What Buyers Want Most—And How the Market Is Delivering

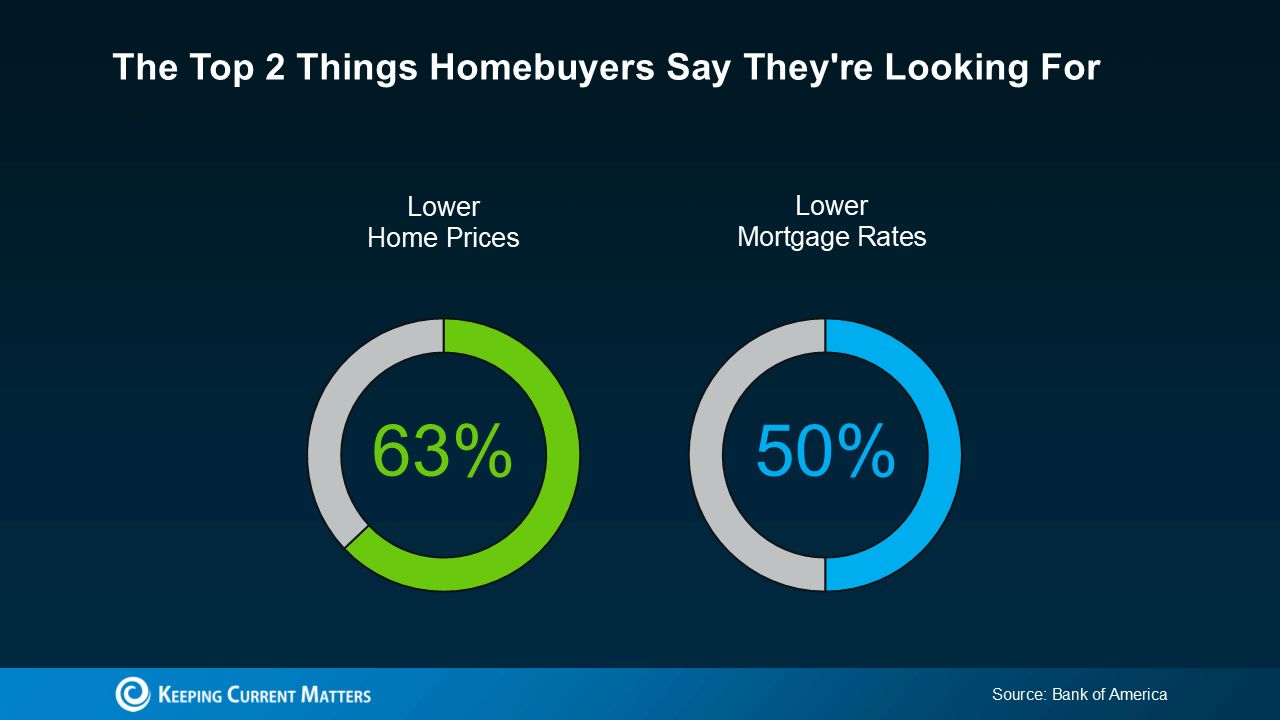

A recent Bank of America survey asked prospective buyers what would make them more confident about moving. The responses centered on one theme: affordability—especially when it comes to prices and interest rates.

The encouraging news is that, even though the overall economy still feels uncertain, there are signs of change in both prices and rates. Here’s a breakdown to give you a clearer picture.

Prices Are Easing

In recent years, home prices surged at a pace that left many buyers on the sidelines. But that rapid climb has slowed. For example, between 2020 and 2021, prices jumped 20% in just 12 months. Today, forecasts call for single-digit growth—far more typical.

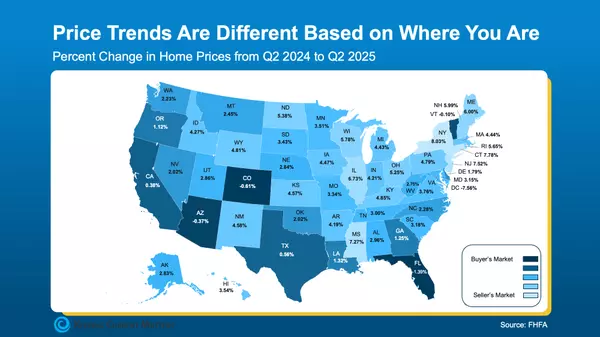

It’s important to note that trends vary by location. Some markets may still see increases, while others may dip slightly. Prices aren’t falling dramatically, but they are leveling off. For buyers, that moderation brings relief—making it easier to budget and move forward with confidence.

Mortgage Rates Are Coming Down

Mortgage rates have eased from recent highs, giving homebuyers some welcome relief. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“With prices rising at a slower pace and rates dipping slightly, affordability is improving—opening a window of opportunity for buyers to enter the market.”

Even a modest decline in rates can significantly reduce your monthly payment. While short-term volatility is likely, the overall outlook points to rates holding in the low-to-mid 6% range over the coming year—far better than just a few months ago, with the possibility of further declines depending on the economy.

Why This Matters

While confidence in the broader economy may still be shaky, the housing market is adjusting. Prices are moderating, and mortgage rates have eased from their peaks.

This doesn’t erase affordability challenges altogether, but it does create a different landscape than we saw earlier this year. These shifts could open the door for more buyers to step back into the market as we head into next year.

Bottom Line

The two biggest concerns for buyers are finally seeing some positive shifts. Prices are beginning to moderate, and mortgage rates are gradually easing. Both of these trends could carry forward into 2026, offering a more balanced market than we’ve seen in recent years.

If you’re thinking about making a move, this is the time to connect with a trusted local real estate agent who can walk you through what’s happening in your area, explain how these changes affect your specific situation, and help you build a strategy that makes sense for your goals.

Categories

Recent Posts

GET MORE INFORMATION