Budgeting for a Home in 2025: Why the Old Rules No Longer Work

For years, homebuyers were taught one golden rule:

Never spend more than 30% of your income on housing.

That was the trusted benchmark — the line that separated “affordable” from “over your head.”

But here’s the reality in 2025: that line is fading fast.

📊 According to Realtor.com® Affordability Report, the average U.S. household would need to spend 44.6% of their income to buy a median-priced home.

And in places like Los Angeles? It’s over 100%.

So if you’re running the numbers and wondering why homeownership feels out of reach, you’re not doing anything wrong — the rules just changed.

And now, it’s time your budgeting strategy does too.

Why the 30% Rule Feels Broken 🔧

The 30% rule wasn’t created for today’s market. It traces back to a 1969 federal housing policy (the Brooke Amendment), which capped public housing costs at 25% of income — later bumped to 30% in the 1980s. That number eventually became gospel for lenders and budgeting tools.

✅ It worked well for decades — helping buyers keep room in their budgets for saving, spending, and staying stable.

But here’s what it didn’t consider:

- Regional differences (a $2,500 mortgage hits different in Worcester vs. Wellesley)

- Existing debt, medical bills, or child care

- Today’s reality of high interest rates and even higher home prices

Trying to force-fit your home search into a 30% model can feel frustrating — and outdated.

So What Does Work? Budgeting Smarter in 2025 🧠

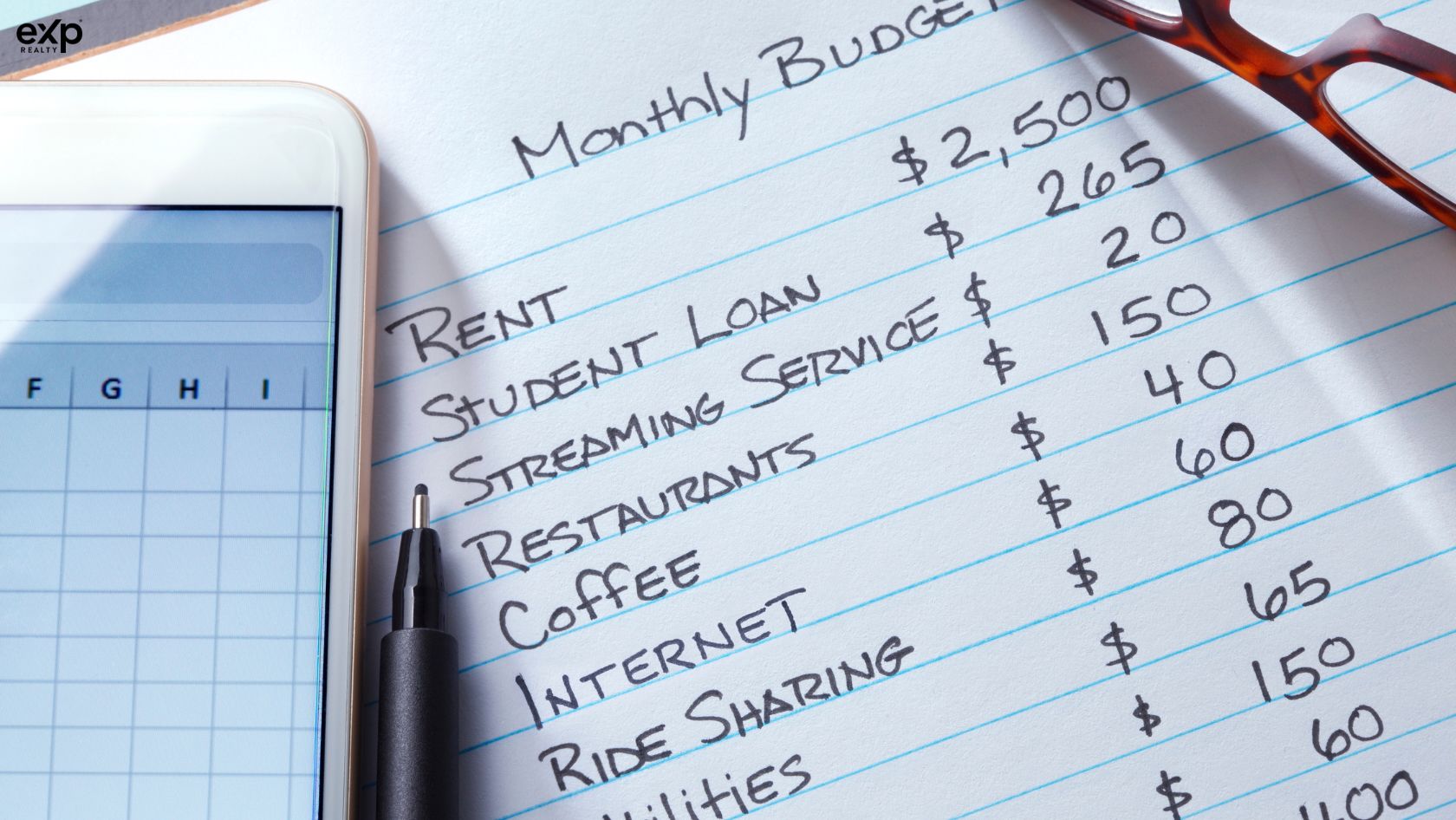

1. Set a Real-Life Monthly Comfort Number

Skip the percentages. Ask:

“What can I realistically spend each month without sacrificing my lifestyle or savings goals?”

Include:

- Current rent or mortgage

- Recurring expenses (car, insurance, groceries)

- Loan or credit payments

- Travel, hobbies, and family costs

- Retirement and emergency savings

This is about financial sustainability — not just qualifying for a loan.

2. Know the Real Cost of Owning a Home

A $450,000 listing isn’t your monthly payment. Factor in:

- Mortgage principal + interest

- Property taxes + insurance

- Private mortgage insurance (if <20% down)

- HOA dues, if applicable

- Utilities, maintenance, repairs

Pro tip: Don’t wait until you fall in love with a home. Talk to a lender early to see the full picture.

3. Use the 30% Rule as a Warning Light 🚦

If you’re slightly over 30% — but have little to no debt — you might be fine.

But if you’re closer to 50% and juggling student loans, credit cards, or inconsistent income?

That’s your sign to pause and reassess.

4. Get Local, Get Creative

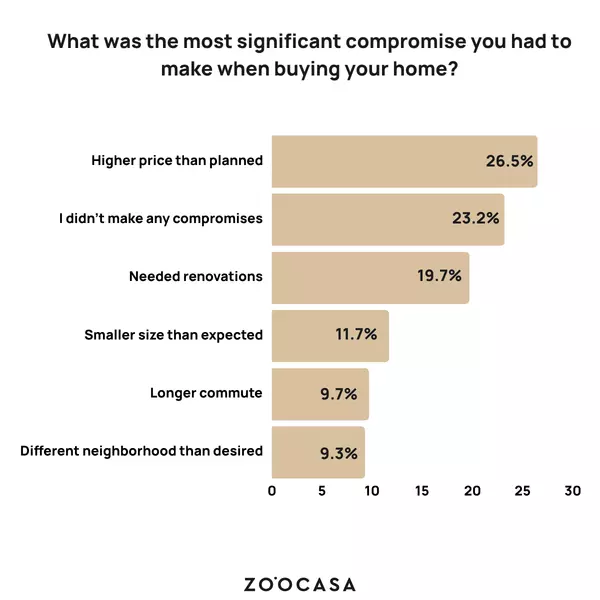

Affordability isn’t just about price — it’s about options. Try:

- Expanding your radius. Even a 10-minute shift can lower your budget by thousands.

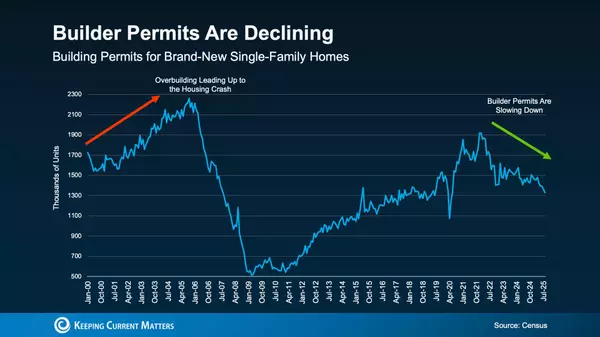

- Looking at new builds. Builders are offering serious incentives in 2025.

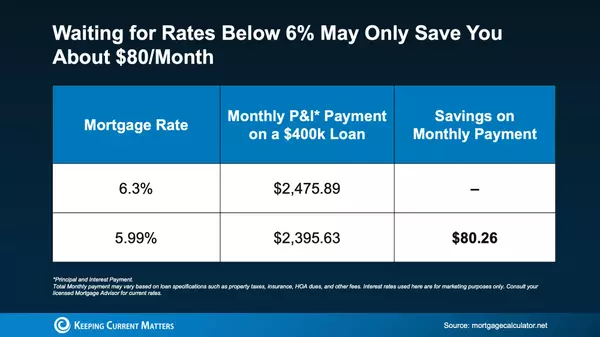

- Negotiating rate buydowns. Many sellers are willing to get creative.

- Focusing on “right now” homes. Your first or next place doesn’t need to be your forever one.

The Takeaway 🎯

The 30% rule may no longer fit — but the goal remains:

✅ Buy a home that fits your life.

✅ Spend sustainably.

✅ Stay flexible and informed.

And if you’re feeling stuck, I’ve got your back. Let’s talk through your budget, your goals, and a smart path forward — one that actually works for you in today’s market.

Categories

Recent Posts

GET MORE INFORMATION