Does a 3% Mortgage Mean I Should Stay Put?

If you’re sitting on a 3% mortgage rate, it makes total sense to hesitate. Why give up such a good deal? Even if moving has crossed your mind, that low rate probably makes you pause and think, “Is it really worth it?”

But here’s a different way to look at it: Are you putting your lifestyle on hold just to keep your rate? Because most people don’t move because of interest rates — they move because life changes. So maybe the better question is:

Will this home still fit your life five years from now?

Take a minute and think ahead. Is your family growing? Are your kids moving out soon? Retirement on the horizon? Are you already feeling cramped — or maybe like you’ve outgrown the space emotionally or financially?

If you truly see no changes ahead and you’re content where you are, holding onto that 3% may be the right call. But if you even suspect a move is in your future — whether in one year or five — it’s worth planning ahead.

Because waiting just a year or two could mean buying at a higher price point.

Here’s What the Experts Are Predicting

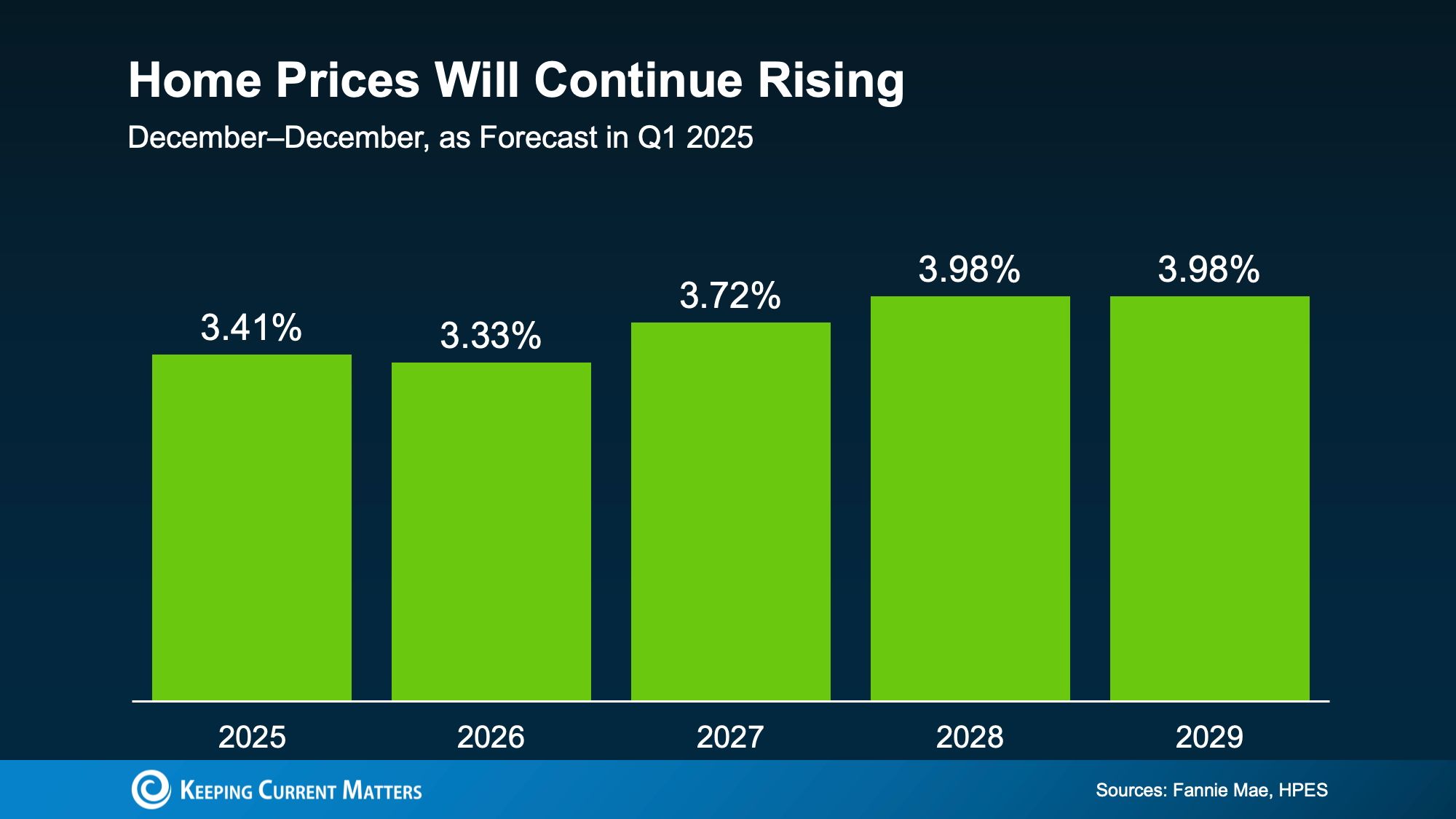

Fannie Mae surveys over 100 housing experts every quarter. Their consensus? Home prices are projected to keep climbing through at least 2029. (See chart below.)

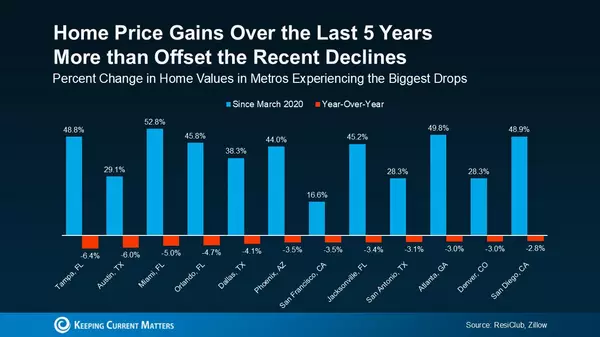

Sure, those forecasts aren’t predicting huge jumps year after year — but they are pointing to steady growth. Some markets might level off or even dip slightly in the short term. But zoom out, and the long-term trend is clear: home prices tend to rise. And even small gains stack up quickly.

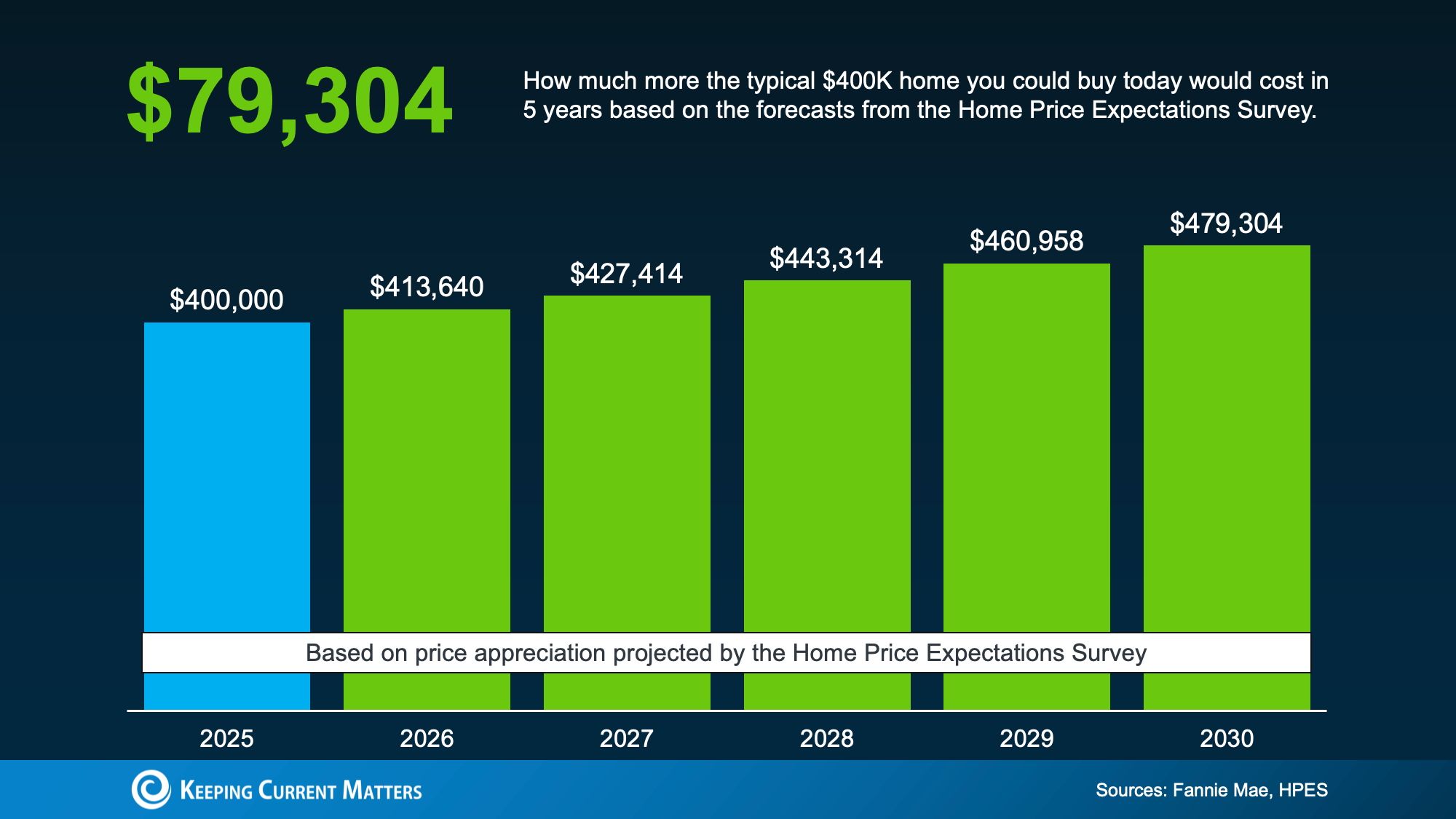

Here’s what that could mean for you: Let’s say you're planning to buy a home around $400,000. If you wait five years, expert projections suggest that same home could cost you nearly $80,000 more (see graph below). That’s the cost of waiting.

In short: the longer you wait, the more you’re likely to pay for your next home.

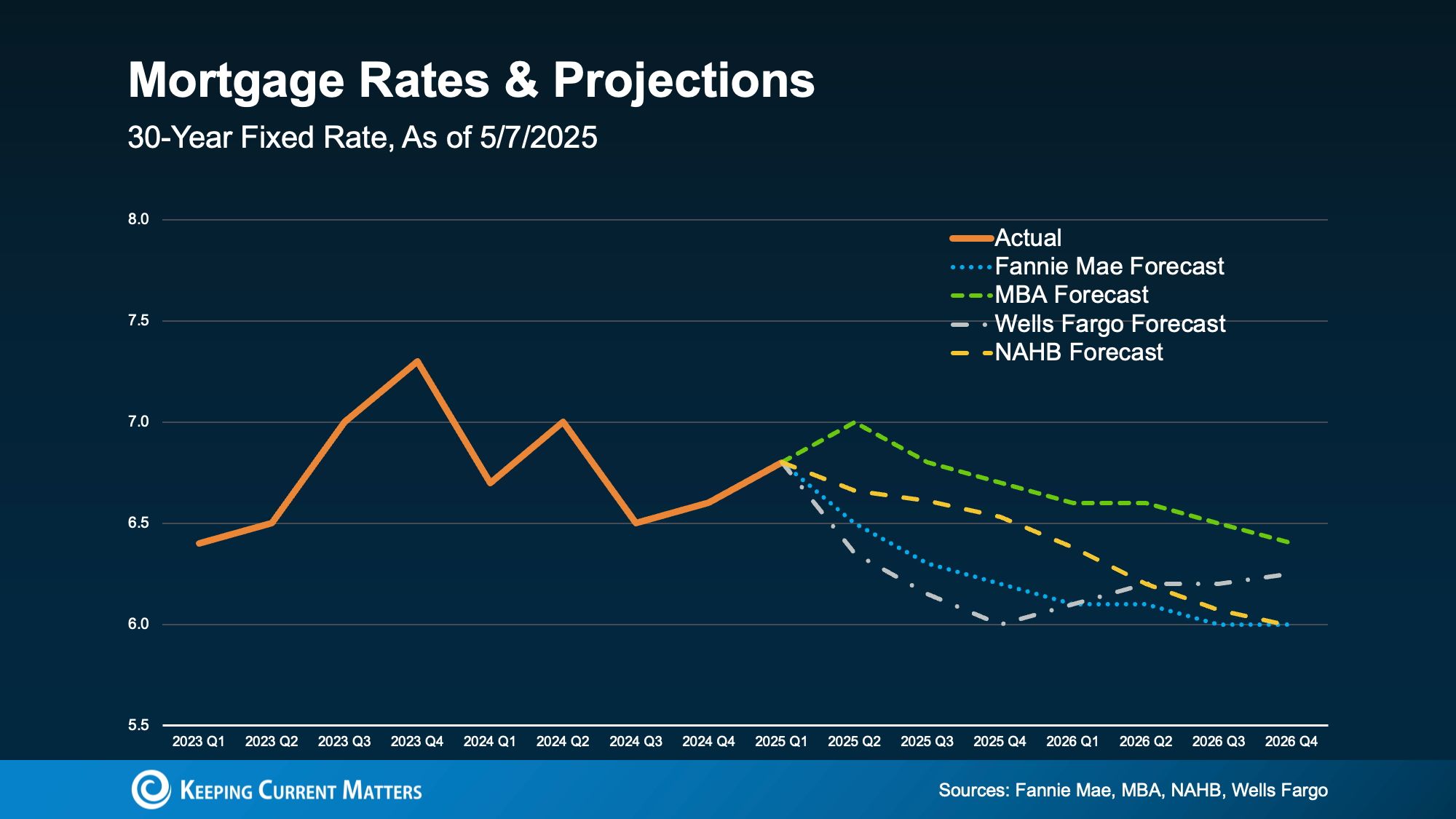

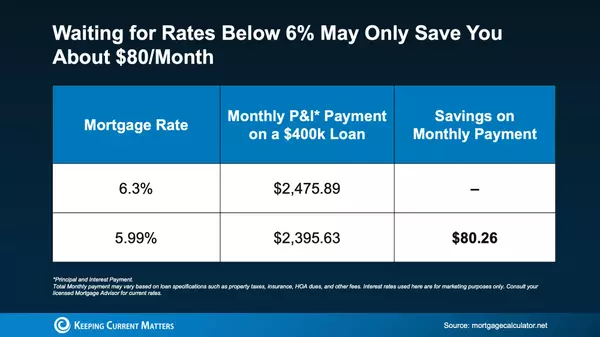

If a move is even somewhat on your horizon, now’s the time to think seriously about your timeline. You don’t have to jump right away — but it’s smart to explore your options before prices rise further. Yes, mortgage rates are expected to come down. But not by much. And if you’re waiting for those ultra-low 3% rates to come back… experts say that’s just not likely (see graph below).

So the real question isn’t “Why move?” — it’s “When makes the most sense?” Because once you look at the numbers, it becomes clear: waiting might not actually save you money. And that’s exactly the kind of strategy conversation worth having with a trusted agent right now.

Bottom Line

Holding onto a low mortgage rate is a smart move — until it starts limiting your options.

If you see a move in your future, even if it’s not immediate, now is the time to start running the numbers. The sooner you understand what’s ahead, the better you can prepare and position yourself for what’s next.

Categories

Recent Posts

GET MORE INFORMATION