Use Your Home’s Equity To Help Your Children Become Homeowners

If you own a home, chances are you’ve built up a solid amount of wealth—simply by living in it while its value appreciated over time. And that equity you’ve gained? It could be life-changing for your child.

With affordability still a major hurdle, many first-time buyers—despite having steady jobs and strong financial plans—are finding it tough to break into the housing market. That’s where your home equity can be a game-changer.

To put it in perspective, the average U.S. homeowner with a mortgage has about $311,000 in equity, according to Cotality (formerly CoreLogic). That’s a powerful financial tool—and some parents are already tapping into it to help their kids become homeowners, too.

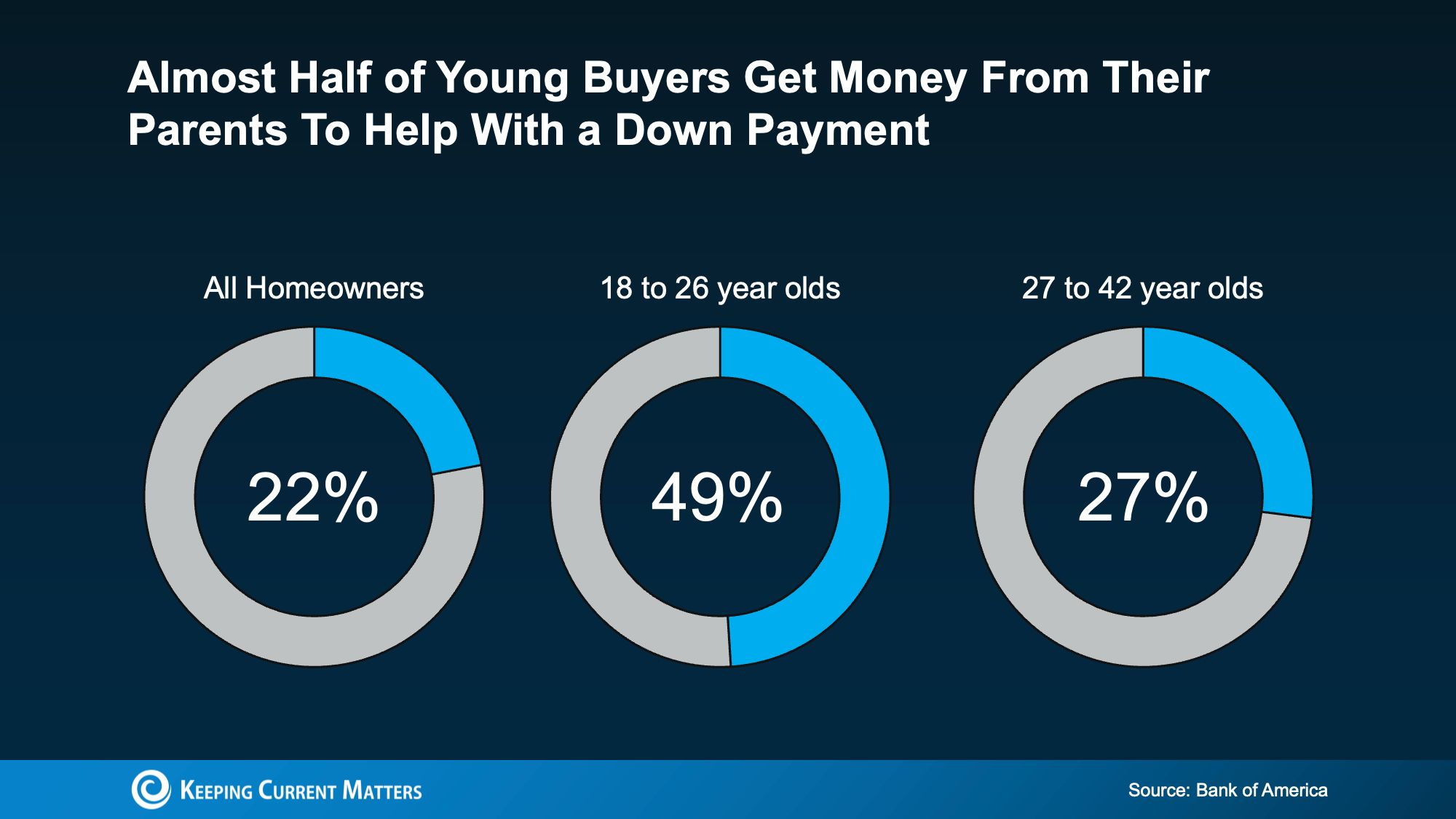

In fact, a recent report from Bank of America shows that 49% of buyers aged 18 to 26 received financial help from their parents to cover part of their down payment (see chart below).

While the data doesn’t break down exactly how many parents used their home equity to help, it’s clear that the wealth built through homeownership played a major role—especially considering how much equity today’s average homeowner has.

Of course, every family’s situation is different. But for many, using that equity to help a child buy a home becomes more than just a financial decision—it’s a legacy move. It opens the door for the next generation to start building equity, stability, and a future with fewer financial obstacles.

Because at the end of the day, this isn’t just about dollars—it’s about impact. For many parents, it’s the joy of hearing their child say, “We got the house,” and knowing they helped make it possible.

And that help really matters. According to Compare the Market, 45% of Americans who received financial support from parents or grandparents said they wouldn’t have been able to buy a home without it.

Bottom Line

Your home equity might be the key that makes homeownership achievable for your children—especially if doing it on their own feels just out of reach. So here’s a thought to consider:

If helping your kids buy a home turned out to be more within reach than you expected, wouldn’t it be worth exploring that possibility?

To find out what’s truly possible—and how to approach it in a way that makes sense for your family—connect with a trusted lender and a financial advisor. They can help you run the numbers, weigh your options, and take a smart next step.

Categories

Recent Posts

GET MORE INFORMATION