Mapping the Foreclosure Trends You Shouldn’t Ignore

Foreclosure Headlines Are Back; But Don’t Fall for the Hype Foreclosure stories are making waves again and many of them are designed to grab attention by triggering fear. But when you dig into the actual numbers, the reality looks very different from the doom-and-gloom narrative.

Yes, foreclosure starts are up 7% in the first half of 2025 — but context matters. That increase is coming off historically low levels and is still nowhere near anything resembling a crisis.

Foreclosures Are Still Exceptionally Low

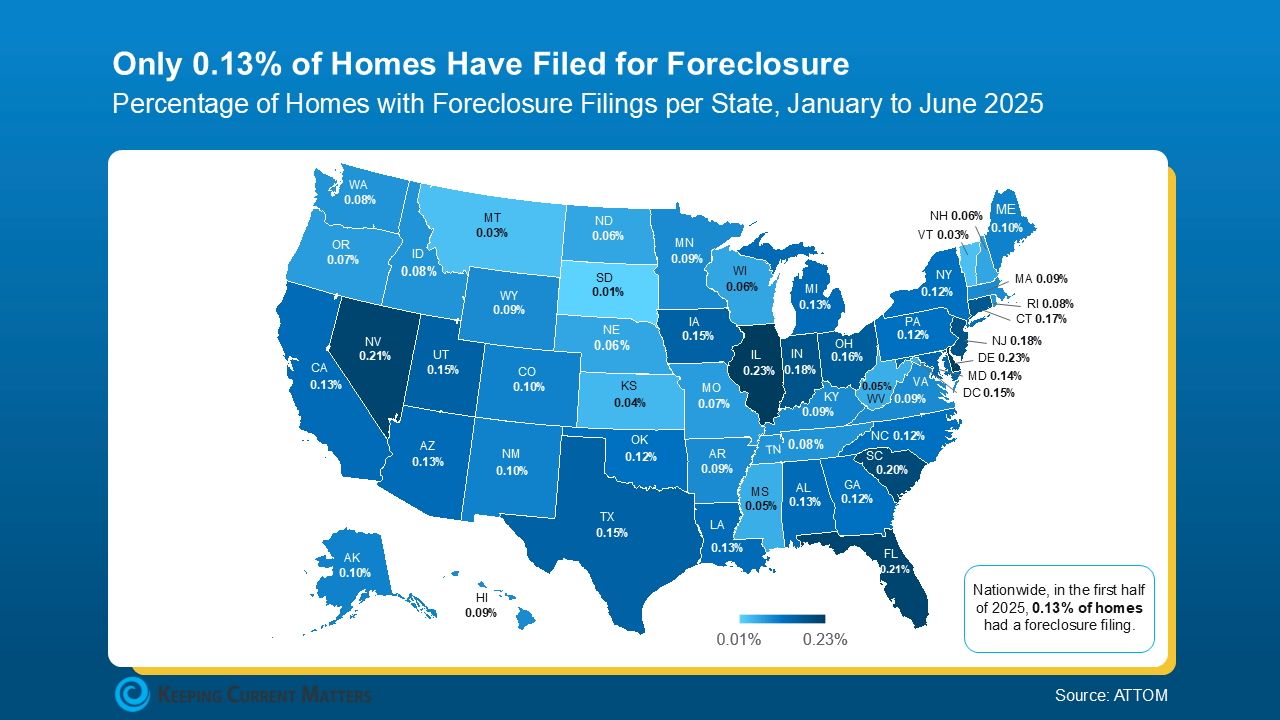

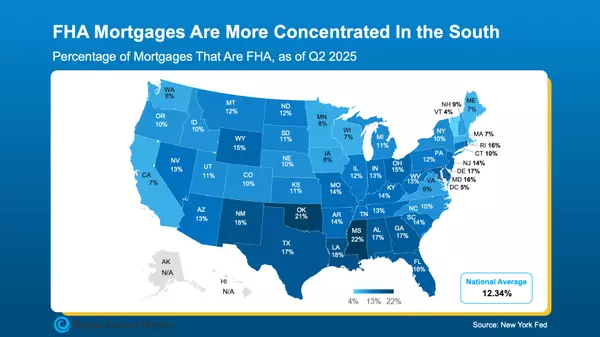

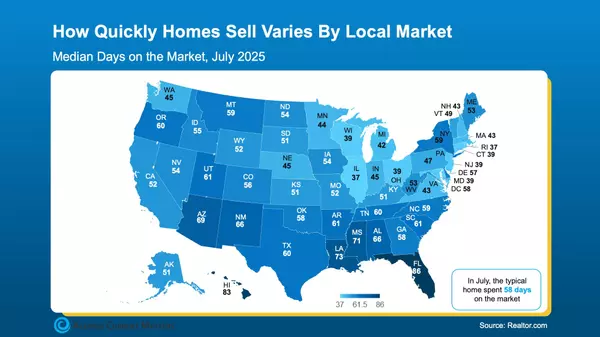

Even with the recent rise, filings remain far below where they were during the housing crash. In fact, just 0.13% of U.S. homes saw a foreclosure filing in the first half of the year. That’s not even a quarter of one percent — an extremely small portion of all households. Of course, like most things in real estate, the numbers depend on your local market.

Check out this map for a clearer picture of how foreclosure activity really looks across the country — and why most areas aren’t anywhere close to danger zones.

Perspective Matters: Today’s Foreclosure Rate Is Still Exceptionally Low To put things into perspective, ATTOM reports that in the first half of 2025, 1 in every 758 U.S. homes had a foreclosure filing. That’s the 0.13% you see on the map above. Compare that to 2010—at the height of the housing crash—when Mortgage News Daily reports it was 1 in every 45 homes. That’s a massive difference.

This Isn’t 2010: The Market Fundamentals Are Strong

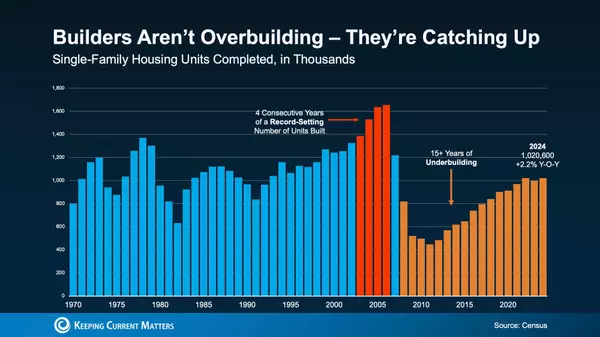

Back then, reckless lending practices left many homeowners with mortgages they couldn’t afford. As values dropped, they found themselves underwater—owing more than their homes were worth. When payments became unmanageable, walking away was often the only option. The result? A wave of foreclosures that helped trigger a full-blown housing crisis.

Today’s housing market looks very different. Lending requirements are much tighter, homeowners have built up record-high equity, and when someone falls on hard times, that equity often gives them a better path forward: selling rather than losing the home.

As Rick Sharga, Founder of CJ Patrick Company, puts it:

“One of the biggest reasons foreclosure activity remains historically low is that most homeowners—including those facing foreclosure—now have more equity than ever before.”

No one wants to see a homeowner in distress. But if you’re facing financial pressure, talk to your lender early. There may be more options on the table than you realize.

Bottom Line

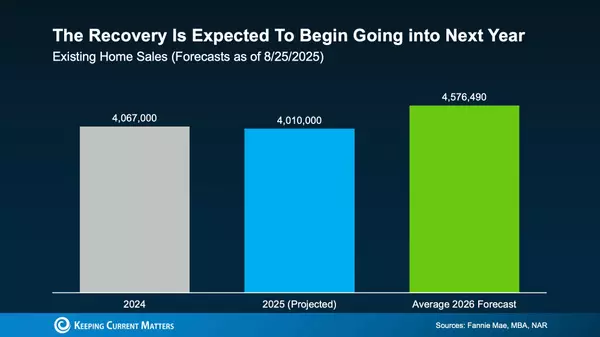

While recent headlines may sound dramatic, they rarely tell the full story. The actual data shows foreclosure activity remains well below historical norms and there’s no indication of a looming crash.

If you’re watching the market and want a clearer understanding of what’s really going on or how these trends might impact the value of your home it’s a good time to connect with a local real estate expert. A knowledgeable agent can help you separate fact from fear and walk you through exactly what the data means for your neighborhood.

Categories

Recent Posts

GET MORE INFORMATION