Is the Housing Boom Going Too Far? Let’s Break Down the Numbers

If it seems like new construction signs are popping up on every corner, you’re not imagining it — builders have been hard at work. That’s led many to ask: are we headed toward another overbuilding scenario like the one before the 2008 housing crash?

Despite the headlines, there’s no cause for concern. The numbers tell a different story — instead of speeding up, builders are actually easing off the gas.

Builders Are Pumping the Brakes, Not Ramping Up

Building permits — the applications that signal upcoming construction — are one of the clearest indicators of where the housing market is headed. And right now, those permits are moving down, not up. Here’s why that matters.

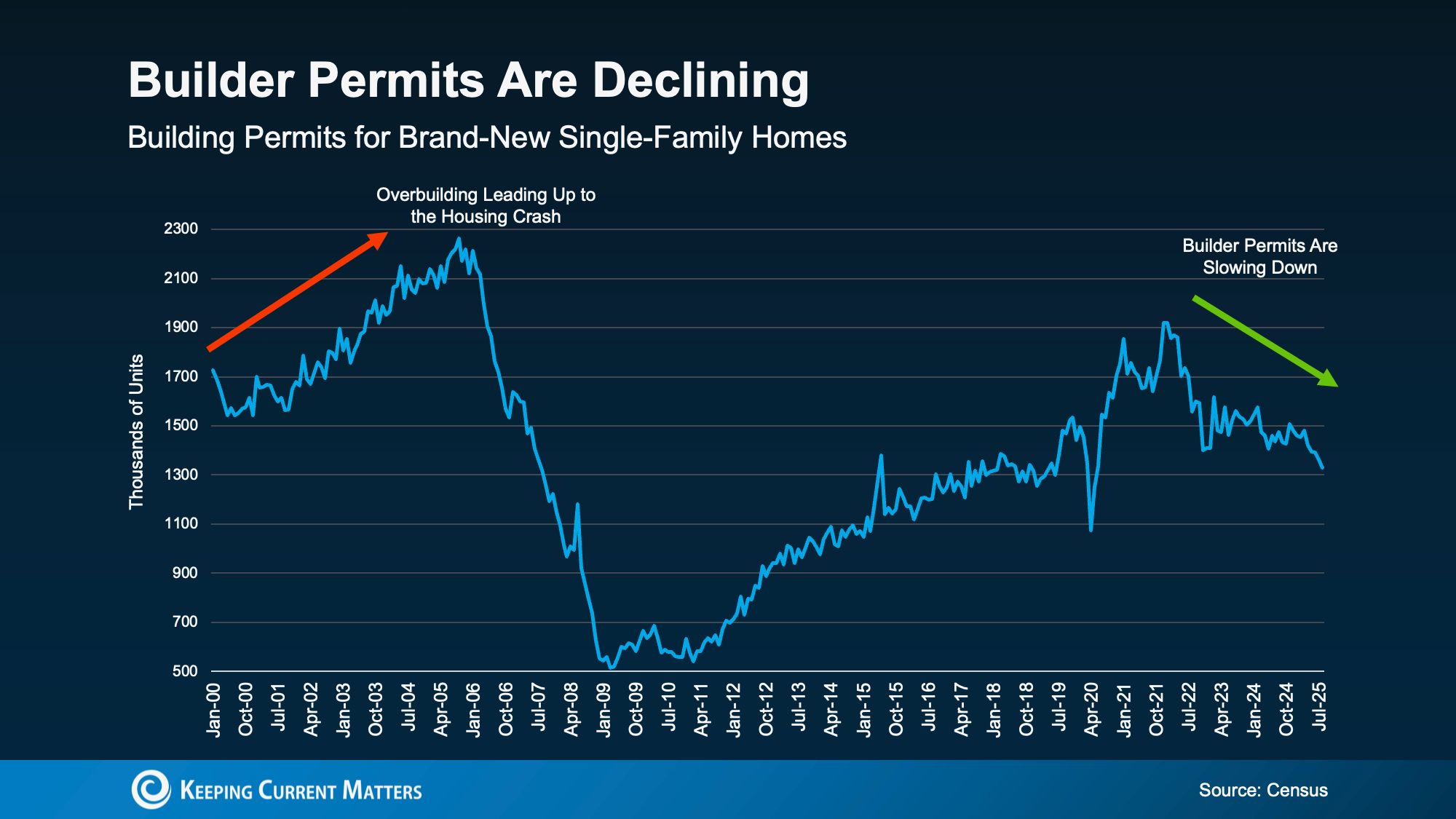

In the years leading up to the 2008 housing crash, builders dramatically increased single-family home construction (see the red arrow below). The problem? They built far more homes than the market could absorb — creating an oversupply that drove prices down. That’s the scenario many people remember and fear could happen again.

However, while homebuilding has been gradually recovering since around 2012, today’s situation is very different. The latest data shows builders are actually slowing down, starting fewer new homes at the moment (see the green arrow below).

Fresh data from the National Association of Home Builders (NAHB) backs this up — single-family building permits have now declined for eight consecutive months.

The Slowdown Isn’t Accidental — It’s Strategic

Builders are closely tracking market conditions and buyer demand, adjusting their pace accordingly. They’re intentionally slowing new projects to prevent an excess of unsold homes. As Ali Wolf, Chief Economist at Zonda, explains:

“Builders are still completing existing projects but taking a more cautious approach when it comes to starting new ones.”

That’s a sharp contrast to the period before the housing crash, when overconfidence fueled record levels of new construction — even as buyer demand was falling. Today’s builders are taking a smarter approach: they’re tuned into the market and making adjustments early to keep supply and demand in check.

The Regional View Tells the Same Story

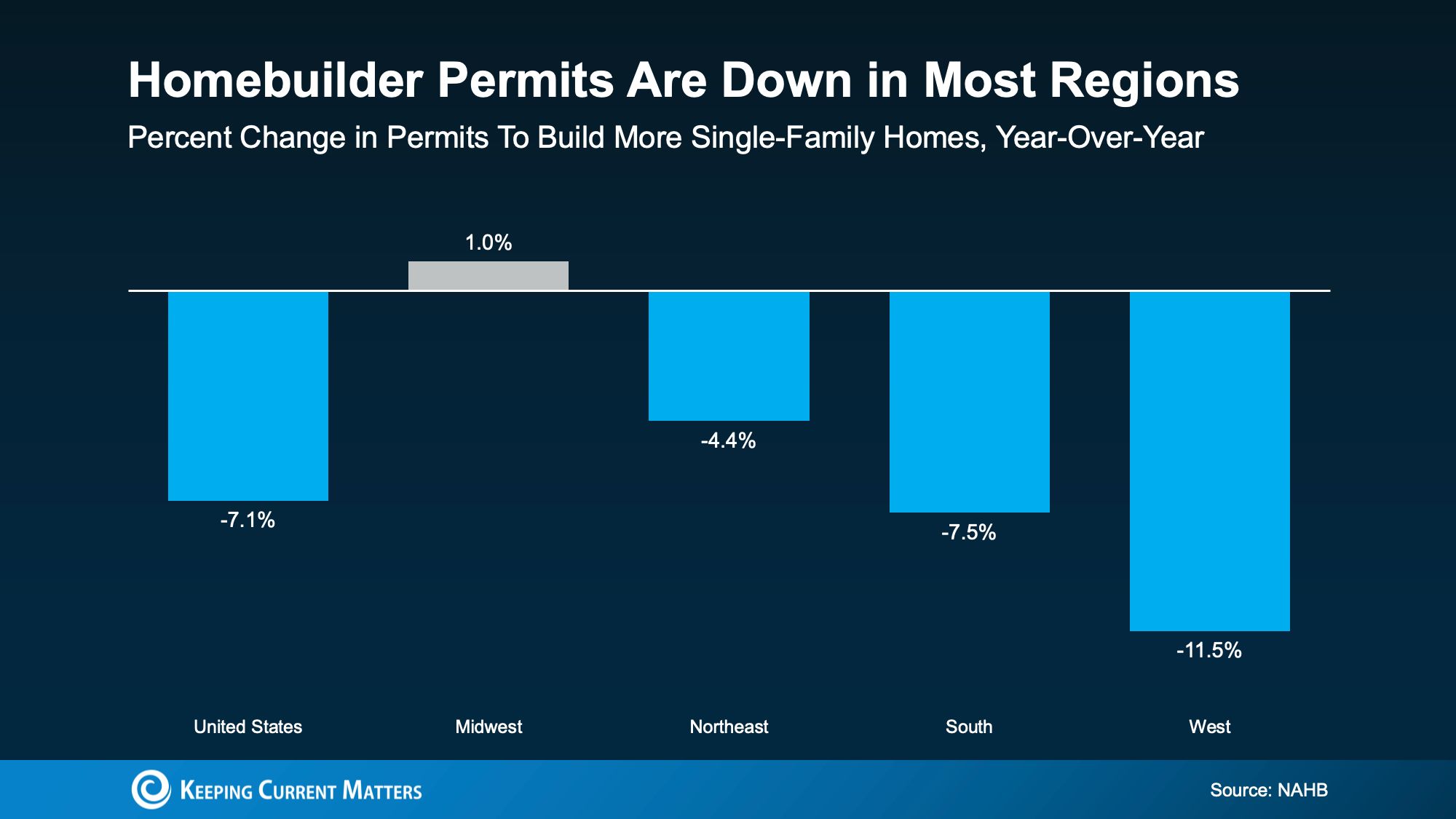

While housing inventory naturally varies from one area to another, the broader regional data reveals a consistent trend across most markets (see the graph below):

According to the NAHB, single-family permits have declined across almost every region in the country — with only one area showing a modest increase. Even in that case, the growth is minimal, barely enough to register as a true gain.

Why This Isn’t a Repeat of 2008

Before the 2008 crash, builders kept ramping up production even after buyer demand had vanished. This time, they’re taking a proactive approach — slowing down before the market gets out of balance.

After years of underbuilding, the market actually needs more homes. Builders know that, but they’re being deliberate about how quickly they add new supply.

So while there are more new homes on the market today, it doesn’t signal oversupply — it means buyers finally have more choices. Builders are pacing construction responsibly, not flooding the market. And that’s a healthy sign for housing overall.

Bottom Line

Just because you’re spotting more new homes for sale doesn’t mean builders are going overboard. The steady decline in building permits over the past eight months shows this isn’t a runaway building spree — it’s a controlled, thoughtful recovery that reflects today’s market realities.

Builders are proceeding with caution, keeping an eye on demand, and adjusting to avoid repeating the mistakes of the past. It’s a sign of balance, not excess.

If you’re curious about how new construction activity is shaping up in your specific area — whether opportunities are opening for buyers or trends are shifting for sellers — reach out to a trusted local real estate professional who can walk you through what’s happening right now in your neighborhood.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Is there an overbuilding risk like before 2008?", "acceptedAnswer": { "@type": "Answer", "text": "No. Today’s homebuilding pace is slowing, not speeding up. Before the 2008 crash, single-family construction surged and created oversupply. Currently, builders are issuing fewer permits and starting fewer new homes, signaling they are not repeating the past." } }, { "@type": "Question", "name": "What are building permits, and why do they matter?", "acceptedAnswer": { "@type": "Answer", "text": "Building permits are applications for approval to begin new construction. Rising permits point to more future building; declining permits indicate a slowdown. Single-family permits have fallen for eight straight months, showing builders are easing off new projects." } }, { "@type": "Question", "name": "Why are builders slowing down new construction now?", "acceptedAnswer": { "@type": "Answer", "text": "Builders are taking a strategic, data-driven approach. They’re closely tracking demand, finishing existing pipelines, and being cautious with new starts to avoid excess unsold inventory—unlike the overconfidence seen pre-2008." } }, { "@type": "Question", "name": "Is the slowdown intentional?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Builders are deliberately pacing new projects to align with current buyer demand and prevent a glut of inventory. This proactive move supports a healthier, more balanced market." } }, { "@type": "Question", "name": "Are all regions showing the same trends?", "acceptedAnswer": { "@type": "Answer", "text": "Nearly every U.S. region has seen a decline in single-family permits. Only one region shows a modest, nearly flat uptick, indicating the slowdown is broad-based rather than isolated." } }, { "@type": "Question", "name": "Does more new construction mean oversupply?", "acceptedAnswer": { "@type": "Answer", "text": "Not in this context. After years of underbuilding, the market needs additional inventory. More new homes today mainly mean buyers have more options, while builders remain disciplined to avoid oversupply." } }, { "@type": "Question", "name": "Is this like what led to the 2008 crash?", "acceptedAnswer": { "@type": "Answer", "text": "No. Before 2008, builders kept producing homes even as demand faded. Today, they are watching conditions and reducing new starts early to maintain balance—reflecting lessons learned from the past." } }, { "@type": "Question", "name": "What should buyers and sellers expect?", "acceptedAnswer": { "@type": "Answer", "text": "Buyers should see more new-construction choices without a flood of excess supply, and sellers benefit from a more stable environment that helps support property values. For neighborhood-specific guidance, consult a local real estate professional." } } ] }

Categories

Recent Posts

GET MORE INFORMATION