How Home Equity Keeps You Financially Strong, Even in a Shifting Market

Recent reports on softening home prices may raise questions about your home’s value. However, the numbers make it clear—despite minor price declines in certain areas, homeowners continue to hold significant equity advantages.

The Connection Between Home Prices and Equity

Home equity rises and falls alongside home prices. When prices go up, your equity grows. When prices ease, that growth naturally slows. Here’s how that trend has unfolded recently.

Following the record-breaking surge of 2020 and 2021, a bit of cooling was only to be expected.

At that time, the supply of homes for sale reached historic lows. With so few options available, competition among buyers drove prices—and homeowner equity—sharply higher.

But that rapid pace couldn’t last indefinitely. The market was bound to balance out, and that’s exactly what’s happening now.

As more listings hit the market this year, price growth has slowed—and with it, the rate of equity gains. That doesn’t mean you’ve lost value; it simply reflects a more sustainable pace.

Putting It in Perspective

Chances are, you still have significantly more equity than you did just a few years ago—and that gives you a strong advantage if you’re thinking about selling. Here’s the proof.

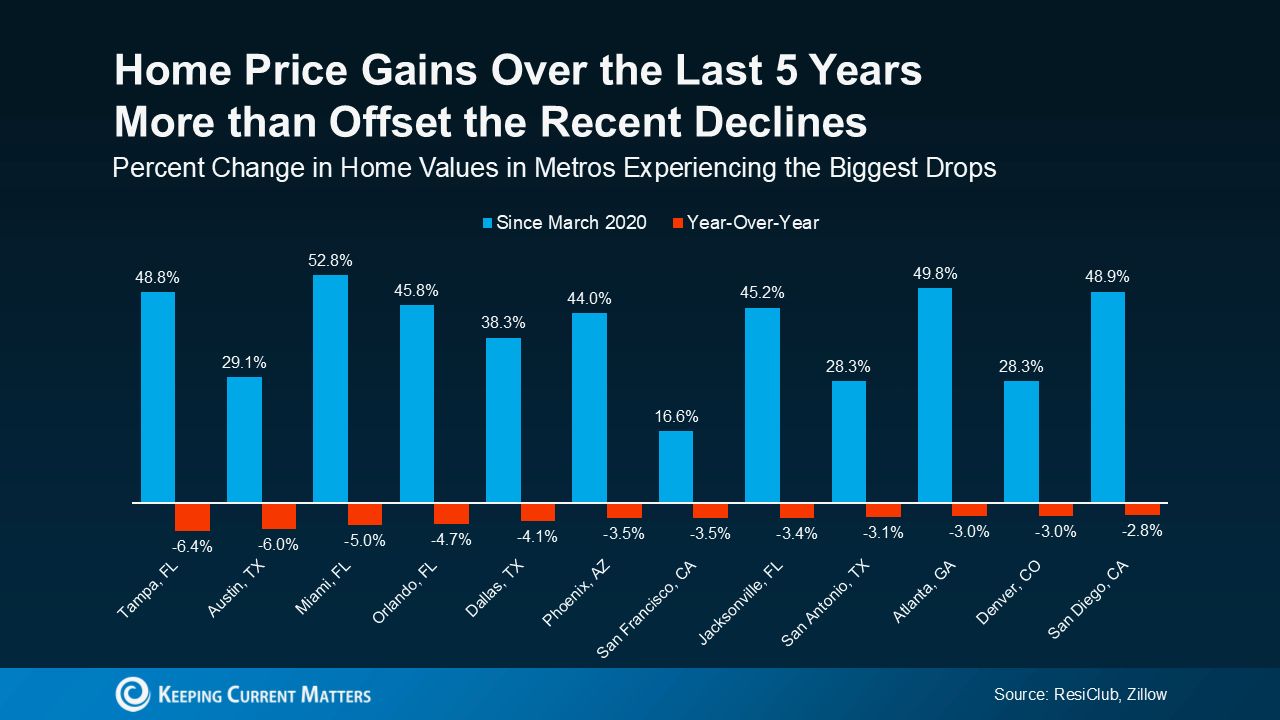

Zillow’s data shows that since March 2020, home prices nationwide have surged by an impressive 45%. That’s a remarkable increase.

In most markets, home prices are still climbing—just at a more moderate pace. Even in the metros areas seeing the largest declines (the ones grabbing headlines), the average dip is only around 4%.

So, what does that really mean? In the vast majority of areas, price growth continues steadily. And in the few places where values have eased slightly, the gains made over the past five years still far outweigh those minor pullbacks.

In short, these slight dips don’t come close to wiping out the substantial gains of recent years. Homeowners who’ve owned their properties for a while are still far ahead—by a wide margin—and that’s consistent across nearly every market.

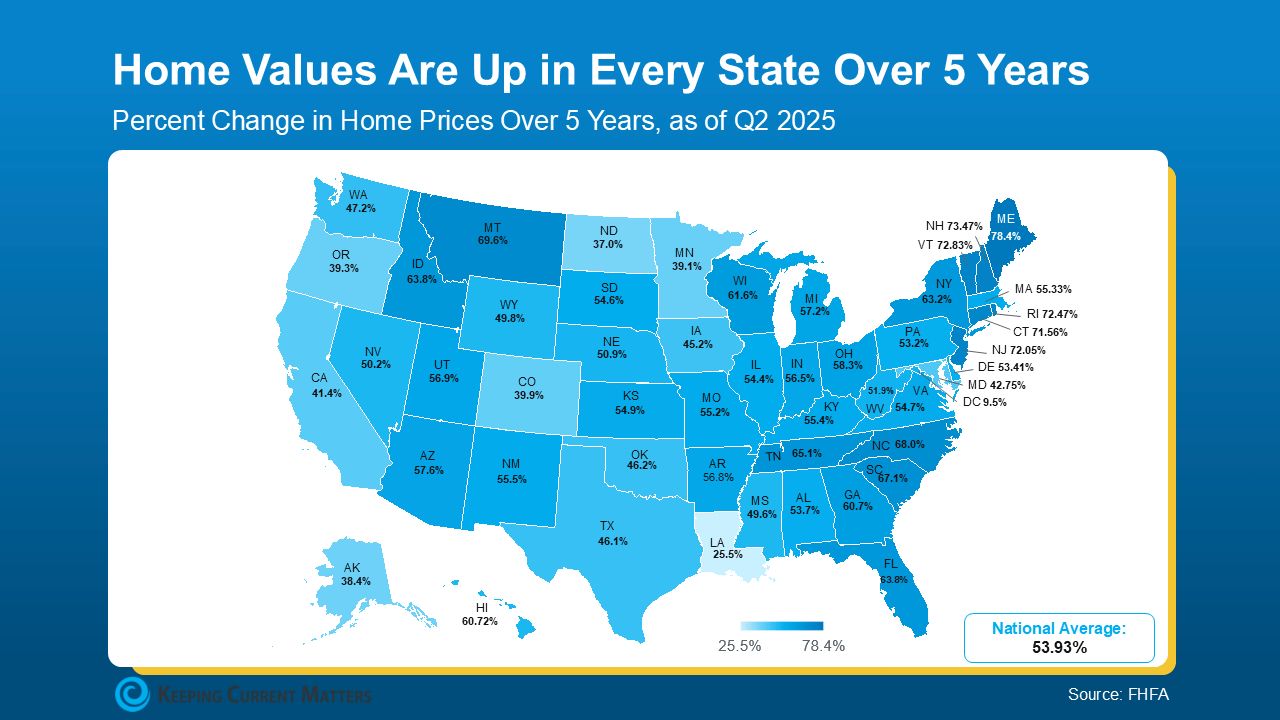

Data from the Federal Housing Finance Agency (FHFA) illustrates this clearly. Looking at the broader, state-by-state picture, every single state has experienced price growth over the past five years. That means homeowners everywhere are sitting on significantly more equity than they had just half a decade ago (see graph below):

Chances are, if you’ve owned your home for more than a few years, you’ve built the kind of equity that used to feel out of reach before the pandemic. And if you decide to sell, that equity can give you the flexibility to move up, downsize, or make your next move with confidence.

If you’re worried that recent price dips could lead to something bigger, here’s some perspective from Jake Krimmel, Senior Economist at Realtor.com:

“The recent, modest declines in overall home values and total equity aren’t a red flag. While the market is normalizing, widespread price drops across the country are highly unlikely anytime soon.”

The recent slowdown in price growth isn’t something to fear—it’s a healthy sign of balance returning to the housing market after several years of record-breaking gains. And even with that moderation, most homeowners remain in an exceptionally strong financial position.

Bottom Line

Even though prices have softened slightly in a few areas, today’s homeowners are still holding on to near-record levels of equity—one of the strongest financial cushions in history. That equity not only boosts your net worth, but it can also open doors to new opportunities, whether you’re thinking about upsizing, downsizing, or investing in your next property.

If you’re curious about how much equity you’ve built—or just how far ahead you really are—it’s worth having a conversation with a trusted local real estate professional. They can help you get a clear picture of your home’s current market value and what that means for your next move. You might be pleasantly surprised by just how much your home has appreciated.

Here are several questions and detailed answers about how home equity keeps you financially strong, even as the housing market shifts. ### What Is Home Equity and Why Is It Important? **Question:** What is home equity and how does it benefit homeowners financially? **Answer:** Home equity is the difference between your home's current market value and the remaining balance on your mortgage or any other liens. It is an important financial asset because it increases your net worth, can be borrowed against in emergencies, used as leverage to buy a new home, or cashed out when selling. This equity serves as a cushion during periods when home prices soften or fluctuate, providing financial security even if short-term values decrease. ### How Do Changes in Home Prices Affect Equity? **Question:** How do changing home prices influence your equity position? **Answer:** Home equity moves in tandem with home prices—when prices rise, equity grows; when prices decline or grow more slowly, equity growth moderates. Even recent minor declines in home values have not erased the substantial gains from the surge of 2020-2021, meaning most homeowners have much more equity than before the pandemic. ### How Significant Are Recent Price Changes? **Question:** Has the recent cooling in the market wiped out homeowners’ equity? **Answer:** No, the slowing pace of price increases simply reflects a more sustainable trend after the record rises of recent years. Even in metro areas with declines, the average dip is only about 4%, which is modest compared to the average 45% price growth nationwide since March 2020. The gains from previous years continue to far outweigh any minor pullbacks. ### Are Homeowners Still Financially Ahead? **Question:** Are homeowners still in a strong financial position despite recent market changes? **Answer:** Yes, most homeowners are still in a significantly stronger financial position, with near-record levels of equity. Data from the Federal Housing Finance Agency shows every state has experienced home price growth over the past five years. For people who have owned homes for several years, accumulated equity remains a robust financial advantage. ### Should Homeowners Be Worried About Price Declines? **Question:** Should recent price dips be a concern for homeowners? **Answer:** Modest declines in home values are not a sign of widespread financial trouble. Housing economists emphasize that these are normal signs of a market returning to balance after years of rapid growth. Widespread price drops across the country are highly unlikely, and homeowners' equity cushions remain strong. ### How Can Homeowners Use Their Equity? **Question:** What can homeowners do with their built-up equity? **Answer:** Homeowners can use their equity to move up to a larger home, downsize, invest in property, or simply enjoy enhanced financial flexibility. Consulting with a local real estate professional can help you understand your specific situation and make decisions with confidence. *** These questions and answers explain why home equity remains a source of financial strength, even as housing markets experience mild price shifts. Homeowners who have held properties for several years generally remain far ahead thanks to lasting equity gains.Categories

Recent Posts

GET MORE INFORMATION