How Much Could Your Home Actually Sell For?

Have you ever thought about the one thing most homeowners don’t check nearly as often as they should?

Here’s the spoiler: it’s the value of your home.

The truth is, your house is probably the largest financial asset you own. And if you’ve been living there for a few years, it’s likely been building wealth for you in the background—even if you haven’t been tracking it.

With the way the market has shifted recently, you might be surprised at just how much your equity has grown.

What Exactly Is Home Equity?

Home equity is the hidden wealth sitting in your home. It’s the gap between what your house could sell for today and what you still owe on your mortgage. Your equity builds in two ways: as home values rise and as you chip away at your loan with monthly payments.

Here’s a simple example: if your home is worth $500,000 and you still owe $200,000, you’ve got $300,000 in equity. And you’re not alone—Cotality reports the average U.S. homeowner with a mortgage is sitting on about $302,000 in equity right now.

Why Your Equity May Be Larger Than You Expect

Homeowners today are holding near-record levels of equity. Two key factors explain it:

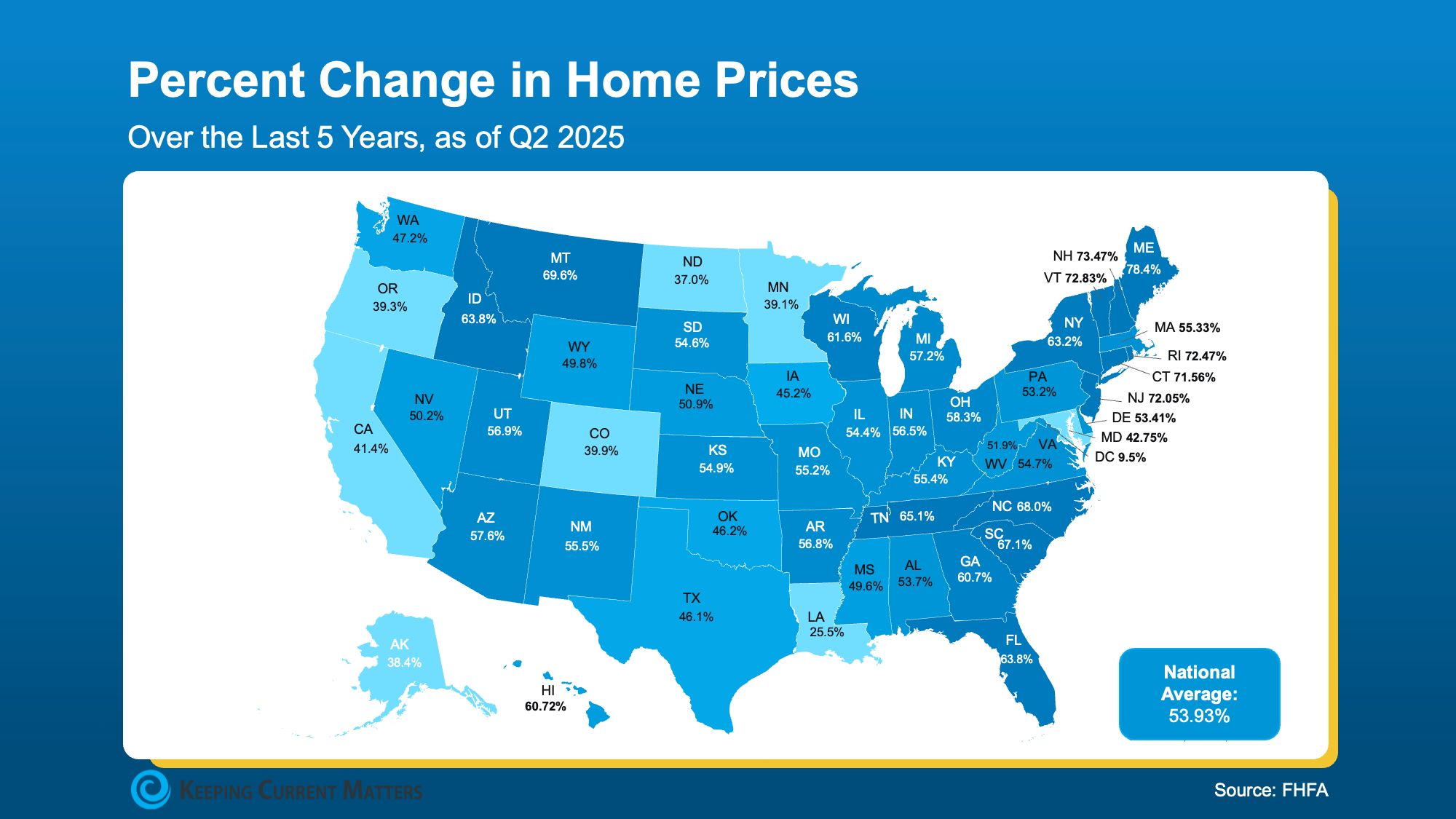

1. Rising Home Prices. Over the last five years, U.S. home prices have climbed nearly 54%, according to the Federal Housing Finance Agency (FHFA). (See the map below.)

That means your home is probably worth far more today than when you first purchased it, simply because prices have risen so much over time. And while you may have heard that prices are leveling off—or even dipping slightly in some markets—the reality is this: if you’ve owned your home for several years or longer, you’ve likely built up enough equity to sell and still come out ahead.

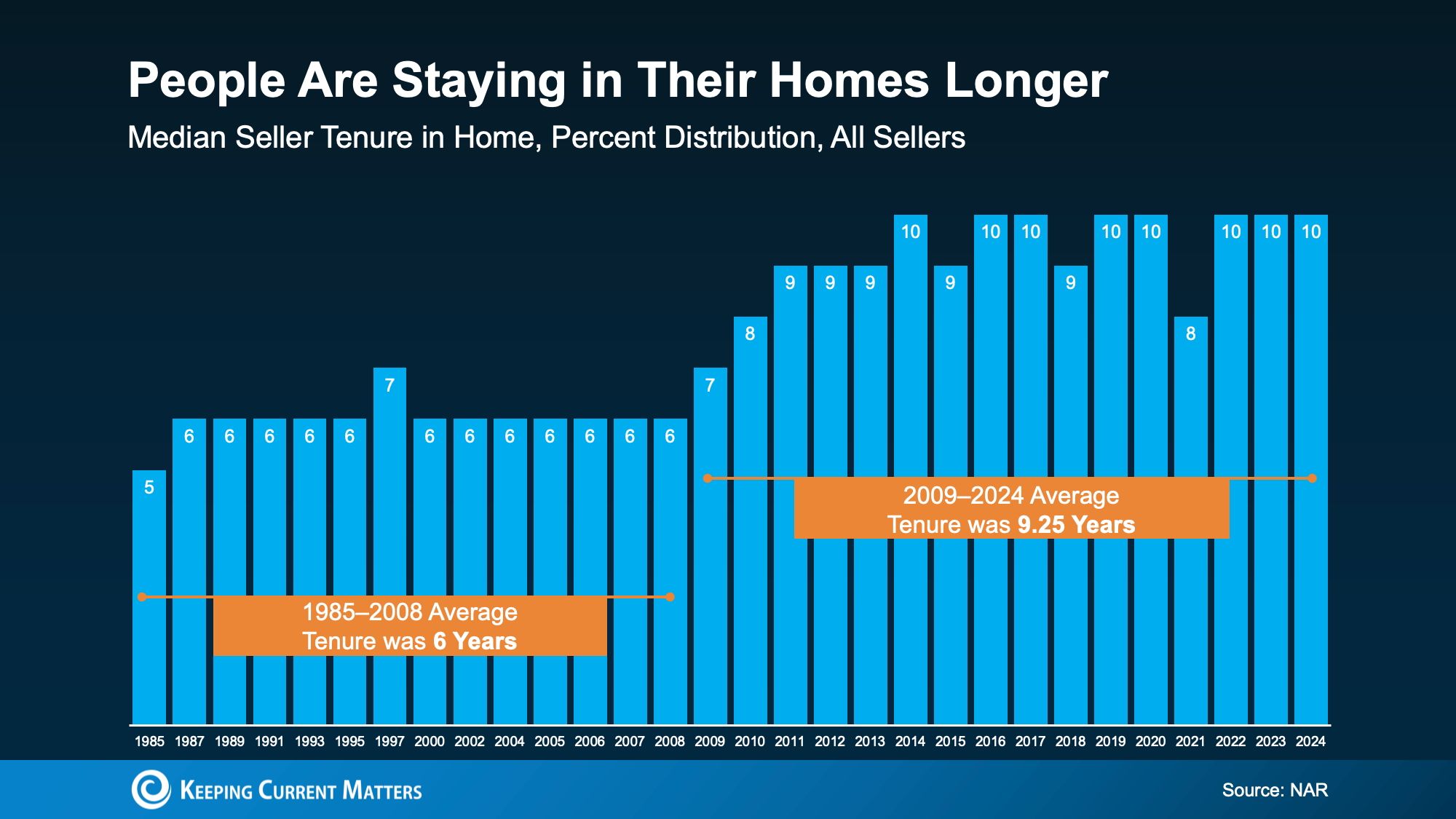

2. Homeowners Are Staying Put Longer. According to data from the National Association of Realtors (NAR), the average homeowner now stays in their home for about 10 years (see graph below):

That’s a longer stay than in years past. And over that time, you’ve been quietly building equity—not just through your monthly mortgage payments, but also through the steady climb of home values. Remember, real estate is a long game. Short-term ups and downs happen, but over time, homeowners almost always come out ahead.

If you’ve owned your home for a while, here’s what that steady growth has meant: according to NAR,

“In the last 10 years, the average homeowner has gained about $201,600 in wealth from home price appreciation alone.”

How Can You Put Your Equity to Work?

Equity isn’t just a number on paper—it’s a powerful resource you can tap into to fuel your next chapter. Depending on your goals, you might:

- Buy Your Next Home. Use your equity to cover a down payment—or even purchase your next place outright with cash.

- Upgrade Your Current Home. Renovate to match your lifestyle today, and if you choose the right projects, boost your home’s resale value at the same time.

- Fund a Dream Venture. Put your equity toward starting that business you’ve been envisioning—whether it’s equipment, software, or marketing—to unlock new earning potential.

Bottom Line

Chances are, your home is worth more than you realize right now. If you’re wondering just how much, the smartest move is to connect with a local real estate professional who can run the numbers for you. That way, you’ll have a clear picture of your equity, understand exactly what you’re working with, and feel confident about the options available for your next step forward.

Categories

Recent Posts

GET MORE INFORMATION