Market Swings? Your Home's Value Stays Steady

With so much economic uncertainty lately, it’s no surprise the stock market has been all over the place. If you’ve checked your 401(k) or investment accounts recently, you’ve probably felt that gut-punch of watching it spike one day and dip the next. It’s a financial rollercoaster—one that can be hard to stomach.

But if you own a home, here’s something important to keep in mind. As Investopedia explains:

“Historically, stocks have shown much more volatility than real estate. That doesn’t mean home prices never shift—think back to 2007-2008—but those extreme drops are rare. Stocks tend to swing more wildly in value.”

In other words, while your investments might feel like they’re riding waves, home values tend to move more steadily. Housing isn’t immune to change, but it’s generally a more stable asset.

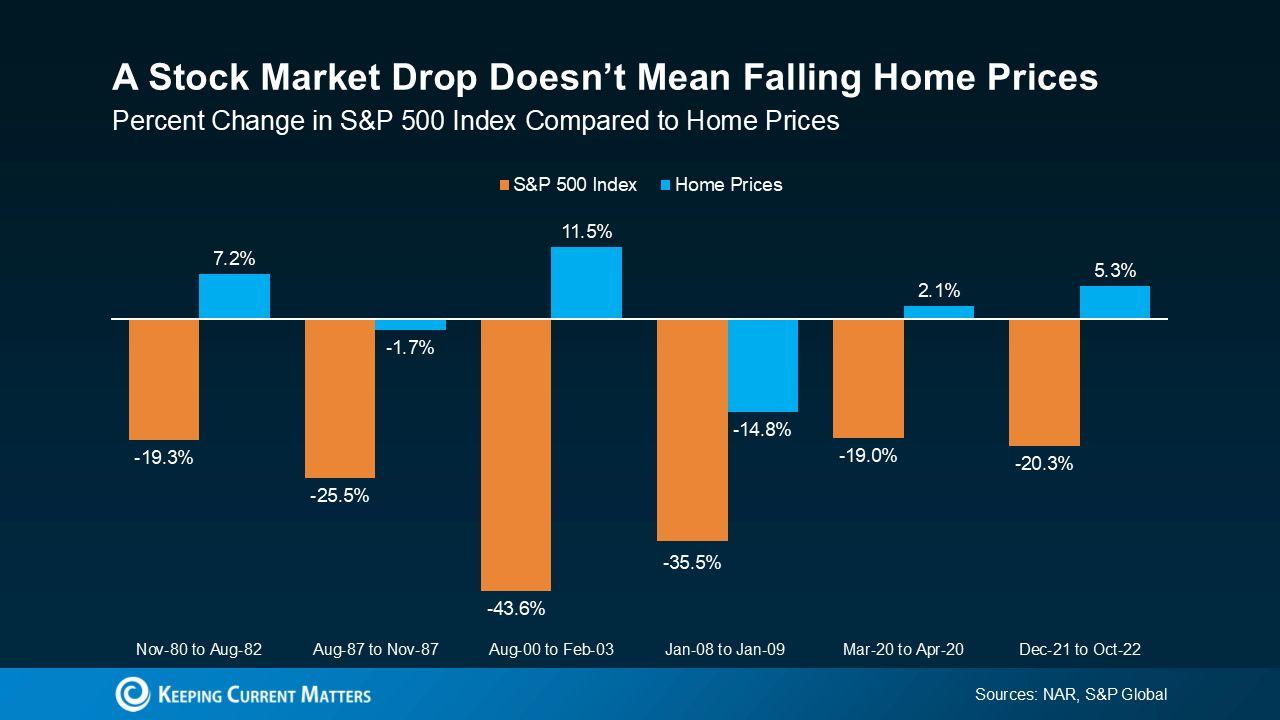

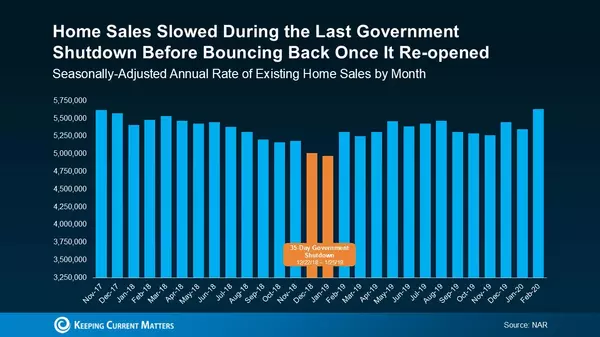

Just look at the data in the graph below—it highlights how home prices (blue bars) have held their ground during times when the stock market (orange bars) took a hit. A dip on Wall Street doesn’t mean a dive in your home’s worth.

Even when the stock market takes a major hit, home prices don’t necessarily follow suit.

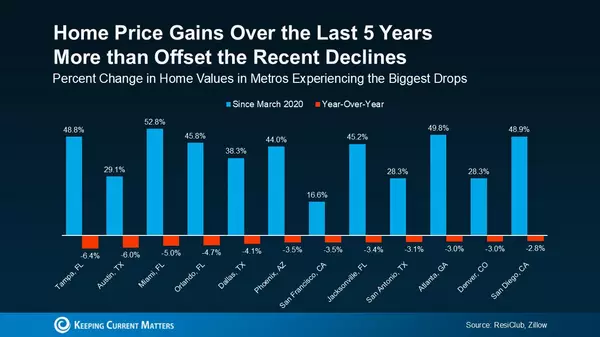

The steep price declines during 2008 stand out in our memories, but they were the exception—not the norm. That downturn was triggered by risky lending practices, subprime mortgages, and an oversupply of homes—all factors that aren’t in play today. That’s what made it such a unique and severe event.

In fact, in many other periods—both before and after that time—home values actually increased while the stock market declined. It’s a clear reminder that real estate tends to be a more stable investment.

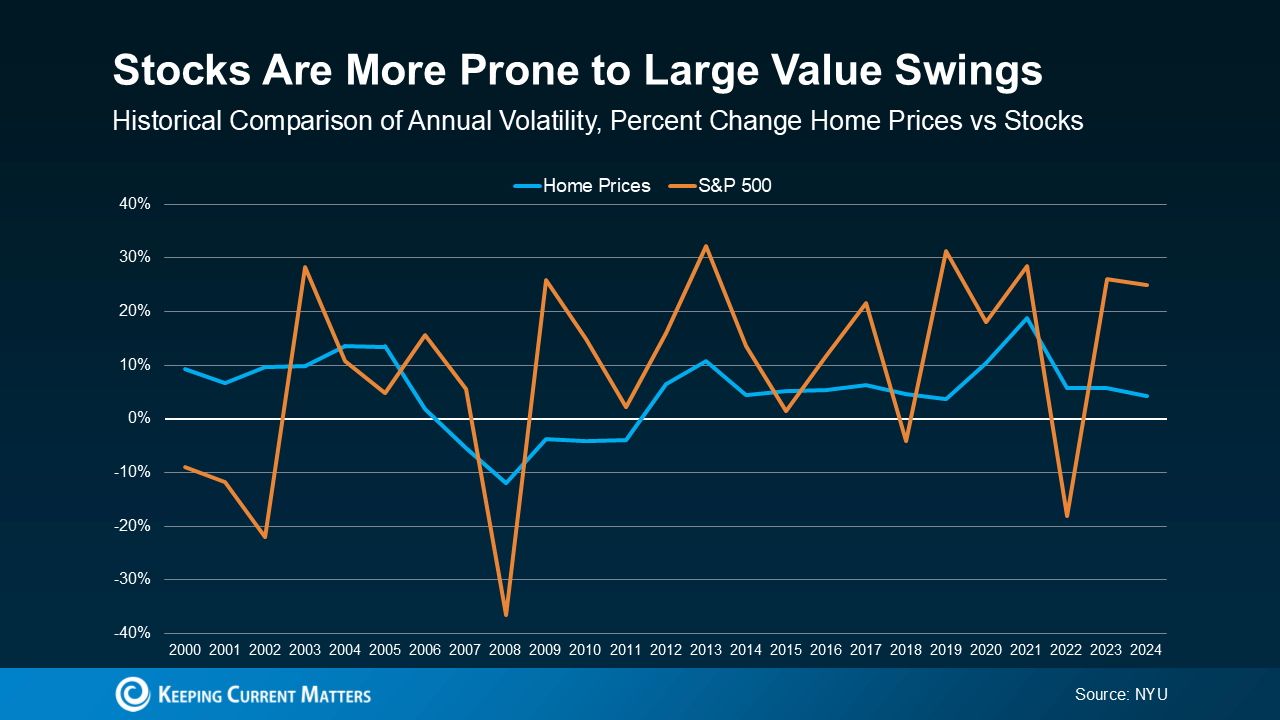

The graph below illustrates this well: while stock prices (orange line) often swing dramatically, sometimes shifting more than 30% in a single year, home prices (blue line) tend to move at a much steadier pace.

In short, stock prices tend to fluctuate a lot more than home values. One day you're riding high, the next you're facing a dip. Real estate, by contrast, doesn’t typically swing so wildly.

That’s one reason real estate often feels like a safer, more stable investment than the stock market.

So, if the recent market turbulence has you feeling uneasy about your financial outlook, take comfort in knowing your home is much less likely to follow those sharp ups and downs.

That stability is exactly why homeownership is widely considered a smart long-term investment. Even when the market feels uncertain, homeowners tend to come out ahead over time.

Bottom Line

Many people are feeling uneasy about their finances these days, and that’s completely understandable given the economic headlines. But there’s one solid reason you can feel a bit more at ease—your investment in real estate. Unlike more volatile assets, real estate has consistently proven its long-term value and resilience, offering stability when it matters most. It’s an investment that has truly stood the test of time.

Categories

Recent Posts

GET MORE INFORMATION