Don’t Wait for a Recession to Make Your Move; Here’s Why

Recession fears are back in the spotlight. If you’ve been thinking about buying or selling, you might be questioning whether now’s the right time to make a move. You’re not alone—a recent survey by John Burns Research and KCM shows that 68% of people are hitting pause on their real estate plans because of economic uncertainty.

But here’s the twist: not everyone is waiting out of fear. In fact, some buyers are waiting because they’re optimistic. According to Realtor.com, nearly 30% of potential homebuyers say a recession would actually make them more likely to purchase. Why? Because they see it as a chance to buy at a better rate.

“In the first quarter of 2025, nearly 30% of surveyed homebuyers said a recession would actually make them more likely to buy a home. Why? Because some buyers view a downturn as a window of opportunity. If the economy slows, the Federal Reserve may step in and cut interest rates to boost activity. That could lead to lower mortgage rates, which may help ease affordability challenges. For many buyers—especially those working with smaller down payments—a recession could feel like a more strategic time to enter the market.”

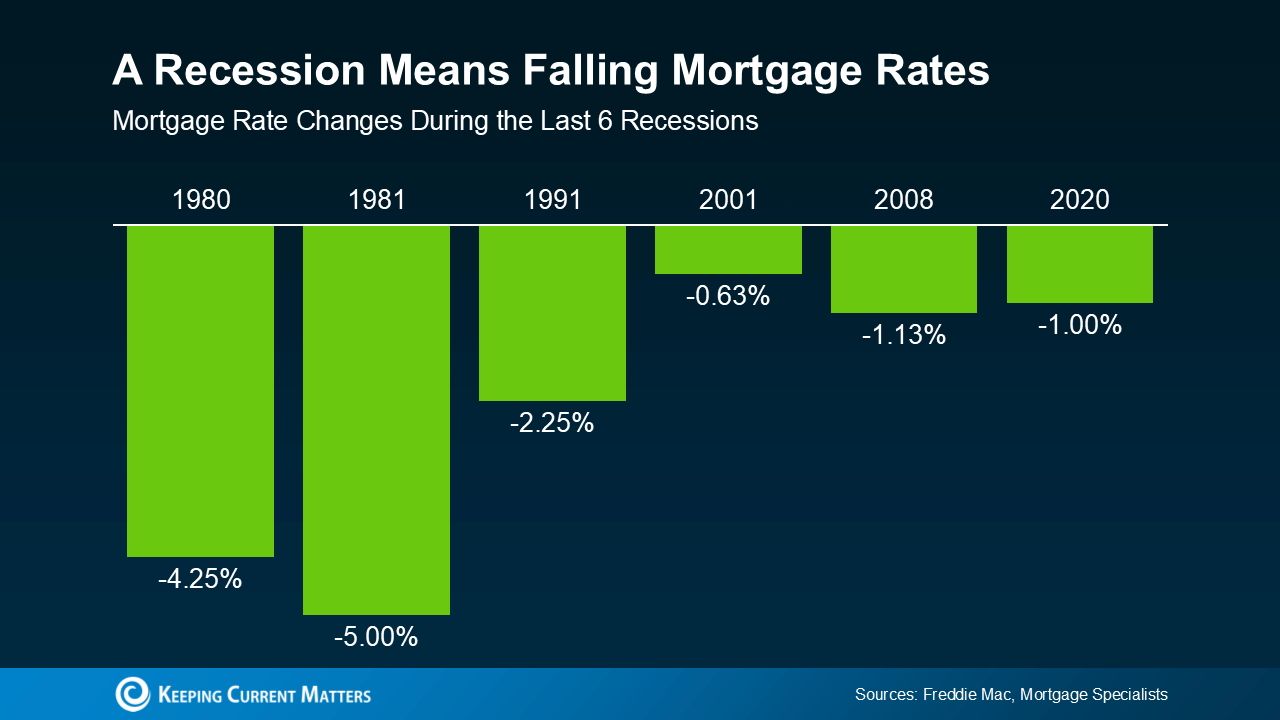

Their thinking makes sense. During past recessions, the Fed has often lowered interest rates to stimulate the economy. That usually puts downward pressure on mortgage rates—a trend we’ve seen in every one of the last six recessions. So while economic headlines might stir uncertainty, history shows opportunity often hides in moments of slowdown.

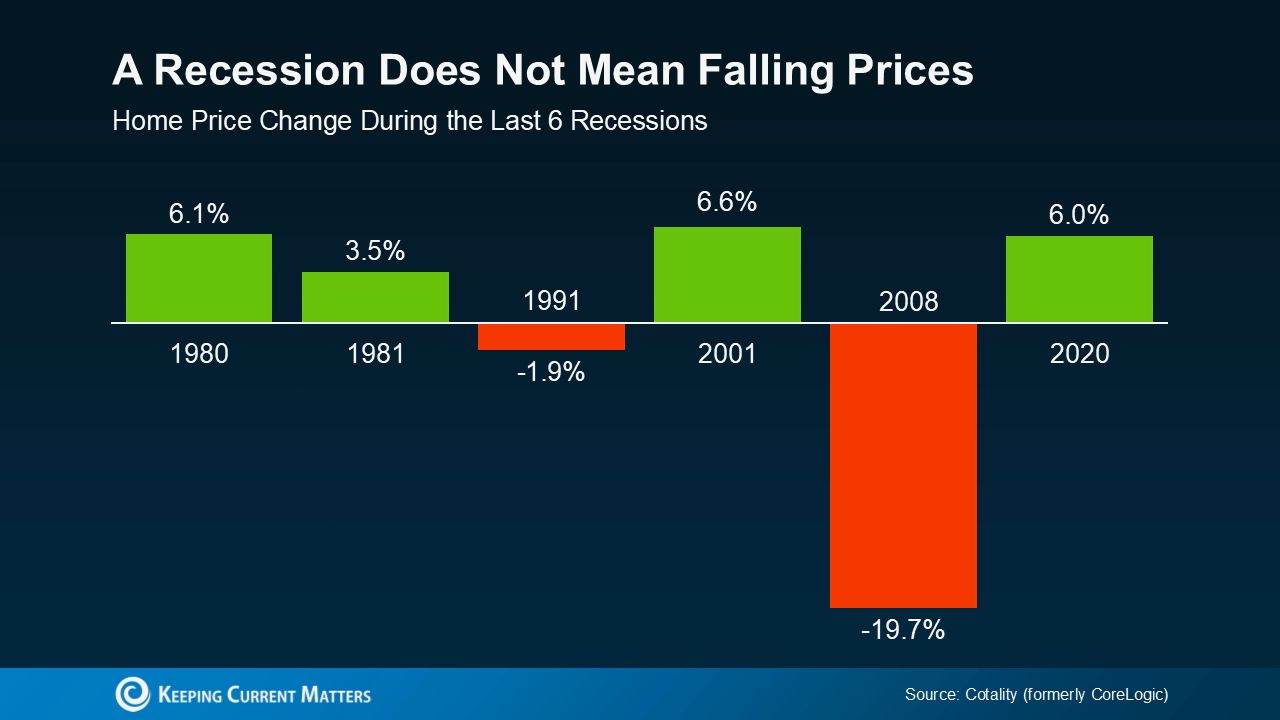

But here’s what many hopeful buyers might be overlooking: they’re not just expecting lower mortgage rates—they’re also betting that home prices will fall. And that’s where the data tells a different story.

According to Cotality (formerly CoreLogic), home prices actually increased during four of the last six recessions—not the price drop many buyers are counting on.

A lot of people assume that if a recession hits, home prices will tumble like they did in 2008; but that was the exception, not the rule. In fact, 2008 is the only time we’ve seen a major drop like that. Since then, prices have stayed resilient, largely due to a long-standing inventory shortage—even as more homes gradually hit the market.

Since prices tend to stay on whatever path they’re already on, know this: prices are still holding steady or rising in most metros, although at a much slower pace. So, a big drop isn’t likely. As Robert Frick, Corporate Economist with Navy Federal Credit Union, explains:

Historically, home prices tend to stick to the trend they’re already on. And right now, prices in most markets are either holding steady or rising; just at a slower pace. So a sharp drop isn’t likely. As Robert Frick, Corporate Economist at Navy Federal Credit Union, puts it:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point.”

Bottom Line

If you’ve been holding off in hopes that a recession will create the perfect buying or selling window, it’s worth taking a closer look at what typically happens—and what doesn’t. Yes, mortgage rates may dip. But a major drop in home prices? That’s unlikely.

Rather than waiting for a market shift that may never come, now’s the time to get clarity. Talk with a local agent who can help you navigate today’s landscape and build a strategy that works for you, no matter what the headlines say.

Categories

Recent Posts

GET MORE INFORMATION