Why Today’s Market Still Makes Sense for Sellers—Even with Current Rates

Hanging onto a 3% mortgage rate is tough to walk away from—no doubt about it. It’s been one of the biggest reasons many homeowners have stayed put the past few years. But here’s the thing:

A low rate doesn’t fix being out of space, struggling with stairs, or living far from the people you care about. For more and more sellers, those lifestyle needs are outweighing the appeal of a cheaper mortgage.

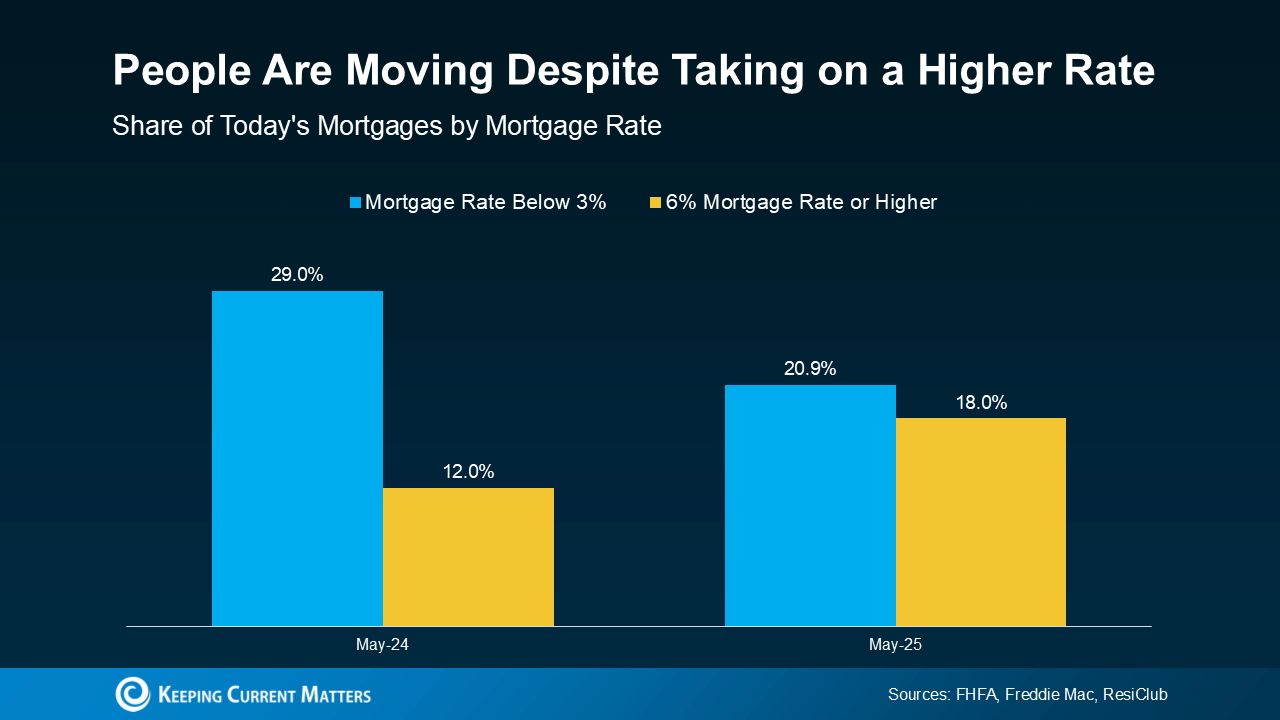

In fact, the numbers show a shift is happening. The share of homeowners with sub 3% rates is shrinking as more decide to move—many of them locking in new rates above 6% (see graph below).

What’s Really Driving People To Move Right Now

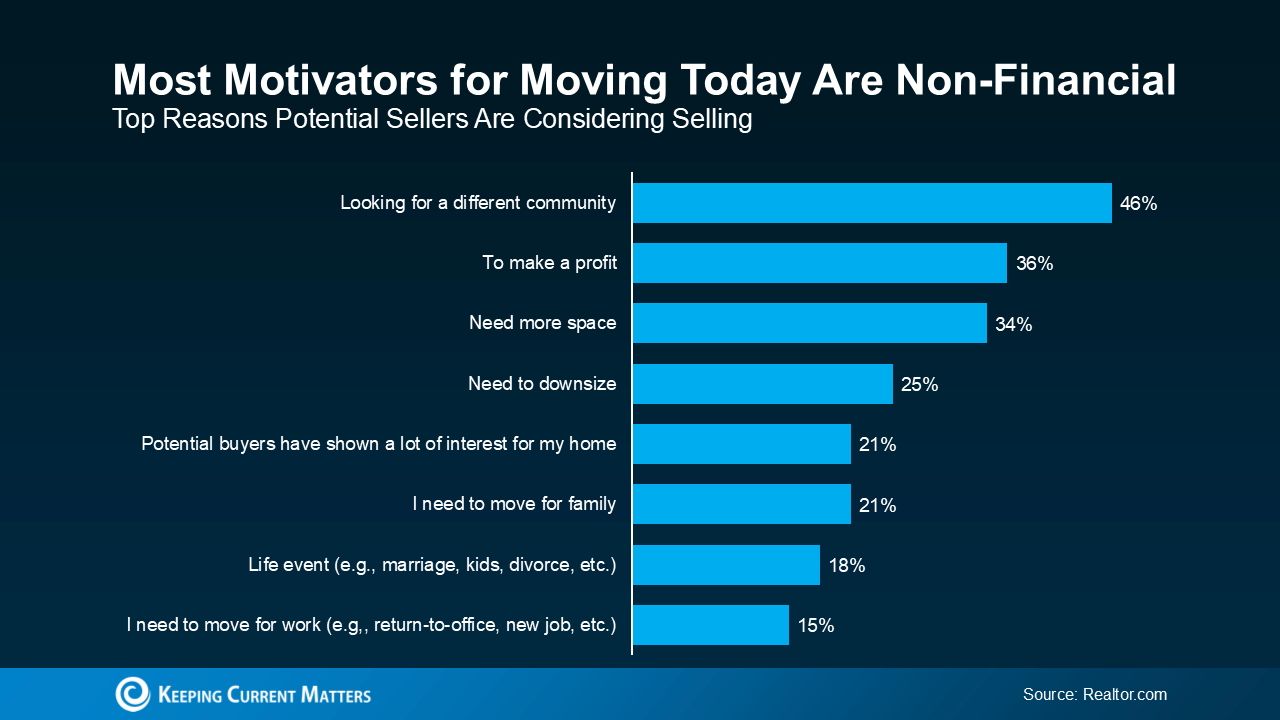

Why would anyone trade a low mortgage rate for a higher one? According to a survey from Realtor.com, the answer is clear: necessity. Nearly 79% of homeowners thinking about selling today say they’re doing it because they have to, not just because they want to. And most of those reasons? They’re not about money—they’re about real-life needs (see graph below):

Do Any of These Feel Familiar?

- You’ve Outgrown Your Home: A growing family, kids needing their own space, or a parent moving in can make your current home feel too small—fast.

- You’re Ready to Downsize: The kids have moved out, and it’s time to simplify. Fewer rooms to clean, lower bills, and less upkeep? That’s a win.

- You Want to Be Closer to Family: Whether it’s helping with grandkids or supporting aging parents, being near loved ones can outweigh the numbers.

- Life Circumstances Have Shifted: A new relationship, a separation, or simply needing a fresh start—sometimes change means a new home, too.

- Work Is Moving You: A job offer, a transfer, or a new opportunity might mean packing up and starting fresh somewhere else.

What About Rates?

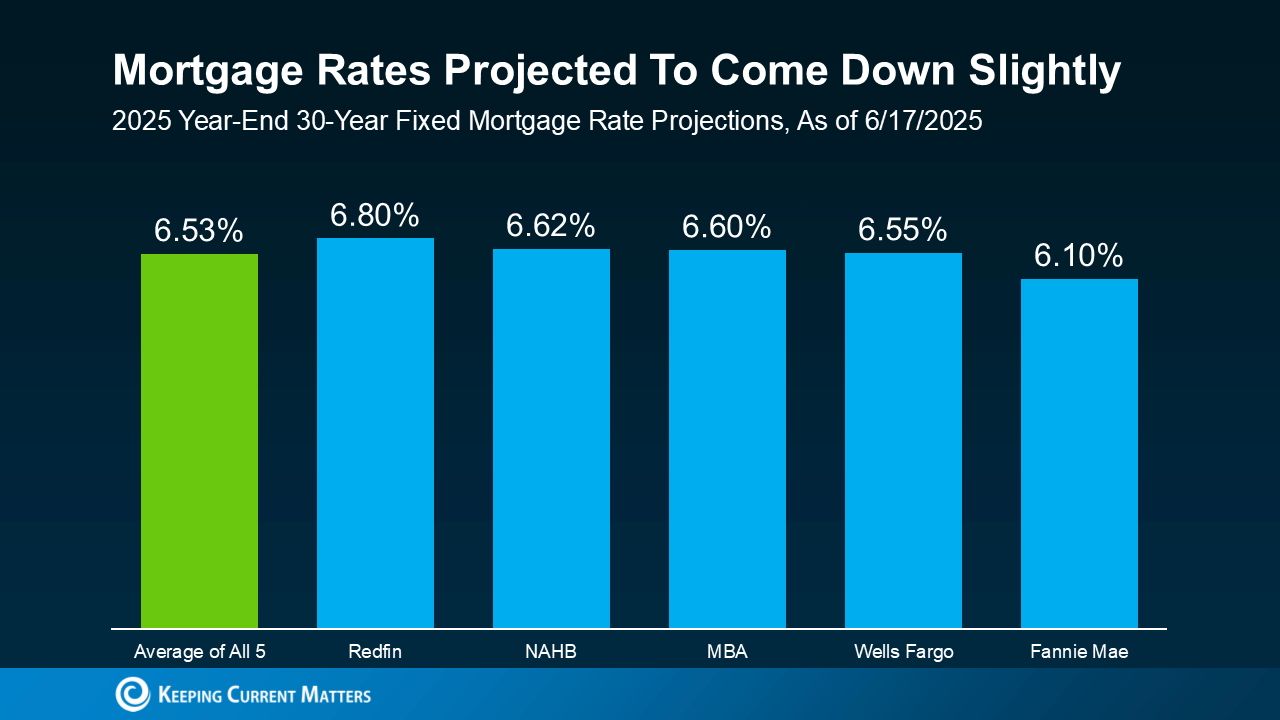

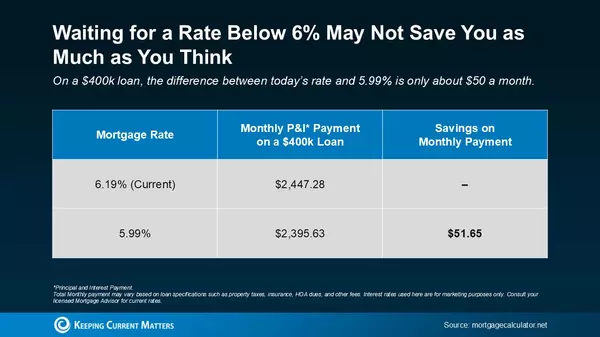

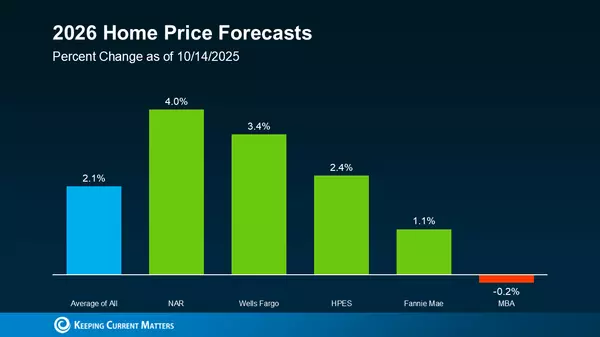

Yes, rates are expected to decline—but gradually. Most forecasts show only slight drops this year. That 3% rate? It’s not likely coming back anytime soon (see graph below).

Waiting for a major rate drop might seem like a smart move—but it could mean spending even more time in a home that no longer fits your life.

For many, that wait has already dragged on. In fact, Realtor.com reports nearly 2 out of 3 potential sellers have been thinking about moving for over a year.

So the real question is: How much longer are you willing to put your life on hold?

Bottom Line

Maybe your current home made perfect sense five years ago. But that “for now” house you bought in 2020? It may no longer fit the way you live in 2025—and that’s not just understandable, it’s completely normal.

Sure, mortgage rates matter. They’re part of the equation. But the bigger, more personal question is:

What kind of home do you really need to support the way you live today—and where you want to go next?

If your life has changed, your home should change with it. Talk to a local agent about what’s different now, and what kind of move could actually move your life forward.

Categories

Recent Posts

GET MORE INFORMATION