FHA Loans: A Smart Move for First-Time Buyers

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan.

One of the most powerful resources for first-time buyers? FHA loans. These government-backed loans are designed to lower the financial barriers that stop many buyers from taking the leap. That’s why so many people are using them to finally make homeownership happen.

Whether you’re ready to stop renting, put down roots, or simply want a place that’s truly yours, an FHA loan might help you get there sooner than you expected.

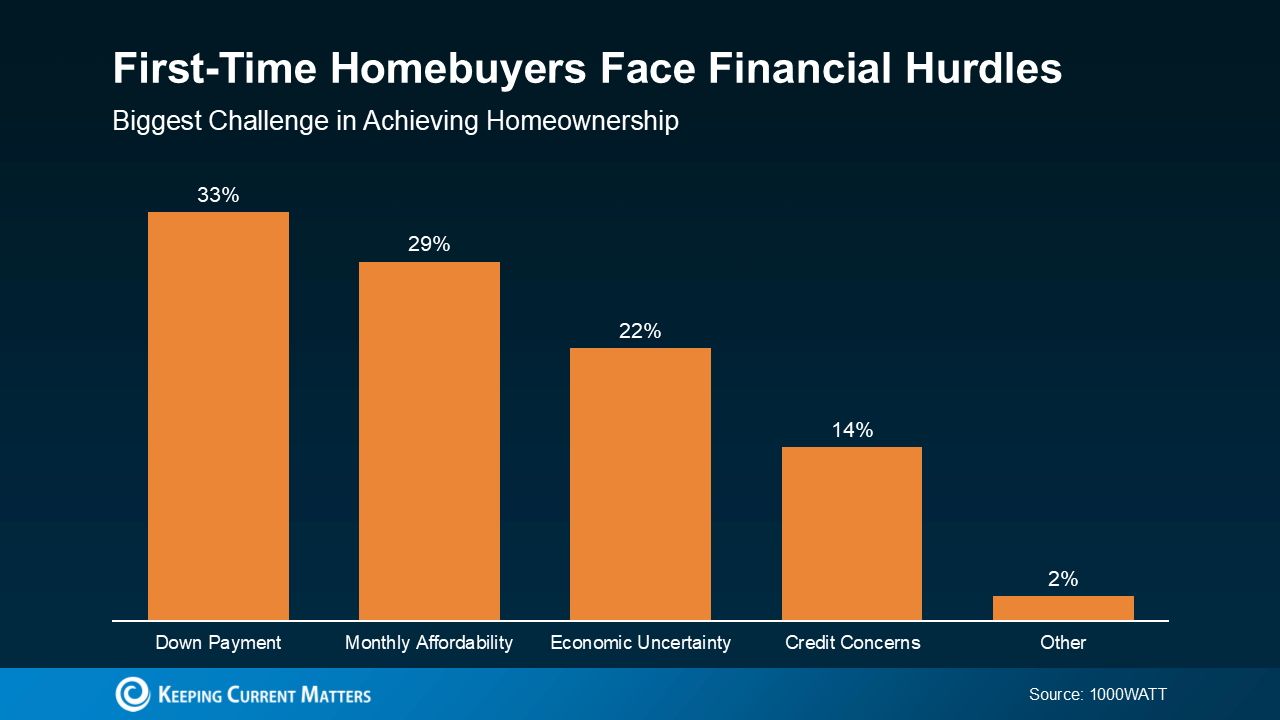

And you’re not alone. According to a recent 1000WATT survey, the two biggest concerns for first-time buyers today are coming up with a down payment and affording monthly mortgage payments, especially with where home prices and rates are. (See graph below.) FHA loans were built to help address exactly those challenges.

Here’s How FHA Loans Make a Difference

FHA loans are designed to help first-time buyers navigate the biggest financial hurdles.

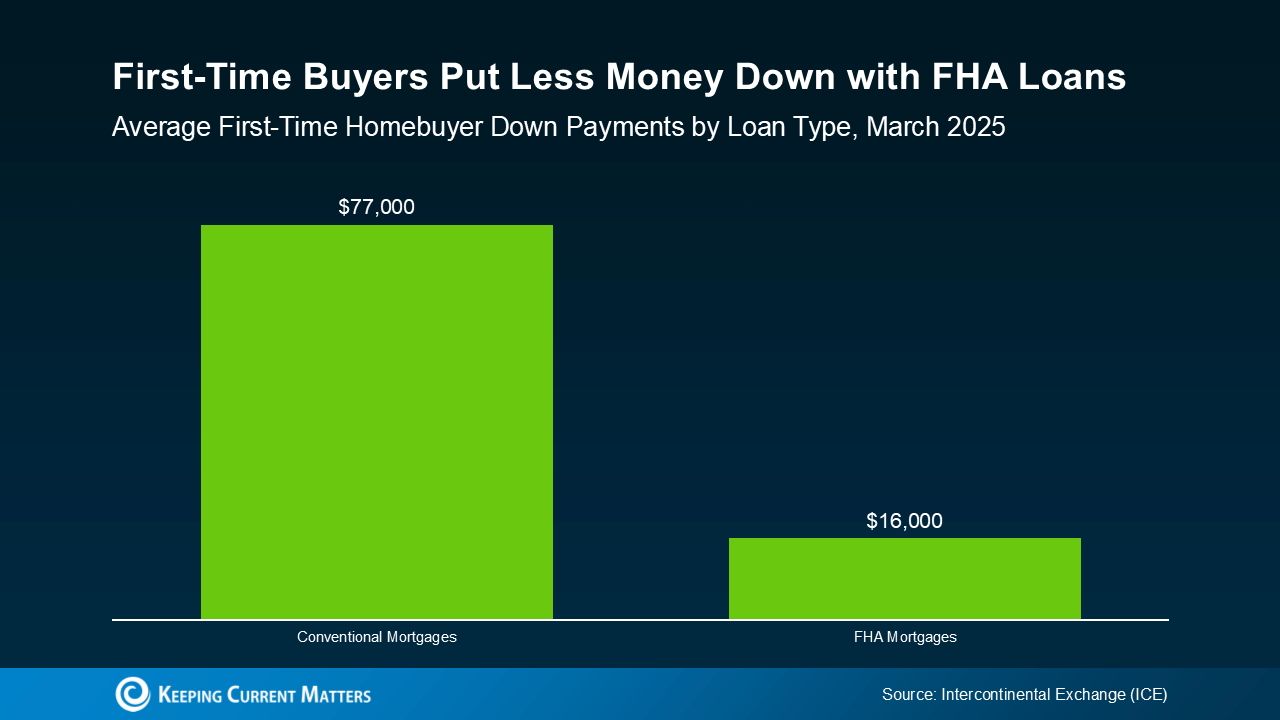

According to Intercontinental Exchange (ICE), the average down payment for first-time buyers using an FHA loan is just $16,000—compared to $77,000 with a typical conventional loan. That’s a major difference and a big reason why so many new buyers are choosing this path (see graph below).

FHA Loans Can Lighten the Load—Up Front and Every Month One of the biggest advantages of an FHA loan is that you may not need as much cash to get started. But that’s not the only benefit. You could also end up with a lower monthly payment.

That’s because FHA loans often come with lower interest rates than conventional loans. As Bankrate explains:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

If you’re exploring your first home purchase, it’s definitely worth looking into an FHA loan. With lower down payment requirements and potentially better mortgage rates, they’re designed to help tackle the two biggest challenges first-time buyers face: affording the upfront costs and managing monthly payments.

A knowledgeable lender can break it all down, help you compare options, and guide you toward the loan that fits your budget and your goals.

Bottom Line

With the right loan program and the right expert guidance, achieving homeownership might be more possible than you think—even in today’s market.

If you’re wondering what your options look like, connecting with a trusted local lender is a great first step. They can walk you through the details, compare loan types, and help you find a path forward that fits your goals and your budget.

Categories

Recent Posts

GET MORE INFORMATION