Which Offers More Value: Renting or Buying a Home?

You might be wondering lately: Is it even worth trying to buy a home right now?

With home prices still high and mortgage rates sticking around, renting can feel like the easier—or maybe even the only—option. That’s totally valid. For some, now may not be the right time to buy. The truth is, you should only buy when you’re financially ready and it aligns with your goals.

But here’s something to keep in mind about renting:

While it might seem like the safer or more affordable route month-to-month, over time, it can actually cost you more. According to a recent Bank of America survey, 70% of would-be buyers are concerned about what long-term renting means for their financial future—and with good reason.

Owning a home may feel out of reach, but with the right plan, it’s more attainable than you think. And the long-term benefits? Worth it.

Homeownership Helps Build Wealth

Buying a home isn’t just about putting a roof over your head. It’s about building equity and securing your financial future.

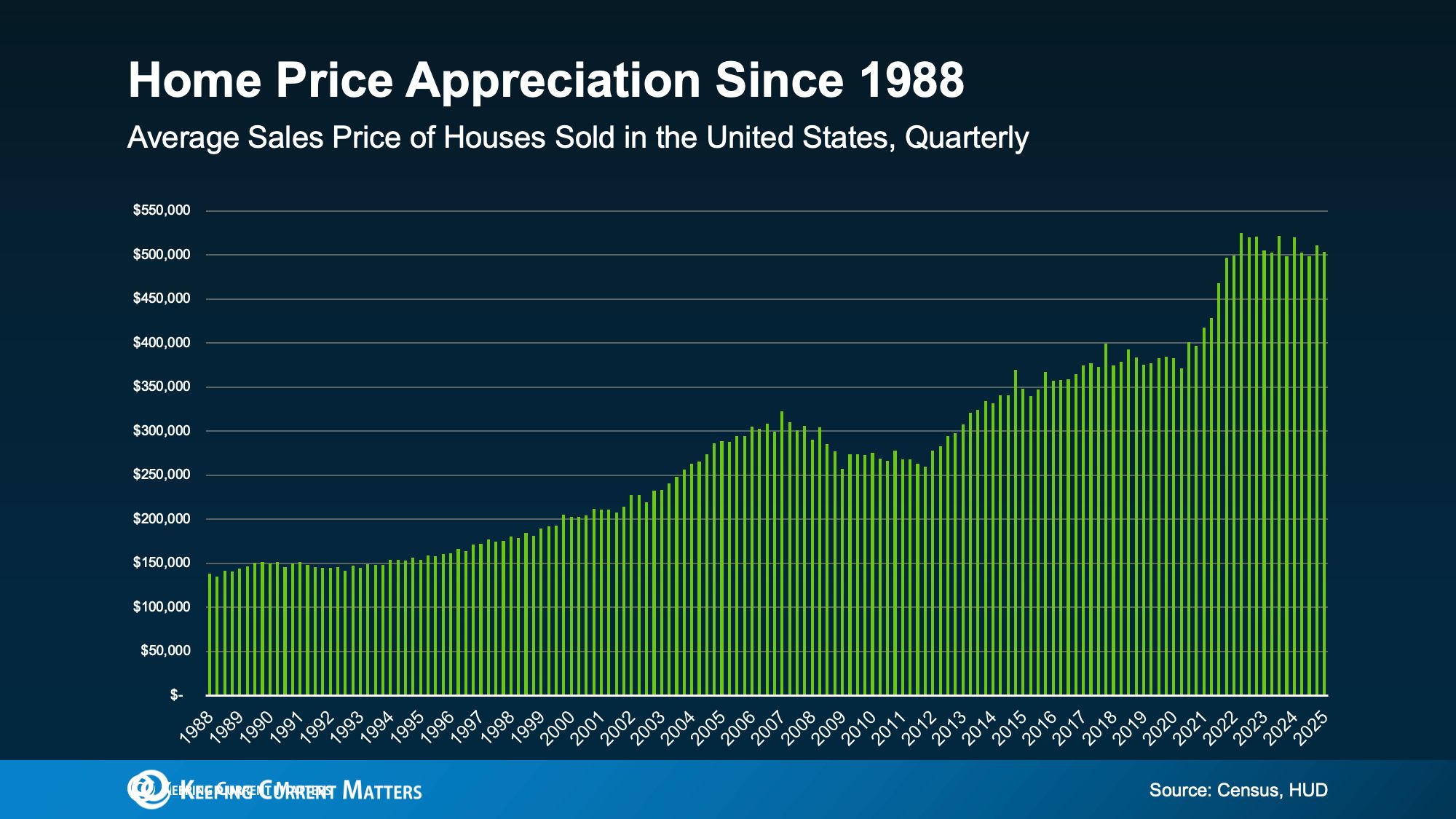

Historically, home values trend upward. So, the longer you wait, the more expensive that purchase may become—even if prices dip short-term, the long view shows steady gains (see graph below).

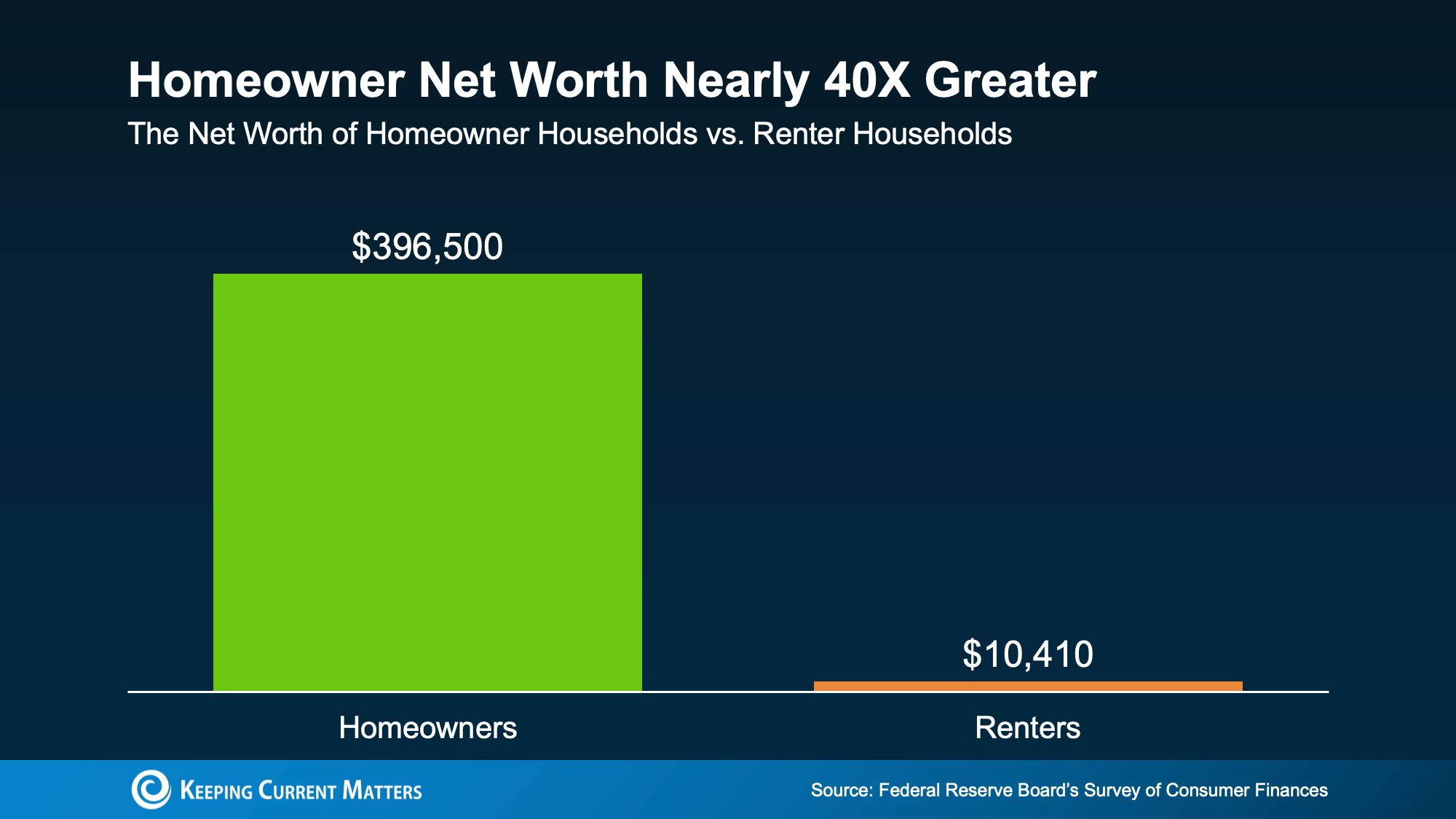

As home values increase, so does your equity—your ownership stake in the property. That’s the gap between what your home is worth and what you still owe on it. Every mortgage payment you make helps grow that equity, and over time, it becomes a key part of your overall net worth.

Here’s the eye-opener: the average homeowner’s net worth is almost 40 times higher than that of a renter. That’s a huge wealth gap—and the numbers in the graph below speak for themselves.

It’s no wonder Forbes puts it this way:

“Renting might feel like the less stressful option . . . but owning a home is still a cornerstone of the American dream and one of the most reliable ways to build long-term wealth.”

The Real Cost of Renting

In the short term, renting can feel easier. Lower upfront costs, fewer maintenance headaches, and the flexibility to move when you want. But in the long run? It can really add up.

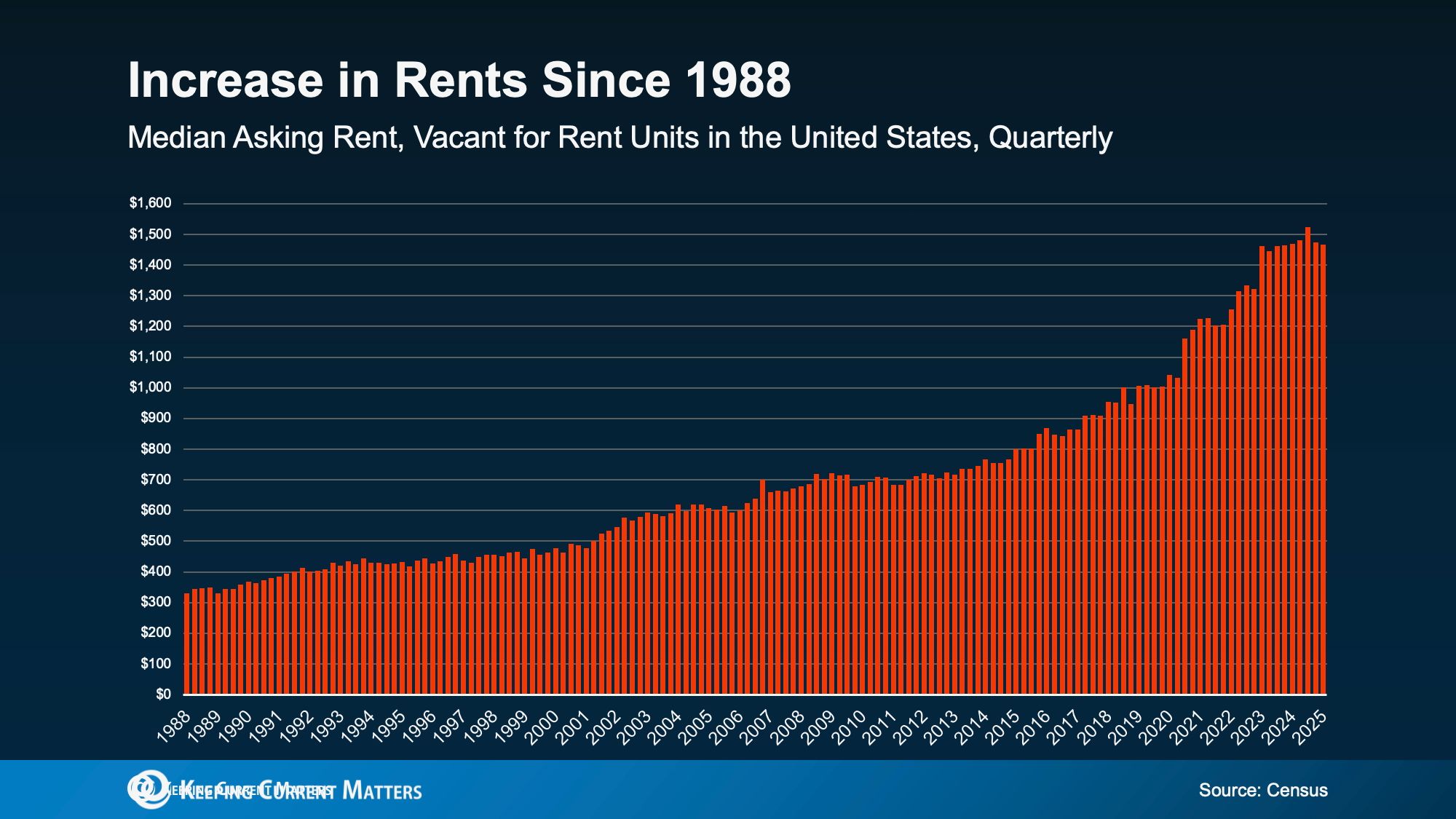

While home prices have climbed steadily over the years, rent has, too—and that’s what makes the path to homeownership harder to catch up to. Even if rent feels stable now, the long-term trend is clear: it keeps rising (see graph below).

That kind of financial uncertainty is more than just a feeling—it’s real. According to a recent Bank of America survey, 72% of aspiring buyers worry that rising rent could hurt both their short- and long-term financial future.

Here’s the bottom line: Rent doesn’t build wealth. It doesn’t come back to you later. It simply helps your landlord pay their mortgage—not yours.

So whether you rent or own, you’re paying a mortgage. The real question is: whose mortgage do you want to pay?

What Renting vs. Buying Really Comes Down To

Renting may feel more manageable in the moment. You pay your monthly rent, and that’s that. But it ends there. Owning, on the other hand, turns every mortgage payment into growing equity—a kind of built-in savings account you live in.

Yes, buying comes with more responsibility. But it also offers long-term rewards that renting never will: wealth-building, stability, and future options.

As Joel Berner, Senior Economist at Realtor.com, puts it:

“It might seem easier to keep renting, but buyers need to weigh that against the equity and generational wealth they’re missing out on. Over time, homeownership can be the smarter financial move—even if it feels tougher upfront.”

Bottom Line

Renting might feel like the more manageable option right now—and for many, it is. But over time, it can quietly cost you more, all while doing little to help you build long-term financial security or future stability.

If owning a home seems out of reach today, you’re definitely not alone. Many are in the same spot. But the key to breaking out of the rental cycle is having a plan. When you connect with a local real estate expert, you can define your goals, understand what steps to take, and start preparing now—so when the timing is right, you’re ready to make your move with confidence.

Categories

Recent Posts

GET MORE INFORMATION