The Housing Market Is Starting to Shift in a New Direction for 2026

After years of elevated mortgage rates and cautious buyers, signs of renewed momentum are taking shape in the housing market. Sellers are returning, buyers are re-engaging, and for the first time in a while, real movement is starting to appear.

It’s not a boom — but it is a meaningful shift, one that may pave the way for a stronger 2026.

Here are three key trends currently helping fuel this gradual comeback.

1. Mortgage Rates Are Trending Downward

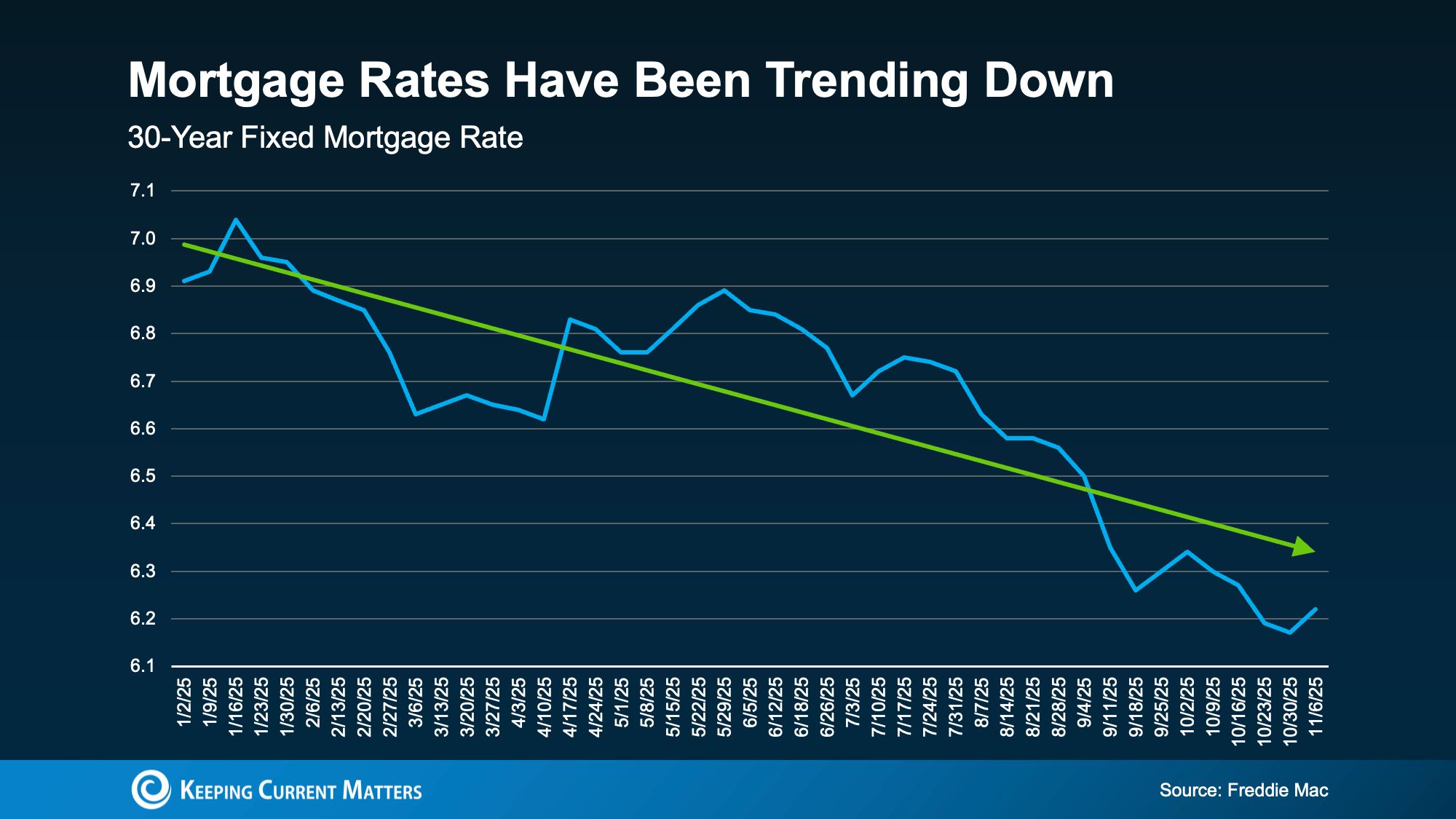

Mortgage rates are always going to have their ups and downs – that’s just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

Mortgage rates naturally fluctuate, especially during periods of economic uncertainty, so short-term swings aren’t surprising. What matters more is the broader trajectory — and this year, the overall trend has been moving lower (see graph below).

Over the past few months, we’ve seen the lowest mortgage rates of 2025 so far. According to Sam Khater, Chief Economist at Freddie Mac, this improvement could result in substantial yearly savings for many buyers, making homeownership incrementally more affordable.

“For a typical-priced home, today’s rates could help buyers save thousands per year compared to earlier in 2025, which signals a gradual improvement in affordability.”

This matters because it directly impacts how much home you can qualify for. Lower rates mean lower monthly payments — and more purchasing power.

For example, Redfin data shows that a buyer with a $3,000 monthly budget can now afford approximately $25,000 more home than they could one year ago. That’s significant and a key driver behind the recent increase in market activity.

2. More Homeowners Are Willing To List

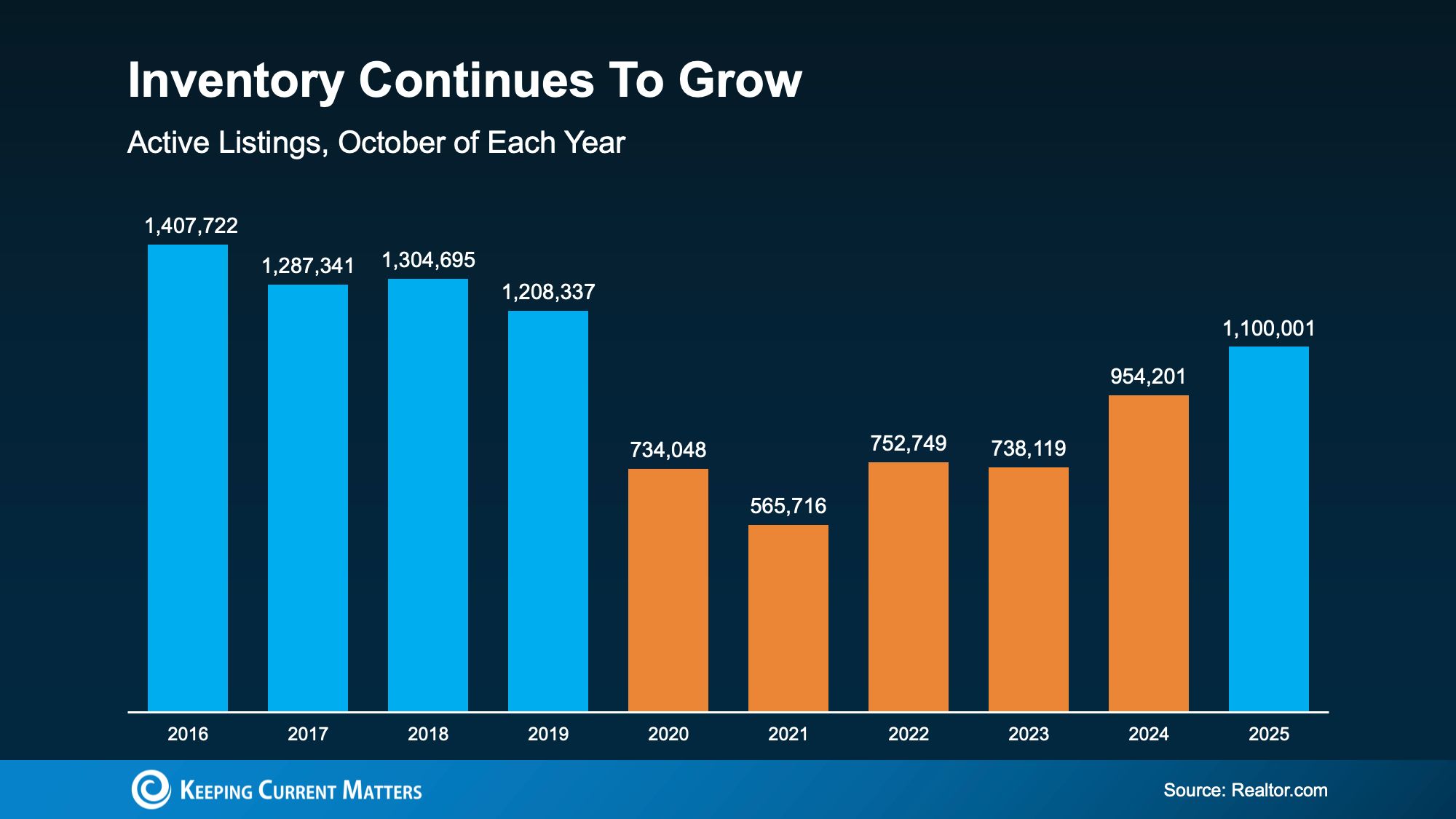

For quite some time, many homeowners chose not to move because they didn’t want to part with their low mortgage rates — a “lock-in effect” that kept inventory limited. While that mentality still exists, it’s beginning to soften as rates trend lower. In addition, life events are becoming a stronger driver of mobility, which is gradually increasing the number of homes hitting the market.

Recent data from Realtor.com highlights how much housing inventory has expanded — and what’s notable is that it’s approaching levels not seen in nearly six years (see blue section in the graph below).

This shift back toward more typical inventory levels is a positive development. It gives buyers access to choices they haven’t seen in years and helps move the market toward a healthier balance.

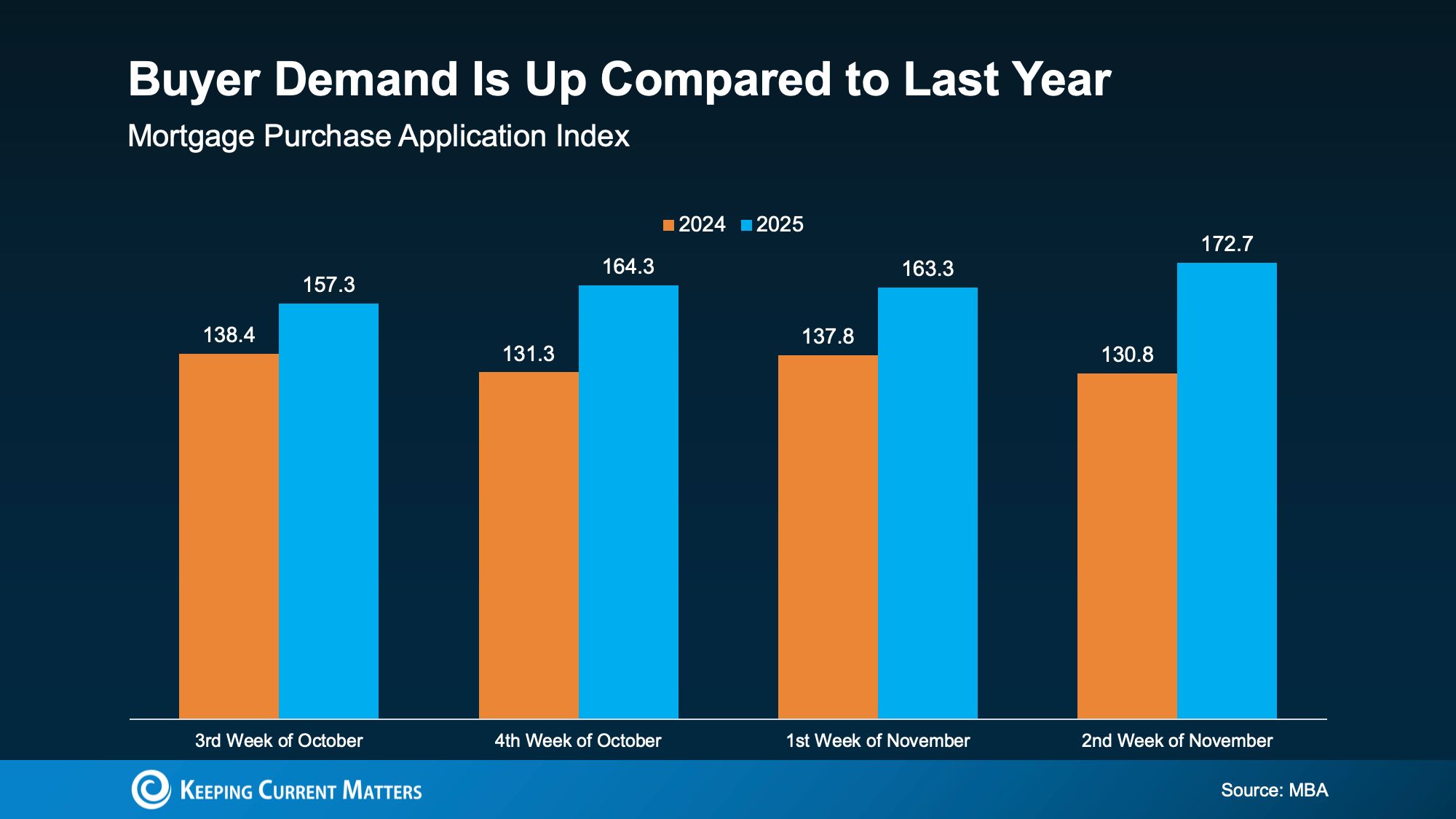

3. More Buyers Are Returning

It’s not just homeowners taking action. As inventory improves and affordability gradually strengthens, buyers are stepping back into the market. According to the Mortgage Bankers Association (MBA), purchase applications are up year-over-year — a strong indicator that demand is rebuilding (see graph below).

Experts anticipate this trend to continue, with economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) projecting gradual sales growth as we approach 2026.

This won’t be an instant rebound or sudden surge, but rather a slow, steady improvement — and it’s progress many have been waiting for.

Bottom Line

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

Connect with a local real estate agent about what’s changing and how you can make the most of it in 2026.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What is happening in the housing market as we approach 2026?", "acceptedAnswer": { "@type": "Answer", "text": "After a stretch of slow activity due to high mortgage rates, the housing market is showing renewed momentum. Sellers are starting to list again, buyers are re-engaging, and overall activity is gradually increasing. It’s not a boom, but it is a meaningful shift toward a stronger market heading into 2026." } }, { "@type": "Question", "name": "Why are mortgage rates important in driving this shift?", "acceptedAnswer": { "@type": "Answer", "text": "Mortgage rates directly affect monthly payments and purchasing power. As rates trend downward, buyers can afford more home for the same budget, making homeownership more realistic for many households." } }, { "@type": "Question", "name": "Are mortgage rates actually decreasing?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. While day-to-day volatility still happens, the overall trend in 2025 has been downward. According to Freddie Mac’s Chief Economist Sam Khater, today’s rates can save buyers thousands of dollars per year compared to earlier in 2025." } }, { "@type": "Question", "name": "How much more home can buyers afford with improved rates?", "acceptedAnswer": { "@type": "Answer", "text": "Based on Redfin data, a buyer with a $3,000 monthly budget can now afford about $25,000 more home compared to one year ago. This increase in purchasing power is helping fuel renewed buyer activity." } }, { "@type": "Question", "name": "Why are more homeowners deciding to list their homes?", "acceptedAnswer": { "@type": "Answer", "text": "The long-standing lock-in effect — where owners stay put to keep their low mortgage rates — is easing. With rates trending lower and personal life events becoming more influential, such as job changes, family needs, and downsizing, more homeowners are finally choosing to move." } }, { "@type": "Question", "name": "What does current housing inventory look like?", "acceptedAnswer": { "@type": "Answer", "text": "Inventory levels have expanded noticeably. Realtor.com reports that available homes are approaching the highest levels seen in nearly six years. This provides buyers with more choices and helps move the market closer to a balanced environment." } }, { "@type": "Question", "name": "Are buyers coming back to the market?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. As inventory rises and affordability slightly improves, buyers are returning. The Mortgage Bankers Association reports year-over-year increases in purchase applications, a strong sign that demand is rebuilding." } }, { "@type": "Question", "name": "Will the market suddenly boom in 2026?", "acceptedAnswer": { "@type": "Answer", "text": "No. Experts expect a slow and steady improvement, not a rapid surge. Economists from Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors forecast continued modest growth in home sales leading into 2026." } }, { "@type": "Question", "name": "What factors are contributing the most to this gradual comeback?", "acceptedAnswer": { "@type": "Answer", "text": "Three main factors are driving the gradual comeback: declining mortgage rates, more homeowners listing their properties, and increased buyer activity and application growth. Together, they’re helping the market gain real traction." } }, { "@type": "Question", "name": "What should buyers or sellers do now to prepare for 2026?", "acceptedAnswer": { "@type": "Answer", "text": "Buyers and sellers should connect with a knowledgeable local real estate agent. An experienced professional can help you understand your local market, navigate changing conditions, and make informed decisions as the housing landscape continues to evolve." } } ] }

Categories

Recent Posts

GET MORE INFORMATION