13 Smart Ways to Save Money When Buying a Home in Massachusetts

Buying a home is one of the biggest financial decisions you’ll ever make—and in today’s market, every dollar counts. Between rising interest rates and record-high prices, finding a way to stretch your budget can make all the difference. Whether you’re shopping for your first condo in Boston or upgrading to a single-family home on the North Shore, here are 13 practical money-saving tips to help you buy smarter and keep more cash in your pocket.

1. Work with a Negotiator, Not Just an Agent

Your real estate agent can be the difference between overpaying and landing a great deal. A top negotiator knows how to spot undervalued homes, leverage contingencies, and request credits for repairs. Even a small discount—say 5% off the list price—on a $700,000 home means $35,000 in savings.

2. Time Your Purchase Right

Real estate is seasonal. Prices typically cool down in winter, when fewer buyers are competing.

- 🧤 Winter months: Less competition = better deals.

- 🌸 Spring & summer: Expect higher prices and bidding wars.

In Greater Boston, homes bought in February sell for roughly 3–4% less than peak months. Timing matters.

3. Boost Your Credit Before Applying

A strong credit score means lower interest rates—and long-term savings.

For example, on a 30-year mortgage, improving your credit from 680 to 760 can save you tens of thousands in interest.

Tip: Pay down high balances and avoid opening new credit accounts before applying for a loan.

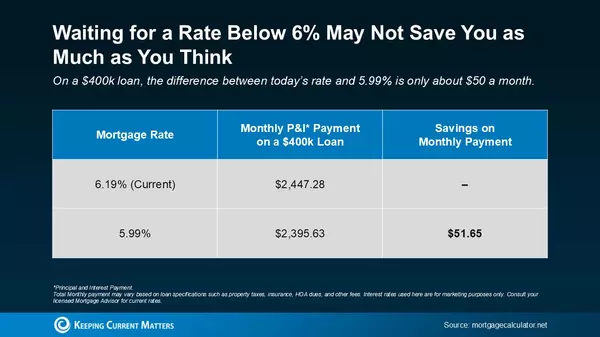

4. Shop Around for Mortgage Rates

Don’t take the first offer. Comparing rates from at least three lenders can save you $600–$1,200 a year. Ask each lender for a Loan Estimate and compare fees, not just rates.

💡 Pro Tip: Collect quotes within 45 days—credit bureaus treat it as one inquiry.

5. Consider Homes That Need a Little TLC

Turnkey homes are in high demand—but fixer-uppers often sell for 20–30% less.

You can use programs like:

- 🏡 FHA 203(k) or Fannie Mae HomeStyle loans to finance both purchase and renovation costs.

That’s instant equity potential for buyers willing to do some updating.

6. Bundle Your Inspections

You’ll likely need a home inspection, pest check, and maybe radon or lead testing. Instead of booking separately, ask if your inspector offers package deals. Combining inspections can easily save $100–$300.

7. Save for a Larger Down Payment

Yes, saving more upfront can actually cost you less overall. A higher down payment:

- Lowers your monthly payment

- Can eliminate PMI (Private Mortgage Insurance)

- Strengthens your offer in competitive markets

Even an extra 5% down could save you hundreds per month over the life of your loan.

8. Explore Down Payment Assistance

First-time buyers in Massachusetts may qualify for local or federal programs, such as:

- 🏠 MassHousing Down Payment Assistance Program

- 🪖 VA loans for veterans (0% down)

- 🌾 USDA loans for rural buyers

Check your city or county for grants and credits—many go unused each year.

9. Avoid or Eliminate PMI

If you put less than 20% down, you’ll likely pay PMI—costing roughly 0.5–1% of your loan each year.

To avoid or reduce it:

- Put 20% down

- Refinance once you reach 20% equity

- Ask about lender-paid PMI options

10. Check for Profession-Based Perks

If you’re a teacher, nurse, police officer, or firefighter, you might qualify for special savings like:

- The Good Neighbor Next Door program (up to 50% off HUD homes)

- Local “Heroes” buyer programs offering rebates or closing cost credits

11. Take Advantage of Special Buyer Programs

Fannie Mae’s HomePath Ready Buyer Program offers up to 3% toward closing costs when purchasing select homes—plus discounted pricing on certain foreclosed properties. It’s worth looking into if you’re flexible on location or property type.

12. Negotiate Your Closing Costs

Closing costs typically run 2–5% of your home’s price—but many buyers don’t realize they’re negotiable.

Try these strategies:

- Ask sellers for closing credits

- Request your lender to waive or reduce fees

- Compare title and escrow company rates before choosing

13. Buy Less House Than You Can Afford

It’s tempting to max out your preapproval, but that’s how buyers end up house-poor.

A smaller home means:

- Lower taxes

- Lower maintenance

- More room in your budget for life, travel, and savings

Remember—a modest home with financial freedom beats a dream home with debt stress any day.

🧾 Final Thought

The path to homeownership doesn’t have to drain your savings. With the right timing, preparation, and strategy, you can make a confident purchase and keep your finances healthy. The goal isn’t just to buy a home—it’s to own it comfortably.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "How does working with a skilled negotiator save you money?", "acceptedAnswer": { "@type": "Answer", "text": "A skilled Massachusetts real estate agent can identify undervalued properties, write offers with inspection and appraisal contingencies, and negotiate repair credits or price reductions. In some cases, strong negotiation can save a buyer around 5% off the purchase price — that’s about $35,000 on a $700,000 home." } }, { "@type": "Question", "name": "Is there a best time of year to buy a Massachusetts home?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. In Massachusetts, buyers often get better deals in the winter — especially in January and February — because there’s less competition. Prices can be 3–4% lower than peak spring months, giving buyers more leverage and less risk of bidding wars." } }, { "@type": "Question", "name": "How does improving your credit before applying for a mortgage save you money?", "acceptedAnswer": { "@type": "Answer", "text": "A higher credit score helps you qualify for a lower interest rate. Even moving from the mid-600s to the mid-700s can save tens of thousands of dollars over a 30-year mortgage, because you’ll pay less interest every month." } }, { "@type": "Question", "name": "Why is it smart to shop around for mortgage rates?", "acceptedAnswer": { "@type": "Answer", "text": "Different lenders offer different rates and fees. Getting quotes from at least three lenders can save $600–$1,200 per year, and if you collect those quotes within 45 days it typically counts as one credit inquiry, so your credit score is protected." } }, { "@type": "Question", "name": "Should you consider homes that need work?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Homes that need cosmetic updates or light repairs often sell 20–30% below similar move-in-ready homes. Buyers can also use renovation-friendly loans like FHA 203(k) or Fannie Mae HomeStyle to finance improvements and build equity quickly." } }, { "@type": "Question", "name": "How can bundling home inspections reduce costs?", "acceptedAnswer": { "@type": "Answer", "text": "Many inspectors in Massachusetts offer package pricing when you combine general, pest, and radon inspections. Bundling them with one provider can save $100–$300 compared to ordering each inspection separately." } }, { "@type": "Question", "name": "Is saving for a larger down payment worth it?", "acceptedAnswer": { "@type": "Answer", "text": "Often, yes. A larger down payment can lower your monthly mortgage payment, help you avoid private mortgage insurance (PMI), and strengthen your offer in a competitive market. Even an extra 5% down can add up to thousands in long-term savings." } }, { "@type": "Question", "name": "What down payment assistance is available in Massachusetts?", "acceptedAnswer": { "@type": "Answer", "text": "Massachusetts buyers may qualify for programs through MassHousing, as well as federal options like VA and USDA loans, which offer low or no down payment. Some local cities and towns also offer grants or closing cost help for first-time buyers." } }, { "@type": "Question", "name": "How can you avoid or eliminate PMI?", "acceptedAnswer": { "@type": "Answer", "text": "You can avoid PMI by putting 20% down on a conventional loan. If that’s not possible upfront, you can ask your lender to remove PMI once you reach 20% equity, or refinance if your home’s value has increased. Lender-paid PMI is another option, but compare total costs first." } }, { "@type": "Question", "name": "Are there profession-based buyer perks in Massachusetts?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Teachers, healthcare workers, police officers, and firefighters may qualify for programs like HUD’s Good Neighbor Next Door, which can offer steep discounts on certain homes, and some brokerages or lenders offer local “hero” credits toward closing costs." } }, { "@type": "Question", "name": "Can special buyer programs reduce costs?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Programs like Fannie Mae’s HomePath Ready Buyer can offer up to 3% toward closing costs on select properties and often list homes at below-market prices. These are good options for buyers who are flexible on location or style of home." } }, { "@type": "Question", "name": "How negotiable are closing costs?", "acceptedAnswer": { "@type": "Answer", "text": "Closing costs, which usually run 2–5% of the purchase price, are sometimes negotiable. Buyers can request seller credits, ask lenders to reduce or waive certain fees, and shop around for more affordable title and closing services." } }, { "@type": "Question", "name": "Why should you buy less house than you can afford?", "acceptedAnswer": { "@type": "Answer", "text": "Buying below your maximum preapproval keeps your monthly expenses, taxes, and maintenance manageable. That helps you avoid becoming house-poor and gives you more financial flexibility after closing." } } ] }

Categories

Recent Posts

GET MORE INFORMATION