How to Buy Multiple Rental Properties Using Financing

1

Growing a rental portfolio takes strategy, organization, and the right financial tools. Whether you're aiming to scale from one property to five or build a long-term income stream, here's a step-by-step breakdown on how to buy multiple rental properties with financing.

1. Start by Stabilizing Your Current Property

Before expanding, make sure your existing rental is performing well. That means:

-

Rents are competitive and consistently collected

-

Vacancies are minimized

-

Maintenance and upgrades are up-to-date

Lenders often require a “seasoning period”—typically 3 to 12 months—before allowing you to leverage equity or refinance, so a solid foundation is key.

2. Diversify Property Types

Spreading your investments across different asset classes helps manage risk and increase returns. Consider mixing:

-

Residential: Single-families, duplexes, triplexes, and turnkey rentals

-

Vacation & Short-Term: Properties in desirable travel markets

-

Commercial or Mixed-Use: Offices, retail, or multifamily buildings

-

Land: Raw lots with development potential

Choose based on your cash flow goals, risk tolerance, and long-term appreciation plans.

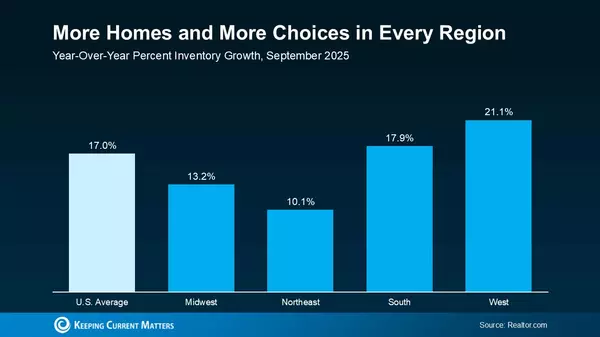

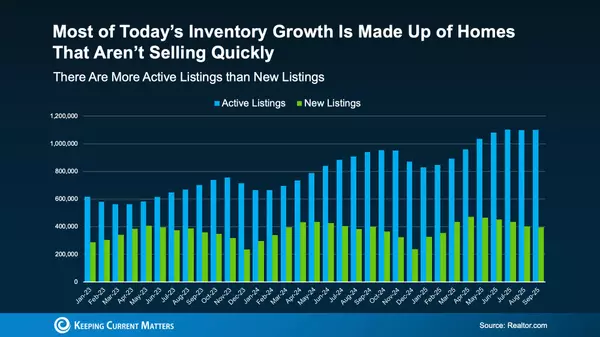

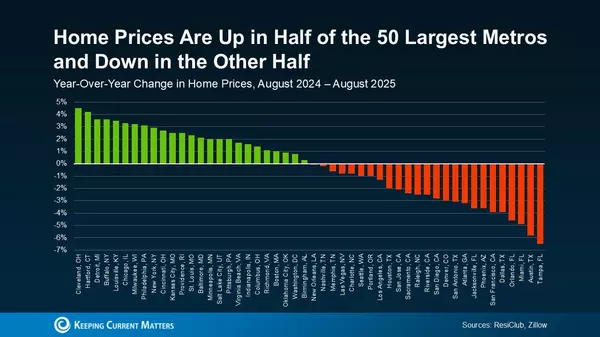

3. Explore New Locations

Once you know what you want to buy, start looking beyond your backyard. Use platforms like Realtor.com, Zillow, or Trulia—and most importantly, partner with a real estate agent who can set up MLS alerts tailored to your investment criteria.

4. Run the Numbers

Before making offers, dig into the financials:

-

Cap Rate – the property’s net return based on operating income

-

Cash-on-Cash Return – how much income you’re earning relative to what you’ve invested

-

ROI – overall profitability of the investment

Focus on positive monthly cash flow over speculative appreciation. If the property doesn’t cash flow, consider how to increase income or reduce expenses.

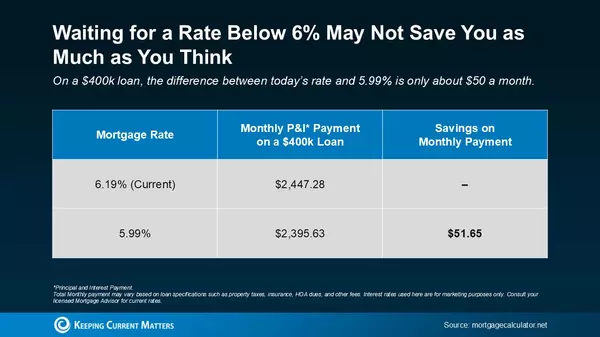

5. Choose the Right Financing Strategy

Financing gets more complex with scale, but you have options:

| Loan Type | Best For | Highlights |

|---|---|---|

| Hard Money | Short-term flips or quick deals | Fast funding, high rates (12%–18%), interest-only terms |

| Conventional Loan | Strong credit & down payment (25%+) | Fixed rates, backed by Fannie/Freddie |

| Portfolio Loans | Seasoned investors with multiple properties | Flexible terms, less rigid qualification standards |

| HELOC or Investment LOC | Equity-rich primary residence or rentals | Revolving line of credit based on property equity |

| Owner Financing | Creative deals, seller-held notes | Flexible terms, higher interest, seller becomes the lender |

| Blanket Loans | Buying or refinancing multiple properties | One loan for multiple assets, often short term |

| Cash-out Refinance | Unlocking equity in owned properties | Replaces existing mortgage, frees up funds for reinvestment |

| 1031 Exchange | Selling to reinvest and defer taxes | Tax-deferred equity rollover into new investment property |

Be ready to supply tax returns, bank statements, proof of income, and a track record of managing properties.

6. Plan for Property Management

Decide whether to self-manage or hire help.

-

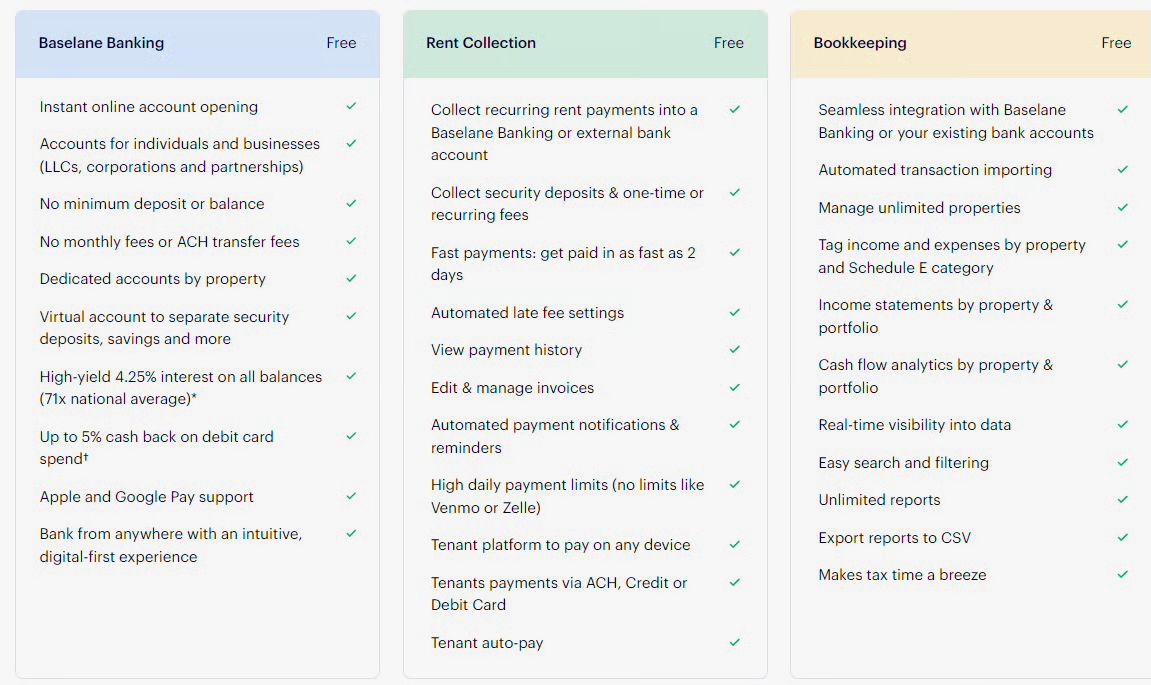

Self-managing? Use tools like Baselane or other landlord software to automate rent collection, tenant screening, and maintenance tracking.

-

Hiring a property manager? Expect to pay 4%–10% of gross rent.

Either way, having systems in place is essential for managing multiple doors smoothly.

Final Thoughts

Buying multiple rental properties can unlock powerful income and long-term wealth—but it takes preparation. From choosing the right properties to financing smartly and managing effectively, each step matters. Run your numbers, stay strategic, and build a portfolio that works for your goals.

Categories

Recent Posts

GET MORE INFORMATION