Why Saving for a Home Feels Hard (and How to Fix It)

Saving for a home doesn’t have to mean pressing pause on your entire life. You still want to celebrate your friends’ big moments, take a trip here and there, and enjoy your weekends guilt-free. But without a plan, those “just this once” expenses can quietly chip away at your down payment savings.

Take wedding season, for example: by the time you cover travel, gifts, outfits, and pre-wedding festivities, attending one wedding plus a bachelor or bachelorette weekend averages about $2,016 — almost the same as the typical monthly rent of $2,072. Now multiply that by two or three weddings in a single summer, throw in birthdays, holiday spending, and last-minute events, and it’s easy to see why saving feels impossible.

The good news? You don’t have to decline every invitation or give up your favorite coffee runs. You just need a plan that helps you spend with intention, save consistently, and stay focused on your goal of homeownership.

Why Saving Feels So Tough Right Now

Between high rents, climbing home prices, and inflation driving up the cost of everything from groceries to gas, saving can feel like an uphill battle. Without a clear plan, it’s easy to:

- Dip into savings for “just one” special event

- Let subscriptions and small purchases quietly add up

- Put off saving altogether because the goal feels too far away

And renters are feeling the pressure. In a recent survey:

- 45% said they had to make a housing-related sacrifice just to attend wedding celebrations

- 15% downsized to a smaller rental or starter home, and 11% moved in with roommates

- 25% turned down at least one event because the cost was simply too high

The upside? A few small, intentional shifts can help you feel in control again — and get your savings back on track.

7 Smart Money Habits to Start Today

Here are practical strategies I share with renters and future homebuyers:

1. Know Your Budget

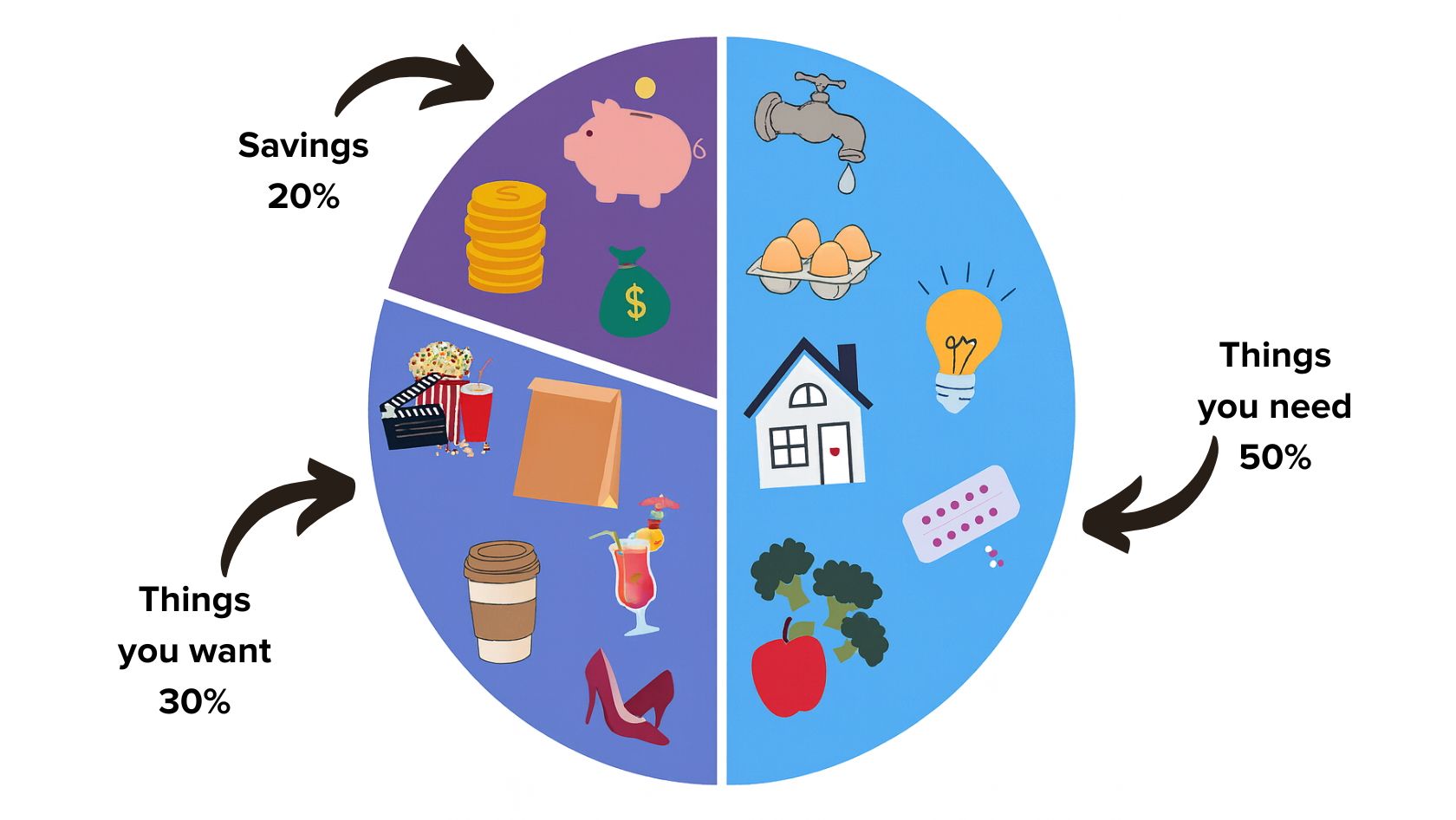

Before saying “yes” to any trip or big event, get clear on what you can truly afford. A simple way to do this is with the 50/30/20 rule:

- 50% for needs (rent, utilities, groceries)

- 30% for wants (travel, events, dining out)

- 20% for savings or debt repayment

2. Make Housing Savings Non-Negotiable

Treat your down payment like a bill that must be paid. Automate transfers to a separate savings account on payday so you’re consistently funding your goal.

3. Build an Emergency or “Oops” Fund

Start small, then grow it over time to cover surprise expenses. Round-up apps like Acorns make saving painless, and a high-yield savings account can help your money grow faster.

4. Trim Your Monthly Expenses

In July, 36% of rentals included perks like free rent or parking. If your lease is up, ask about incentives that could save you money.

Can’t move? Review monthly bills — utilities, phone, internet — and call providers to ask about lower-cost plans. Even canceling unused subscriptions or cooking at home more often frees up cash.

5. Be Selective with Events

You don’t have to miss every celebration — just choose intentionally.

Split costs with friends, attend only part of a weekend event, or set a spending cap. These tweaks let you show up without derailing your savings.

6. Put Your Finances on Autopilot

Set up autopay for bills and automate your savings contributions. When good habits run in the background, it’s much easier to stay consistent.

7. Explore All Paths to Homeownership

You don’t always need 20% down to buy a home. Many programs offer options with as little as 0–3% down, making homeownership more attainable than most people think.

Connect with a real estate expert to find out what opportunities are available in Peabody.

The Big Picture

Buying a home is one of the most exciting and rewarding milestones you can achieve — but it rarely happens by chance. With a clear plan and consistent habits, you can enjoy life’s biggest celebrations, create lasting memories, and still stay on track to own your dream home in Peabody.

Categories

Recent Posts

GET MORE INFORMATION