple: it’s traditionally one of the slowest periods in the housing market. Many buyers and sellers step back, waiting for spring. As a result:

- You face less competition

- Multiple-offer situations are less common

- Sellers are often more open to negotiation

- You can take more time evaluating your options

With fewer buyers actively searching, you’re able to move at a more comfortable pace. Winter also tends to separate casual sellers from those who truly need to sell. With less buyer traffic, motivated sellers are often more open to negotiation. As Realtor.com notes:

“Lower competition reduces bidding wars and gives buyers more leverage on the details that matter—such as closing cost credits, home warranties, and repair concessions. Over time, these negotiated extras can translate into thousands of dollars in savings.”

That flexibility can show up in many ways, from price reductions to seller-paid closing costs or more accommodating timelines. While discounts aren’t guaranteed, buyers are more likely to be taken seriously and given room to negotiate.

Should You Hold Out for Spring?

Here’s the key takeaway: when you strip away the pressure and frenzy of the spring market, it’s often easier to secure the right home at a price that works for your budget.

Waiting until spring usually means more buyers, more competition, and higher stress—often at a higher cost.

While the timing has to fit your life, don’t assume warmer weather automatically means a better opportunity. January often offers less competition, potentially lower prices, and more motivated sellers—advantages that tend to disappear once spring demand picks up.

Bottom Line

If you’ve been considering making a move, this time of year may offer more opportunity than it gets credit for. With fewer buyers in the market and sellers who may be more open to negotiation, winter can create conditions that work in a buyer’s favor rather than against them. Instead of assuming it’s better to wait, it’s worth exploring what today’s market could realistically offer you.

If you’re curious about what buying in January could look like in your specific situation, connect with a local agent who can walk through your numbers, review current inventory, and help you understand the options available in your area.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Does buying a home in January really make sense?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, it often does—especially if you're budget-conscious. While spring feels like prime time for homebuying, data shows January ranks as one of the most affordable months. You can see softer pricing, less competition, and more motivated sellers, which can make it a smart move before the spring frenzy starts. Learn more at https://listwithjameslynch.com/." } }, { "@type": "Question", "name": "Why are home prices usually lower in January?", "acceptedAnswer": { "@type": "Answer", "text": "LendingTree data indicates January often has one of the lowest price-per-square-foot points of the year. Buyer activity tends to dip in winter, which can keep prices softer until spring demand pushes them up. In the most recent full-year data, a typical 1,500 sq ft home cost about $23,000 less in January than in May—and this seasonal pattern commonly repeats." } }, { "@type": "Question", "name": "How much can you save buying in January versus spring?", "acceptedAnswer": { "@type": "Answer", "text": "Savings depend on the home’s size, price, and location, but recent data highlights a meaningful gap: buyers of a typical 1,500 sq ft home paid roughly $23,000 less in January than in May. With affordability still tight for many households, seasonal dips like this can make a noticeable difference—especially as spring prices rise with increased buyer demand. Explore options at https://listwithjameslynch.com/." } }, { "@type": "Question", "name": "Is there less competition when buying a home in winter?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Winter is typically a slower season, and many buyers wait for spring. That often means fewer multiple-offer situations, more time to evaluate homes, and more negotiating room. Sellers may be more open to discussions around price, closing costs, repairs, or other concessions—especially when competition is lower." } }, { "@type": "Question", "name": "Why are sellers more motivated in January?", "acceptedAnswer": { "@type": "Answer", "text": "Winter tends to filter out casual sellers, leaving a higher share of sellers who truly need to move. With fewer buyers touring homes, motivated sellers may be more flexible on terms to get a deal done—such as price adjustments, seller-paid closing costs, repair credits, or timeline flexibility. These advantages often fade once spring activity ramps up. More seller insights at https://listwithjameslynch.com/." } }, { "@type": "Question", "name": "Should you wait for spring to buy a home?", "acceptedAnswer": { "@type": "Answer", "text": "Not always. Spring typically brings more buyers, more competition, and often higher prices—plus more stress. January can offer a calmer market with fewer bidding wars and better negotiating conditions. If the timing works for your life, winter can be a smart window to buy without the spring rush. See current opportunities at https://listwithjameslynch.com/." } }, { "@type": "Question", "name": "What are the biggest advantages of January homebuying?", "acceptedAnswer": { "@type": "Answer", "text": "Common advantages include lower price-per-square-foot trends (as cited in LendingTree-style seasonal analyses), reduced competition and fewer bidding wars, more motivated sellers who may offer concessions, and more time for due diligence and searching. Together, these can create buyer-friendly conditions that often shift once spring demand returns. Start your search at https://listwithjameslynch.com/." } }, { "@type": "Question", "name": "How can I explore January homebuying options in my area?", "acceptedAnswer": { "@type": "Answer", "text": "Connect with a local agent to run your numbers, review inventory, and compare listings that match your budget. You can also browse current homes and market updates at https://listwithjameslynch.com/. A local expert can help you spot real opportunities and negotiate terms that matter—especially in a lower-competition season like January." } } ] }

Categories

Recent Posts

GET MORE INFORMATION