A Smart Move for Retirement: Investing in a Second Home

Thinking About Retirement? You’re Not Alone.

If you’ve been wondering whether you’re on track to retire someday, you're in good company. A recent report from Intuit found that 69% of people feel today’s financial climate makes long-term planning difficult and 68% aren’t even sure they’ll be able to retire at all.

That uncertainty has more people looking for ways to build financial security and real estate is emerging as a smart solution.

Why Consider Real Estate?

If the numbers line up for you, owning a second home could be a game changer for your retirement plan. Here’s what it could offer:

- Build long-term wealth: As home values appreciate, your second property can grow your net worth.

- Earn rental income: Renting it out can generate extra cash flow. Just keep in mind that income will help cover expenses like the mortgage and upkeep.

- Cash in later: You might choose to sell the home in the future and use the profit to boost your retirement savings.

- Diversify your portfolio: A second home gives you a physical asset that’s not tied to the stock market, helping balance your financial plan.

Second Homes Aren’t Just for Wealthy Investors

If you're thinking, “This is only for serious investors,” think again. Most people who own multiple properties aren’t big-time investors they’re everyday homeowners.

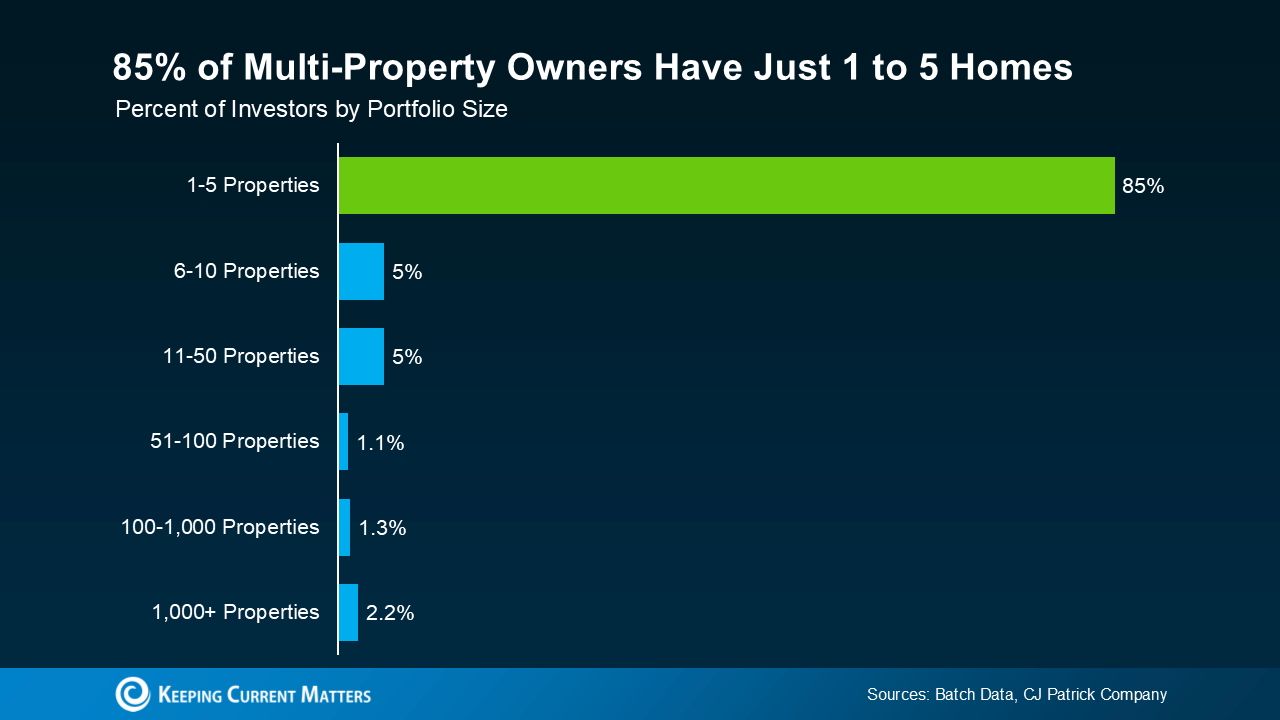

In fact, research from BatchData and CJ Patrick Company shows that 85% of people who own more than one home have just 1 to 5 properties. This is something more attainable than you might think.

Second Homeowners Are Everyday People Not Just Big-Time Investors Contrary to what you might think, most people who own multiple properties aren’t large-scale investors. They’re regular homeowners who picked up an extra home often to rent out, build equity, or hold onto as part of a long-term plan.

Why Now Could Be a Smart Time To Act

Today’s market is creating new opportunities for buyers. According to Danielle Hale, Chief Economist at Realtor.com:

“...the balance of power in the housing market keeps shifting in favor of homebuyers. A confluence of factors including more homes for sale, rising price cuts, and slower-moving inventory is giving buyers more leverage than they’ve had in years...”

If you're in a region where home values are projected to climb, buying now and selling down the road could strengthen your financial future. Prefer steady income? Renting the home out in the meantime could give your retirement fund a boost.

How To Get Started: Build the Right Team

If the idea of owning a second home appeals to you, the first step isn’t diving into listings it’s surrounding yourself with the right experts:

- A local real estate agent who knows the market inside and out

- A lender who understands second home and investment financing

Having the right people in your corner makes the process smoother and your decisions smarter from day one.

Bottom Line

Connect with a trusted local real estate agent to explore what’s possible. They’ll walk you through the opportunities, help you run the numbers, and see if a second home could offer more financial stability and peace of mind for your future.

If adding a second property could help you retire earlier, or give you more freedom when you do, wouldn’t it be worth taking a closer look?

Categories

Recent Posts

GET MORE INFORMATION