How a Government Shutdown Impacts the Housing Market

With all the recent chatter about a potential government shutdown, many are wondering if the housing market comes to a standstill.

The reality? It doesn’t.

Transactions continue, contracts get signed, and homes still change hands. While some administrative parts of the process may move more slowly, the broader housing market remains active and resilient.

What Usually Happens During a Shutdown

When the government shuts down, several federal agencies either pause or reduce their operations. This can create a few temporary hurdles in real estate—particularly when it comes to processing specific government-backed loans and meeting insurance requirements:

- According to Selma Hepp, Chief Economist at CoreLogic, applicants using FHA, VA, or USDA loans—which make up roughly one-quarter of all mortgage applications—could experience notable processing delays during a shutdown due to agency furloughs.

- Zillow adds that an estimated 2,500 mortgage originations per working day risk being delayed when government operations pause.

- Additionally, flood insurance approvals may be put on hold, as the National Flood Insurance Program (NFIP) can be temporarily disrupted, causing closings in flood zones to stall until it resumes.

Even with those temporary hurdles, most real estate transactions still move forward. Buyers continue to buy, sellers continue to sell, and agents keep guiding clients through the process.

The Housing Market Typically Rebounds Quickly

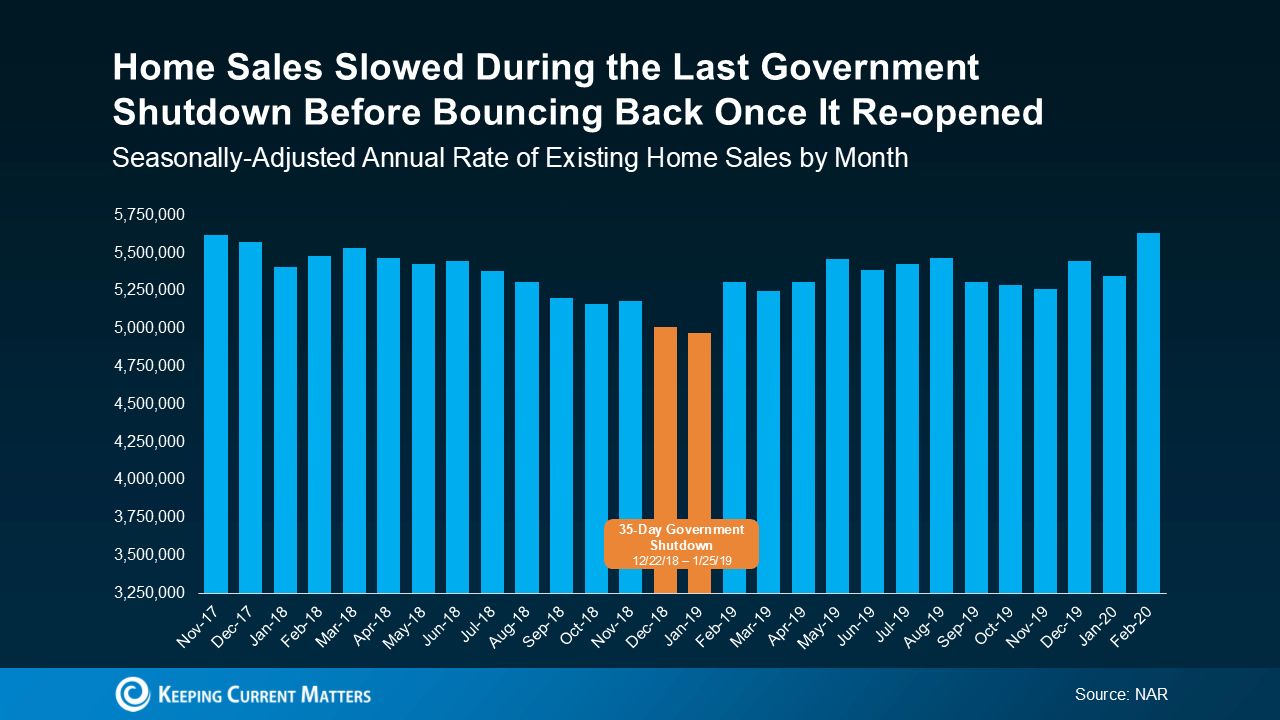

History shows the housing market is remarkably resilient. During the last major government shutdown at the end of 2018—which lasted 35 days—sales activity dipped only slightly, then bounced back as soon as the government reopened.

According to data from the National Association of Realtors (NAR), existing home sales slowed for roughly two months but rebounded swiftly as postponed closings cleared once operations resumed (see graph below).

It’s important to understand that the dip shown by the orange bars on this graph isn’t just part of normal seasonal trends. The sharper, more sudden decline directly corresponds to the 35-day government shutdown—and sales rebounded immediately once it ended.

What This Means for You

If you’re in the process of buying or selling a home, there’s no need to panic. Most transactions will still close—though some may experience minor delays. According to Jeff Ostrowski, Housing Market Analyst at Bankrate,

“If your closing is scheduled for the coming weeks, you might see a short delay—but for most people, it’ll be more of a brief slowdown than a deal-breaker.”

If you’re just beginning to consider buying or selling, this moment could actually present an opportunity. Periods of uncertainty often cause some people to pause their plans, which can briefly shift the balance of the market.

With fewer buyers competing, well-prepared purchasers may find less pressure and more negotiating power. Likewise, motivated sellers may be more open to offers. These short pauses in activity can create a window to make your move before the market gains momentum again.

Bottom Line

While a government shutdown can create short-term delays or extra steps for some buyers, it doesn’t bring the housing market to a halt. In fact, history shows that real estate activity typically rebounds quickly once the government reopens—just as it did after the 35-day closure in 2018.

If you’re wondering how a potential shutdown might influence your next move—or simply want help interpreting what it means for your local market—reach out to a trusted real estate professional. The right agent can walk you through the nuances, keep your plans on track, and help you make confident decisions no matter what’s happening in Washington.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What happens to the housing market during a government shutdown?", "acceptedAnswer": { "@type": "Answer", "text": "The housing market does not come to a standstill during a government shutdown. Most real estate transactions continue, contracts are signed, and homes still change hands. While some administrative processes may slow down, the broader market remains active and resilient." } }, { "@type": "Question", "name": "Which parts of the homebuying process are affected?", "acceptedAnswer": { "@type": "Answer", "text": "Government shutdowns can delay the processing of government-backed loans, such as FHA, VA, and USDA loans, which account for about one-quarter of all mortgage applications. Flood insurance approvals may also be put on hold, especially in flood-prone areas, since the National Flood Insurance Program (NFIP) can be temporarily disrupted." } }, { "@type": "Question", "name": "How long do these delays typically last?", "acceptedAnswer": { "@type": "Answer", "text": "Delays are usually short-term and resolve quickly once the government reopens. For example, during the 35-day shutdown at the end of 2018, existing home sales dipped slightly for about two months but rebounded swiftly after operations resumed." } }, { "@type": "Question", "name": "Does a government shutdown stop home sales?", "acceptedAnswer": { "@type": "Answer", "text": "No, a government shutdown does not stop home sales. Most transactions proceed as usual, though some buyers relying on government-backed loans or flood insurance may experience minor delays." } }, { "@type": "Question", "name": "What should buyers and sellers do during a shutdown?", "acceptedAnswer": { "@type": "Answer", "text": "Buyers and sellers should not panic. Most transactions will still close, though some may experience brief delays. Well-prepared buyers may find less competition and more negotiating power, while motivated sellers may be more open to offers." } }, { "@type": "Question", "name": "Can a government shutdown create opportunities in the housing market?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, periods of uncertainty can cause some buyers and sellers to pause, briefly shifting the market balance. This can create opportunities for well-prepared buyers and motivated sellers to make moves before the market regains momentum." } }, { "@type": "Question", "name": "How quickly does the housing market recover after a shutdown?", "acceptedAnswer": { "@type": "Answer", "text": "The housing market typically rebounds quickly after a shutdown ends. Historical data shows that sales activity resumes and often returns to normal levels within a few weeks of government operations restarting." } }, { "@type": "Question", "name": "Should I consult a real estate professional during a shutdown?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, consulting a trusted real estate professional is recommended. They can help navigate any administrative delays, keep your plans on track, and provide guidance tailored to your local market conditions." } } ] }

Categories

Recent Posts

GET MORE INFORMATION