How Downsizing After Retirement Simplifies Your Life

Retirement offers a time for relaxation, adventure, and indulging in your passions. As you envision this thrilling new chapter in your life, it's essential to consider if your current home still meets your needs.

If your current home is too large, too expensive, or simply not convenient anymore, downsizing could enhance your retirement experience. To determine if a smaller, more manageable home is ideal for your new lifestyle, consider these questions:

- Do the original reasons for buying my current house still apply, or have my needs evolved since then?

- Do I truly need and desire the space I currently have, or would a smaller home be more suitable?

- What are my current housing expenses, and how much do I aim to save by downsizing?

If you answered yes to any of these questions, consider the advantages of downsizing.

The Advantages of Downsizing to a Smaller Home

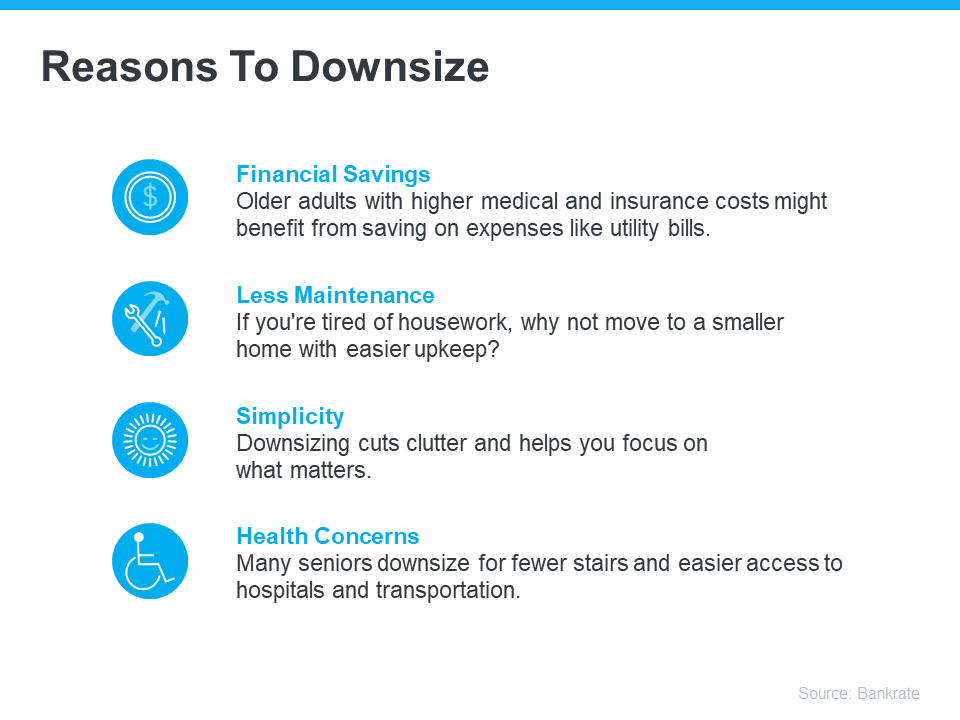

There are numerous reasons to downsize. Here are a few highlighted by Bankrate:

How Your Home Equity Can Facilitate Downsizing

If those benefits appeal to you, you might already have the resources to make it happen. A recent article from Seniors Guide explains:

"With homeowners aged 62 and older holding over $12 trillion in home equity, downsizing becomes a sensible option..."

If you've owned your home for some time, chances are you've accumulated a significant amount of equity. This equity can be leveraged to purchase a home that better suits your current needs. Greg McBride, Chief Financial Analyst at Bankrate, elaborates:

"Downsizing involves converting that equity from the sale of your home into cash or a substantial down payment on a more affordable home, thereby lowering your monthly living costs."

When you're prepared to leverage your equity for your next move, your real estate agent will assist you every step of the way. This includes pricing your current house competitively for sale, identifying a home that aligns with your changing needs, and navigating affordability considerations at today’s mortgage rate.

Bottom Line

Beginning your retirement journey? Consider downsizing—it could greatly benefit you. When you're ready, consult with a local real estate agent to discuss your housing goals this year.

Categories

Recent Posts