The Credit Score You Need To Buy a Home in Today’s Market

Most Buyers Get This Wrong About Credit Scores According to Fannie Mae, 90% of buyers either don’t know what credit score lenders actually require—or they guess too high.

Think about that. A lot of people believe they need perfect credit to buy a home, when the truth is... they don’t. And if you’ve been holding off because you assume your score isn’t good enough, you might be closer to homeownership than you think.

Here’s the thing:

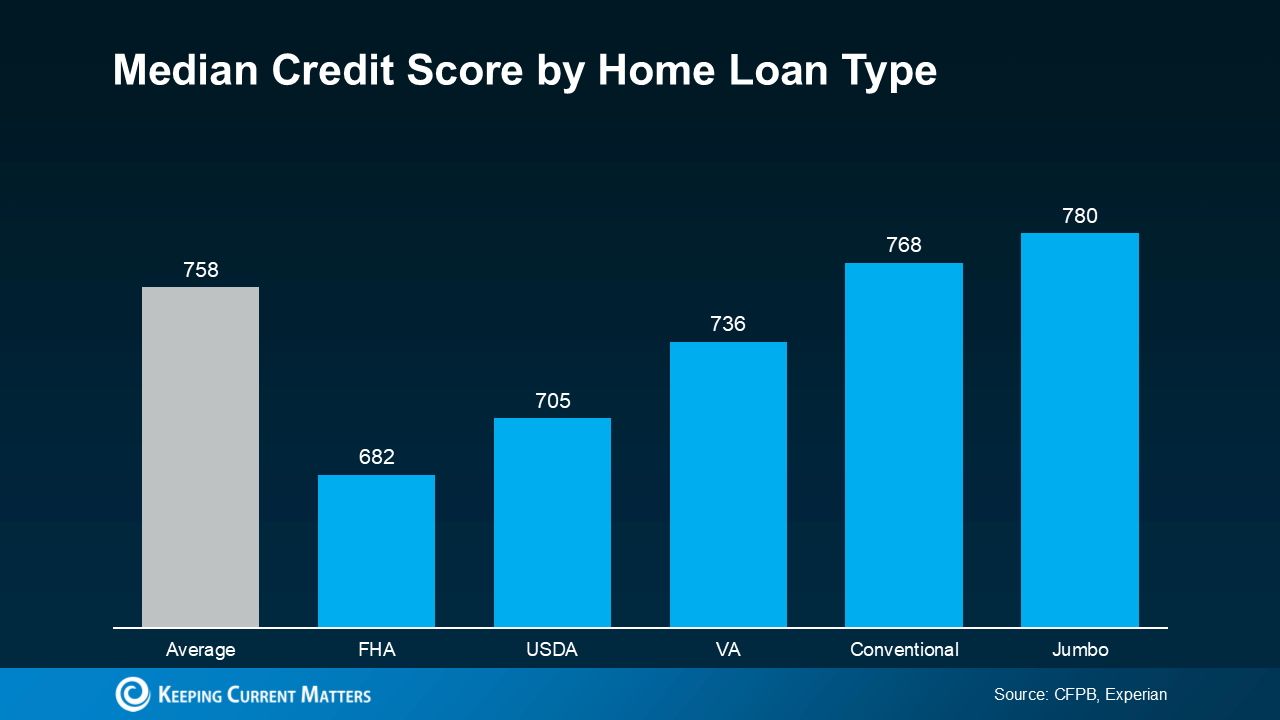

There’s no single credit score you must have to buy a home. It depends on the loan type—and there’s more flexibility than most realize. Check out this chart showing the median credit scores for recent homebuyers by loan type. It might surprise you.

What You Need To Know About Credit Scores and Home Loans Here’s something many buyers overlook: there’s no one-size-fits-all credit score requirement. Lenders use different benchmarks, so even if you think your score isn’t high enough, you may still qualify. In fact, this flexibility could open doors you didn’t know were available. The smartest way to find out where you stand? Talk to a trusted lender. As FICO explains,

"There’s no universal score that all lenders require. Each lender sets its own standards and evaluates a variety of factors beyond just your credit score.”

Why Credit Still Counts

While there's no magic number, your credit score still plays a huge role in the homebuying process. It helps lenders evaluate how reliable you are when it comes to managing debt—whether you pay bills on time, how much debt you carry, and how you use credit.

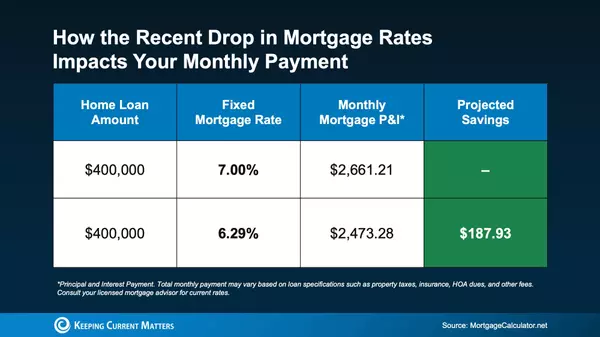

And that number doesn’t just determine whether you qualify—it can influence your mortgage rate, your loan terms, and ultimately, how much home you can afford. As Bankrate puts it:

“Lenders look at your credit score not just to approve the mortgage, but to decide the terms. The higher your score, the better the rate and conditions you’ll likely receive.”

But here’s the good news: you don’t need perfect credit to move forward. Many buyers are approved with scores that are far from flawless.

Want To Raise Your Score? Start With These Moves

If you chat with a lender and decide to give your credit a boost, here are a few smart strategies recommended by the Federal Reserve:

- Pay on Time, Every Time: From credit cards to utilities, consistent on-time payments build trust and show lenders you’re financially reliable.

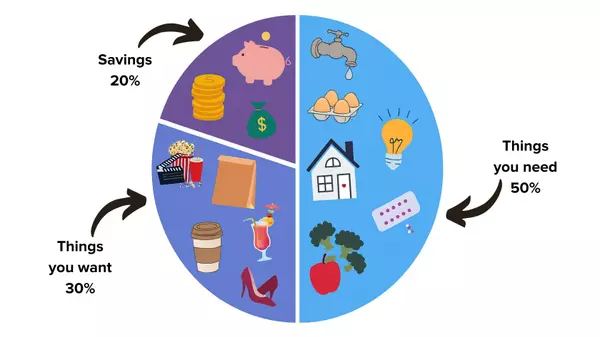

- Reduce Your Debt Load: The less of your available credit you’re using, the better. Keeping your balances low can make you a more appealing borrower.

- Check Your Credit Report: Get your reports from all three bureaus and fix any errors. It’s one of the quickest ways to lift your score.

- Avoid New Accounts for Now: Opening too many new credit lines can trigger hard inquiries, which might temporarily ding your score. Better to hold off until after you buy.

Bottom Line

You don’t need a perfect credit score to qualify for a home loan—but the stronger your score, the more favorable your loan terms could be. That might mean a lower interest rate, better options, or even increased purchasing power. The smartest way to find out where you stand—and what’s possible for your situation—is to connect with a trusted lender who can walk you through your options and help you take the next step with confidence.

Categories

Recent Posts

GET MORE INFORMATION