Buyers, Take Note: Mortgage Rates Just Hit Pause

Affordability has been a major hurdle for buyers in recent years. With home prices climbing and mortgage rates rising, many people have felt caught in a tough spot—wanting to move but unsure if they could make the numbers work.

Now, there’s a bit of good news. While things are still tight, mortgage rates have started to show some consistency. And that shift could help give buyers a little more confidence and clarity when planning their next move.

Mortgage Rates Are Holding Steady (For Now)

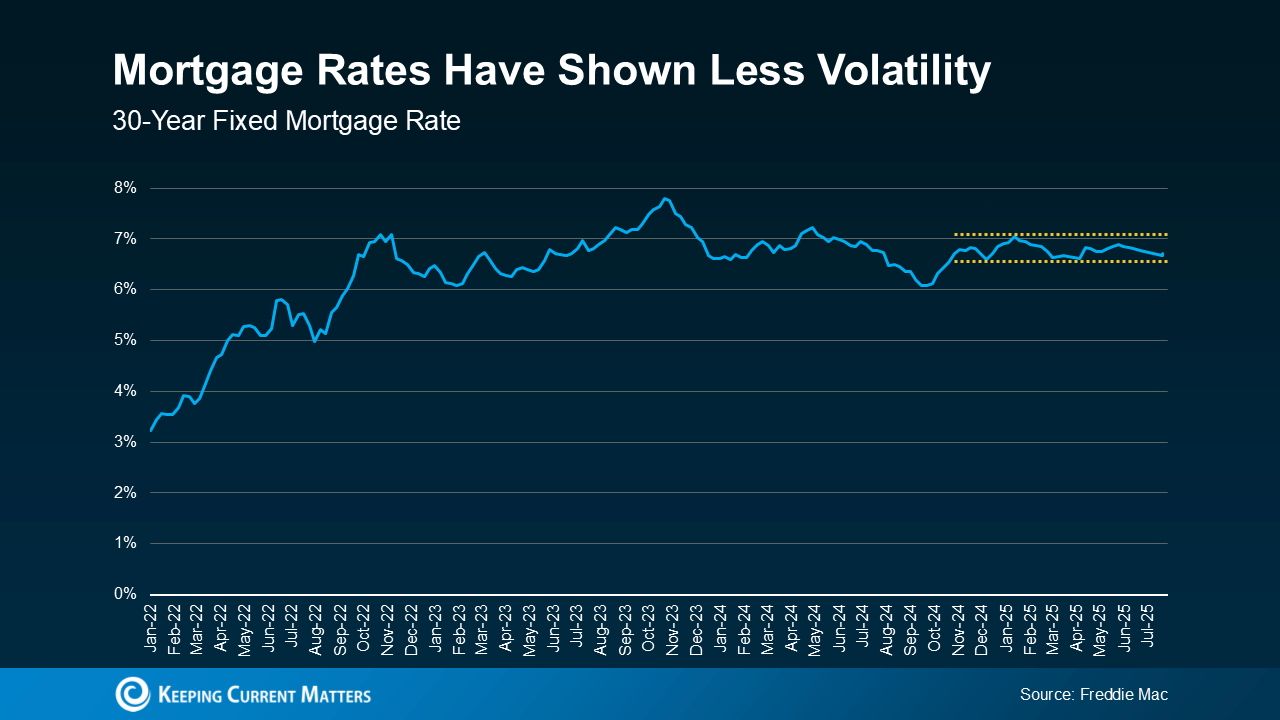

After months of volatility, rates have finally started to find their footing—settling into a narrower, more stable range. That’s a big shift from the rollercoaster buyers have been riding over the past year (check out the graph below).

As shown in the graph, rates have hovered within a half-percent range since late last year. And that kind of consistency is a big deal.

Rates Have Finally Calmed Down If you've been watching mortgage rates over the past year, you’ve probably noticed something surprising: they’ve actually settled into a fairly tight range. Sure, there are still slight ups and downs, but the wild swings we saw not long ago? Those have been few and far between lately.

As HousingWire puts it:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most ‘calm’ periods for mortgage rates in recent memory.”

Why That Matters for Buyers

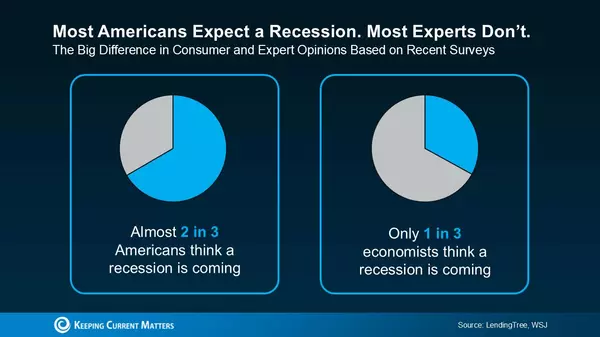

Let’s face it — when rates are bouncing all over the place, it’s hard to make confident decisions. Uncertainty makes it tough to budget or know what your payment might look like next week, let alone next year.

But this new level of stability? It gives you a clearer lens into what buying might actually cost you. And that kind of predictability makes planning — and moving — feel a lot more manageable. So instead of waiting for some perfect moment, this might be the window to make a solid plan.

Will This Stability Last?

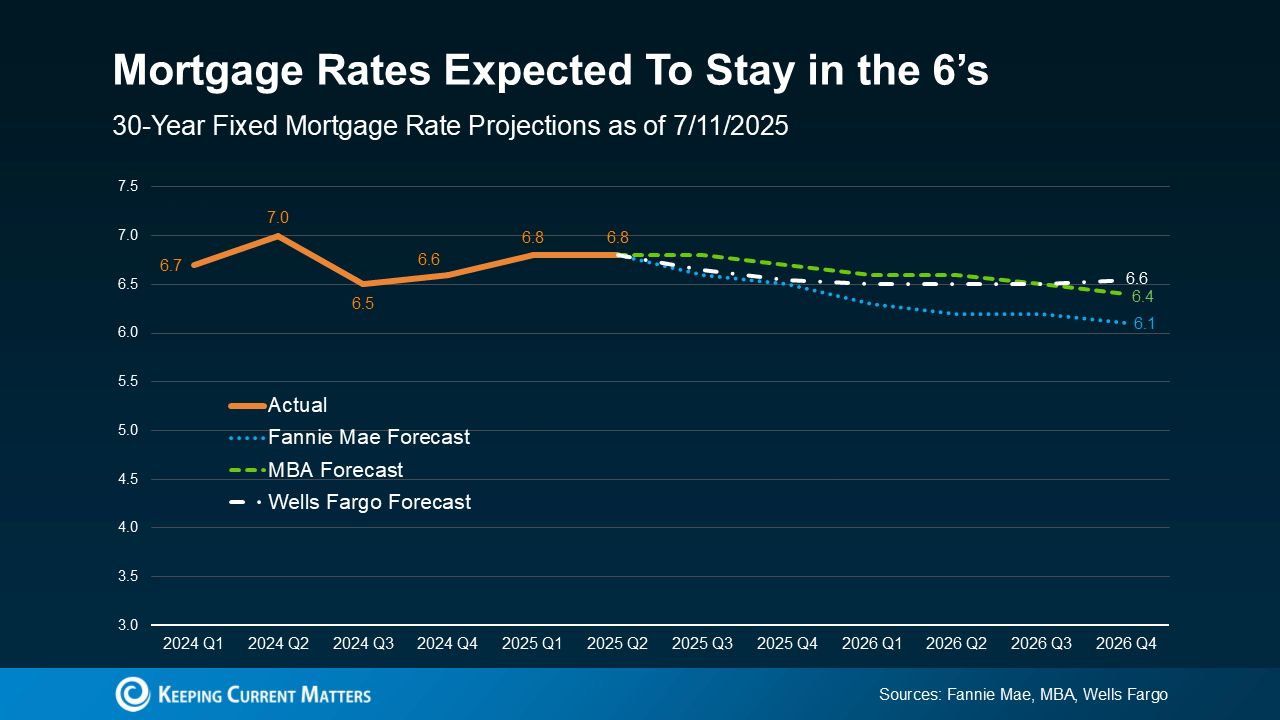

Most experts think this steady streak isn’t going away anytime soon. Rates may inch down slightly later this year, but don’t expect dramatic drops. Danielle Hale, Chief Economist at Realtor.com, explains:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

Translation: slow and steady, not a sudden dip.

Trying To Time It? Here’s the Truth The idea of waiting for the “perfect” rate sounds smart — until you realize how unpredictable this market really is. As Jeff Ostrowski from Bankrate puts it:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

And if you look at the longer-term forecasts? Most experts still expect rates to hover in the mid-6% range well into 2026. So if you’re holding out for something drastically lower, you could be waiting a while.

A More Favorable Market for Buyers The current market offers a much better setup for buyers than we’ve seen in a while. With rates holding steady, inventory ticking up, and home prices cooling off just a bit, there’s finally a window of opportunity. Sam Khater, Chief Economist at Freddie Mac, puts it this way:

“Mortgage rates have remained in a tight range over the past few months. That kind of stability—combined with better inventory and slower price growth—is a positive shift for today’s market.”

Just keep in mind: rates aren’t immune to outside forces. Economic updates, inflation reports, and market shifts can still nudge them up or down. But right now, buyers have something they haven’t had in a while—predictability. And that makes this a great time to explore your options.

Bottom Line

Affordability is still a hurdle, but with the market showing more signs of stability, making your next move may feel a lot more manageable. When rates are steady, it’s easier to map out your options and plan with more confidence.

If you're curious about what buying could realistically look like right now, connect with a trusted lender or local real estate agent. They can help you crunch the numbers, explore financing options, and give you a clear picture of your potential monthly payment in today’s environment. The sooner you get that clarity, the sooner you can stop putting things on hold—and start making real progress toward your next move.

Categories

Recent Posts

GET MORE INFORMATION