Would You Let $80 Stand Between You and Homeownership?

A lot of buyers are stuck in “wait-and-see” mode. Rates are hovering just above 6%, and many are thinking, I’ll jump in when they hit the 5s. And sure, everyone wants a better rate.

But here’s the truth: that magical 5.99% isn’t the game-changer most people assume.

Affordability is still tough — no denying it. But the market has already handed prepared buyers a quiet advantage. Rates have been trending down for months, and even the drop we’ve already seen can save you more than you might expect.

How Much You’ve Already Saved — Without Even Noticing

Let’s put real numbers behind it. Rates hit their peak back in May, climbing just over 7%. Since then, they’ve drifted steadily downward, and we’re now sitting in the low 6s. It might sound like a small shift, but the impact on your payment is anything but small.

Redfin’s data shows that the typical monthly payment on a $400,000 home is already nearly $400 lower than it was in May.

In other words, buyers who step in now are saving hundreds every month compared to what they would’ve paid just a few months ago. That’s meaningful cash flow — especially for anyone who hit pause thinking ownership was out of reach.

And sure, waiting for even bigger savings sounds appealing. But that strategy comes with a real risk. Here’s why.

Where Experts Expect Rates to Go Next

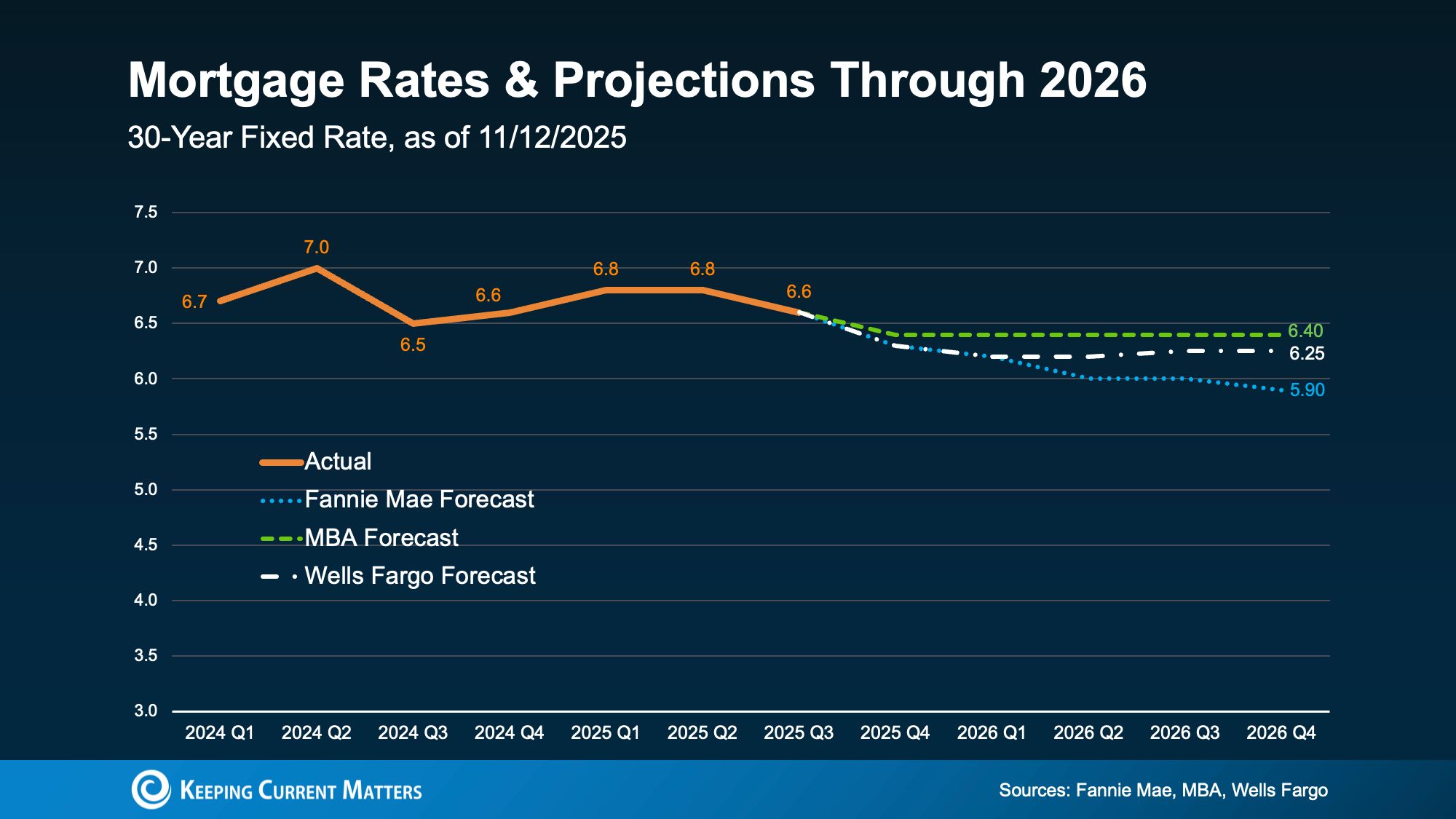

Most major forecasters agree: mortgage rates are likely to hover around today’s levels through 2026. In other words, there’s no solid reason to expect a dramatic drop anytime soon. In fact, only one forecasting group is predicting rates might dip into the upper 5s next year (see chart below).

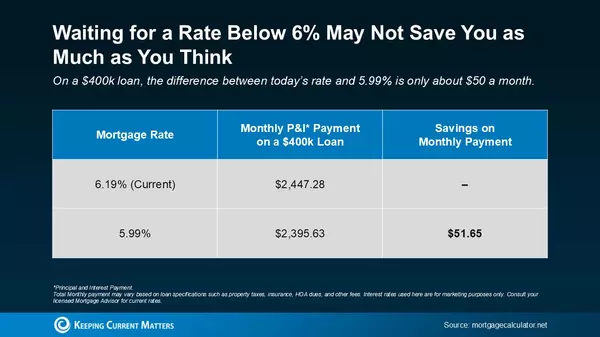

Even if rates do slip below 6%, the “extra savings” many buyers are waiting for won’t make nearly as big of a dent as they think.

The Real Math Behind a 5.99% Rate

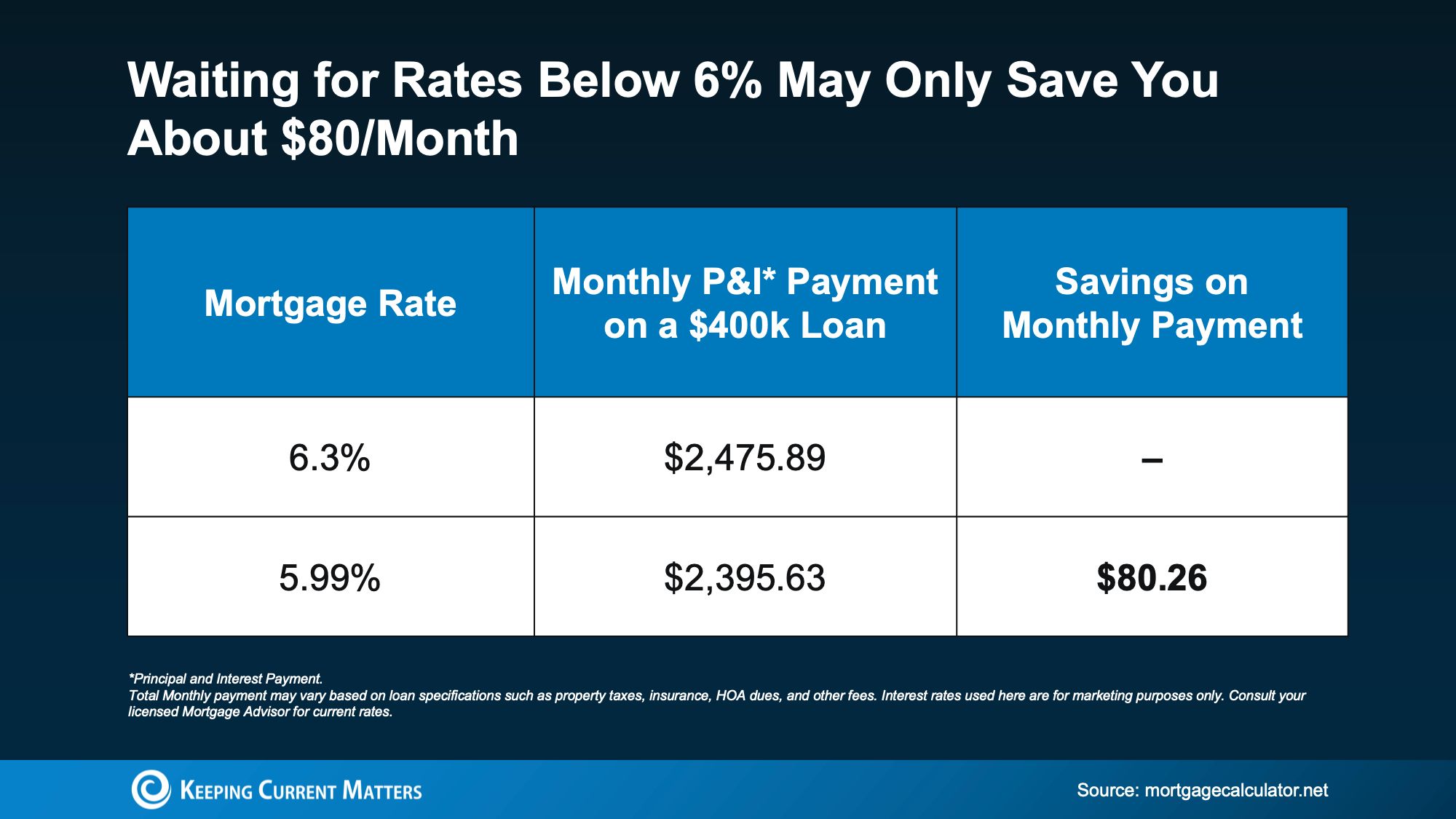

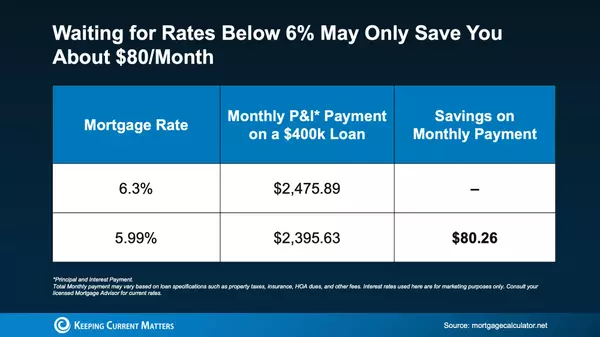

Here’s the breakdown: if rates drop to 5.99% from where they’ve been recently, you’re looking at roughly $80 a month in savings on a typical home — give or take, depending on your price point and the rate your lender offers (see chart below).

Eighty dollars. That’s all we’re talking about. For most families, that’s one night of takeout — not exactly a life-changing difference. But the nearly $400 a month you’re already saving compared to when you stopped your search this spring? That’s meaningful.

So here’s the real question:

Is waiting around for an extra $80 a month actually worth it?

Because while you’re holding out for a tiny dip, the bigger opportunity may already be passing you by.

When Rates Drop, Buyers Pile In

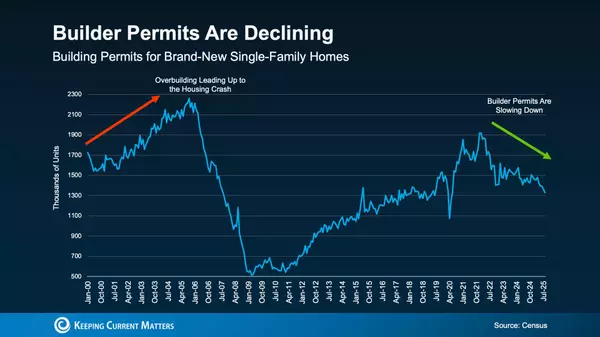

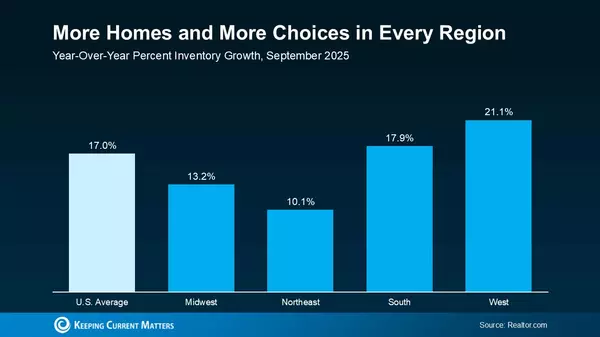

Right now, you’ve got an edge: more inventory to choose from, motivated sellers, and far less competition. But once rates dip below 6%, buyer psychology flips — and the entire landscape changes.

According to the National Association of Realtors (NAR), if rates hit 6%, roughly 5.5 million additional households could afford the median-priced home. Even if a small portion of them jump in, that’s still hundreds of thousands of buyers re-entering the market.

More competition means more bidding wars — and likely higher prices. In fact, price growth alone could wipe out the tiny savings you were holding out for.

So if you’re waiting for rates under 6%, remember: that extra $80 a month might not be worth what it ends up costing you.

Bottom Line

You don’t need to sit around waiting for 5.99%. The opportunity to move — and to save — is already here. So it’s worth asking yourself: Are you really going to let $80 a month stand between you and owning a home you love?

If you find a property that fits your life and the numbers line up, stepping in now may put you far ahead of the crowds who are waiting for a rate that might never come. Talk with a trusted agent or lender, run the scenarios, and see exactly what’s possible in your market today. A clearer picture of your buying power might show you that the right time isn’t someday — it’s now.

Categories

Recent Posts

GET MORE INFORMATION