The Truth About Mortgage Rates: It’s Not as Bad as You Think

Mortgage rates have been the monster under the bed for a while. Each time they rise a little, buyers hesitate and say, “Maybe I’ll wait.” But here’s the truth — holding out for that perfect 5-something rate could cost you more in the long run.

The Magic Number

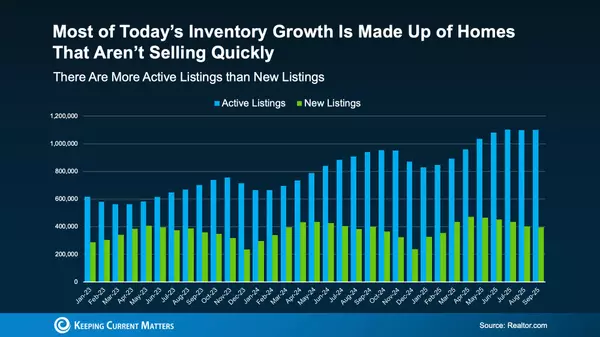

According to the National Association of Realtors (NAR):

“If 30-year fixed mortgage rates dropped to 6%, roughly 5.5 million more households — including about 1.6 million renters — could afford the median-priced home. At that level, an estimated 550,000 of those households might purchase within the next year or so.”

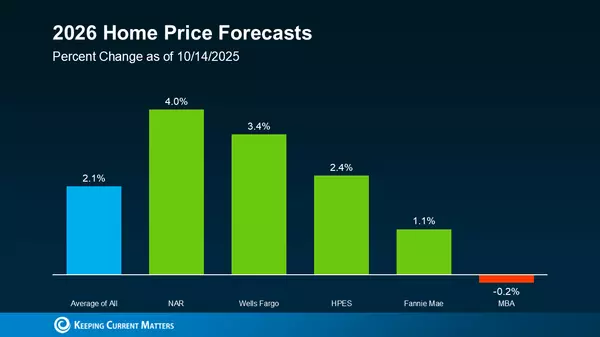

When rates reach that sweet spot, which many experts predict could happen in 2026, buyer psychology will shift fast. That’s when pent-up demand will pour back into the market — pushing home prices higher.

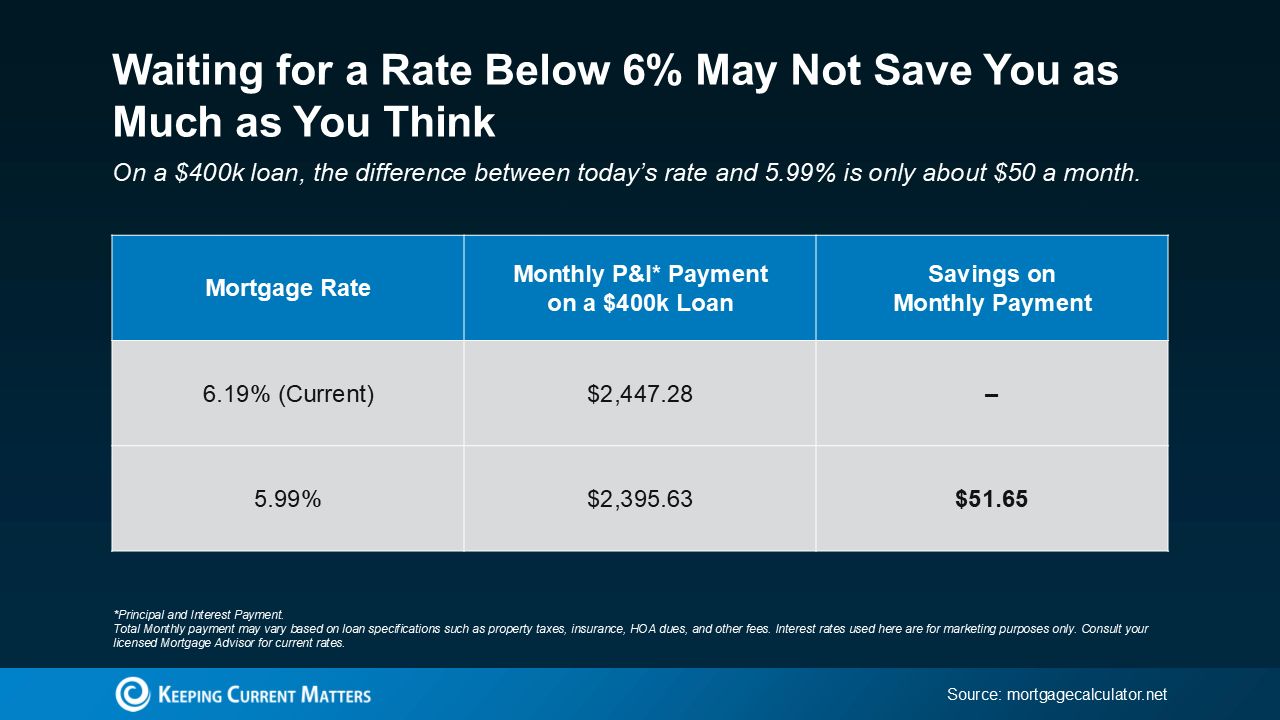

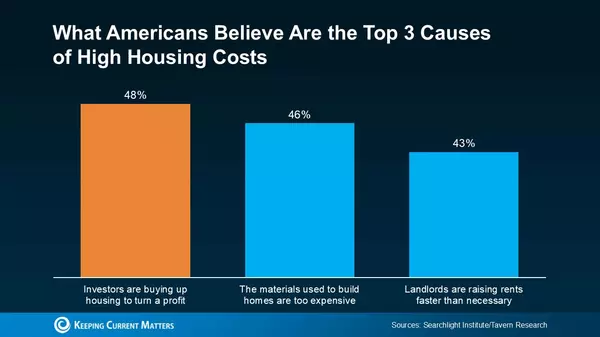

So while a 5.99% rate may sound like a huge win, waiting for that number might not save you as much as you think once home values start climbing. (See chart below)

On a $400,000 loan, the gap between today’s rate (around 6.2%) and 5.99% is about $50 a month — less than what many spend on coffee or takeout. Once prices rise as more buyers re-enter the market, that small savings could disappear fast.

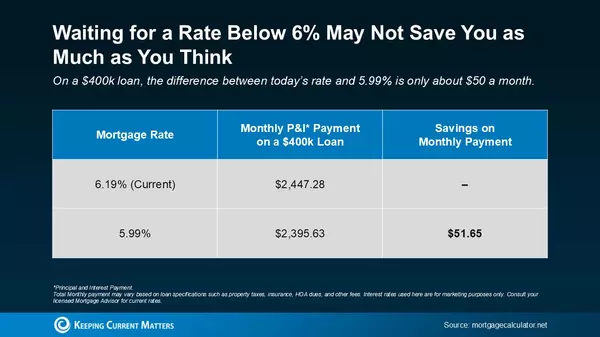

So if you’re holding out for 5.99%, it may not be worth missing the current window — when you have more homes to choose from, stronger negotiation power, and less competition. Those advantages fade quickly once rates dip below 6% and buyers rush back in.

Let’s do some quick math

According to Jessica Lautz, Deputy Chief Economist and Vice President of Research at NAR,

“In the past five weeks, mortgage rates have averaged around 6.31%, giving strategic buyers a window of opportunity to revisit their home search with expanded inventory and more options to choose from.”

Matt Vernon, who leads Retail Lending at Bank of America, explains:

“Instead of waiting for a more appealing rate, buyers should focus on their own financial picture. If the home fits their needs and the monthly payments are manageable, now could be the right time to move forward.”

Bottom Line

If buying at today’s rate makes you hesitate, remember — waiting doesn’t always work in your favor. Once rates slip below 6%, as many experts expect next year, more buyers will jump back in, and prices will likely follow.

The truth is, opportunity often shows up before it feels comfortable. Today’s market offers room to negotiate, more inventory to choose from, and less competition at the table. Don’t let fear of a number keep you from gaining the advantages that exist right now.

Because if you’re financially ready and the home feels right, this could be your best window to move — before the next wave of demand wakes the market back up.

{ "@context": "https://schema.org", "@type": "FAQPage", "inLanguage": "en-US", "mainEntity": [ { "@type": "Question", "name": "What is the impact of waiting for mortgage rates to drop below 6%?", "acceptedAnswer": { "@type": "Answer", "text": "Waiting for rates to fall below 6% could mean missing out on current advantages such as greater inventory, stronger negotiation power, and less competition. While a lower rate sounds appealing, pent-up demand is likely to surge once rates dip, pushing prices higher and increasing competition." } }, { "@type": "Question", "name": "How much do you really save on a $400,000 loan if rates fall from 6.2% to 5.99%?", "acceptedAnswer": { "@type": "Answer", "text": "The drop from about 6.2% to 5.99% is roughly a $50-per-month difference on a $400,000 loan. That small monthly savings can be outweighed by potential home price increases when demand rises after rates decline." } }, { "@type": "Question", "name": "Why could waiting for lower rates cost buyers more in the long run?", "acceptedAnswer": { "@type": "Answer", "text": "If many buyers wait for sub-6% rates, a demand surge can quickly push prices higher, potentially erasing the modest monthly savings from a lower rate. Buying sooner can offer more choices and better deals—advantages that diminish as the market heats up." } }, { "@type": "Question", "name": "What do experts say about buying now versus waiting?", "acceptedAnswer": { "@type": "Answer", "text": "Jessica Lautz (NAR) notes that rates around 6.31% create a window to find more inventory and negotiate better. Matt Vernon (Bank of America) advises focusing on personal affordability and needs rather than chasing a “perfect” rate; if the home fits and payments are comfortable, buying now may make sense." } }, { "@type": "Question", "name": "What is the expected effect if rates reach 6%?", "acceptedAnswer": { "@type": "Answer", "text": "If 30-year fixed rates reach 6%, about 5.5 million additional households could afford the median-priced home, and roughly 550,000 might purchase within 12–18 months. This influx of buyers could drive prices up due to renewed competition." } }, { "@type": "Question", "name": "What is the key takeaway for potential buyers?", "acceptedAnswer": { "@type": "Answer", "text": "Prioritize your own financial situation and today’s market conditions instead of waiting for an arbitrary number like 5.99%. Opportunity often appears before the crowd jumps in—acting now can help secure better terms ahead of the next wave of competition." } } ] }

Categories

Recent Posts

GET MORE INFORMATION