Turning Your Tax Refund Into a Down Payment: Here’s How

You’ve been steadily building your savings and picturing the day you finally unlock the door to a home that’s all yours. But here’s something you might not have considered—your tax refund could be the boost that gets you there faster.

As Freddie Mac puts it:

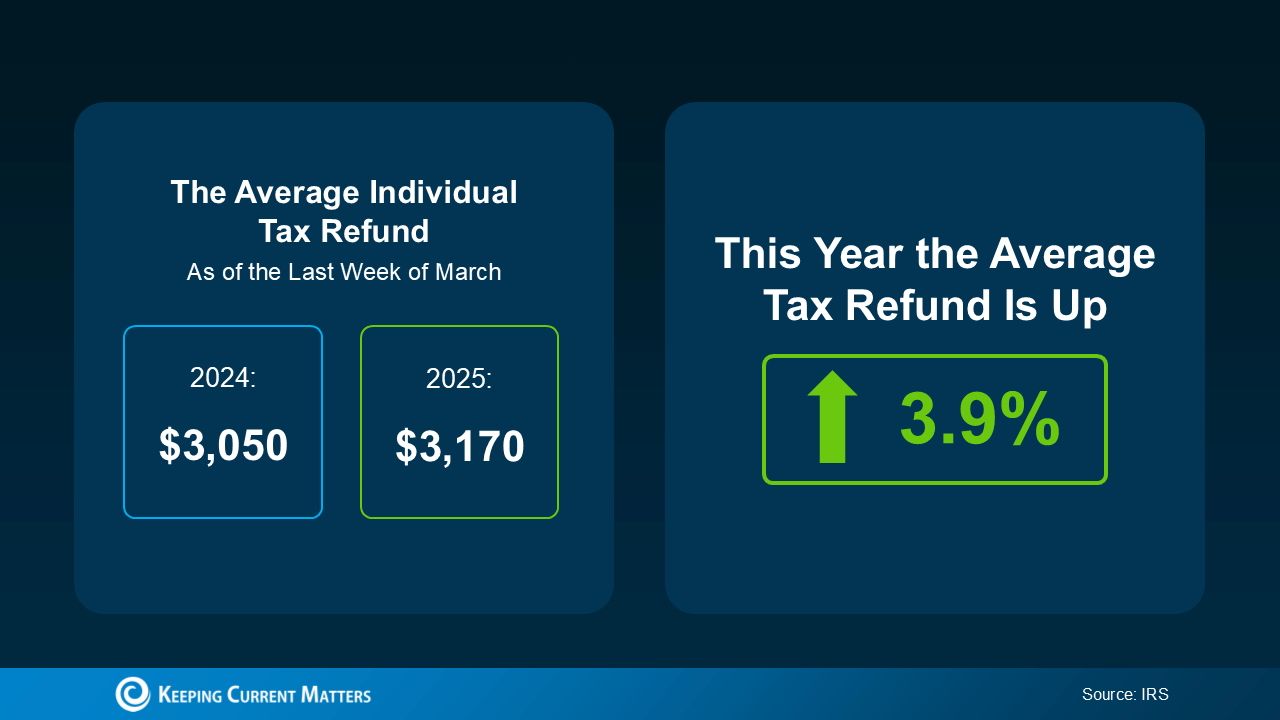

“…a tax refund from the IRS can be a helpful addition to your homebuying. That extra cash can go a long way in covering those upfront expenses like your down payment or closing costs. And the good news? Refunds are a bit higher this year than last. In fact, according to the IRS, the average refund has increased by 3.9%.

So if you’re expecting one, don’t just spend it—invest it in your future home.

Naturally, everyone’s tax refund will be different—but no matter the amount, even a little extra cash can make a big difference when you’re buying a home. According to Freddie Mac, here are a few smart ways to put that money to work:

- Boost your down payment – Saving for a down payment is one of the biggest challenges buyers face. Using your tax refund to add to your savings can help you reach your goal faster. And here’s a myth-buster: you don’t need 20% down to buy a home.

- Cover those closing costs – Closing costs include important fees like appraisals, title insurance, and loan processing. These usually range from 2% to 5% of your home’s price—so putting your refund toward these costs can ease your financial load when it’s time to close.

- Lower your interest rate – Some lenders offer the option to “buy down” your mortgage rate—meaning you pay a little more upfront to secure a lower monthly payment. If today’s rates and prices are stretching your budget, this could be a great strategy to explore.

And here’s the best part—you don’t have to navigate it alone. Teaming up with a trusted real estate agent and lender can help you understand your options and create a smart plan to move forward when you're ready.

Bottom Line

When you’re working toward buying a home, every dollar counts—and your tax refund can be a powerful tool to help you move the needle. It might not cover everything, but it can give your savings the extra lift you need to get one step closer to making homeownership a reality. Whether it goes toward your down payment, closing costs, or reducing your mortgage rate, that refund can bring your dream within reach.

So ask yourself: what would having a place to truly call your own mean for you or your family this year?

Categories

Recent Posts