Foreclosures Are Up—But Here’s Why It’s Not a Crisis

When it feels like the price of everything is climbing, it’s understandable to wonder how that impacts the housing market. Some are starting to worry that rising costs might lead more homeowners to fall behind on their mortgage payments—and possibly trigger a surge in foreclosures. And with recent reports showing a slight increase in foreclosure filings, that concern is gaining traction.

But before jumping to conclusions, it’s important to take a step back and look at the full picture.

This Isn’t 2008 All Over Again

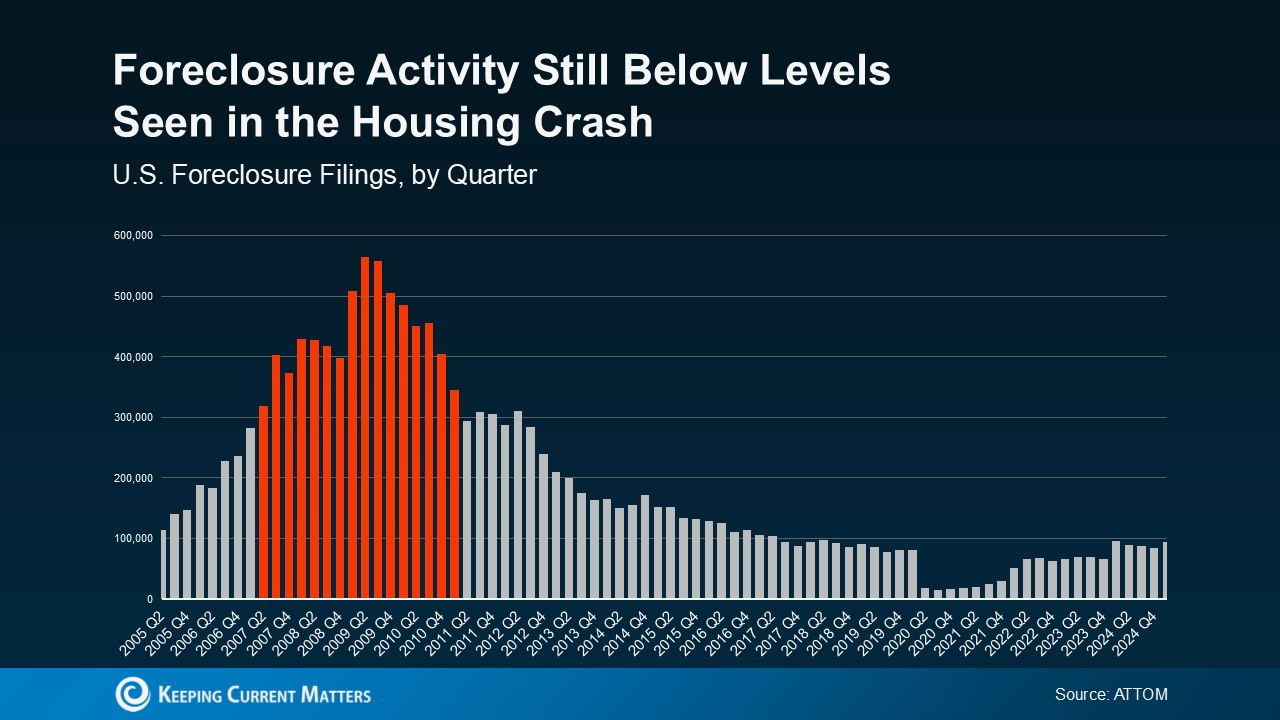

Yes, foreclosure activity did rise slightly in the latest quarterly report from ATTOM. But it’s still running below historical averages—and nowhere near the levels seen during the last housing crisis. That contrast becomes even more obvious when you look at the data over time.

A side-by-side comparison of Q1 2025 and the peak foreclosure years during the 2008 crash (highlighted in red on the graph) shows just how different today’s market truly is.

Back in 2008, the story was very different. Loose lending practices gave mortgages to buyers who couldn’t truly afford them. When those payments became unmanageable, foreclosures surged, flooding the market with distressed properties. The result? An oversupply of homes and a steep drop in prices.

Today’s lending standards are much tighter, and most homeowners are on solid financial ground. That’s one key reason foreclosure activity remains relatively low—even with a slight recent uptick.

If you're comparing today's numbers to 2020 or 2021 and thinking foreclosures have “spiked,” here’s an important reminder: those were unusual years. Federal protections like foreclosure moratoriums were in place during the pandemic to help homeowners avoid losing their homes during uncertain times. That artificially reduced foreclosure filings during those years.

So instead of measuring against those low points, look at more typical years like 2017 through 2019. By that comparison, today’s foreclosure filings are still below average—and far from what we saw during the crash.

Of course, any foreclosure is difficult. These aren’t just statistics—they represent real people facing real challenges. But zooming out, the current trend doesn’t suggest market instability.

Why We Haven’t Seen a Wave of Foreclosures

One major reason? Equity.

Thanks to several years of rising home values, most homeowners now have a strong financial cushion. As Rob Barber, CEO of ATTOM, puts it:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike.”

In simple terms: even if someone hits financial trouble, they’re more likely to sell their home than face foreclosure—because they have equity to work with. That’s a major shift from 2008, when many were underwater on their mortgages and couldn’t sell.

Rick Sharga, Founder and CEO of CJ Patrick Company, echoes that in a recent Forbes article:

“A significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Bottom Line

While foreclosure activity has ticked up recently, it’s still nowhere near the levels we saw during the 2008 housing crash. The key difference? Most homeowners today have far more equity in their homes, providing a financial buffer even as living costs continue to climb.

If you're a homeowner experiencing financial difficulty, don’t wait—reach out to your mortgage provider. You may have more options than you realize, and taking action early can help you protect your investment and avoid unnecessary stress.

Categories

Recent Posts

GET MORE INFORMATION