Key Considerations for Home Buyers: Home Prices, Mortgage Rates, and Expert Insights

If you're contemplating the purchase of a home, it's likely that you're closely following the developments in the housing market. You gather information from various sources: the news, social media, your real estate agent, discussions with friends and family, even chance encounters at the local supermarket. Undoubtedly, topics like home prices and mortgage rates dominate these conversations.

To navigate through the overwhelming amount of information and provide you with the most relevant insights, let's turn to the data. Consider the following essential questions regarding home prices and mortgage rates to assist you in making an informed decision:

1. Where Do I Think Home Prices Are Heading?

A dependable source of such information is the Home Price Expectation Survey conducted by Pulsenomics. This survey gathers opinions from a diverse national panel comprising more than one hundred economists, real estate experts, as well as investment and market strategists.

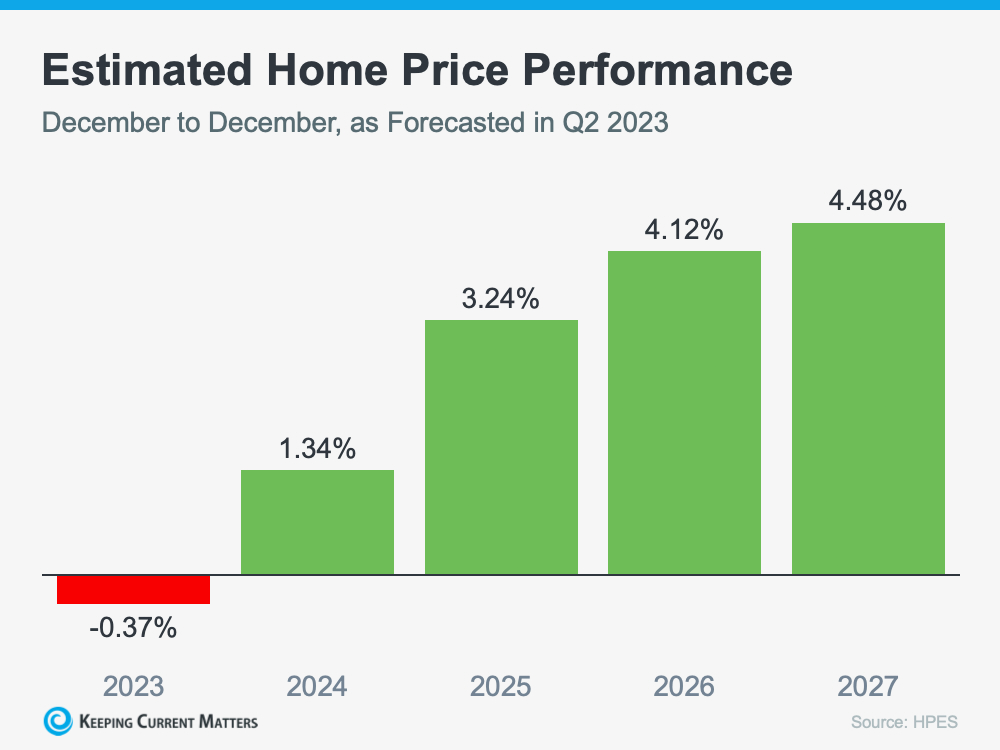

Based on the most recent findings, the surveyed experts anticipate a minor decline in home prices this year (indicated by the red portion in the graph below). However, it is crucial to consider the broader context. The most severe declines in home prices have already occurred, and many markets are currently experiencing appreciation once again. It's worth noting that the projected 0.37% depreciation shown in the Home Price Expectation Survey (HPES) for 2023 is far from the catastrophic crash that was initially speculated by certain individuals.

Now, let's shift our focus to the future. As depicted by the green portion in the graph below, it is evident that home prices have taken a positive turn and are projected to appreciate in 2024 and beyond. According to the Home Price Expectation Survey (HPES), after this year, we can anticipate home price appreciation returning to more typical levels for the upcoming years.

Therefore, why is this relevant to you? It implies that if you purchase a home now, it is highly likely that its value will increase over time, allowing you to build home equity. However, if you delay your decision, according to these projections, the home will likely become more expensive in the future. Therefore, acting promptly would be advantageous.

2. Where Do I Think Mortgage Rates Are Heading?

In the previous year, mortgage rates experienced an upward trend due to factors such as economic uncertainty and inflation. However, recent reports indicate that although inflation remains elevated, it has started to stabilize after reaching its peak. This development is promising for both the market and mortgage rates. Allow me to elaborate on the reasons behind this.

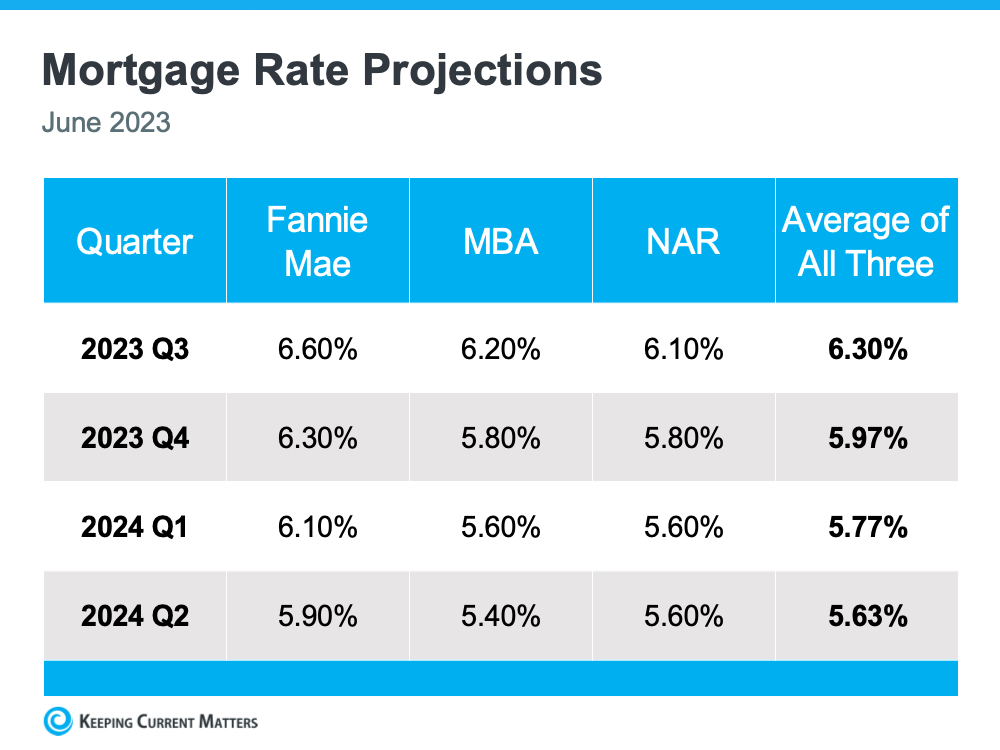

As inflation subsides, it typically leads to a corresponding decrease in mortgage rates. This could be the reason why certain experts anticipate a slight decline in mortgage rates over the upcoming quarters, with an average range of approximately 5.5% to 6%.

However, even the experts cannot provide an absolute certainty regarding the future trajectory of mortgage rates, whether it's for the next year or even the next month. This uncertainty arises due to the multitude of factors that can influence these rates. To provide you with a perspective on the range of potential outcomes, here are the key factors you should take into account:

- Should you proceed with the purchase now and mortgage rates remain unchanged, it would be a wise decision. By doing so, you would position yourself favorably as home prices are expected to increase over time. Consequently, you would have successfully avoided the impact of rising prices.

- In the scenario where you proceed with the purchase now and mortgage rates decline (as projected), it is likely that you have made a sound decision. By acquiring the house at this time, you would have acted preemptively before home prices experience further appreciation. Additionally, in the future, if mortgage rates decrease even further, you can always explore the option of refinancing your home.

- In the event that you proceed with the purchase now and mortgage rates increase, it would validate your excellent decision-making. By buying the property prior to the escalation of both home prices and mortgage rates, you have effectively secured a favorable position.

Bottom Line

If the thought of purchasing a home has crossed your mind, it is essential to have insights into the expected trends concerning home prices and mortgage rates. Although absolute certainty is not possible, expert projections can provide valuable information to keep you well-informed. It is advisable to rely on a dependable real estate professional who can offer an expert opinion tailored to your local market.

Categories

Recent Posts

GET MORE INFORMATION