Why Economists Say a Recession Isn’t on the Horizon

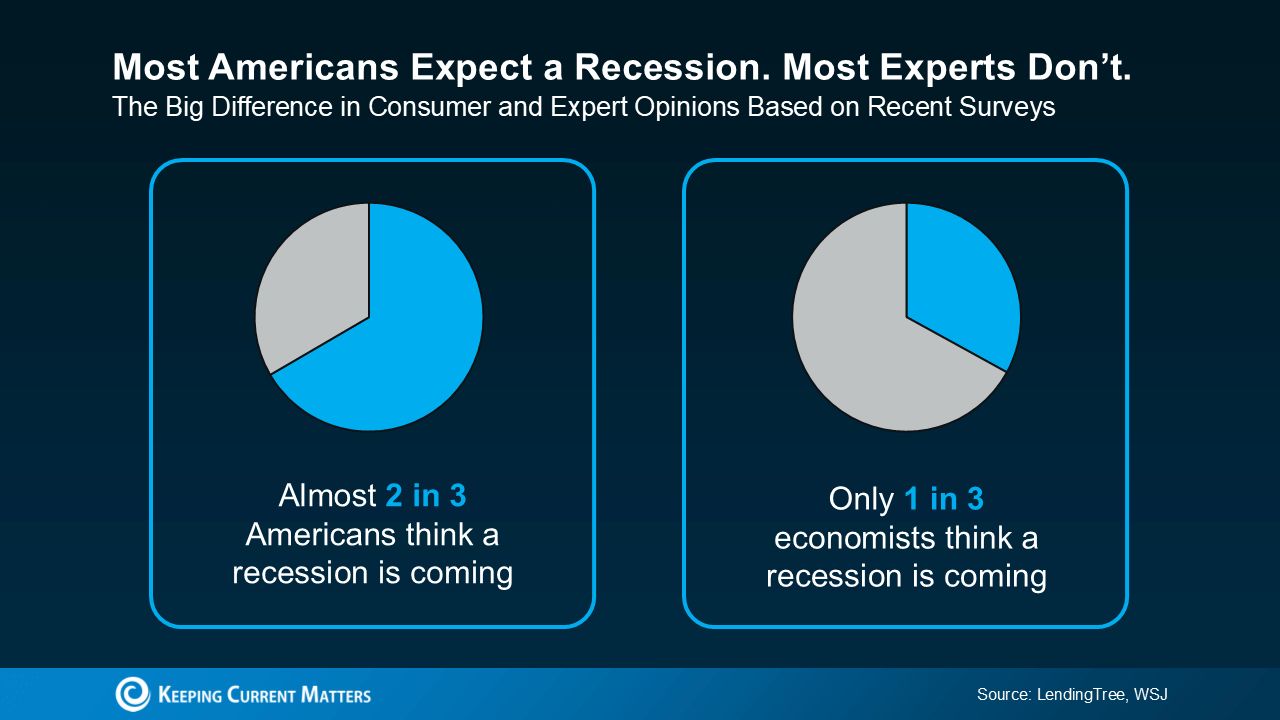

Homebuyers are paying close attention to the economy — and it makes sense. A home is one of the biggest financial decisions most people make, and all the recession chatter in the news has caused some buyers to hesitate. In a recent LendingTree survey, nearly two-thirds of Americans said they expect a recession, and 74% admit it’s influencing their financial choices.

The encouraging part? Most experts don’t share that same level of concern.

Most Americans Expect a Recession — But Leading Economists Don’t

An October Wall Street Journal report shows that only one in three surveyed experts believe a recession is likely within the next 12 months (see chart below).

If economists aren’t sounding the alarm, should you be? We’re not in a recession, and there’s no clear indication that one is around the corner.

What we do have is uncertainty — and the smartest way to navigate that is by relying on solid data, not worry. That starts with making sure you have the right information to make a well-grounded decision.

Tips for Buying a Home When the Economy Feels Uncertain

The smartest approach right now is to stay aware of economic trends without letting them overshadow your real-life priorities. Markets shift, but the core reasons people buy homes—family needs, career changes, lifestyle upgrades—stay remarkably steady. As Danielle Hale, Chief Economist at Realtor.com, puts it:

“Many well-prepared buyers who’ve been waiting are driven by life changes—bigger families, new jobs, or retirement—and those priorities often matter more than temporary economic concerns.”

What matters most is timing your move around your actual life—not whatever’s in the headlines.

That said, one thing is crucial if you’re buying in today’s environment: job stability. You want to be confident in your income and your ability to handle your mortgage comfortably, even if your circumstances or the broader economy change.

If your job feels stable and you’ve built up a solid savings cushion, experts say you don’t have to hit pause. Just keep these points from Redfin’s economists in mind:

- Set a budget and stick to it: Avoid stretching too far. Keep your payments manageable and ensure your savings can cover unexpected costs—including rising expenses like insurance and property taxes.

- Negotiate confidently: With more homes on the market and some buyers stepping back, you have leverage. Use that negotiating power to secure the strongest deal you can.

- Be intentional with payments and rates: Speak with lenders about what payment fits your comfort zone today and what your options look like if rates drop later.

- Think about selling first: If you’re already a homeowner, selling before buying can ease financial pressure and give you a clearer picture of your budget for the next place.

Nothing is more valuable right now than having the right people in your corner. Bankrate puts it clearly:

“Buying during a downturn can work in your favor — but only if your finances are solid. Partner with an experienced local real estate agent who knows the market and can help you secure the strongest deal, even in uncertain conditions.”

Bottom Line

Most Americans believe a recession is on the horizon — but the majority of experts don’t see it the same way.

That means you don’t automatically need to hit pause on your plans. If your financial footing is solid, your job feels secure, and you have a genuine reason to move, you can still move forward with confidence. The key is having the right professionals guiding you through each step so you’re making decisions based on clarity, not concern.

So what’s actually holding you back from taking your next step? Reach out to a trusted local agent and lender, walk through your options, and get the information you need to make a confident move.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Why are so many Americans worried about a recession right now?", "acceptedAnswer": { "@type": "Answer", "text": "A recent LendingTree survey found that nearly two-thirds of Americans expect a recession, and 74% say that fear is impacting their financial decisions. With frequent economic headlines and uncertainty, it’s natural for homebuyers to feel hesitant." } }, { "@type": "Question", "name": "Do economists agree that a recession is likely soon?", "acceptedAnswer": { "@type": "Answer", "text": "Not really. According to an October report from The Wall Street Journal, only about one in three leading economists believe a recession is likely within the next 12 months. In other words, most experts don’t share the same level of concern that many consumers do." } }, { "@type": "Question", "name": "If experts aren’t sounding the alarm, should homebuyers be worried?", "acceptedAnswer": { "@type": "Answer", "text": "No. We are not in a recession, and there’s no solid indicator suggesting one is imminent. While uncertainty exists, the best strategy is to rely on real data and solid financial planning — not worry." } }, { "@type": "Question", "name": "How should buyers think about the economy when deciding whether to purchase a home?", "acceptedAnswer": { "@type": "Answer", "text": "Stay informed but don’t let headlines overshadow your real-life needs. People buy homes for reasons that remain steady regardless of the economy—growing families, job changes, lifestyle upgrades, retirement, and more." } }, { "@type": "Question", "name": "What do experts say about buying a home during economic uncertainty?", "acceptedAnswer": { "@type": "Answer", "text": "According to Realtor.com Chief Economist Danielle Hale, many well-prepared buyers move forward because life changes—not the economy—drive their decision. If your finances are strong and you have clear reasons to move, uncertainty doesn’t have to stop you." } }, { "@type": "Question", "name": "What’s the most important factor buyers should consider in today’s environment?", "acceptedAnswer": { "@type": "Answer", "text": "Job stability. Making sure your income is reliable gives you confidence that you can comfortably manage your mortgage even if economic conditions shift." } }, { "@type": "Question", "name": "What financial tips do Redfin economists recommend for today’s buyers?", "acceptedAnswer": { "@type": "Answer", "text": "Redfin economists recommend that today’s buyers: (1) Set a solid budget and avoid stretching beyond your comfort zone. (2) Negotiate confidently, since more inventory and fewer buyers can give you leverage. (3) Discuss payments and rate strategies with lenders, including what happens if rates drop later. (4) Sell first if possible to reduce financial strain and clarify your budget for your next home." } }, { "@type": "Question", "name": "Is buying during uncertain economic times a bad idea?", "acceptedAnswer": { "@type": "Answer", "text": "Not necessarily. Bankrate notes that buying during a downturn can actually work in your favor—if your finances are stable and you’re partnered with an experienced local real estate agent who can help you secure a strong deal." } }, { "@type": "Question", "name": "Should buyers pause their home search because of recession fears?", "acceptedAnswer": { "@type": "Answer", "text": "Not automatically. If your job is secure, your savings are strong, and you have a real reason to move, you can proceed with confidence. What matters most is making decisions based on facts—not fear." } }, { "@type": "Question", "name": "What’s the next step for buyers who still feel unsure?", "acceptedAnswer": { "@type": "Answer", "text": "Connect with a trusted local real estate agent and lender. They can help you evaluate your finances, understand your options, and determine whether now is the right time to make your move." } } ] }

Categories

Recent Posts

GET MORE INFORMATION