You Might Be Paying Too Much for a Fixer-Upper; Here’s What’s Different Now

— are selling for more than brand-new construction.

Recent data shows the median price for an existing home is $429,400, while a newly built home comes in at $410,800.

That’s an $18,600 gap in favor of new builds.

So if you’ve been eyeing a resale home thinking it’s the “cheaper” option, you might want to check out all your options.

If you’ve been assuming resale homes are the “budget” option, it’s time to rethink that. Let’s unpack what’s driving this shift, why it matters, and what it could mean for your buying strategy.

The Numbers at a Glance

From 2010–2019, new homes typically sold for about $66,000 more than existing ones. Over the last five years, that gap tightened to around $25,000.

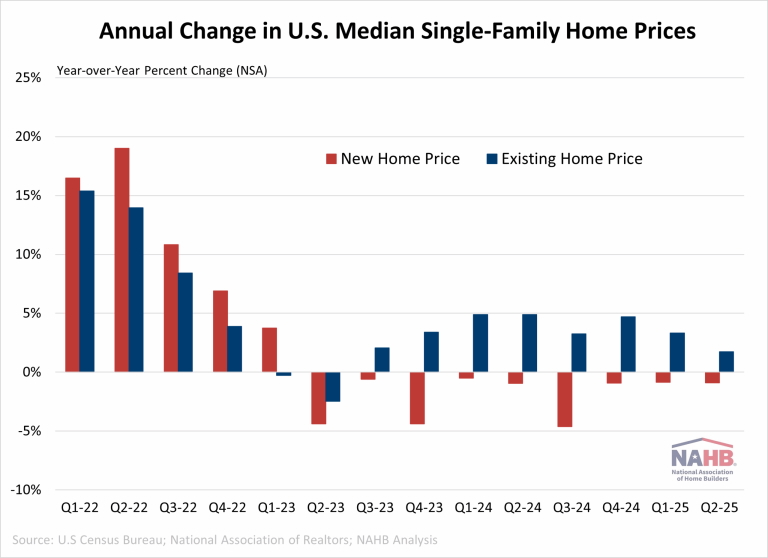

Then in Q2 and Q3 of 2024, things flipped — existing home prices edged past new home prices for the first time. Now, in 2025, that trend isn’t just holding… it’s strengthening.

Here’s the pricing movement over the past year:

- New home prices decreased 0.9% year-over-year

- Existing home prices increased 1.7% over the past year.

The Hidden Price Tag of a Fixer-Upper

Buying a fixer-upper with the idea of saving money can be tempting — but today’s renovation reality may tell a different story.

Here’s what’s driving the higher costs:

- Materials & labor remain expensive — While inflation has eased since the pandemic, prices for lumber, roofing, and skilled trades are still elevated.

- Contractor delays are common — Backlogs mean you could wait weeks or even months just to get an estimate.

- Unexpected repairs are almost a given — Older homes often hide costly issues like outdated wiring or hidden mold.

- Time equals money — Longer timelines mean more stress, higher carrying costs, and delayed move-in dates.

When you factor in these expenses, that “bargain” fixer-upper could easily cost more than a move-in-ready new home.

Why New Construction Is Looking Like the Smarter Buy

Right now, builders have the advantage because they’re adapting to what buyers want:

- Designing smaller, more efficient homes to keep prices down

- Building in more affordable areas

- Offering real incentives like interest rate buydowns, closing cost help, and free design upgrades

By operating at scale, they can hold prices steadier — which is why new home costs are dipping while resale prices keep rising.

When a Fixer-Upper Still Makes Sense

A renovation project can still be the right move if:

- You’re buying well below market value and have run the numbers

- You have the budget, time, and skilled team to handle the work

- You want a specific neighborhood with no new builds available

- You’re planning a custom remodel for complete design control

What This Could Mean for You

If you’re house-hunting, it’s time to rethink the idea that “older” automatically means “less expensive.” That’s no longer true. In many cases, you could end up paying more for a home that needs major updates than for one that’s move-in ready, energy-efficient, and covered by a builder’s warranty.

In today’s market, every dollar matters. Before you commit to a fixer-upper, compare all your options — crunch the numbers, explore builder incentives, and weigh what aligns best with your budget, timeline, and long-term plans.

You may find that the smarter (and more affordable) choice isn’t the one you expected.

Categories

Recent Posts

GET MORE INFORMATION