Buying is Better than Renting in 22 Major U.S. Cities

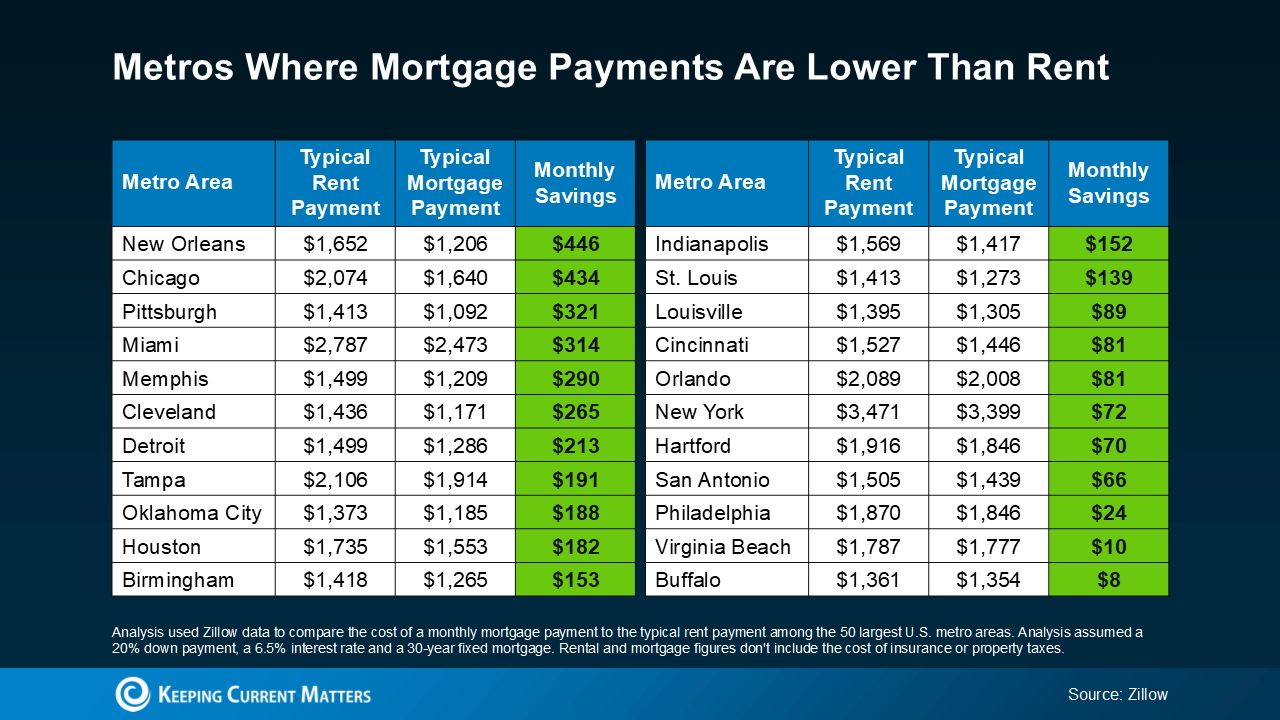

That's correct—based on a recent Zillow study, monthly mortgage payments are now lower than rent payments in 22 out of the 50 largest metro areas (see chart below):

With mortgage rates easing from recent highs, home prices stabilizing, and inventory levels rising, housing affordability has improved considerably. This shift means that in many parts of the country, it’s becoming more affordable to buy a home than to rent one.

If you’ve been renting for a while, this is a game-changer. But if your city isn’t on the list yet, don’t worry—conditions are evolving quickly, and your area could soon be in a similar position. That’s why it’s crucial to speak with a local real estate agent to get a pulse on your market. Understanding how the dynamics are changing in your preferred neighborhood can make a big difference in your homebuying decisions. What once seemed out of reach might be closer than you think.

Keep in mind that this study compares monthly rent to just the principal and interest on a mortgage, not the entire monthly payment. However, as Zillow points out, there are additional costs to homeownership, like property taxes, insurance, utilities, and maintenance, which should be included in your budget calculations. But remember—renters have extra costs, too, such as renters’ insurance, utilities, parking, and other fees. Doing the math might seem daunting, but today, it’s a much more exciting equation to solve.

So, grab your calculator and connect with your agent, because the takeaway is clear: it could be time to reevaluate your budget and see if you can now afford what seemed impossible just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, explains:

“...for those who can make it work, homeownership may offer lower monthly costs and the chance to build long-term wealth through home equity—something renters miss out on. With mortgage rates dropping, it’s a great opportunity to reassess your affordability and determine if it’s a better financial move to buy than rent.”

Whether you’re in one of these budget-friendly metro areas where the scales have already tipped or somewhere in between, now is the time to reach out to a local real estate agent and start the conversation.

With mortgage rates declining and more homes coming onto the market, you’ll want to be ready to act—before everyone else does.

Bottom Line

If you’re tired of renting and wondering if now’s the time to buy, connect with a local real estate agent. Together, you can run the numbers and see if homeownership makes sense for you today—or in the near future.

Categories

Recent Posts

GET MORE INFORMATION