Your Complete State-by-State Closing Cost Breakdown

If you’re gearing up to buy a home this year, don’t forget about one key expense: closing costs.

Most buyers know they’re part of the process, but few understand exactly what’s included — or how much they can vary depending on where you’re buying. Let’s break it down.

What Are Closing Costs?

Closing costs are the extra fees and payments due when you finalize a home purchase — and every buyer pays them. According to Freddie Mac, they usually cover things like homeowners insurance and title insurance, along with a variety of service fees, such as:

- Loan application

- Credit report

- Loan origination

- Home appraisal

- Home inspection

- Property survey

- Attorney services

National vs. Local: Why the Numbers Don’t Always Match

When you look up closing costs online, you’ll often see a national estimate — usually 2% to 5% of the purchase price. While that’s a helpful starting point when budgeting for a home, it doesn’t paint the full picture. In reality, your closing costs can also shift based on:

- Local taxes and government fees such as transfer taxes and recording charges

- Professional service costs including title work and attorney fees in your area

While the price of the home plays a big role, state laws, tax rates, and local fees for title and attorney services can all impact your final costs. That’s why it’s smart to connect with professionals early — so you can plan and budget with confidence before you start house hunting.

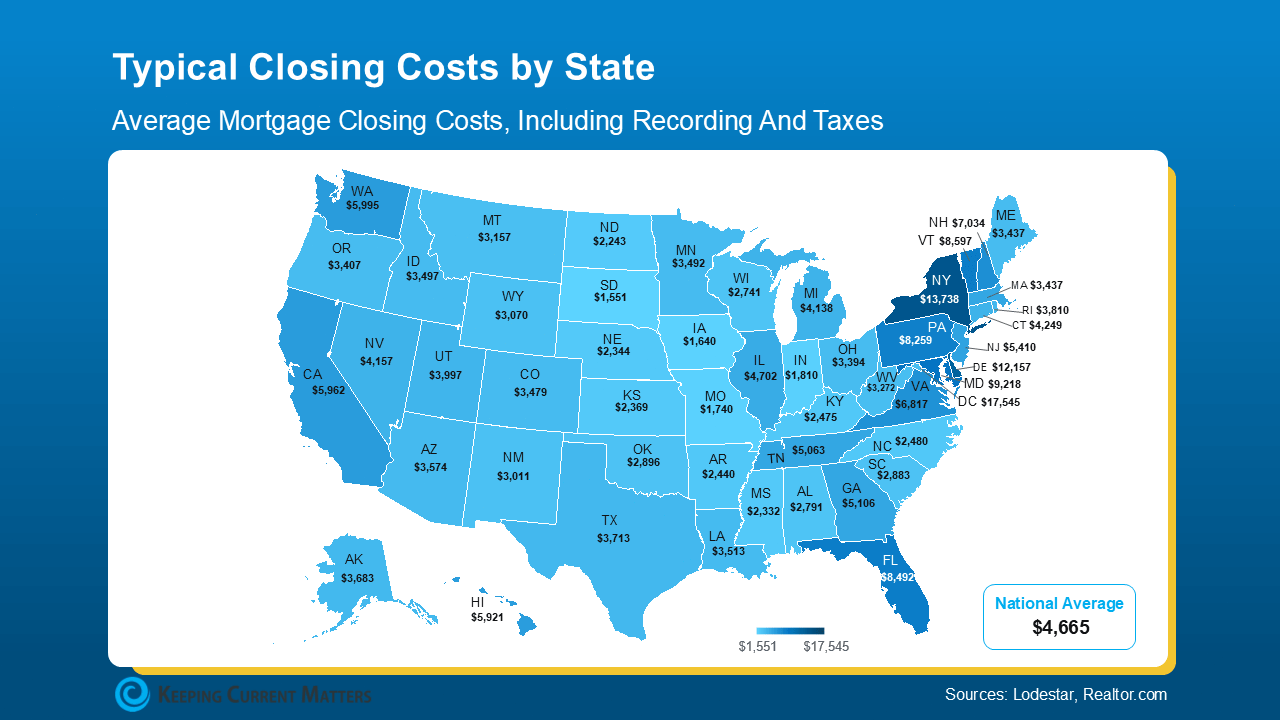

To give you a general idea, here’s a state-by-state breakdown of typical closing costs right now for a median-priced home (see map below):

As the map shows, typical closing costs can range widely — some states average just $1–3K, while others reach $10–15K or more. That’s a big difference, especially for first-time buyers. Knowing what to expect helps you plan ahead.

For the most accurate estimate, talk with a local real estate agent and lender. They can calculate costs for your price point, loan type, and exact location so you can budget confidently.

If you’re eyeing your state’s number and wondering how to reduce it, NerdWallet suggests a few smart strategies:

- Negotiate with the seller. Ask for concessions, such as a credit toward your closing costs.

- Shop for homeowners insurance. Compare policies and rates before locking one in.

- Look into assistance programs. Some states, professions, and neighborhoods offer help. Your agent and lender can guide you to local options.

Bottom Line

Closing costs are an important — and often underestimated — part of buying a home. They can vary widely depending on where you buy, so understanding your numbers (and ways to reduce them) can make a big difference.

Work with a local agent or lender to review typical costs in your area and get a personalized estimate. That way, you can budget with confidence and move forward knowing exactly what to expect.

Categories

Recent Posts

GET MORE INFORMATION