Mortgage Relief Ahead? Experts Predict Rates Could Drop Within a Year

Mortgage rates are trending lower, but the big question is: will the decline continue, and how far could it go?

According to experts, rates may ease further over the next year — and the 10-year Treasury yield is the critical signal to keep an eye on.

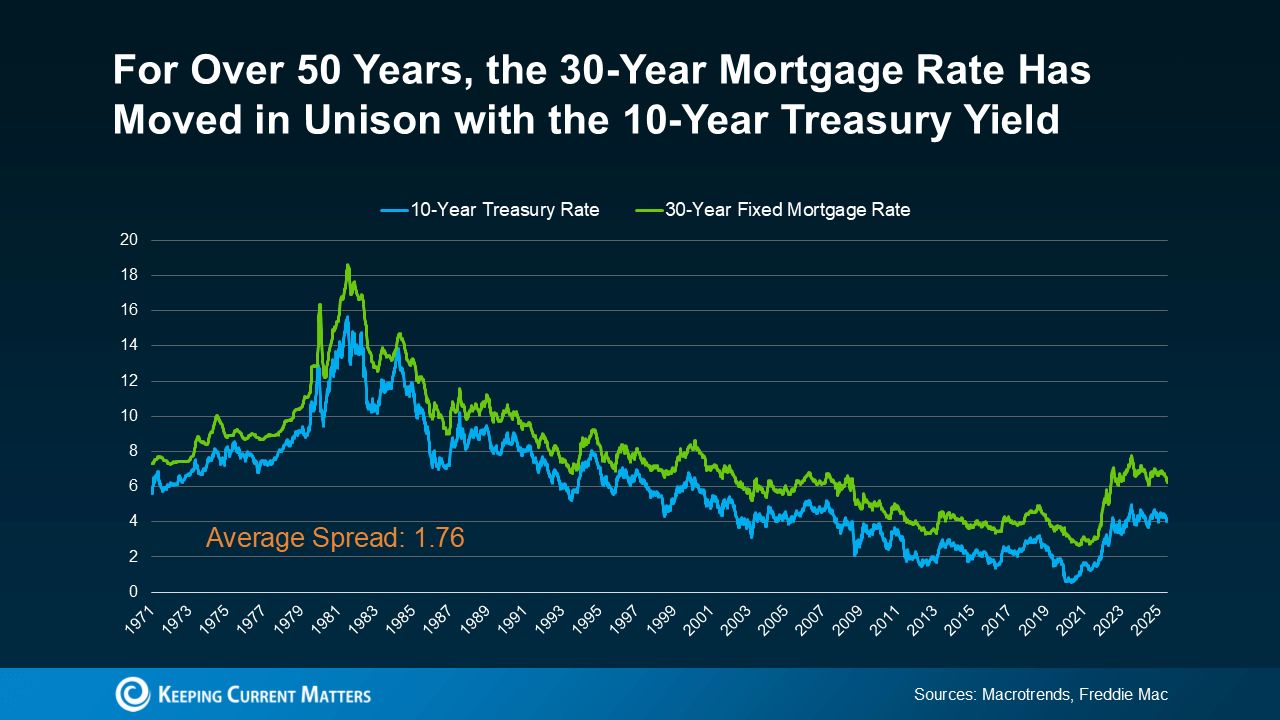

Mortgage Rates and the 10-Year Treasury: A Long-Term Connection

For decades, the 30-year fixed mortgage rate has mirrored the trends of the 10-year treasury yield, one of the most closely watched signals for long-term borrowing costs (see graph below).

As the 10-year Treasury yield goes up, mortgage rates climb. When it drops, mortgage rates tend to ease.

It’s a pattern that’s been reliable for decades. So reliable that experts watch the average gap — known as the spread — which typically sits around 1.76 percentage points (or 176 basis points).

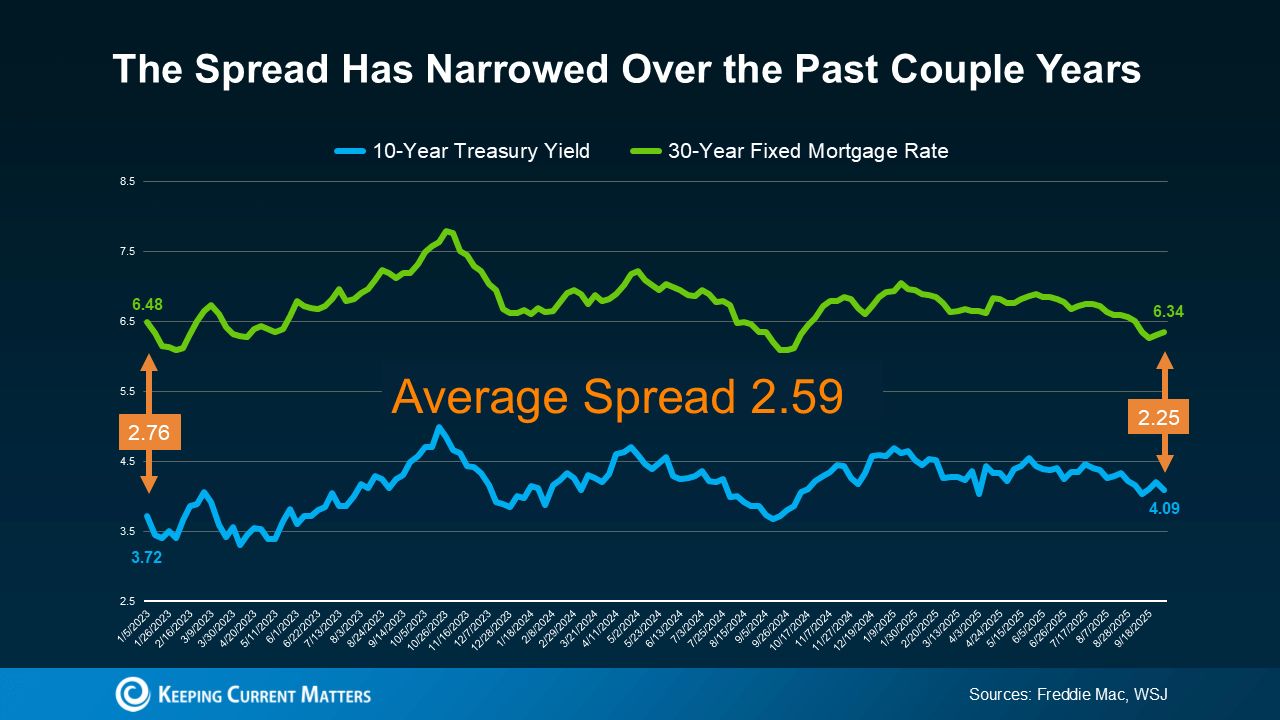

The Spread Is Narrowing

In recent years, the spread has been much wider than normal. Why? Because the spread often reflects market uncertainty — and when uncertainty is high, the gap tends to widen. That’s been a major factor keeping mortgage rates elevated.

The good news: the spread is now starting to shrink, signaling more clarity in the economic outlook (see graph below).

This opens the door for mortgage rates to keep trending down. Or, as Redfin puts it:

“A tighter spread means lower rates. If that trend continues, mortgage rates could drop even more than they already have.”

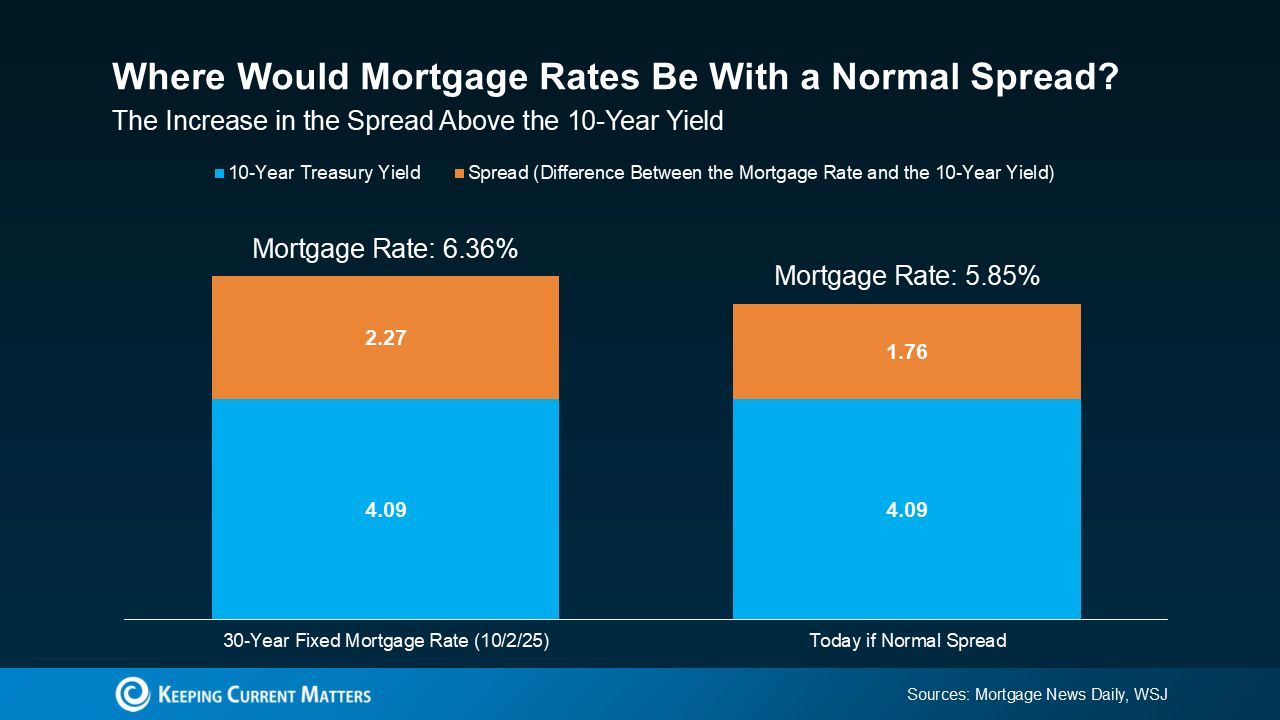

The 10-Year Treasury Yield Is Projected To Fall

It’s not just the spread to watch. The 10-year treasury yield itself is also expected to decline in the months ahead. Together, a lower yield and a narrowing spread could create downward pressure on mortgage rates moving into next year.

That’s why many experts are forecasting easing rates, with a chance they could dip into the upper-5% range by year’s end.

Here’s the math: with the 10-year Treasury yield currently around 4.09% and the average spread at 1.76%, mortgage rates would be expected to land near 5.85% (see graph below).

Of course, the story isn’t set in stone — the economy will keep changing, and with it, mortgage rates will rise and fall.

How it all plays out will hinge on the job market, inflation, and broader economic signals. The good news? Right now, the 2026 forecast suggests a steady decline in rates, and things already appear to be trending in the right direction.

Bottom Line

Staying on top of all these moving pieces can feel overwhelming, especially with the market shifting so quickly. That’s why having a knowledgeable agent or lender in your corner is so important — they’ll track the changes, break them down clearly, and handle the heavy lifting for you.

If you’d like real-time updates on mortgage rates and guidance tailored to your situation, connect with a trusted professional who can keep you informed every step of the way and help you confidently plan your next move.

Categories

Recent Posts

GET MORE INFORMATION