Why VA Home Loans Are a Game-Changer for Veterans in Today’s Market

If you’ve served in the military—or your spouse has—you’re eligible for one of the strongest benefits available to homebuyers: the ability to purchase a home with no down payment required.

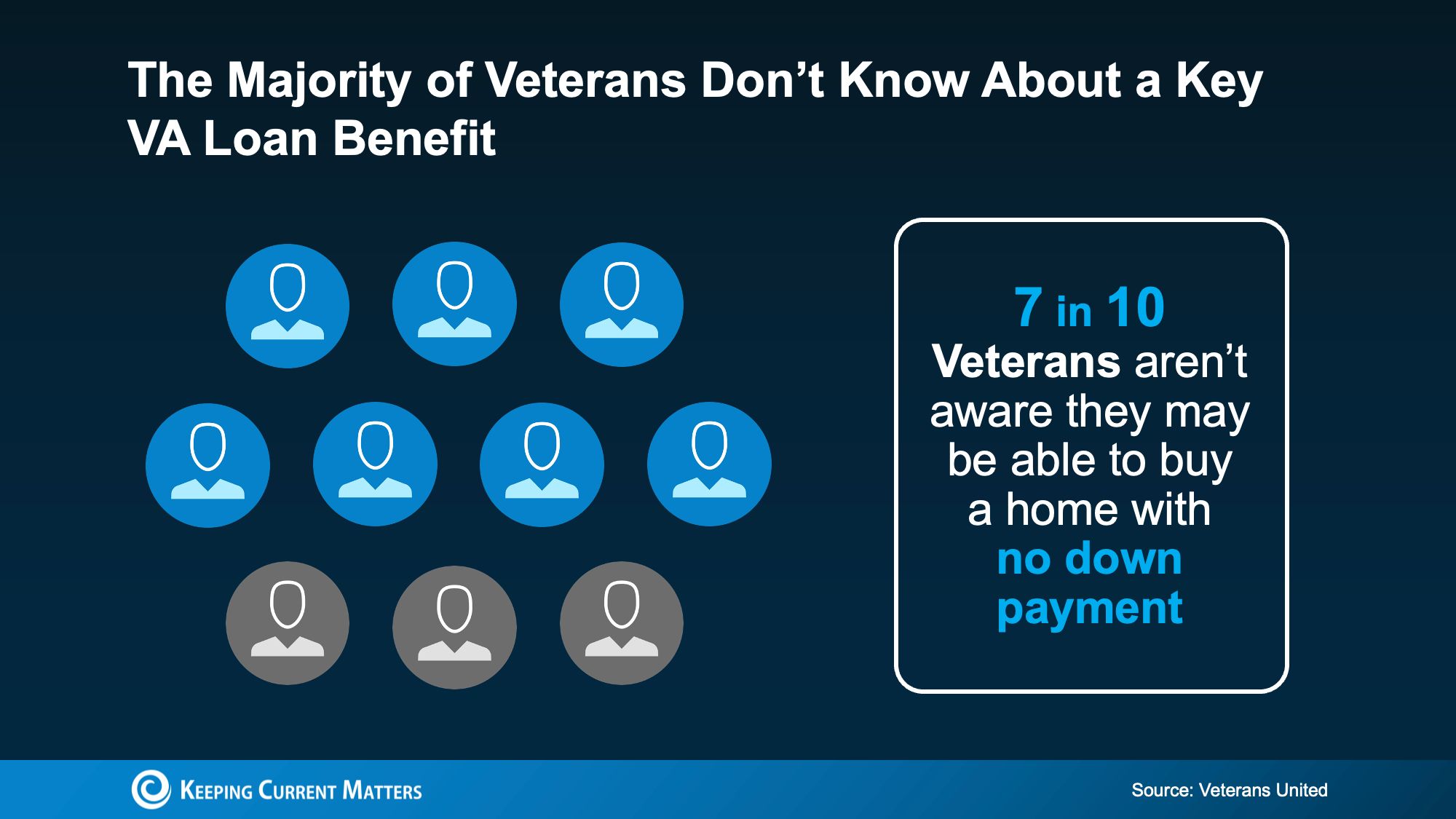

Yet, according to Veterans United, about 70% of Veterans (that’s 7 out of 10) aren’t even aware this opportunity exists.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really benefit about Veterans Affairs (VA) home loans right now.

That’s a major missed opportunity for those who’ve rightfully earned this benefit through their service. Let’s take a closer look at what you should know about VA home loans today.

Why VA Home Loans Are a Smart Choice

For nearly 80 years, VA loans have helped millions of Veterans and active-duty service members achieve homeownership. According to the Department of Veterans Affairs, here are some of the biggest advantages:

- $0 Down Payment: Many Veterans can purchase a home without spending years saving for a down payment.

- Lower Upfront Costs: The VA restricts which closing costs Veterans must pay, keeping more money in your pocket at closing.

- No Private Mortgage Insurance (PMI): Unlike most other loan programs, VA loans don’t require PMI—helping reduce your monthly payment.

These benefits make VA loans an excellent way for service members and their families to build financial stability, save money, and grow long-term wealth through homeownership.

Can You Still Get a VA Loan During a Government Shutdown?

Recently, some confusion has spread about whether VA loans are still being processed during the government shutdown. That uncertainty has caused some Veterans to pause their homebuying plans unnecessarily.

While there may be some minor delays, Veterans United confirms that VA loans are still moving forward:

“There’s been plenty of confusion around how the government shutdown impacts VA home loans—but the truth is, the effect is minimal. Lenders can still request appraisals, issue Certificates of Eligibility, submit VA Funding Fees, and process loans as usual. In short, Veterans can continue to buy or refinance homes using their VA benefits.”

So even with the headlines, your VA home loan benefits remain fully available. The system is up and running—it just might take a little longer to finalize everything.

Why the Right Agent and Lender Matter

Using your VA home loan is much easier when you have the right team guiding you. As VA News explains:

“Working with a military-friendly real estate agent or broker who truly understands the VA loan process can make a world of difference. Choosing the right professional—along with a knowledgeable VA lender—helps ensure strong communication and a smooth path to closing.”

The right agent and lender will walk you through every step, from qualification to closing, helping you maximize your hard-earned benefits and avoid unnecessary stress along the way.

Bottom Line

If you’re a Veteran, a VA home loan is one of the most powerful financial benefits available to you—a well-deserved reward for your service and sacrifice. It can open the door to homeownership with no down payment required, lower closing costs, and flexible qualification options that make buying a home more achievable than you might think.

Beyond saving money upfront, a VA loan can also help you build long-term stability and equity while keeping your monthly payments manageable. Whether you’re buying your first home, upgrading, or refinancing, the program is designed to make the process smoother and more affordable for those who’ve served.

If you’d like to understand exactly how these benefits apply to your situation, connect with a trusted VA-approved lender. They can walk you through your eligibility, current rates, and the steps to get started—so you can take full advantage of the homeownership opportunities you’ve rightfully earned.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What is a VA home loan?", "acceptedAnswer": { "@type": "Answer", "text": "A VA home loan is a mortgage option backed by the U.S. Department of Veterans Affairs and is available to eligible veterans, active-duty service members, and some surviving spouses. It offers key benefits such as no down payment and more flexible qualification requirements compared to many conventional loans." } }, { "@type": "Question", "name": "Why are VA home loans a game-changer for veterans?", "acceptedAnswer": { "@type": "Answer", "text": "VA home loans provide several powerful advantages: (1) No down payment required, allowing veterans to buy a home with 0% down; (2) Lower upfront costs because the VA limits which closing costs veterans must pay; (3) No private mortgage insurance (PMI), which helps lower monthly payments; (4) Competitive interest rates that are often lower than conventional loans; and (5) Flexible credit requirements designed to accommodate a wider range of credit profiles." } }, { "@type": "Question", "name": "Are VA home loans still available during a government shutdown?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. VA home loans continue to be processed during a government shutdown. While there may be minor delays, key steps such as ordering appraisals, obtaining Certificates of Eligibility, and submitting funding fees still move forward. Veterans can still buy or refinance homes using their VA loan benefits." } }, { "@type": "Question", "name": "Why do many veterans miss out on VA home loans?", "acceptedAnswer": { "@type": "Answer", "text": "According to Veterans United, about 70% of veterans are unaware they qualify for a VA loan. As a result, many veterans miss the opportunity to purchase a home with no down payment and benefit from the lower costs and flexible terms that come with this program." } }, { "@type": "Question", "name": "Why is the right agent and lender important for VA loans?", "acceptedAnswer": { "@type": "Answer", "text": "VA loans have unique guidelines and benefits, so working with a real estate agent and lender who understand the VA loan process can make the experience smoother. VA-savvy professionals can help veterans meet eligibility requirements, structure the offer properly, communicate with the lender, and ensure they maximize the benefits they earned through service." } }, { "@type": "Question", "name": "What are the long-term benefits of a VA home loan?", "acceptedAnswer": { "@type": "Answer", "text": "VA home loans make homeownership more accessible, which helps veterans build equity and long-term financial stability. Because VA loans do not require PMI and often come with favorable interest rates, monthly payments can be lower than other loan types, supporting more sustainable homeownership and wealth-building over time." } }, { "@type": "Question", "name": "How can a veteran get started with a VA home loan?", "acceptedAnswer": { "@type": "Answer", "text": "Veterans should connect with a trusted VA-approved lender to review eligibility, current interest rates, and the steps to apply. A lender can help obtain the Certificate of Eligibility (COE), outline costs, and guide the veteran through preapproval and closing so they can fully use the benefits they have earned. For more details, veterans can also review the official VA Buyers Guide at https://www.benefits.va.gov/HOMELOANS/documents/docs/VA_Buyers_Guide.pdf." } } ] }

Categories

Recent Posts

GET MORE INFORMATION