What Homebuyers Want Most — And How the Market Is Adapting

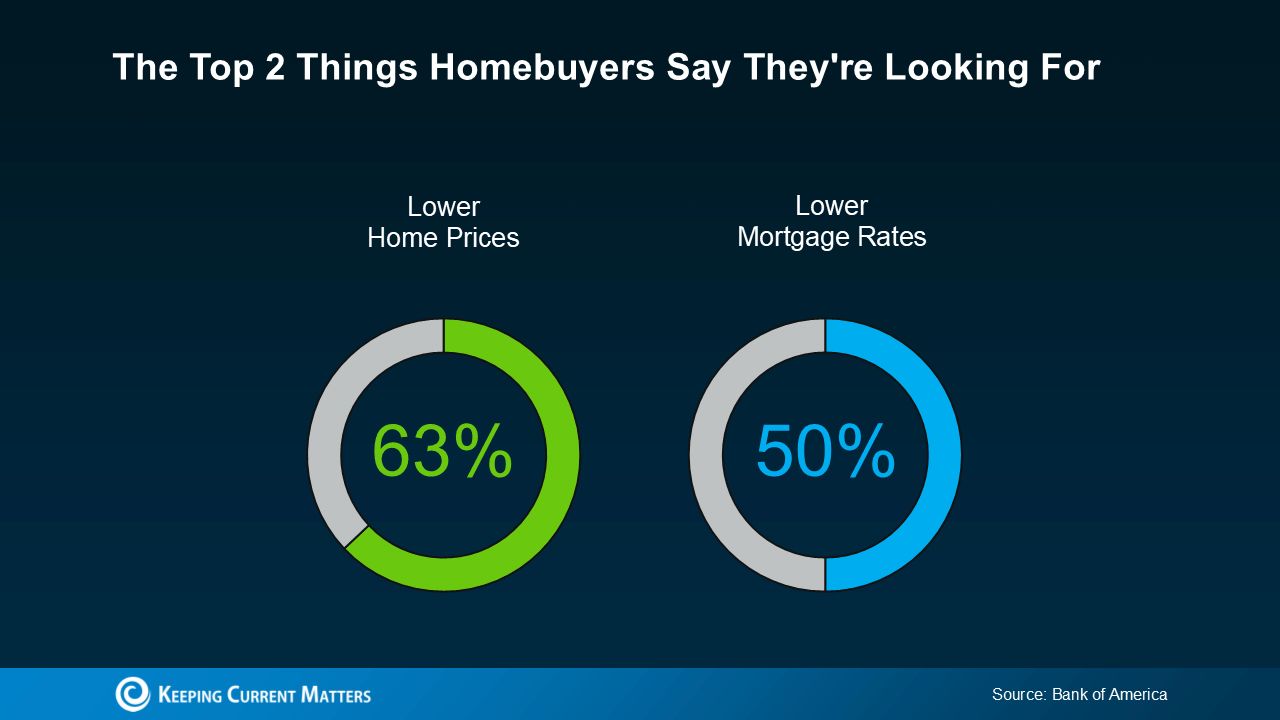

According to a recent Bank of America survey, prospective buyers say the biggest boost to their confidence would come from improved affordability — particularly when it comes to prices and interest rates (see below).

The outlook isn’t all gloomy. Despite some lingering economic uncertainty, there are clear signs of movement in both affordability factors. Let’s break it down so you can see the full picture.

Prices Are Finally Cooling Off

Remember how home prices were skyrocketing a few years ago? From 2020 to 2021 alone, they jumped 20% in just one year. That breakneck pace has finally eased. Nationally, experts now predict single-digit price growth this year — a far more normal trend.

That’s a big shift from the rapid growth we saw only a few years ago. Keep in mind, price trends still vary by location: some markets may see values continue to rise, while others could experience modest declines.

We’re not seeing a crash, but we are seeing moderation — and that’s welcome news for buyers. A slower climb makes it easier to plan, budget, and enter the market with more confidence.

Mortgage Rates Are Coming Down

At the same time, rates have come down from their recent highs. And that’s taken some pressure off would-be homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

Good news — rates have pulled back from the highs we saw not long ago, and that’s taking some pressure off buyers. Lisa Sturtevant, Chief Economist at Bright MLS, puts it this way:

“When home prices cool and mortgage rates slip, it opens a window of opportunity for buyers to jump in.”

Even a small rate drop can cut your monthly payment more than you might expect. Just know that rates can still bounce around, so don’t stress over every daily change.

The big picture? Experts expect rates to hover in the low to mid-6% range, which is far better than where they were a few months back — and they could dip more if the economy shifts.

Why This Is Good News

Confidence in the economy might still be low, but the housing market is adjusting. Prices aren’t climbing as fast, and rates have pulled back.

It won’t solve every affordability hurdle, but it does make the landscape better than it was just months ago — and that shift could be your cue to take another look as we head toward next year.

Bottom Line

Both of the biggest concerns for today’s buyers are finally showing some movement. Home prices are moderating, and mortgage rates are easing — trends that could continue as we head into 2026.

If you’re thinking about making a move, now’s the time to talk with a local real estate agent who can break down what’s happening in your specific market, explain how these shifts affect affordability, and help you create a plan that fits your goals.

Categories

Recent Posts

GET MORE INFORMATION