Is Waiting for Lower Rates Worth It? Here’s What You Need to Know

Mortgage rates are still making headlines — and for good reason. After a weaker-than-expected jobs report, the bond market reacted almost instantly. The result? In early August, rates dipped to 6.55% — the lowest level we’ve seen all year.

It might not seem like a huge change, but for buyers who’ve been holding out for relief, even a modest drop can spark fresh hope that rates are finally on the way down.

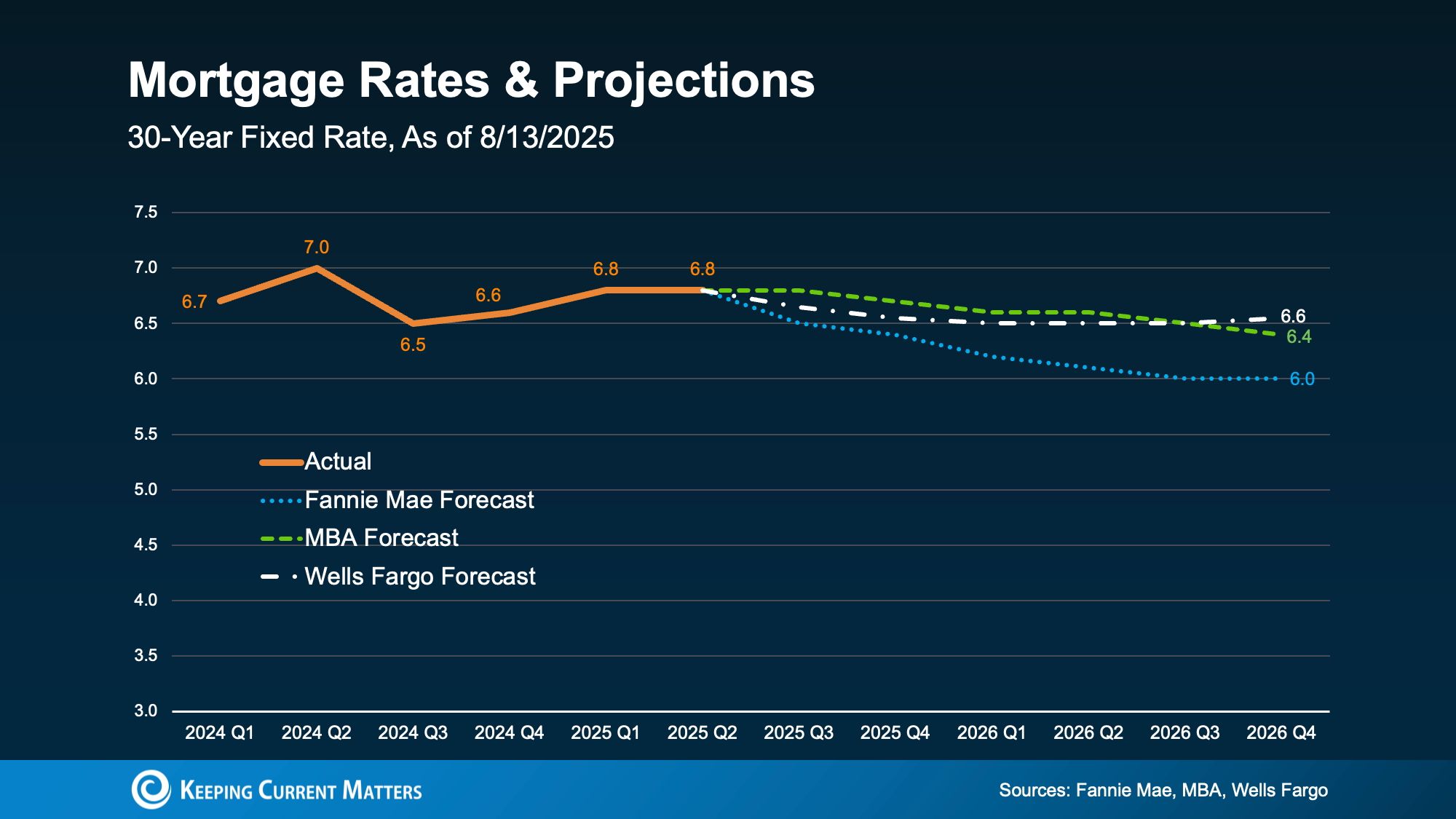

But here’s the reality check: according to the latest forecasts, a dramatic plunge isn’t on the horizon. Most experts expect rates to hover in the mid-to-low 6% range through 2026 (see graph below).

Put simply, we’re not expecting any dramatic rate drops — but small shifts like the one we just saw are still on the table. Every new piece of economic data has the potential to move mortgage rates, and with several key reports coming out this week, we’ll soon have a clearer read on where the economy, inflation, and rates are headed.

What’s the Magic Number for Buyers?

For many buyers, it’s 6%. And that’s not just a nice round number — it matters. According to the National Association of Realtors (NAR), if rates hit 6%:

- 5.5 million more households could afford the median-priced home

- Roughly 550,000 people would likely buy within the next 12–18 months

That’s a huge wave of pent-up demand waiting to be unleashed. Fannie Mae projects we could hit that threshold next year, but here’s the tradeoff: if you’re waiting for 6%, so is everyone else. When rates tick down and buyers flood back in, you could face stiffer competition, tighter inventory, and rising prices.

Right now, the market offers some unique advantages:

- More choices with inventory up

- Slower price growth making homes more realistically priced

- More negotiating power for better deals

These opportunities may disappear once rates drop and demand surges. As NAR says:

“Buyers who are holding out for lower mortgage rates may be missing a key opening in the market.”

Bottom Line

Mortgage rates likely won’t reach 6% this year — but when they do, expect a rush of buyers and tougher competition. If you’d rather shop with less pressure and more leverage, that window is open right now… and it may close quickly depending on where the economy heads next.

Connect with a local agent to get the latest on your market and decide if it’s smarter to act now, before the crowd jumps in.

Categories

Recent Posts

GET MORE INFORMATION