Today’s Mortgage Market: What You Should Know

If you’ve been putting off homeownership because you assumed qualifying for a mortgage would be too tough, here’s an update: things are shifting. Approval is becoming a bit more attainable for well-qualified buyers, even though lending guidelines remain cautious and responsible.

Lenders are easing up slightly, giving more buyers with solid credit or modest down payments a real shot at financing. That small shift is helping more people finally take the next step toward homeownership.

If tighter lending rules were your biggest roadblock, now could be your moment—without the risky practices that led to the 2008 crash. This is smart, measured easing, not reckless lending.

Getting a Mortgage Is Getting Easier – But Standards Still Matter

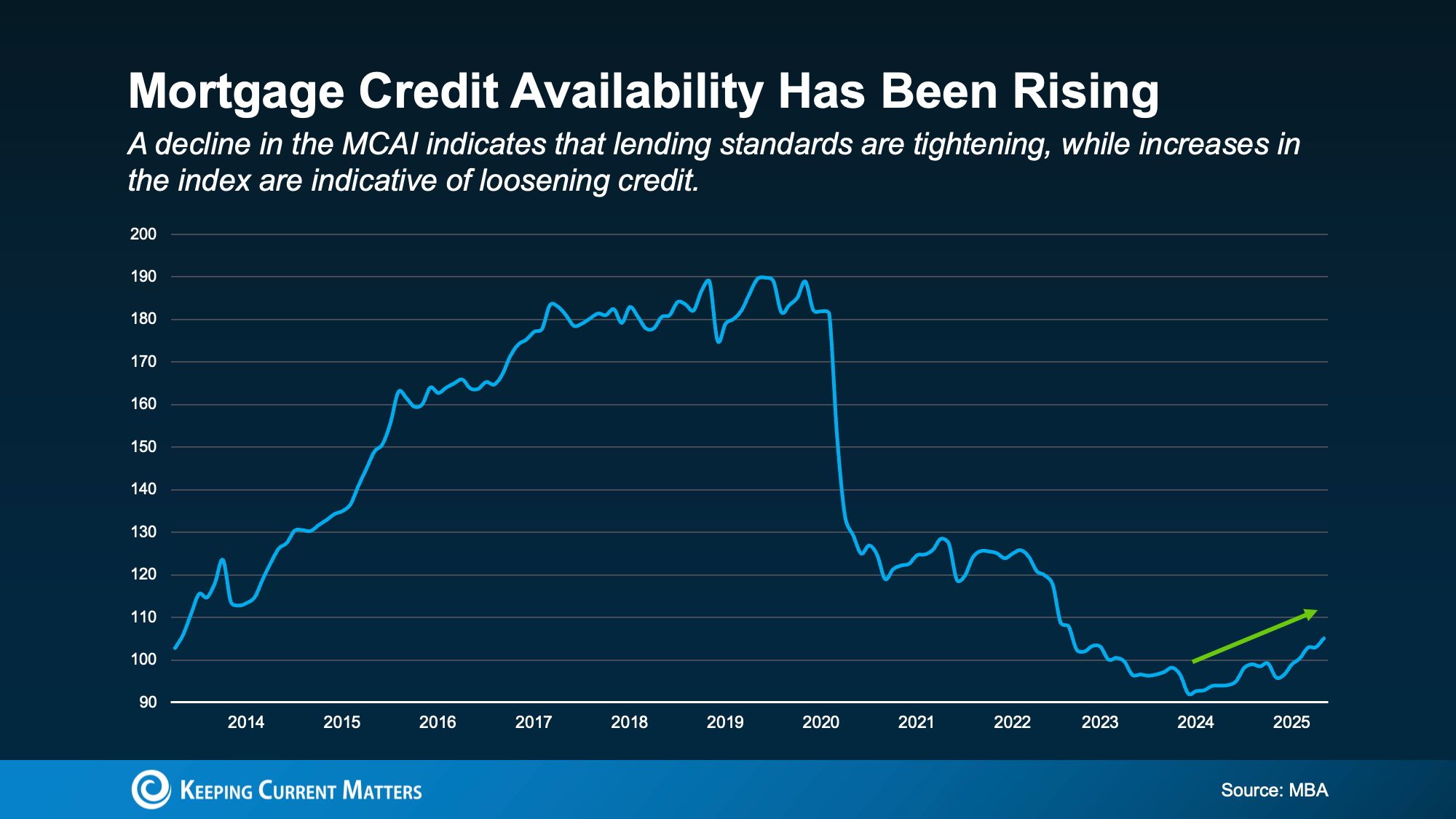

According to the Mortgage Bankers Association, the Mortgage Credit Availability Index (MCAI) just reached its highest level in nearly three years—meaning banks are cautiously expanding credit while still prioritizing financial stability.

That doesn’t mean we’re repeating the mistakes of 2008. While lending is getting slightly more flexible, today’s standards are still far more cautious than they were back then.

Recently, the index has been trending upward—indicating that lenders are gradually relaxing their requirements. In fact, as of May, credit availability reached its highest level in nearly three years (see graph below).

Why does this matter for you? Because you might now qualify for a mortgage that would’ve been out of reach just a few months ago. Lending conditions are shifting in a way that gives more buyers a real shot at financing.

As the National Association of Mortgage Underwriters (NAMU) puts it:

“Mortgage credit availability jumped in May, hitting its highest point since August 2022. This rise shows lenders are becoming more open to easing underwriting criteria, giving borrowers expanded access to financing options...”

Worried This Feels Like 2008?

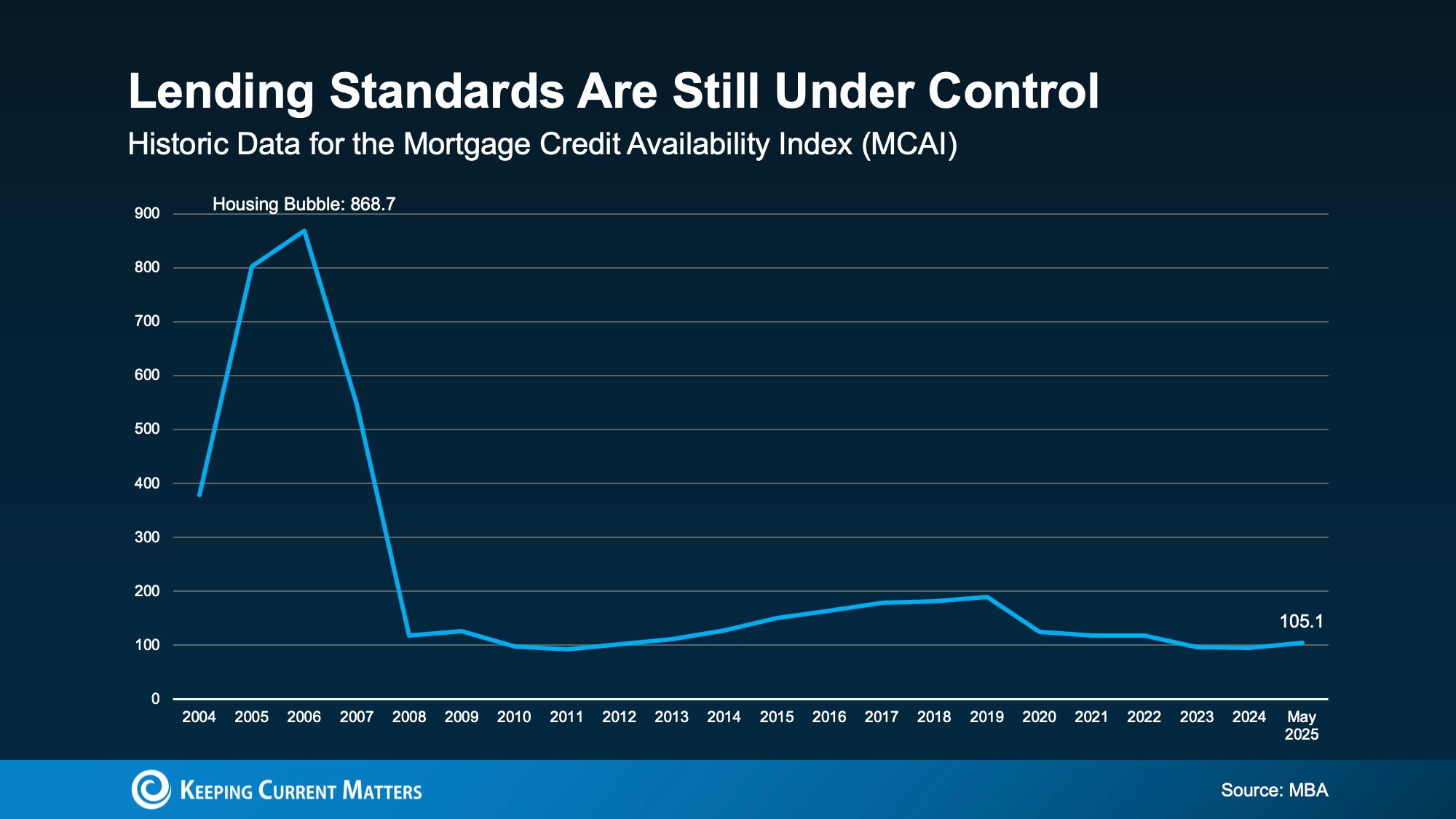

It’s a fair concern—after all, relaxed lending played a major role in the 2008 housing crash. But here’s what’s different this time: even though credit is becoming more accessible, lending practices remain disciplined.

Looking at Mortgage Credit Availability Index (MCAI) data going back to 2004, we’re still far below the overly loose standards that fueled the housing bubble back then (see graph below).

So, the rise in mortgage credit availability isn’t a red flag—it’s actually a positive shift for today’s buyers. It means more people have a real chance to secure financing and move forward. As Brett Hively, Senior Vice President of Mortgage, Finance, and Strategy at Ameris Bancorp, recently explained:

“This increase is creating new opportunities for borrowers to take the next step—whether that’s buying a home or refinancing an existing loan.”

Bottom Line

So, if you’ve been on the sidelines thinking mortgage approval was out of reach, now’s the time to take another look. Lending conditions are shifting, and you might have more options than you realize. Connect with a trusted lender to review your financial situation and explore what’s possible today. It could be the right moment to take that next step toward owning a home.

Categories

Recent Posts

GET MORE INFORMATION