How a Fed Rate Cut Could Impact Mortgage Rates

The Federal Reserve meets this week, and many expect a cut to the Federal Funds Rate. But here’s the big question: will mortgage rates actually follow? Let’s clear things up.

The Fed Doesn’t Control Mortgage Rates Directly

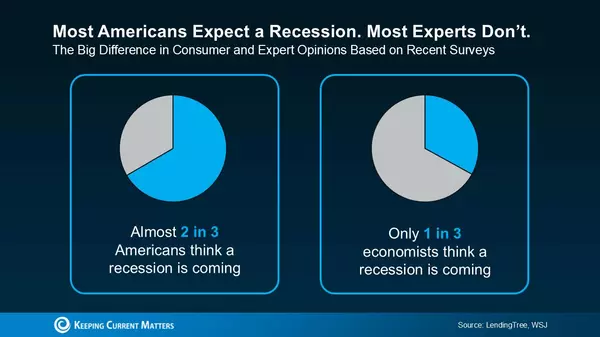

All eyes are on the Fed as they head into their mid-September meeting. Economists widely believe a rate cut is coming to help fend off a potential recession.

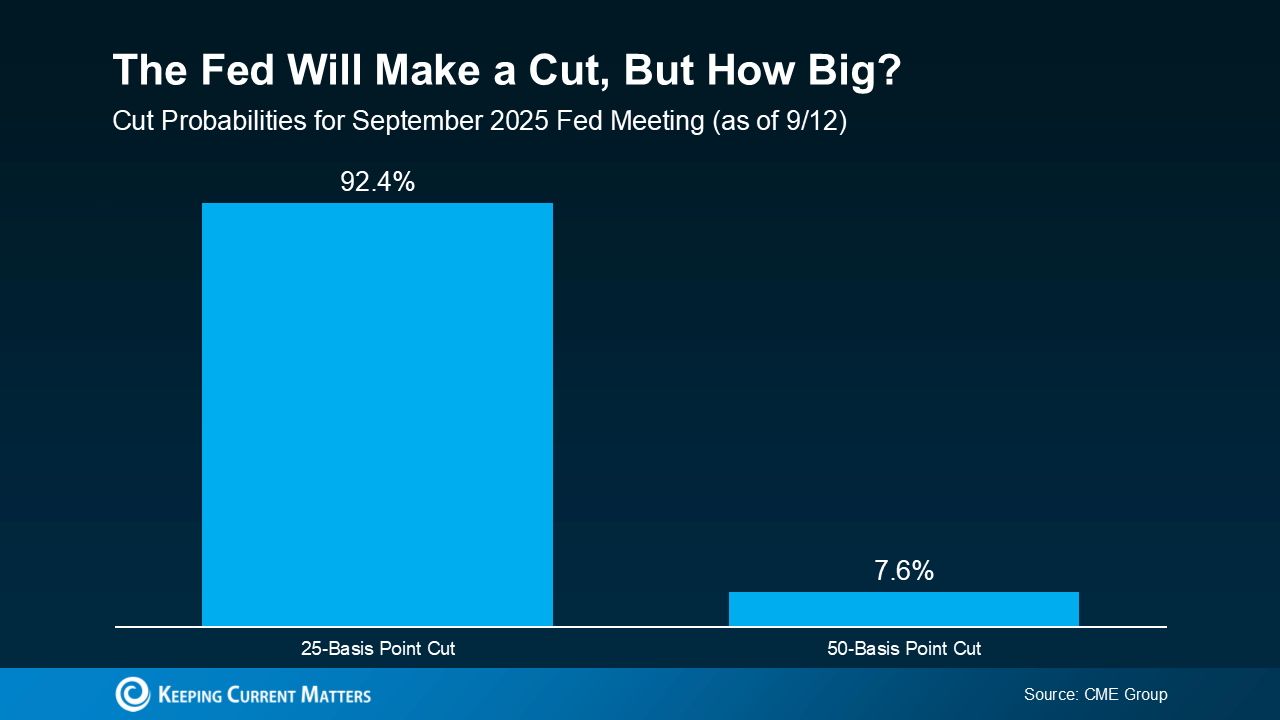

Markets agree. The CME FedWatch Tool shows nearly a 100% probability of a September cut. Right now, odds point to about a 92% chance of a small 25-basis-point cut and an 8% chance of a larger 50-basis-point cut.

The Federal Funds Rate is the short-term interest rate banks charge one another. While it influences borrowing costs throughout the economy, it’s not the same as mortgage rates. That said, the Fed’s decisions often steer where mortgage rates head next.

Why the Market Saw This Coming

Here’s something that may surprise you: mortgage rates often move based on what markets expect the Fed to do, not just the Fed’s official decision. In other words, when a cut looks likely, that expectation is already priced into today’s mortgage rates.

That’s exactly what played out after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates slipped as markets grew more confident a cut was on the way. Even with inflation ticking slightly higher in the most recent CPI report, the Fed is still widely expected to cut.

If the Fed delivers the anticipated 25-basis point cut, the effect is likely already reflected in current mortgage rates. But if they surprise with a 50 basis points cut, we could see rates fall further than they have so far.

What’s Next for Mortgage Rates?

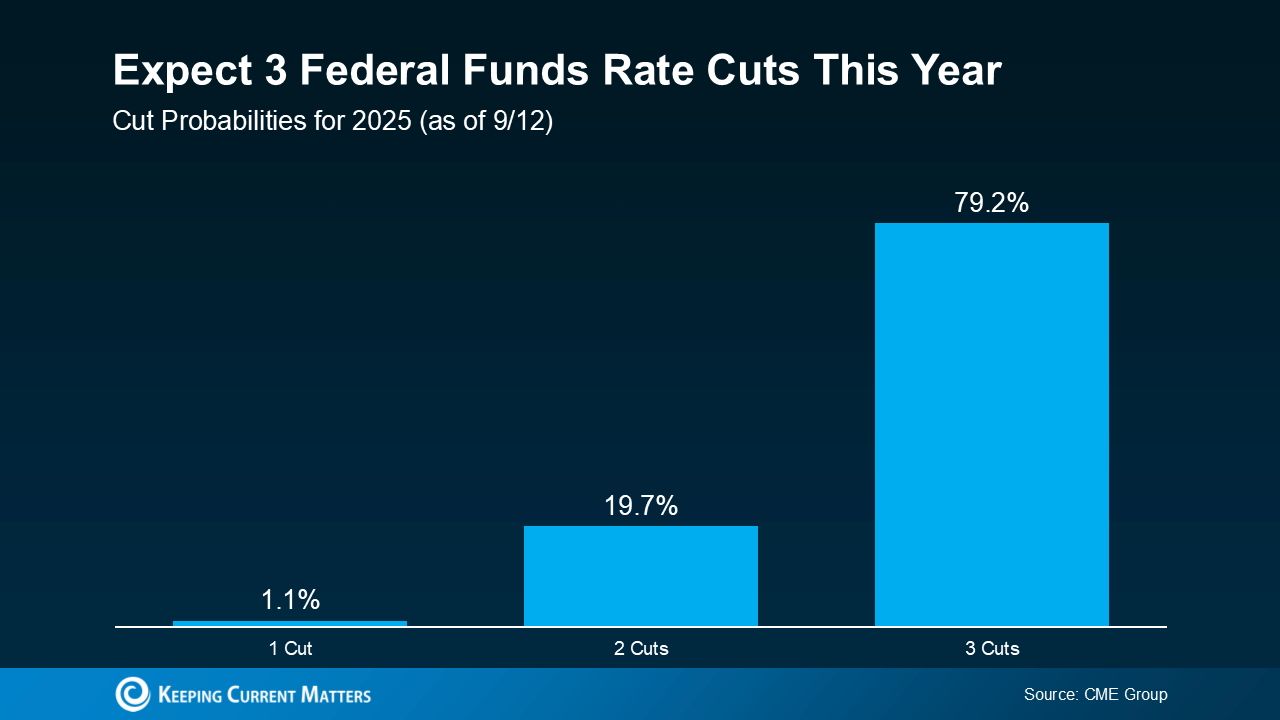

This upcoming cut may not shift mortgage rates dramatically, but many experts believe the Fed could reduce the Federal Funds Rate more than once before year’s end—provided the economy keeps showing signs of cooling (see graph below).

As Sam Williamson, Senior Economist at First American, explains:

“If investors gain confidence that the Fed is starting a rate-cutting cycle, mortgage rates could trend lower in the second half of 2025. That would ease some of the affordability challenges buyers face and potentially spark more demand and activity in the housing market.”

If the Fed delivers multiple cuts—or even if markets simply expect them—mortgage rates could drift down further in the months ahead. But the outlook isn’t set in stone. A surprise spike in inflation or unexpected economic shifts could quickly change the picture.

Bottom Line

Mortgage rates probably won’t fall dramatically overnight, nor will they track the Fed’s actions in perfect lockstep. Still, if the Fed does begin a rate-cutting cycle—and markets remain confident in that direction—mortgage rates could gradually trend lower later this year and into 2026.

For anyone who’s been waiting on the sidelines, this is a smart moment to start talking strategy. Even modest rate shifts can have a real impact on affordability, monthly payments, and long-term buying power. Understanding where things may be headed gives you the clarity to make the right move for your unique situation.

Categories

Recent Posts

GET MORE INFORMATION