What You Don’t Know About Down Payments Might Surprise You

Buying a home should feel exciting—until that dreaded down payment comes to mind. That’s when the doubts start creeping in:

“I’ll never save enough.”

“You need a ton of money up front.”

“Guess I’m stuck renting forever.”

Sound familiar? You’re definitely not the only one thinking it—and here’s the good news: a lot of what you’ve heard simply isn’t true.

Once you see the real numbers, you might be closer to homeownership than you ever realized.

Let’s bust the biggest myth:

Myth #1: You need a large down payment.

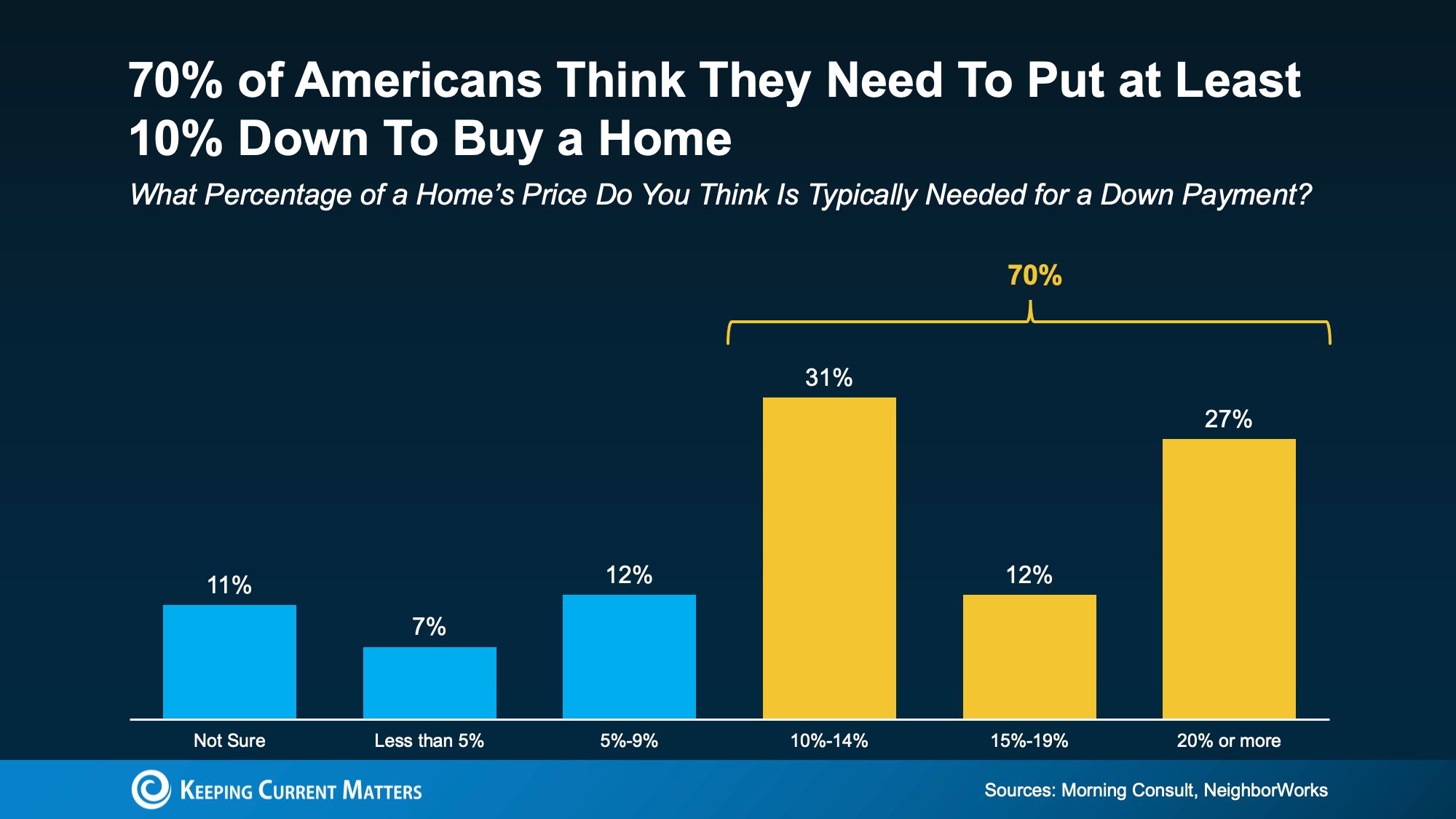

In fact, 70% of Americans believe they need at least 10% down—but that’s not a requirement for most buyers.

Here’s the real deal: according to the National Association of Realtors, first-time buyers typically put down between 6% and 9%—not 20%. And if you qualify for certain loan programs, that number can shrink even more.

That’s why knowing your options can be a game changer.

Myth #2: “Saving for a down payment takes forever.”

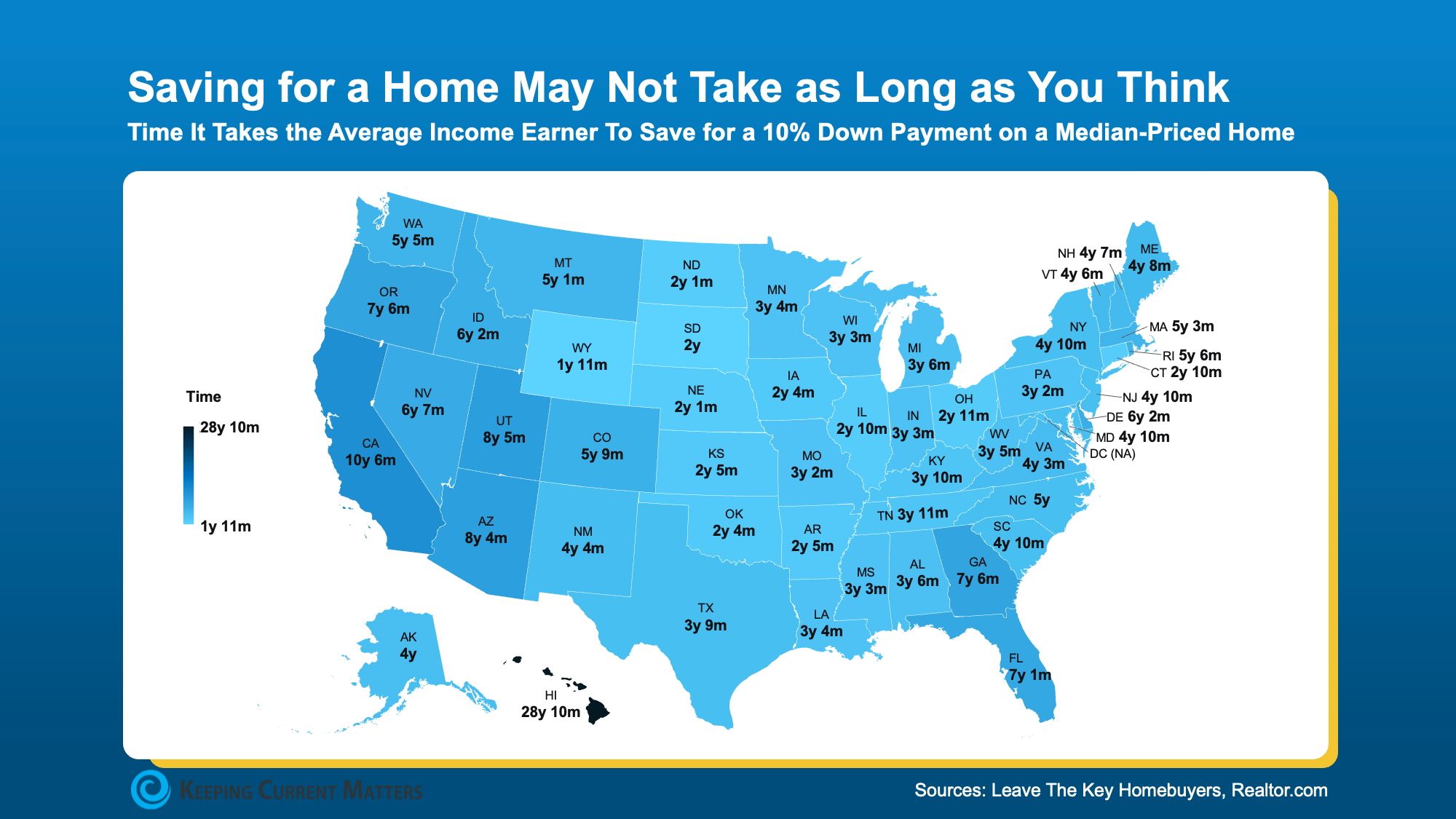

Saving takes commitment, yes—but it may not take as long as you think. With a clear plan and realistic target, many buyers hit their goal sooner than expected.

A recent study shows how many years it takes—on average—to save for a 10% down payment, and it varies widely by state. Some buyers may be closer than they realize.

Here’s something most people don’t realize: you usually won’t need to come up with a full 10% down. And even better? You may not need to fund it all yourself.

Myth #3: “I have to do it all on my own.”

This is one of the most common misconceptions. In reality, there are thousands of down payment assistance programs available to help buyers like you.

Yet, according to the same Morning Consult and NeighborWorks poll, 39% of people don’t even know they exist. That means many future homeowners are much closer to buying than they think—they just haven’t tapped into the support that’s out there.

These programs are specifically designed to help people get started. As Miki Adams, President of CBC Mortgage Agency, puts it:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

Bottom Line

Still waiting to buy because of the down payment? You might not need as much as you think. With the right guidance and a few key resources, your path to homeownership could be easier than expected.

The first step? Chat with a local agent who knows what’s available and can help you get started.

Be honest—if the down payment wasn’t holding you back, would you be ready to buy?

Categories

Recent Posts

GET MORE INFORMATION