What an Economic Slowdown Could Mean for the Housing Market

You’ve probably seen the headlines – the economy’s in the spotlight, and talk of a potential recession is picking up steam. Naturally, that’s got many homeowners and buyers asking: what could this mean for home values and affordability?

Let’s dig into the data and explore how the housing market has actually performed during past recessions, dating all the way back to the 1980s. The results might not be what you expect.

Recession Doesn’t Always Equal Falling Home Prices

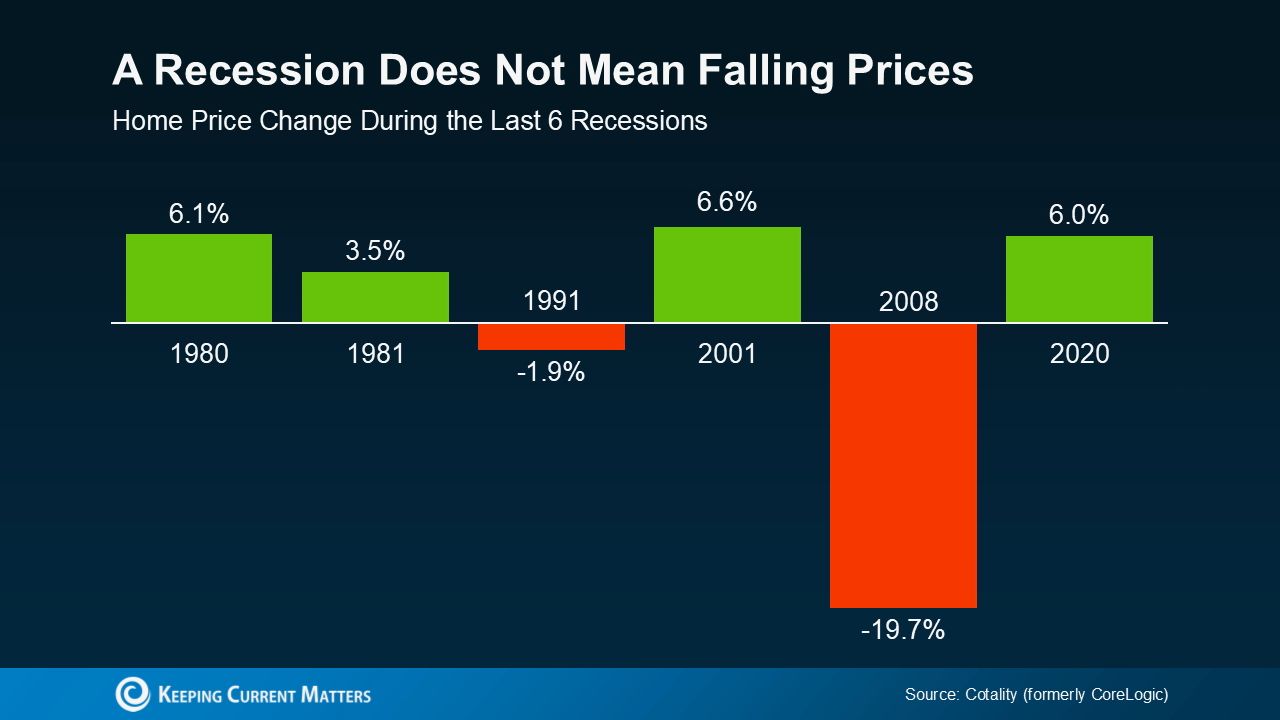

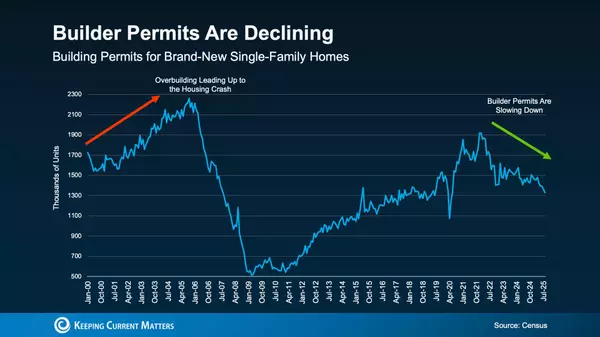

It’s a common assumption that a recession automatically means home prices will drop—but history tells a different story. The sharp decline during the 2008 crash was the exception, not the norm. That drop was largely driven by an oversupply of homes and risky lending practices, which we’re not seeing today.

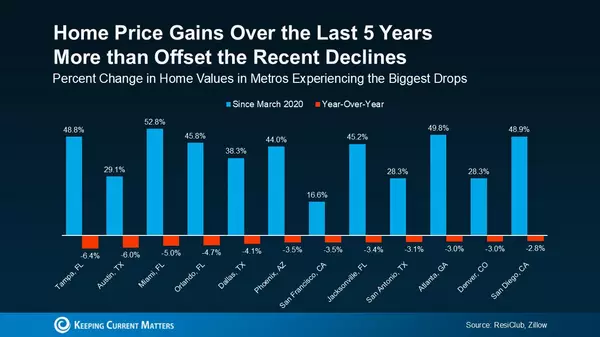

Even in areas where inventory is ticking up, supply is still well below the levels that preceded the last housing crash. In fact, Cotality (formerly CoreLogic) reports that in four of the last six recessions, home prices actually increased. Take a look at the data—it might just shift your perspective.

So before assuming a recession will trigger a major drop in home values, it’s important to look at the facts. History doesn’t back up that belief. In most cases, home prices tend to stay on their existing path — and right now, nationally, that path still points upward, just at a more moderate pace.

Recessions Often Bring Lower Mortgage Rates

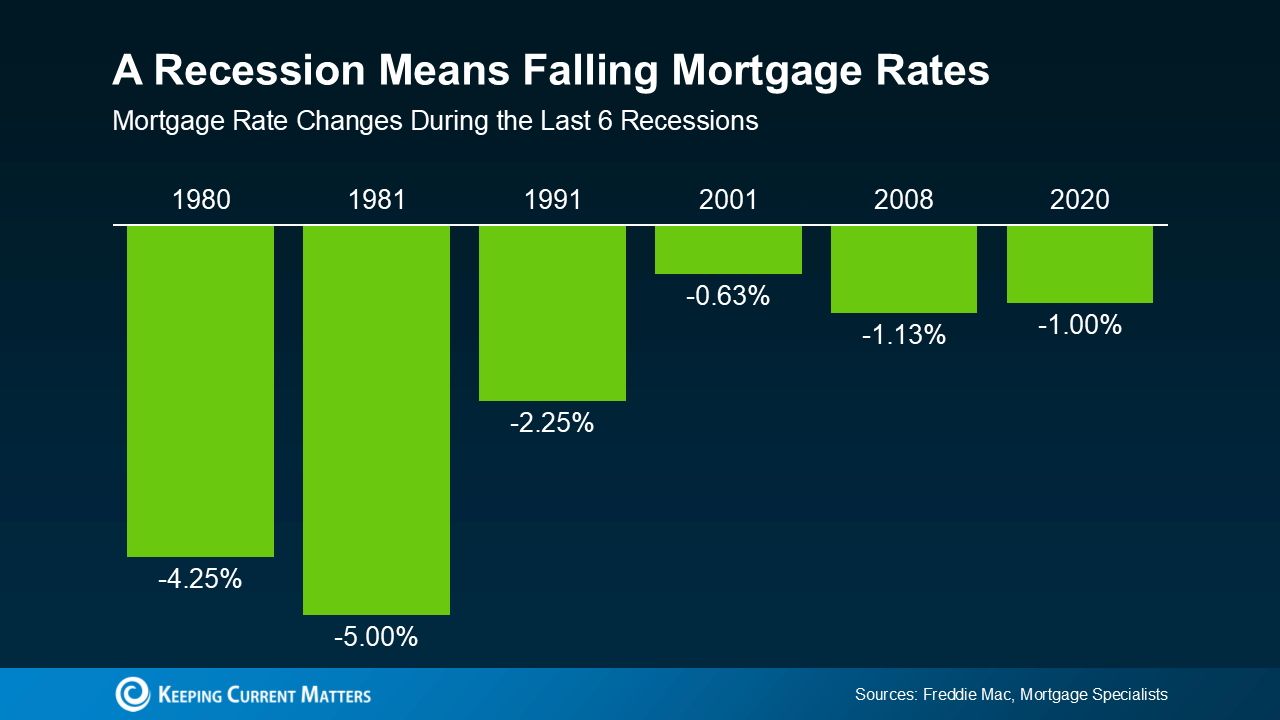

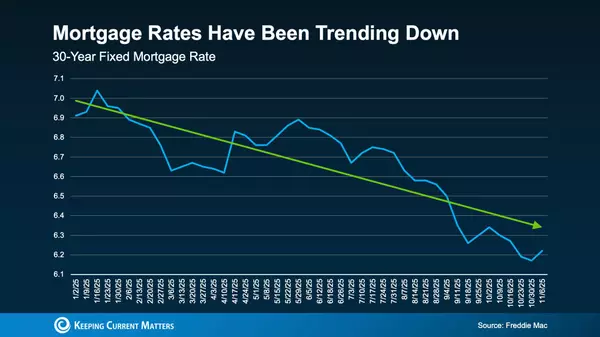

While home prices may hold steady or continue their gradual rise, mortgage rates typically respond differently. Historically, economic slowdowns have led to lower interest rates. In fact, during each of the last six recessions, mortgage rates dropped — and that trend could repeat if a slowdown occurs again (see graph below).

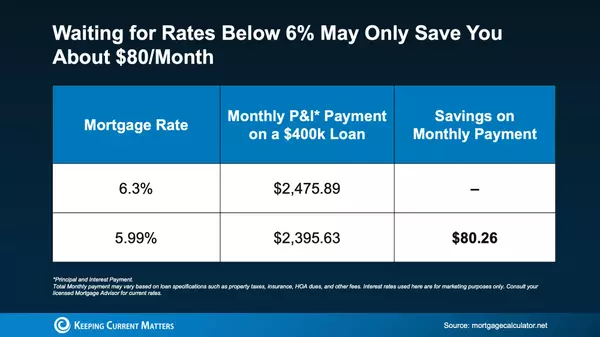

A recession could lead to lower mortgage rates, which would improve your buying power — but don’t count on seeing 3% rates again.

Bottom Line

While we don’t yet have a definitive answer on whether a recession will happen, the likelihood has certainly increased. Even so, that doesn’t mean you need to worry about the impact on the housing market — or your home’s value. Historical trends give us a clearer picture of how the market typically behaves during economic slowdowns.

If you’re curious about how today’s economic conditions are affecting your local real estate market, now is a great time to connect with a trusted agent who can help you make sense of it all and plan your next steps with confidence.

Categories

Recent Posts

GET MORE INFORMATION