Housing Market Trends to Watch in 2026

After a few years where the housing market felt like it was stuck in neutral, 2026 is shaping up to be the year things start moving again. Experts predict that more homeowners and buyers will finally make their move, creating fresh opportunities across the market — and maybe even for you.

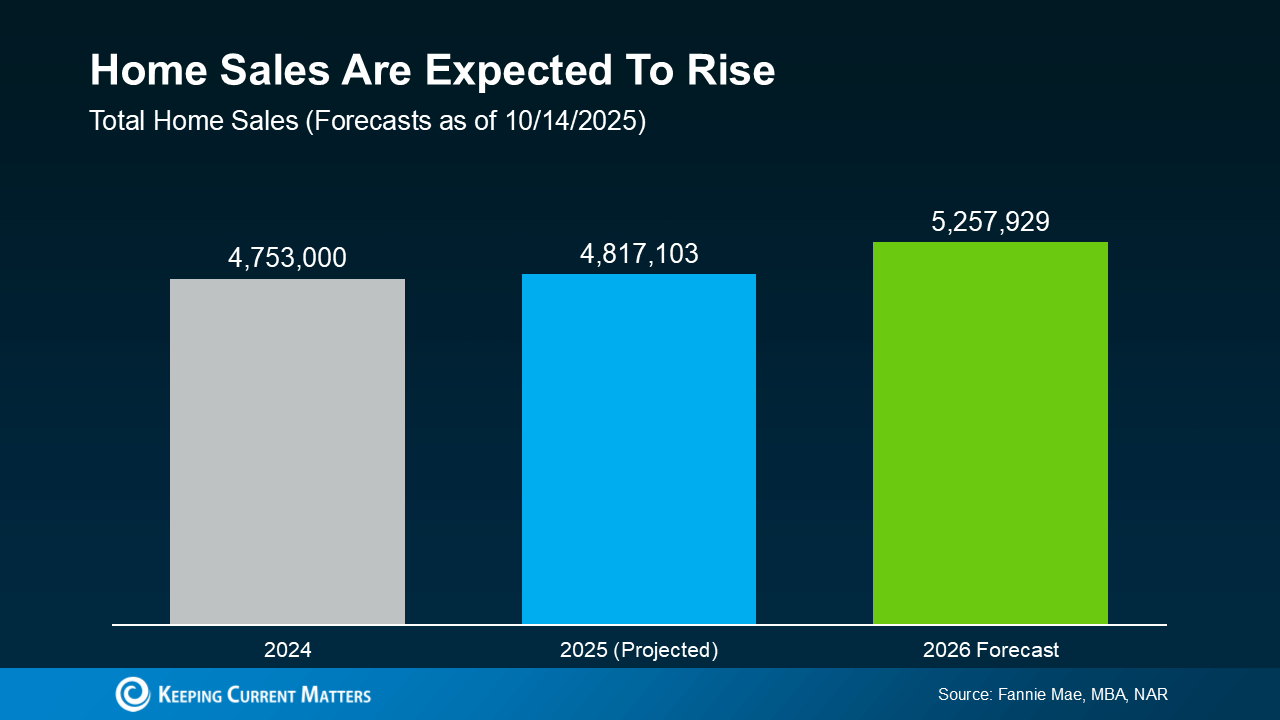

More Homes Expected to Sell

Over the past few years, high prices and mortgage rates caused many would-be movers to hit pause. But that can’t last forever — life keeps moving, and so do people. Industry forecasts show that in 2026, more sellers will list and more buyers will reenter the market, bringing much-needed momentum back to housing. (See graph below)

What’s driving this shift? It really comes down to two things: mortgage rates and home prices. Let’s take a look at what the latest expert forecasts reveal — and why they’re expected to get more people moving in 2026.

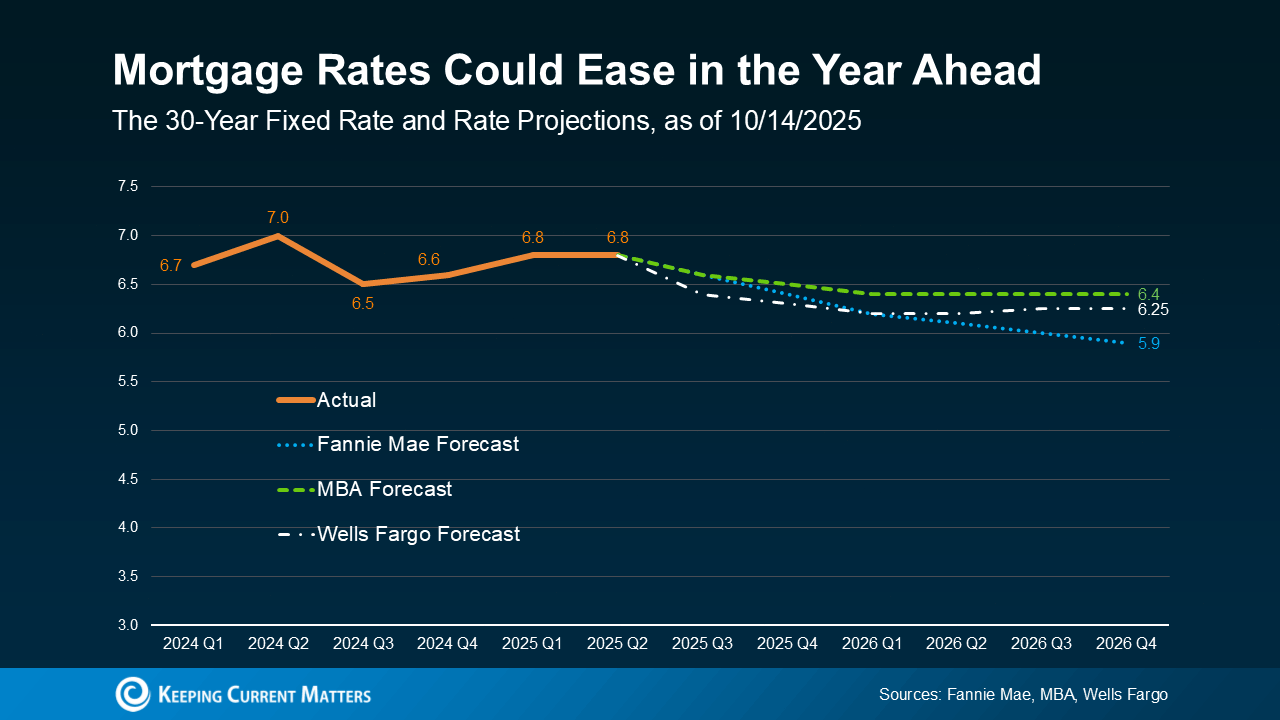

Mortgage Rates Expected To Keep Easing

For most buyers, the top priority has been clear — lower mortgage rates. After reaching highs near 7% earlier this year, rates have finally started to come down.

Experts project that trend could continue into 2026, though the path won’t be perfectly smooth (see graph below).

There’s an old saying in real estate: when rates rise, they take the escalator — but when they fall, they take the stairs. That’s worth remembering, because the path down won’t be quick or smooth.

Over the next year, expect gradual improvement in mortgage rates — with a few bumps along the way as new economic data rolls in. Don’t let short-term swings throw you off; the overall trend still points toward a slow, steady decline.

Experts project rates could settle in the low 6s or even dip into the high 5s. And even small drops can make a big difference.

If you compare today’s rates to when they were near 7% earlier this year, buyers are already saving hundreds per month on a typical mortgage payment. That kind of shift can have a real impact on affordability — and for many buyers, it’s enough to finally make a move.

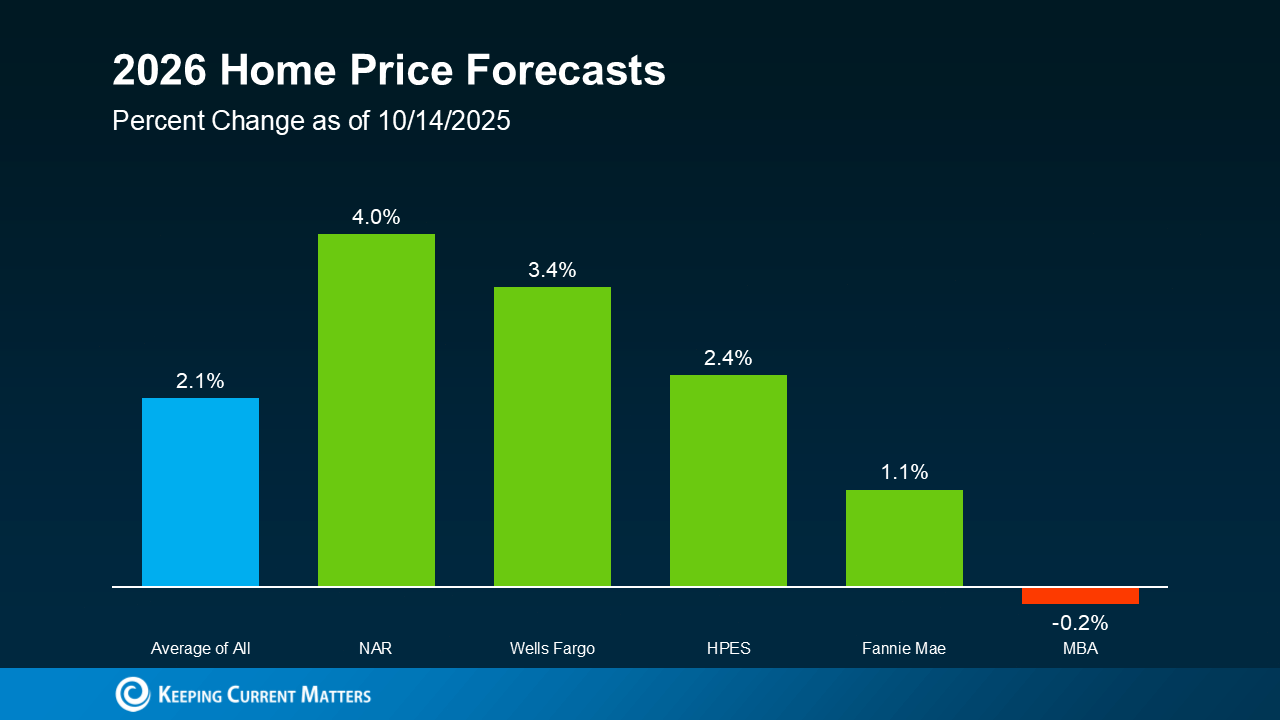

Home Prices Expected To Rise — Just at a Slower Pace

So, what about prices? Nationally, experts predict they’ll keep climbing — just more moderately. With mortgage rates easing from their earlier highs, more buyers are expected to jump back in, adding some renewed competition. That extra demand will help support prices and prevent any major declines.

While a few markets are already seeing small dips, there’s no sign of a major price crash. In fact, after five straight years of appreciation, even those areas showing slight drops are still well above where they were just a few years ago.

Of course, local conditions will tell the real story. Factors like inventory, job growth, and buyer demand vary widely from one city to the next — and that’s what will determine how prices move in your area. Still, when you zoom out, most experts agree prices will continue to rise nationally — just at a steadier, more sustainable pace. (See graph below)

This is another positive development for buyers — and for overall affordability. While home prices are still expected to rise, they’ll do so at a more manageable, sustainable pace. That kind of stability makes it easier to plan your budget and provides confidence that prices won’t spike unexpectedly.

Bottom Line

After a few quieter years, 2026 is shaping up to bring more movement — and more opportunity across the housing market. With sales expected to climb, mortgage rates gradually easing, and price growth leveling out, the foundation is being laid for a market that feels both healthier and more balanced.

For buyers, that means fresh chances to step in with greater affordability and less competition. For sellers, it signals renewed demand and a wider pool of serious buyers ready to make a move.

So here’s the big question: will you be one of the movers making 2026 your year? If you’re thinking about it, now’s the time to start planning ahead — connect with a trusted local agent to position yourself for success before the market gains full momentum.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What is the overall outlook for the housing market in 2026?", "acceptedAnswer": { "@type": "Answer", "text": "The housing market in 2026 is expected to see more movement with increased home sales, easing mortgage rates, and a slower, more moderate rise in home prices. This will create opportunities for both buyers and sellers." } }, { "@type": "Question", "name": "What is driving the increase in home sales expected in 2026?", "acceptedAnswer": { "@type": "Answer", "text": "The increase in home sales is primarily driven by mortgage rates gradually easing from previous highs and home prices rising at a more manageable pace, which improves affordability and encourages more buyers and sellers to enter the market." } }, { "@type": "Question", "name": "How are mortgage rates expected to change in 2026?", "acceptedAnswer": { "@type": "Answer", "text": "Mortgage rates are expected to continue easing gradually in 2026, potentially settling in the low 6% range or even dipping into the high 5% range. However, the decline will be slow and bumpy, not a quick drop." } }, { "@type": "Question", "name": "What impact do changing mortgage rates have on buyers?", "acceptedAnswer": { "@type": "Answer", "text": "Even small drops in mortgage rates can lead to significant savings on monthly mortgage payments, making home buying more affordable and motivating buyers who had been waiting to enter the market." } }, { "@type": "Question", "name": "How will home prices behave in 2026?", "acceptedAnswer": { "@type": "Answer", "text": "Home prices are expected to continue rising nationally but at a slower and steadier pace. While some local markets may see slight declines, a major price crash is not predicted, and overall prices will remain well above levels from a few years ago." } }, { "@type": "Question", "name": "What local factors might affect home prices differently in various areas?", "acceptedAnswer": { "@type": "Answer", "text": "Local factors influencing price trends include inventory levels, job growth, and buyer demand, which vary widely between cities and regions." } }, { "@type": "Question", "name": "What opportunities does the 2026 housing market offer to buyers and sellers?", "acceptedAnswer": { "@type": "Answer", "text": "Buyers benefit from improved affordability and less competition, while sellers face renewed demand and a larger pool of serious buyers ready to move." } }, { "@type": "Question", "name": "What should potential movers do to prepare for the 2026 housing market?", "acceptedAnswer": { "@type": "Answer", "text": "Potential movers should start planning ahead and consider connecting with a trusted local real estate agent to position themselves for success as the market gains momentum." } } ] }

Categories

Recent Posts

GET MORE INFORMATION