The Credit Score Misconception That’s Stopping Buyers From Getting Started

Many would-be homebuyers aren’t on the sidelines by choice—they’re there because they believe they don’t qualify, often due to concerns about their credit score.

A Bankrate survey found that 42% of Americans believe excellent credit is required to qualify for a mortgage. That misconception helps explain why many renters say their credit is the reason they haven’t bought yet.

You might be feeling the same way—checking your credit score, seeing it’s not where you’d like it to be, and deciding homeownership isn’t realistic right now. But here’s the important part: despite what many people believe, perfect credit isn’t required to buy a home.

You don’t need perfect credit to buy a home

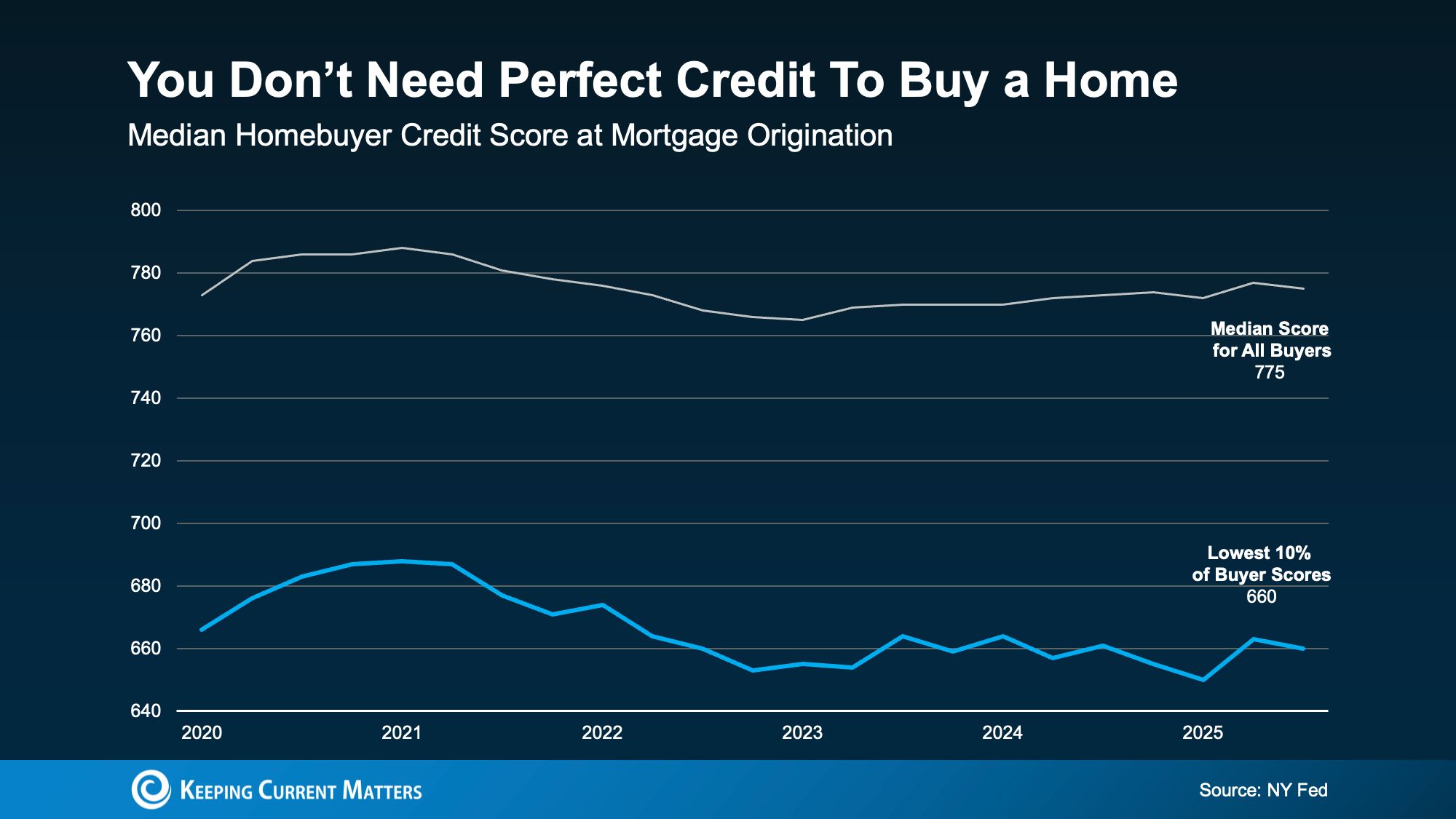

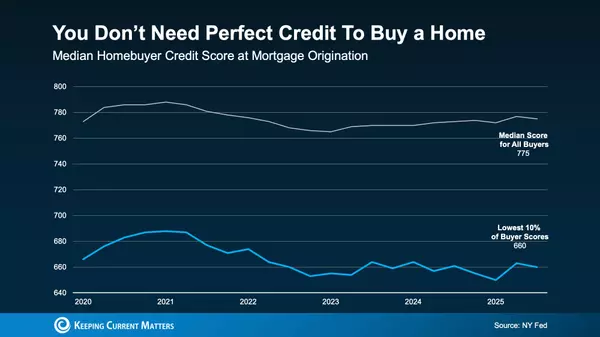

So where does this misconception come from? Part of the confusion is that today’s typical buyer does tend to have a strong credit profile. According to New York Fed data, the median credit score for homebuyers is 775.

That doesn’t mean your credit score needs to be that high to qualify. Recent buyer data shows that many homebuyers secured mortgages with scores well below the median. In fact, about 10% of buyers had credit scores around 660—meaning some were higher, some lower, but the midpoint of that lowest group landed near that range (see graph below).

A lower-than-expected credit score doesn’t automatically disqualify you. FICO explains that lenders don’t all use the same cutoff score when approving mortgages. Each lender applies its own criteria and evaluates multiple factors when determining eligibility.

“Although credit scores like FICO are commonly used in mortgage decisions, lenders apply their own criteria and risk thresholds. There is no single credit score requirement across all lenders, and approval often depends on multiple factors."

That’s why speaking with a knowledgeable lender matters. With a meaningful number of buyers qualifying in the 600-score range, it’s worth exploring what may be possible in your situation.

Bottom Line

Your credit score matters—but it doesn’t need to be perfect.

If credit has been the reason you’ve been waiting to buy a home, it might be time to take another look at your options. If you want help understanding where you stand and what your next step could be, connect with a local lender.

If concerns about credit have kept you on the sidelines, it may be worth revisiting what’s actually possible. A quick conversation with a local lender can help you understand where you stand and what your next step could be.

You don’t need all the answers to start the conversation.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Why are so many would-be buyers staying on the sidelines?", "acceptedAnswer": { "@type": "Answer", "text": "Many renters and would-be buyers believe they don’t qualify for a mortgage, often because they assume their credit score is too low to be approved.", "url": "https://www.bankrate.com/mortgages/home-affordability-report/" } }, { "@type": "Question", "name": "What do Americans typically believe about credit scores and mortgages?", "acceptedAnswer": { "@type": "Answer", "text": "A recent Bankrate survey shows that about 42% of Americans think you need excellent credit to get a mortgage, which keeps many qualified buyers from even applying.", "url": "https://www.bankrate.com/f/102997/x/68dd39e334/down-payments-survey-press-release.pdf" } }, { "@type": "Question", "name": "If typical buyers have high scores, does that mean I need excellent credit too?", "acceptedAnswer": { "@type": "Answer", "text": "No. While recent data show the median credit score on newly originated mortgages is in the mid-700s, many buyers close successfully with significantly lower scores.", "url": "https://calculatedrisk.substack.com/p/q3-ny-fed-report-mortgage-originations?action=share" } }, { "@type": "Question", "name": "Are there buyers getting mortgages with scores around the mid-600s?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Recent mortgage-origination data show a meaningful share of borrowers being approved with scores in the 660 range, with some higher and some lower.", "url": "https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2025Q3" } }, { "@type": "Question", "name": "Do all lenders use the same minimum credit score cutoff?", "acceptedAnswer": { "@type": "Answer", "text": "No. There is no single universal cutoff; each lender sets its own credit thresholds and risk tolerance.", "url": "https://www.luminate.bank/buying-home-without-credit-score" } }, { "@type": "Question", "name": "Is my approval based only on one three-digit score?", "acceptedAnswer": { "@type": "Answer", "text": "No. Lenders typically look at multiple factors, including credit history, income, debts, savings, and the property itself—not just the score.", "url": "https://ficoforums.myfico.com/t5/Credit-in-the-News/New-Mortgage-score-models-accepted-by-Fannie-Mae-and-Freddie-Mac/td-p/6607995" } }, { "@type": "Question", "name": "Can two lenders give different answers on the same application?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Because each lender has its own guidelines and risk models, one lender may approve a borrower that another turns down.", "url": "https://www.luminate.bank/buying-home-without-credit-score" } }, { "@type": "Question", "name": "If my credit score isn’t where I want it, should I still talk to a lender?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. A quick conversation can clarify what’s actually possible now and what small changes could improve your approval odds or pricing.", "url": "https://www.emetropolitan.com/fannie-mae-removes-minimum-credit-score-du-november-2025/" } }, { "@type": "Question", "name": "What can a good local lender help me figure out?", "acceptedAnswer": { "@type": "Answer", "text": "A local lender can help estimate what you can afford, review your credit and income, suggest specific credit-improvement steps, and outline realistic timelines for buying.", "url": "https://www.emetropolitan.com/fannie-mae-removes-minimum-credit-score-du-november-2025/" } }, { "@type": "Question", "name": "Do I need perfect credit before I start the homebuying process?", "acceptedAnswer": { "@type": "Answer", "text": "No. Your credit matters, but it doesn’t have to be perfect; you do not need an “ideal” score to start exploring your options.", "url": "https://calculatedrisk.substack.com/p/q3-ny-fed-report-mortgage-originations?action=share" } }, { "@type": "Question", "name": "What if I feel like I don’t have all the answers yet?", "acceptedAnswer": { "@type": "Answer", "text": "That’s okay—getting started doesn’t require having everything figured out; it only takes reaching out to a lender to understand where you stand and what your next step could be.", "url": "https://www.luminate.bank/buying-home-without-credit-score" } }, { "@type": "Question", "name": "I’m renting now and worried about my credit—what should I do first?", "acceptedAnswer": { "@type": "Answer", "text": "First, request a no-obligation review with a local lender to see whether you’re closer than you think, and if needed, get a simple action plan to move toward qualifying.", "url": "https://www.emetropolitan.com/fannie-mae-removes-minimum-credit-score-du-november-2025/" } } ] }

Categories

Recent Posts

GET MORE INFORMATION