One in Four Massachusetts Homebuyers Are Going Over Budget — Here’s Why

Buyer confidence is slowly returning across Massachusetts, but so are the bidding wars.

With home prices back on the rise in most metro areas — from Boston to Worcester to the North Shore — more local buyers are stretching their budgets just to stay competitive.

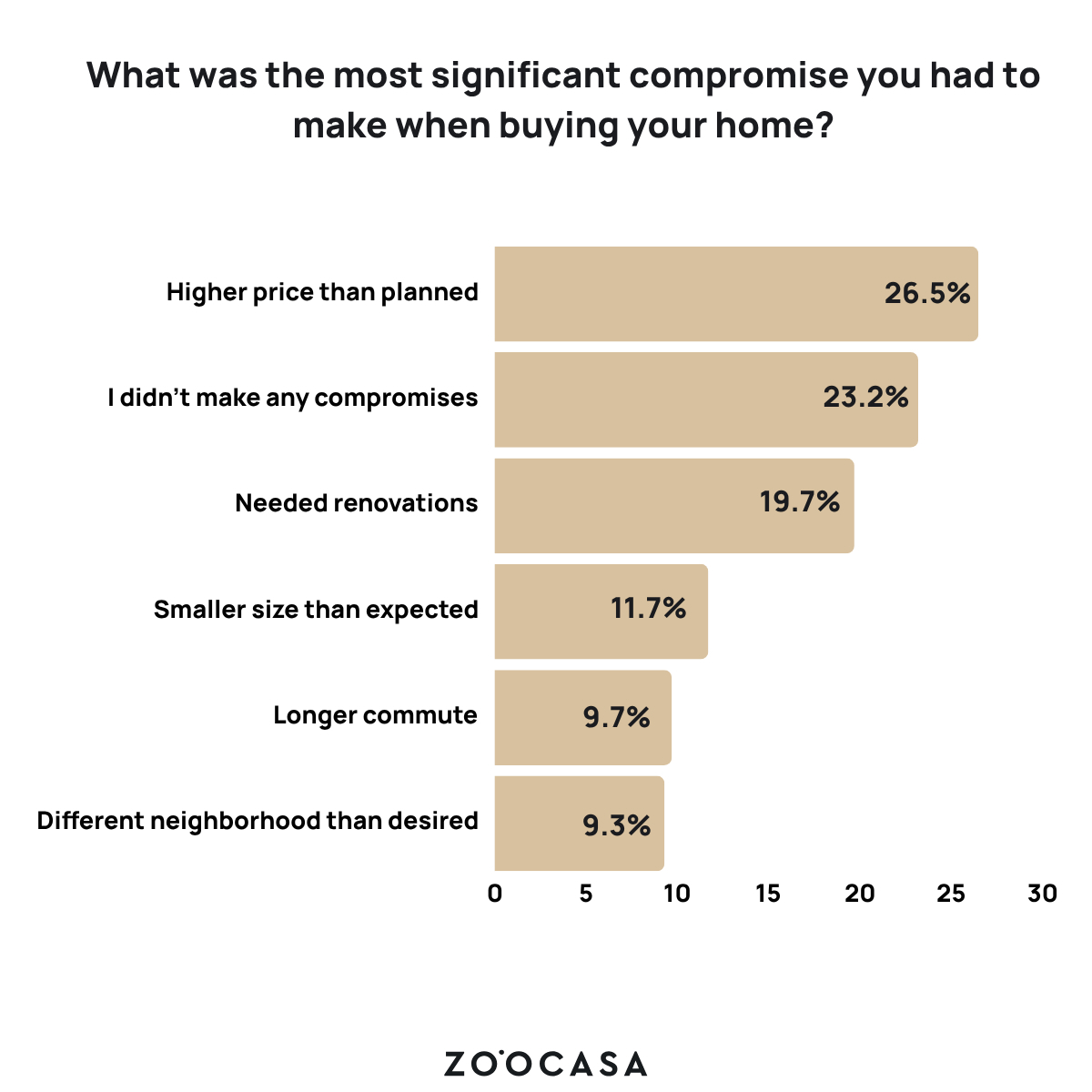

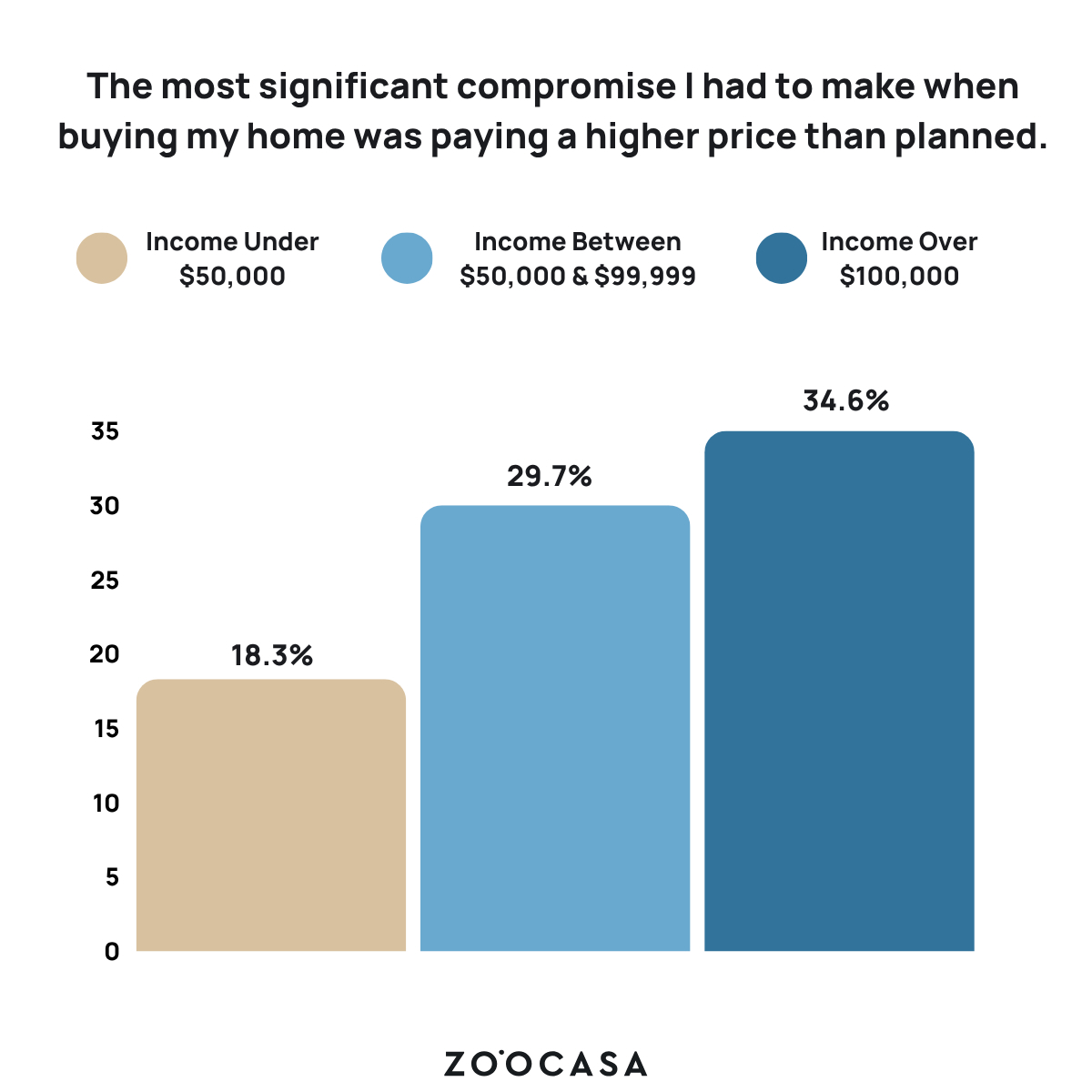

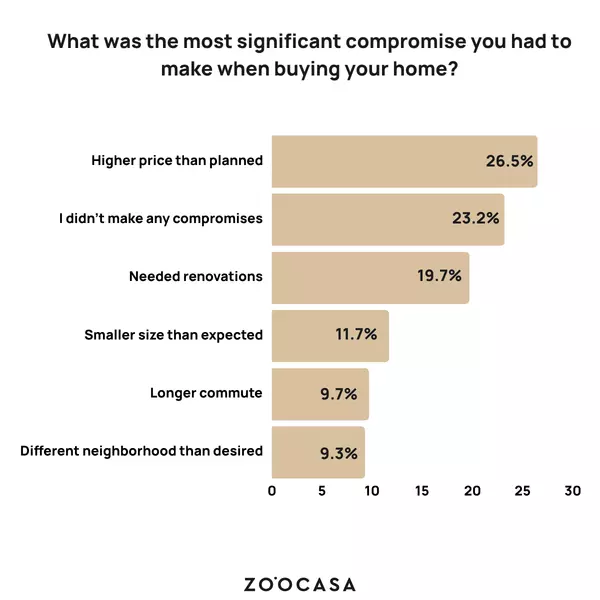

According to recent national survey data, 1 in 4 American homebuyers ended up paying more than they planned for their home. In markets like Boston, Cambridge, and Newton, where demand remains sky-high, that number may be even higher.

Over Budget, But for the Right Zip Code

Across the state, location continues to outweigh price.

Roughly 43% of buyers said location was their #1 deciding factor — far ahead of price, layout, or square footage. In Massachusetts, that often means paying a premium for walkability, top-rated schools, or access to the commuter rail.

Buyers are willing to compromise on:

- Homes that need updates or renovations (nearly 20% did)

- Smaller square footage than expected (about 12%)

- Longer commutes to work (roughly 10%)

In other words, many buyers in Greater Boston and the surrounding suburbs are saying: “I’ll sacrifice space — not location.”

Trust Still Drives Real Estate Decisions

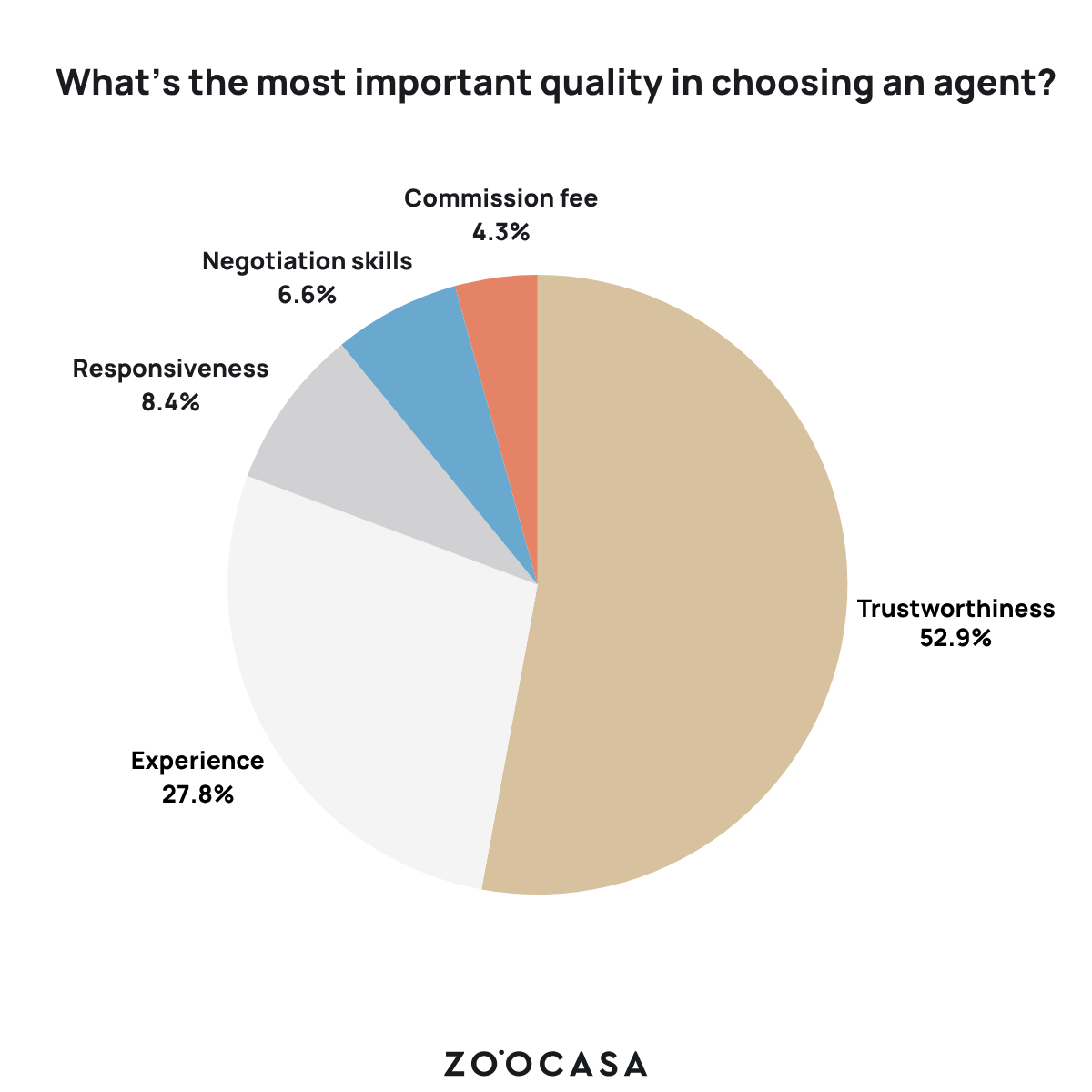

In a market as competitive as Massachusetts, the relationship between buyer and agent matters more than ever.

Over half of all homebuyers (52.9%) said trust is the most important quality in an agent — even more than experience or negotiation skills. That’s especially true for first-time buyers navigating towns like Peabody, Wakefield, and Woburn, where price differences can vary block by block.

Most buyers found their agents through:

- Referrals from friends and family (38.5%)

- Online searches and real estate platforms (31.5%)

Interestingly, even though fewer than 10% rely on social media to find listings, most still believe it’s important for agents to market homes on platforms like Instagram, Facebook, and YouTube — a sign that digital visibility now reinforces credibility.

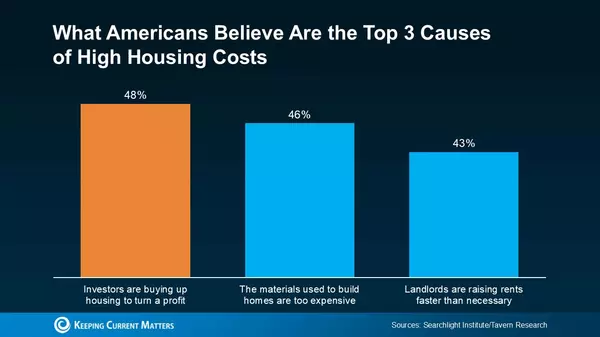

Renters Want to Buy, But the Math Still Hurts

Renters across Massachusetts — from Boston apartments to North Shore condos — still want to buy.

But many are delaying their first purchase 2–5 years out, citing affordability as the biggest barrier. A significant 22% said financial limitations were the main reason they haven’t yet purchased.

With home prices up 6.1% year-over-year in the Northeast, and interest rates only slowly easing, renters face a tough climb. Many are also less financially secure — nearly 40% of renters said they could cover expenses for only 1–3 months if they lost their job, compared to 30% of homeowners who could last six months or more.

That gap makes saving for a down payment harder, especially when monthly rents in places like Cambridge, Somerville, and Medford rival mortgage payments.

What’s Next for Massachusetts Housing?

Affordability challenges aren’t new here — but they may be shifting.

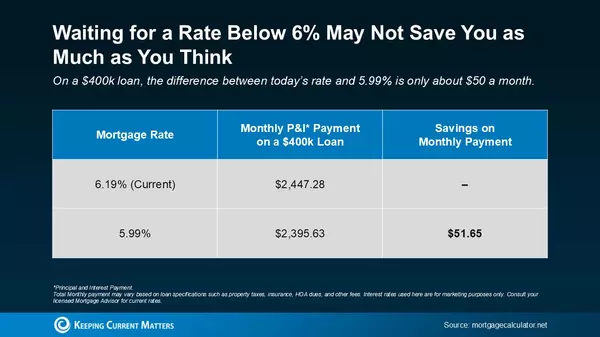

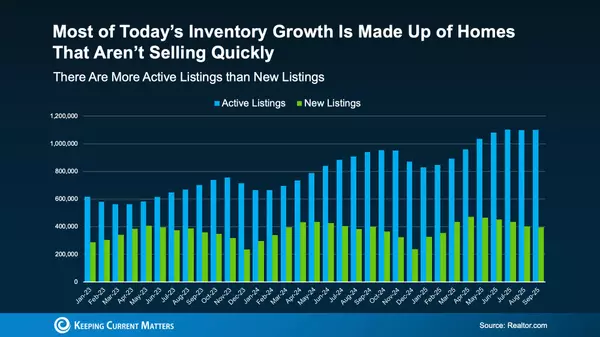

The Federal Reserve’s recent rate cuts could ease borrowing costs heading into 2026, and local inventory is starting to improve slightly in several Boston suburbs.

Still, as more buyers return to the market, competition is expected to tighten again. For anyone considering buying or selling, partnering with a trusted local agent remains key — someone who knows not just prices, but the story behind every neighborhood.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Why are more Massachusetts homebuyers going over budget?", "acceptedAnswer": { "@type": "Answer", "text": "Bidding wars have made a comeback as buyer confidence rebounds and inventory remains tight. With prices rising again across metro areas like Boston, Newton, and Worcester, many buyers are stretching their budgets just to stay competitive. One in four homebuyers nationwide are paying more than planned, and that figure may be even higher in Massachusetts." } }, { "@type": "Question", "name": "What drives buyers to spend more than expected?", "acceptedAnswer": { "@type": "Answer", "text": "Location consistently outweighs price for most buyers. In fact, 43% of Massachusetts buyers said location was their top priority, ahead of layout or square footage. Many are willing to pay extra to live in walkable neighborhoods, near top schools, or within easy reach of commuter rail lines." } }, { "@type": "Question", "name": "How are buyers compromising to secure the right home?", "acceptedAnswer": { "@type": "Answer", "text": "To land a home in their preferred area, buyers are willing to buy properties needing updates or repairs, accept smaller-than-expected floor plans, or tolerate longer commutes. These tradeoffs reflect a strong sentiment among buyers: location matters more than size or condition." } }, { "@type": "Question", "name": "How important is trust between buyers and real estate agents?", "acceptedAnswer": { "@type": "Answer", "text": "Trust is the top factor in choosing an agent for 52.9% of homebuyers, even ahead of experience or negotiation skills. In dynamic markets like Peabody, Woburn, and Wakefield—where prices can shift block to block—buyers value agents who provide honest guidance. Most clients connect with agents through referrals or online searches." } }, { "@type": "Question", "name": "Does social media influence homebuying decisions?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, but indirectly. Fewer than 10% of buyers find homes through social media, yet most still view online marketing as essential to an agent’s credibility. A strong social presence helps agents attract and reassure clients, even when the final purchase happens offline." } }, { "@type": "Question", "name": "What challenges do renters face in becoming homeowners?", "acceptedAnswer": { "@type": "Answer", "text": "Affordability remains the biggest hurdle. About 22% of renters delay home buying due to financial constraints. Rising prices, high monthly rents, and limited savings make it difficult to build a down payment. Nearly 40% of renters said they could only cover expenses for 1–3 months if they lost income, compared to homeowners who are typically better buffered." } }, { "@type": "Question", "name": "What does the future hold for the Massachusetts housing market?", "acceptedAnswer": { "@type": "Answer", "text": "Affordability challenges will persist, but modest relief may be ahead. The Federal Reserve’s rate cuts could lower borrowing costs by 2026, and inventory is improving slightly in select suburbs. However, as more buyers return to the market, competition is expected to remain strong. Working with an experienced local agent who understands neighborhood trends will be crucial for both buyers and sellers." } } ] }

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Why are more Massachusetts homebuyers going over budget?", "acceptedAnswer": { "@type": "Answer", "text": "Bidding wars have made a comeback as buyer confidence rebounds and inventory remains tight. With prices rising again across metro areas like Boston, Newton, and Worcester, many buyers are stretching their budgets just to stay competitive. One in four homebuyers nationwide are paying more than planned, and that figure may be even higher in Massachusetts." } }, { "@type": "Question", "name": "What drives buyers to spend more than expected?", "acceptedAnswer": { "@type": "Answer", "text": "Location consistently outweighs price for most buyers. In fact, 43% of Massachusetts buyers said location was their top priority, ahead of layout or square footage. Many are willing to pay extra to live in walkable neighborhoods, near top schools, or within easy reach of commuter rail lines." } }, { "@type": "Question", "name": "How are buyers compromising to secure the right home?", "acceptedAnswer": { "@type": "Answer", "text": "To land a home in their preferred area, buyers are willing to buy properties needing updates or repairs, accept smaller-than-expected floor plans, or tolerate longer commutes. These tradeoffs reflect a strong sentiment among buyers: location matters more than size or condition." } }, { "@type": "Question", "name": "How important is trust between buyers and real estate agents?", "acceptedAnswer": { "@type": "Answer", "text": "Trust is the top factor in choosing an agent for 52.9% of homebuyers, even ahead of experience or negotiation skills. In dynamic markets like Peabody, Woburn, and Wakefield—where prices can shift block to block—buyers value agents who provide honest guidance. Most clients connect with agents through referrals or online searches." } }, { "@type": "Question", "name": "Does social media influence homebuying decisions?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, but indirectly. Fewer than 10% of buyers find homes through social media, yet most still view online marketing as essential to an agent’s credibility. A strong social presence helps agents attract and reassure clients, even when the final purchase happens offline." } }, { "@type": "Question", "name": "What challenges do renters face in becoming homeowners?", "acceptedAnswer": { "@type": "Answer", "text": "Affordability remains the biggest hurdle. About 22% of renters delay home buying due to financial constraints. Rising prices, high monthly rents, and limited savings make it difficult to build a down payment. Nearly 40% of renters said they could only cover expenses for 1–3 months if they lost income, compared to homeowners who are typically better buffered." } }, { "@type": "Question", "name": "What does the future hold for the Massachusetts housing market?", "acceptedAnswer": { "@type": "Answer", "text": "Affordability challenges will persist, but modest relief may be ahead. The Federal Reserve’s rate cuts could lower borrowing costs by 2026, and inventory is improving slightly in select suburbs. However, as more buyers return to the market, competition is expected to remain strong. Working with an experienced local agent who understands neighborhood trends will be crucial for both buyers and sellers." } } ] }

Categories

Recent Posts

GET MORE INFORMATION