Busting the 20% Down Payment Myth

Saving for a home can feel overwhelming—especially with so many outdated assumptions floating around. One of the biggest? That you have to put 20% down. For many first-time buyers, that number can feel like an impossible hurdle. But here's the good news: it's simply not true.

So, Do You Really Need 20% Down to Buy a Home?

Unless your specific loan type or lender requires it, odds are you won’t have to put 20% down. There are loan options out there designed to help first-time buyers like you get in the door with a much smaller down payment.

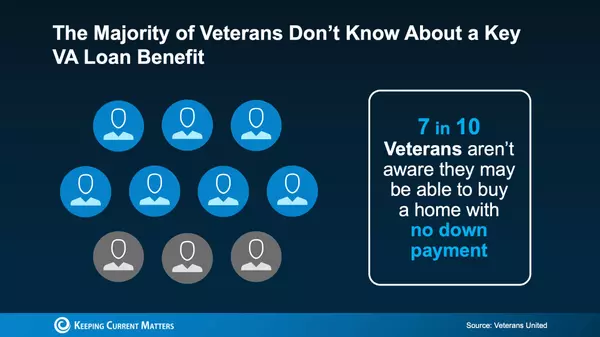

Not necessarily. Unless your lender or loan type specifically requires it, there's a good chance you can put down far less. Programs like FHA loans allow for as little as 3.5% down. And for eligible buyers, VA and USDA loans offer zero down payment options.

Sure, a larger down payment can come with benefits—like lower monthly payments or avoiding mortgage insurance—but it’s not a requirement. As The Mortgage Reports puts it:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

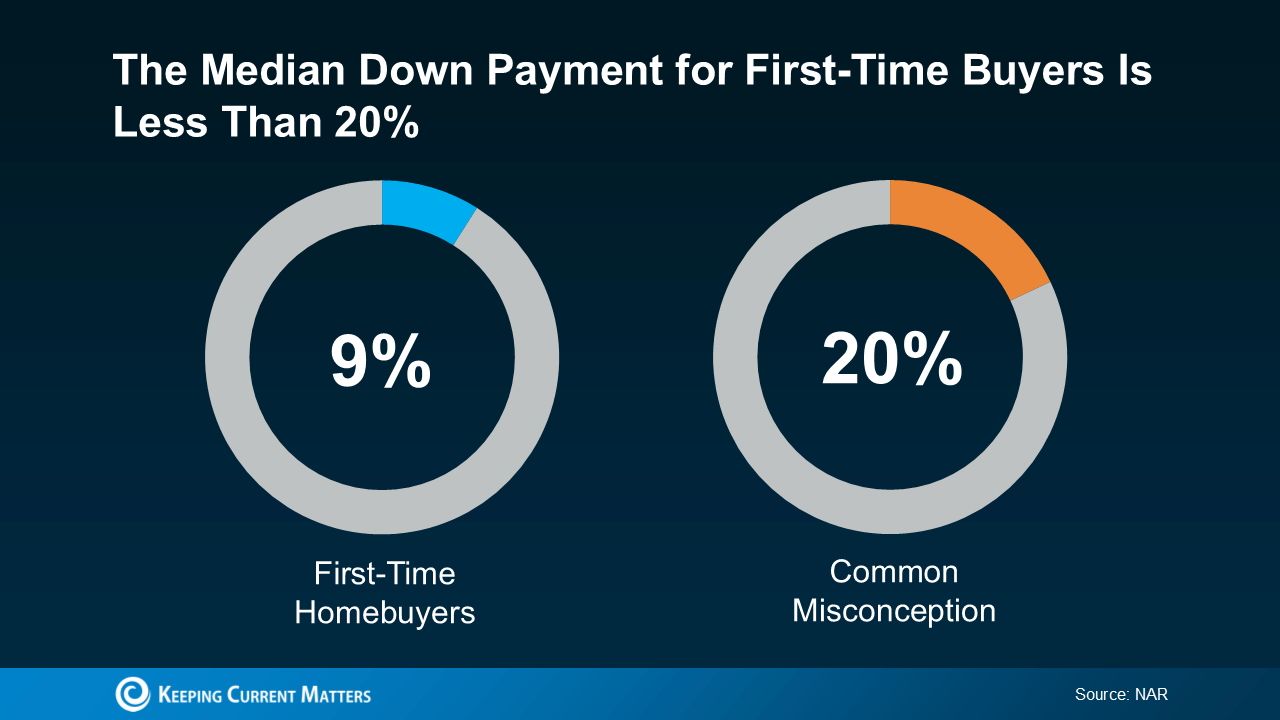

And according to the National Association of Realtors (NAR), the median down payment for first-time buyers is just 9%—far from 20%.

Bottom line? You might not need to save as much as you think. Even better—there are plenty of programs out there that can help stretch your savings even further. And the surprising part? Most buyers don’t even realize these options exist.

Why Explore Down Payment Assistance Programs?

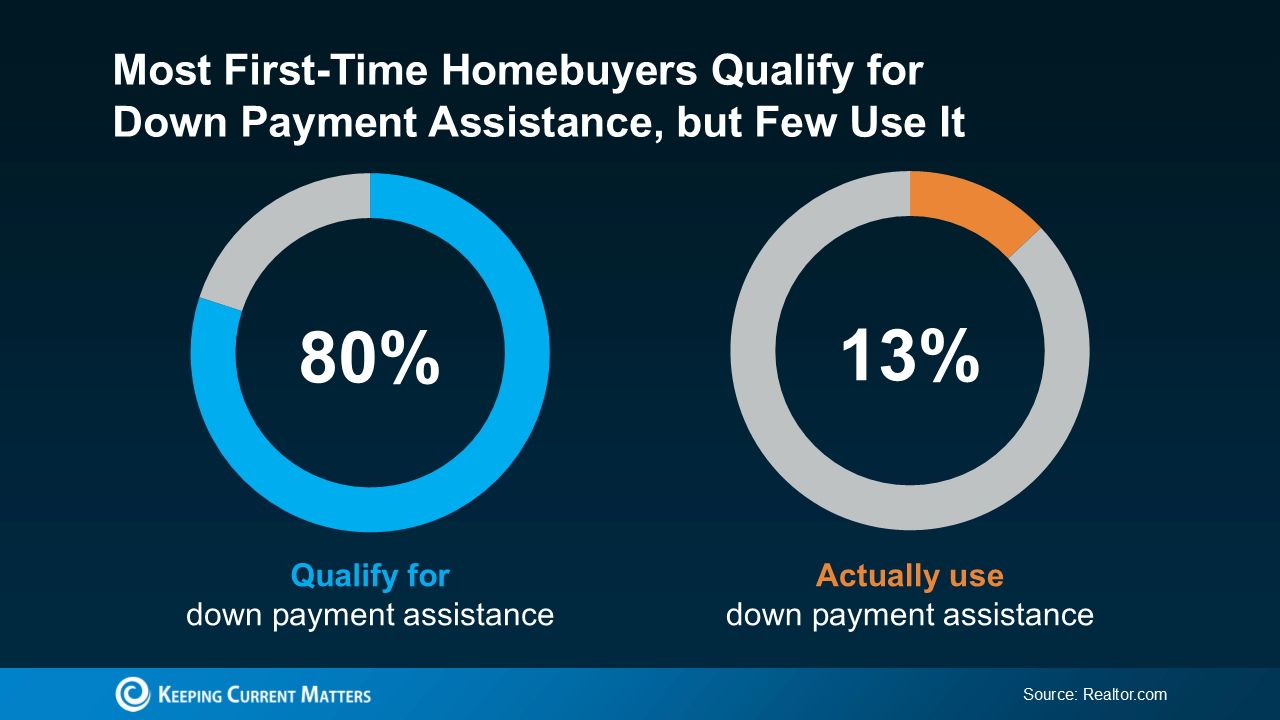

Nearly 80% of first-time buyers are eligible for down payment assistance (DPA), yet only 13% actually take advantage of it (see chart below). That’s a huge missed opportunity for many hopeful homeowners.

That’s a major missed opportunity. And we're not talking pocket change—some of these programs offer thousands of dollars toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, explains:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Now imagine what an extra $17,000 could do for your budget. In many cases, you may even be able to combine multiple programs, giving your savings an even bigger boost. These are the kinds of resources you definitely don’t want to overlook.

Bottom Line

Saving for your first home might seem overwhelming—especially if you’re still holding onto the 20% down payment myth. But the reality is, many loan programs require far less. And on top of that, there are down payment assistance options that can help stretch your savings even further.

Want to see what you qualify for? Connect with a trusted lender to explore your options and find out how close you really are to becoming a homeowner.

Categories

Recent Posts

GET MORE INFORMATION