Before You Call It a Crash—Here’s the Real Story on the Housing Market

Lately, it seems like everyone’s asking the same thing: "Is the housing market on the verge of crashing?"

Between alarming headlines and all the buzz on social media, it’s easy to understand the concern. In fact, a recent survey by Clever Real Estate found that 70% of Americans are worried about a potential crash in 2025. But before you hit pause on your home goals—whether you're thinking about buying or selling—let’s take a step back.

Here’s the truth: The market isn’t crashing. It’s adjusting. And believe it or not, that shift could actually work in your favor.

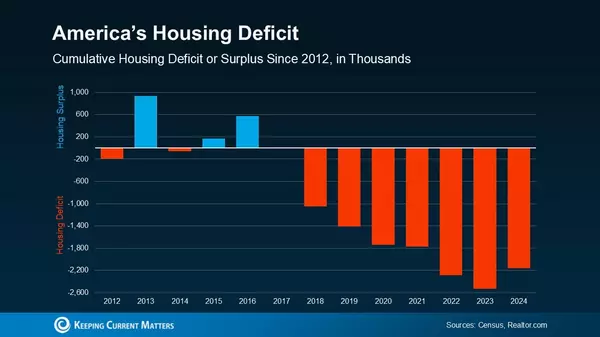

Inventory Is the Key to Understanding Today’s Market

Mark Fleming, Chief Economist at First American, put it plainly:

“The biggest issue right now is a lack of supply. There are more buyers than homes available. That’s basic economics.”

And he’s right. When there’s a limited supply of something in high demand—whether it's concert tickets or homes—prices stay strong. That’s what we’re seeing now.

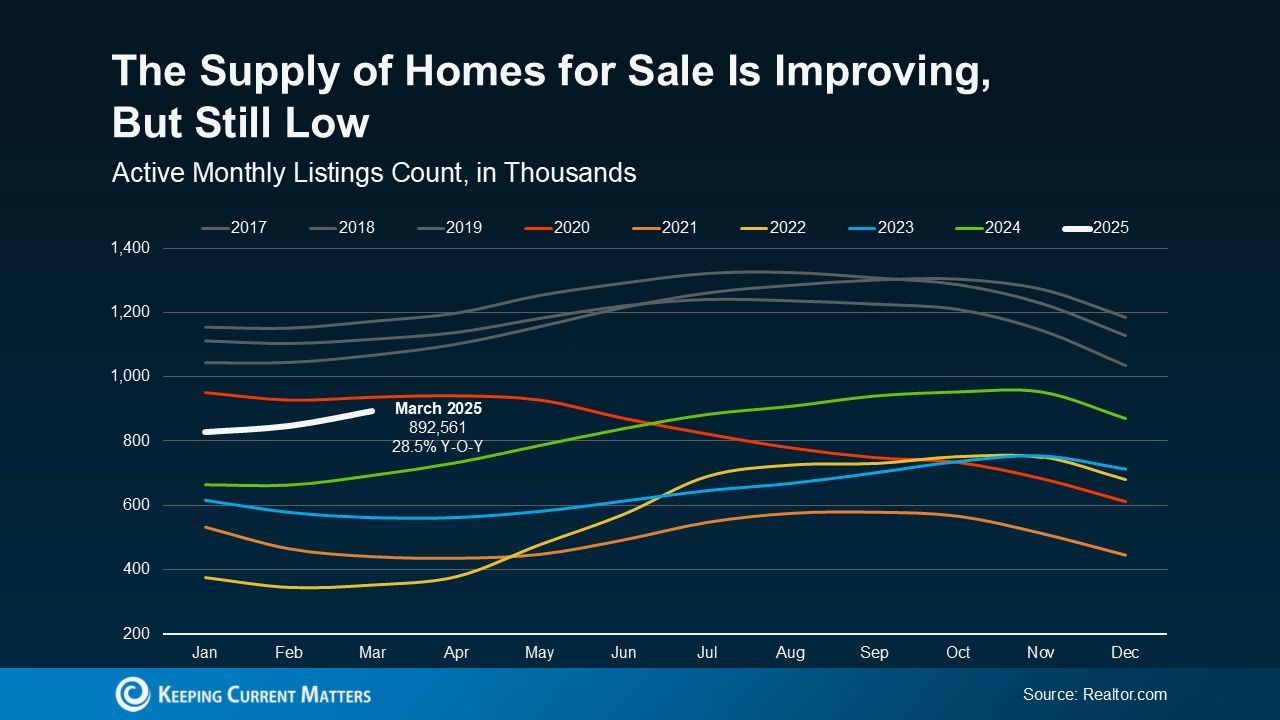

Even though more listings are hitting the market in 2025, we’re still far below what's considered a balanced or “normal” level. Just look at the white line in the graph below compared to the historical average. It shows that while inventory is improving, we’re not even close to an oversupply.

So if you’ve been waiting for prices to plummet... don’t. The fundamentals just don’t support a crash.

Why Home Prices Aren’t Dropping Nationwide One of the biggest reasons we’re not seeing a major drop in home prices? Inventory is still tight. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“When there’s a housing shortage, a price crash just isn’t possible.”

That limited supply continues to act as a cushion, preventing prices from falling on a national scale. But here’s what’s important to know right now…

More Homes = Slower Price Growth (Not a Crash)

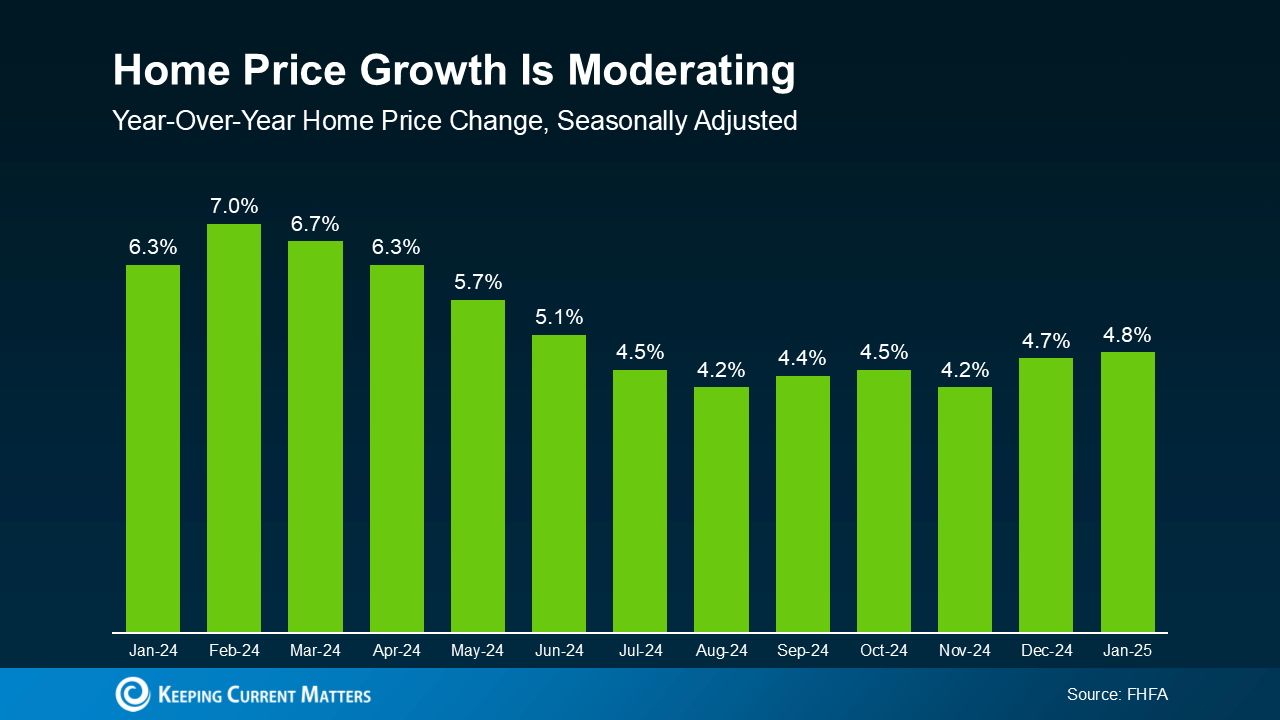

We are seeing more homes come on the market in some areas—and that’s a good thing. Increased inventory helps ease the pressure on home prices, allowing for more sustainable growth rather than steep jumps.

So no, home values aren’t falling. But they’re also not rising as fast as they were in the frenzy of the past few years. What we’re experiencing is a return to balance—a gradual, healthier pace of appreciation that makes it easier for buyers to plan ahead without panic.

Check out the graph below for a clearer look at how price growth is moderating.

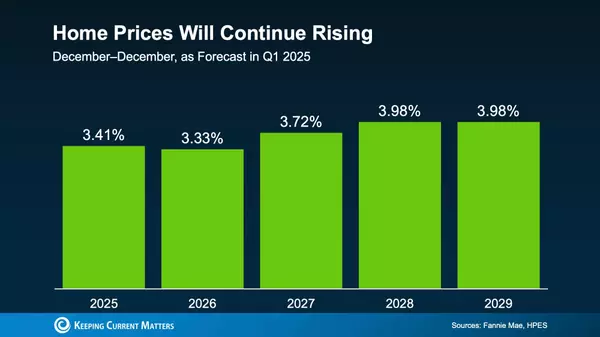

What’s Next for Home Prices? According to Freddie Mac, the trend of slower price growth is expected to stick around for the rest of the year. As they put it:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

In other words, prices will still rise in most areas, but not at the breakneck speed that left so many buyers frustrated. That’s welcome news if you've been dealing with bidding wars or feeling overwhelmed by sticker shock lately.

But remember—real estate is local. What’s happening nationally may look very different in your own neighborhood. That’s why it’s always smart to connect with a local agent who understands the trends in your area and can help you make a confident move.

Bottom Line

Don’t let the headlines shake your confidence. The experts are clear: a housing market crash isn’t expected in 2025. As Business Insider puts it:

“Home price growth in 2025 will likely slow compared to 2024—but it will remain on an upward path.”

What we’re seeing isn’t a collapse—it’s a move toward a more stable, sustainable market. Slower price growth, more inventory, and fewer bidding wars mean more opportunities for buyers and sellers alike. The key? Knowing what’s happening in your area.

Let’s connect and talk about how to make the most of the current market—whether you’re buying, selling, or just weighing your options.

Categories

Recent Posts