Mortgage Rates See Sharpest Drop in 12 Months

You’ve been watching mortgage rates hover for months. Last week, they finally moved – and the shift was huge.

On Friday, September 5th, the average 30-year fixed dropped to its lowest point since October 2024, marking the biggest single-day decline in over a year.

What Caused the Dip?

Mortgage News Daily points to the August jobs report, which came in weaker than expected for the second straight month. That news rippled through financial markets, pulling mortgage rates lower.

In short, signs of a slowing economy — and growing confidence about where things are headed — tend to drive rates down.

Why This Matters for Buyers

This isn’t just about one news cycle or a single report; it’s about what the drop actually means for you.

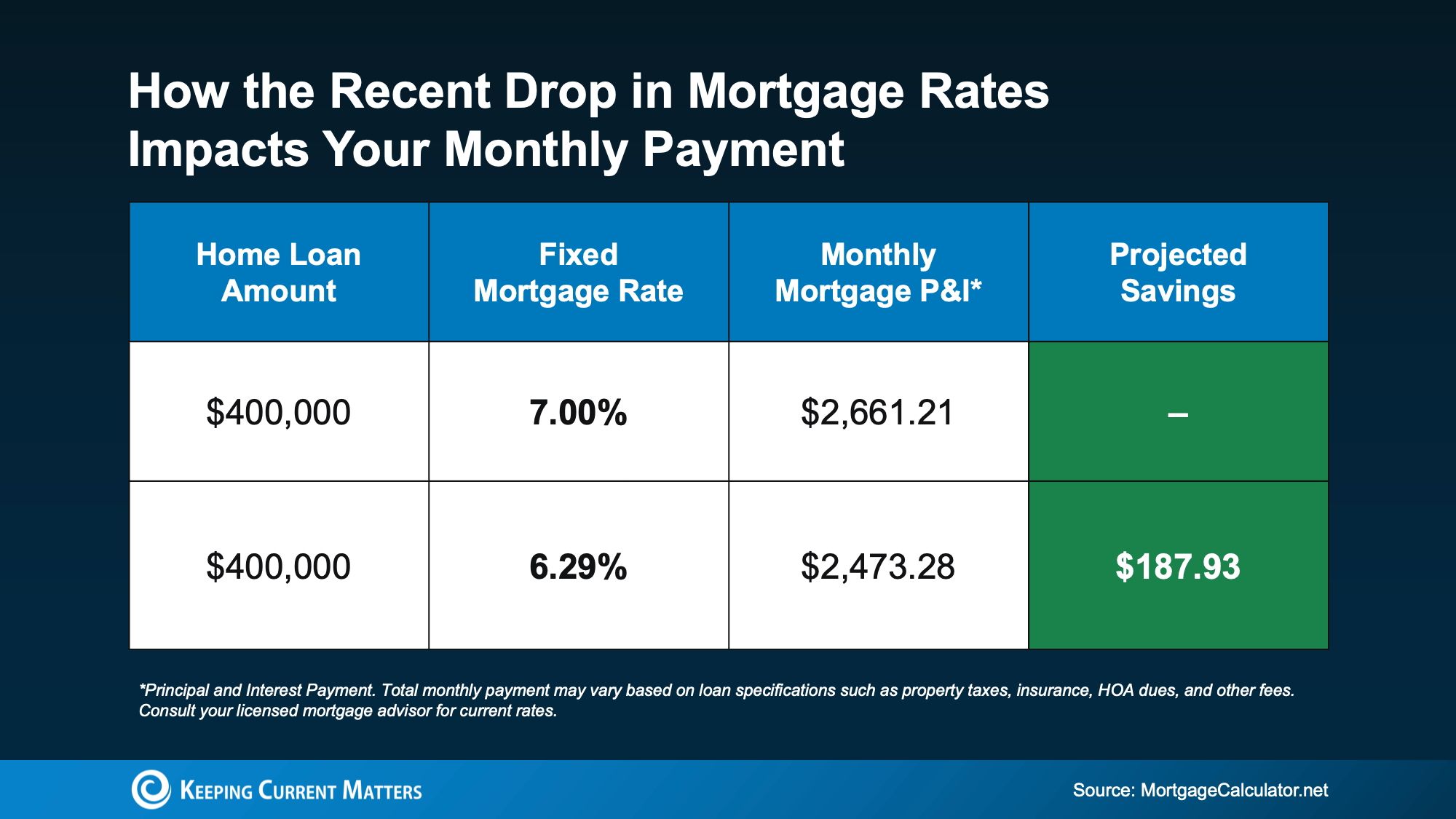

Lower rates translate into lower monthly payments when you buy a home. The chart below compares a typical payment at 7% (back in May) to what it looks like at today’s lower rates.

Compared to where rates were just four months ago, today’s change could cut nearly $200 off your monthly payment. Over a year, that’s about $2,400 in savings.

How Long Will This Last?

That depends on where the economy and inflation head next. Rates could ease further, or they may tick back up.

Stay connected with a strong agent and lender — they’ll track inflation data, jobs reports, and Fed policy updates to give you a read on where things might go.

For now, the key is this: rates have finally broken free from the months-long standstill. If you’ve been waiting, this shift could signal a fresh start. As CNBC’s Diana Olick puts it:

“Mortgage rates have finally moved out of the high-6% range, where they’d been stuck for months.”

And that gives buyers more reason for optimism than they’ve had in quite a while.

Bottom Line

This is the kind of shift buyers have been waiting for.

Mortgage rates just experienced their largest drop in more than a year, and that change could open new doors. If rates hold near this level, a home that felt out of reach just a few months ago may suddenly feel within range.

The question is — what would today’s rates save you on your monthly payment? Connect with a trusted agent or lender to find out and see how this move could work in your favor.

Categories

Recent Posts

GET MORE INFORMATION