$3K Monthly Budget Now Buys $22K More as Mortgage Rates Hit 11-Month Low

Purchasing power has jumped $7,500 in just the past week, as mortgage rates slid to 6.3% following a weak August jobs report.

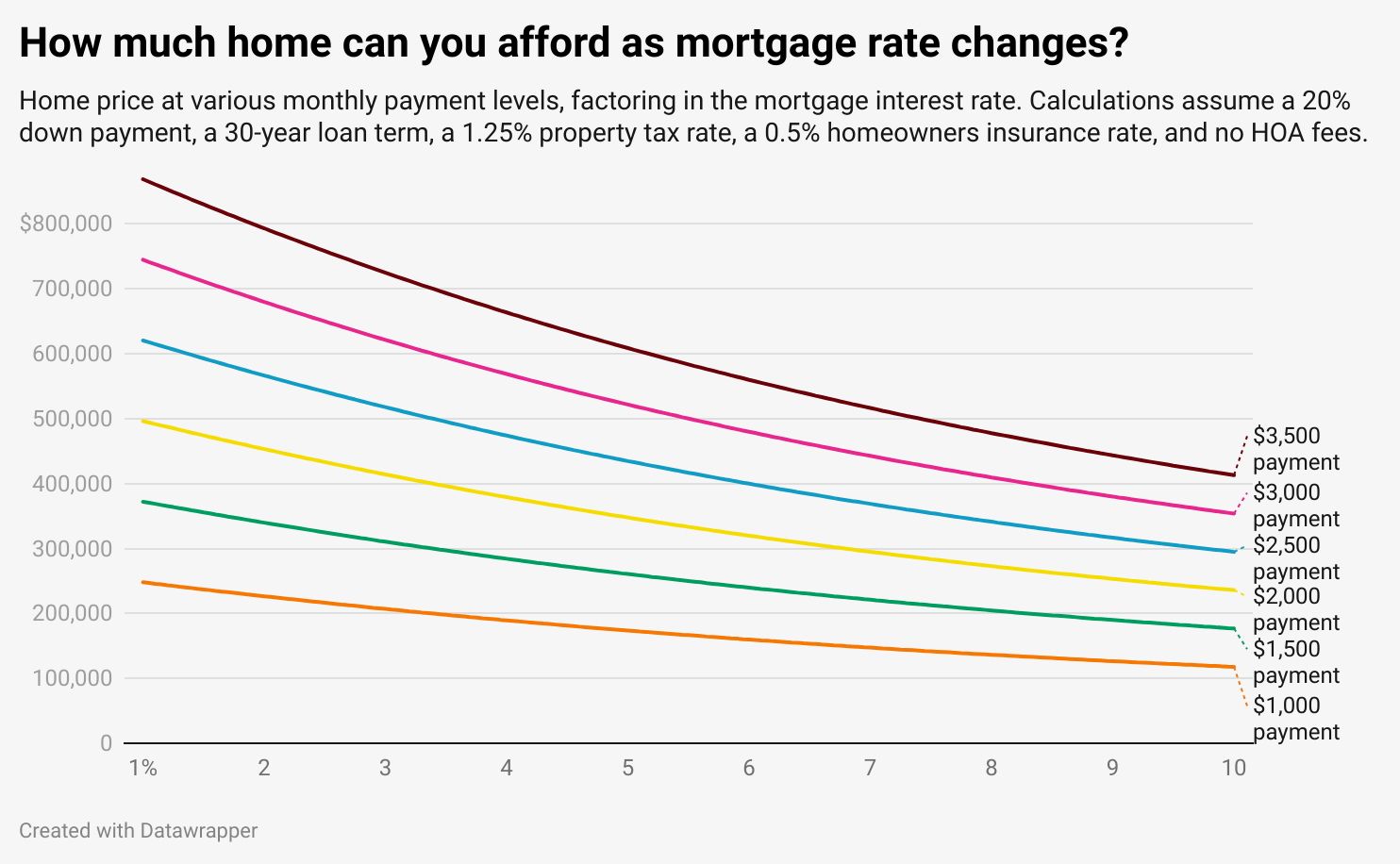

On September 5, the daily average rate dipped to 6.29%—the lowest in 11 months. For a buyer with a $3,000 monthly budget, that shift means they can now afford a $468,000 home, compared to $460,500 just a week earlier when rates hovered around 6.5%.

Even that 6.5% rate was already near a 10-month low, but the bigger picture tells more. Back on June 5, when the average rate was 6.9%, the same buyer’s budget capped them at a $446,000 home. Put simply: in just three months, a buyer with a $3K monthly budget has gained $22,000 in purchasing power thanks to falling rates.

Another way to measure affordability: the monthly payment on a median-priced U.S. home (about $444,000) is now $2,481 at today’s average rate. Just three months ago, when rates were 6.9%, that same payment would have been $2,624—roughly $150 more each month.

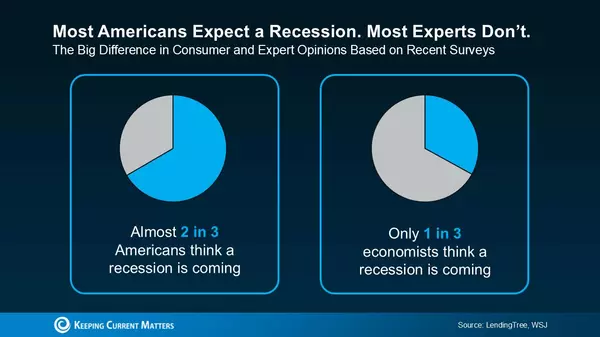

Mortgage rates dropped sharply on September 5 after a weak August jobs report revealed slower hiring, the highest unemployment rate since October 2021, and rising recession risks. The numbers all but guarantee a Fed rate cut on September 17, which is fueling today’s slide in mortgage rates.

“My advice to homebuyers and refinancers: this is the window you’ve been waiting for,” said Chen Zhao, head of economics research at Redfin. “If you’re ready to lock in a mortgage rate, don’t wait. The market has already factored in the Fed’s expected rate cut, so rates aren’t likely to drop much further. Opportunities to secure a rate as low as 6.3% have been rare over the past three years—and buyers have that chance right now.”

Beyond rates, today’s market gives buyers extra leverage. With hundreds of thousands more sellers than buyers, many house hunters can negotiate prices lower or win concessions that weren’t possible just months ago.

The drop in rates isn’t just a win for buyers—it’s also good news for sellers. While the market still has more homes for sale than buyers, new listings have slowed in recent weeks, making fresh inventory harder to find.

If you’ve been on the fence about selling, now is a smart time to list—falling rates are drawing buyers back into the market. And if your home has been sitting for weeks or even months, it may be worth refreshing your marketing strategy or adjusting your price to capture renewed buyer interest.

Categories

Recent Posts

GET MORE INFORMATION