Are Mortgage Delinquencies Pointing to More Foreclosures Ahead?

You’ve probably seen headlines warning that foreclosures are on the rise. If that has you worried about another housing crash, here’s some perspective.

During the last crash (2007–2011), over nine million homeowners lost their homes through distressed sales. Compare that to just 300,000 last year. Even with the recent uptick, today’s numbers are still a fraction of what we saw back then.

So, is a foreclosure wave looming? The short answer: no.

Why? Industry experts track mortgage delinquencies—loans more than 30 days past due—as a leading indicator for future foreclosures. The latest data shows delinquencies remain stable compared to the end of last year. That’s a strong sign we’re not facing widespread trouble.

Right now, delinquencies as a whole are consistent with where we ended last year, which means we’re not seeing the kind of increase that would signal widespread trouble.

Still, there are trends worth monitoring. As Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association, points out, the story isn’t just about overall numbers—it’s about who is falling behind.

“Overall delinquency rates haven’t moved much from last year, but the makeup has shifted. Right now, FHA borrowers account for the largest share of new delinquencies.”

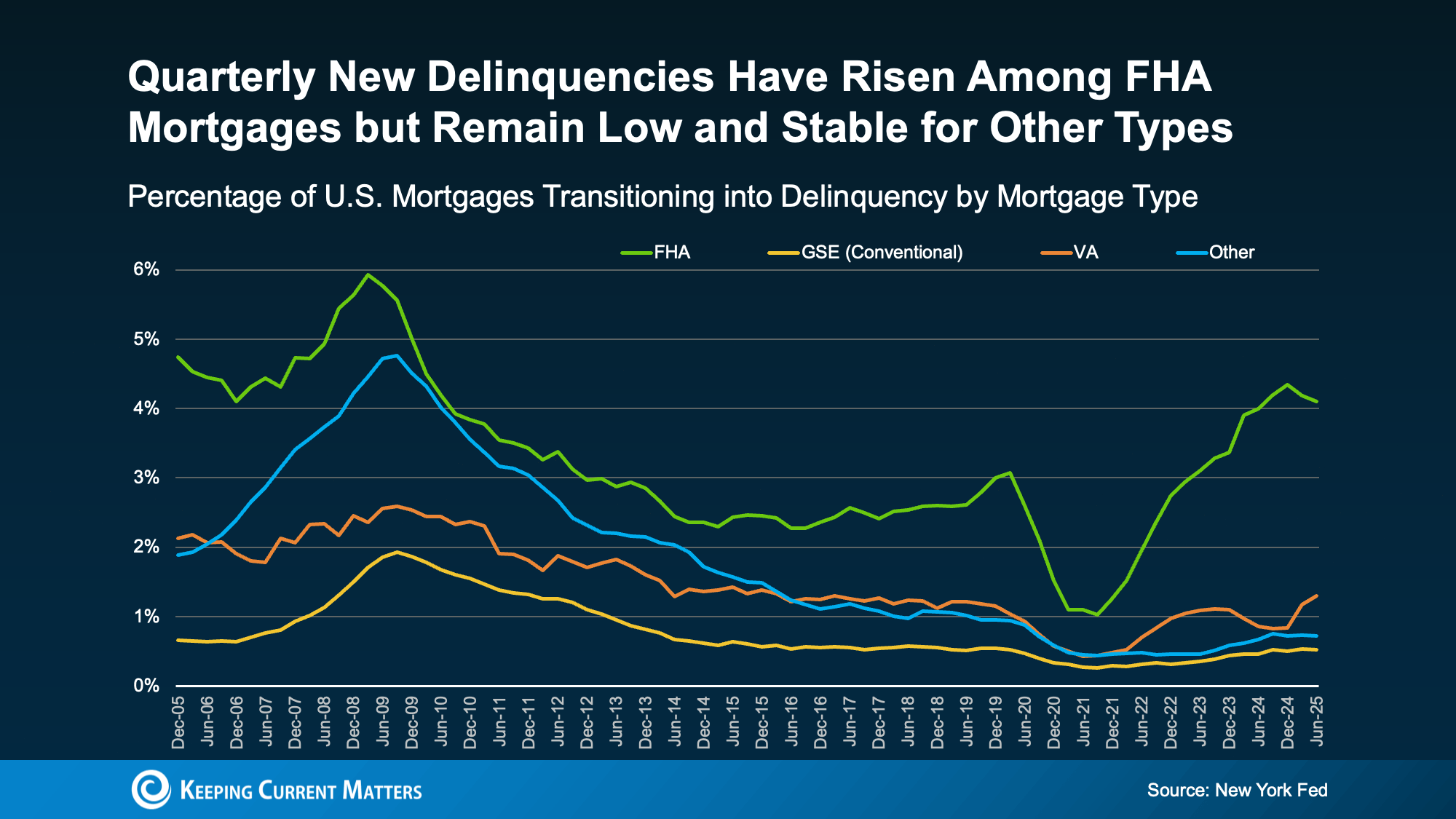

Right now, borrowers with FHA mortgages currently make up the biggest share of new delinquencies (see graph below):

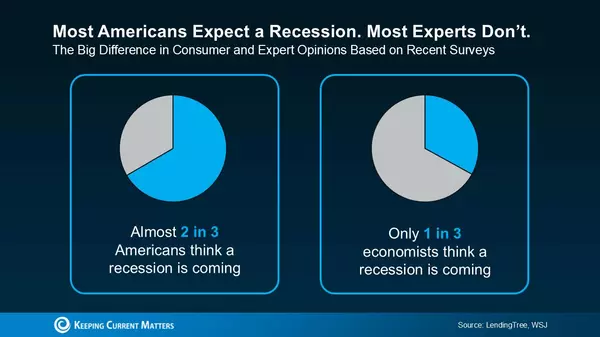

So why might this be happening? Borrowers with FHA loans are often more sensitive to shifts in the economy. With factors like inflation, job market uncertainty, and ongoing recession talk, it makes sense this group could be feeling more strain than others. Still, that doesn’t mean we’re on the verge of a crash.

If you look back at the graph, you’ll see FHA loans are showing more stress than usual—but delinquency rates for conventional, VA, and other loan types remain low and steady. During the 2008 crash, delinquencies spiked across all categories. Today, that’s not the case.

That’s why experts agree the broader mortgage market is much healthier than it was back then.

“The rise in delinquencies is mostly showing up among FHA borrowers. But when you compare today’s mortgage performance to the last 20 years, it’s still remarkably strong.” – ResiClub

Where FHA Loans Are Most Common

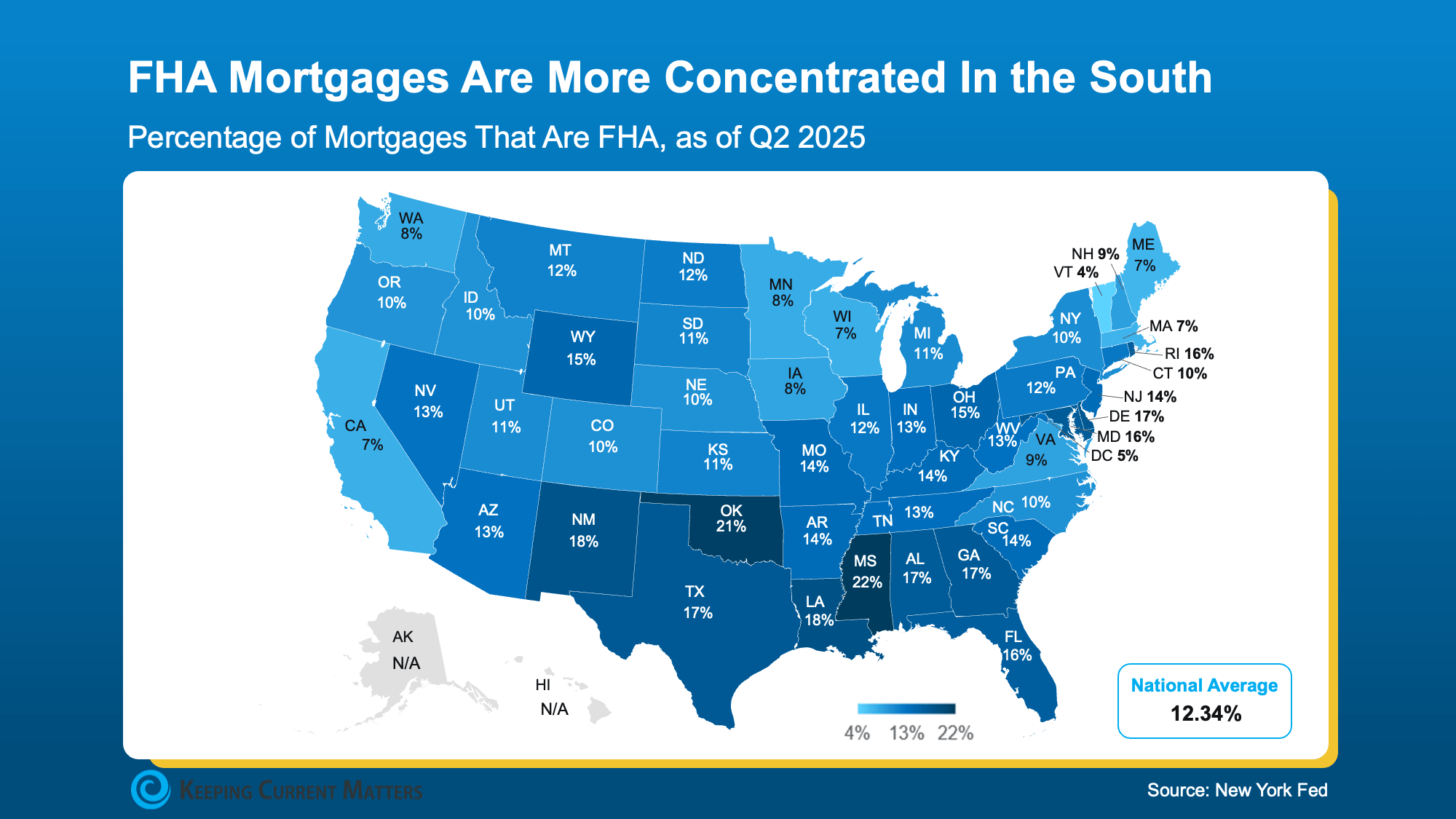

Another reason this isn’t cause for alarm: FHA loans make up only about 12% of mortgages nationwide. But housing is always local. Certain regions—especially in the South—have a higher concentration of these loans.

The map below doesn’t reflect delinquencies. Instead, it highlights which states have the largest share of FHA loans overall.

The Federal Reserve Bank of New York notes that certain regions show a stronger connection between FHA loan concentration and higher delinquency rates—particularly in parts of the South.

“Recent data show that states with more FHA loans also tend to report higher delinquency rates, especially across the South.” – Federal Reserve Bank of New York

Even so, today’s delinquency levels are still well below what we saw during the 2008 housing crisis. This isn’t a warning sign of another crash, but it’s a trend industry experts will continue to track closely in the months ahead.

If You’re Facing Financial Strain

Foreclosure is never easy, and no homeowner should feel they’re facing it alone. If you’re having trouble keeping up with payments, know that there are options available.

Start by contacting your loan servicer—they may be able to work out a repayment plan or modify your loan terms. Another path many homeowners have today is tapping into their equity. With near-record levels of equity across the country, selling your home could allow you to avoid foreclosure altogether.

Bottom Line

Foreclosures have ticked up recently, but they remain far below the extreme levels seen during the 2008 housing crisis. Current delinquency patterns also don’t suggest a crash is looming.

Still, this is a trend that professionals across the industry will be monitoring closely in the months ahead. If you want to stay informed and confident in your decisions, connect with a trusted real estate agent or lender so you’ll always have the latest insights and guidance.

Categories

Recent Posts

GET MORE INFORMATION