How Modern Buyers Are Innovating to Afford Their Dream Home

Feeling daunted by sky‑high prices, rising interest rates, or just not feeling “ready” to buy? You’re in good company. The 2025 NextGen Homebuyer Report finds that while nearly 60% of Gen Z and Millennial buyers believe owning a home is within reach, only 19% feel like now is the right moment to pull the trigger.

So what’s their playbook? They’re thinking outside the box. Below are the four most popular alternative buying strategies young buyers are embracing in 2025—and how to tell if one could be your ticket into homeownership.

1. Tackling a Fixer‑Upper

- Who’s doing it: 42% of buyers in our survey

- Ideal for: DIY‑savvy buyers hunting extra space at a bargain

- Not so great if: You need a turnkey home or have limited renovation funds

Buying a property that needs some TLC can unlock neighborhoods that seem out of reach—fixer‑uppers often list for 10–30% less than comparable move‑in‑ready homes.

Why it works

- Lower purchase price upfront

- Rapid equity growth as you renovate

- Freedom to customize every detail

Watch out for

- Renovation expenses that can escalate

- Permits, inspections, and lengthy timelines

- Financing hurdles with standard mortgages

If a fixer‑upper sounds like your path to homeownership, talk to your agent about renovation-friendly loans—like an FHA 203(k)—that let you roll remodeling costs into your mortgage.

2. Pooling Resources with Friends or Family

- Who’s trying it: 21% of all buyers (32% of Gen Z)

- Ideal for: Buyers with trusted partners ready to combine funds

- Not so great if: You lack clear agreements or share different financial goals

More and more buyers—especially Gen Z—are teaming up with siblings, friends, or partners to split the cost of a home. When done right, co‑buying can halve your expenses and double your purchasing power.

Why it works

- Shared down payment and mortgage payments

- Bigger budget for a nicer home or better location

- Built‑in support network

What to watch for

- Need for solid legal agreements up front

- Potential financial and relationship strains if conflicts arise

- Must define exit or resale plans in advance

Thinking about co‑buying? Have a real estate attorney draw up a co‑ownership agreement that details each party’s contributions, equity split, and the process if someone decides to sell.

3. House Hacking

- Who’s leveraging it: Almost 1 in 5 buyers (18.6%)

- Ideal for: Buyers willing to rent out part of their property

- Not so great if: You prize complete privacy or a single‑use home

House hacking involves purchasing a property—such as a duplex, ADU, or basement apartment—and renting out a unit (via Airbnb or long‑term lease) to offset your mortgage.

Why it works

- Creates a steady stream of rental income

- Cuts down or even covers your monthly mortgage bill

- Transforms your home into a long‑term investment

What to watch for

- Zoning rules and city regulations can limit rentals

- You’ll share space or take on landlord duties

- Extra insurance and careful financial planning are required

Before diving in, research your local short‑term rental (STR) laws—some areas require permits or prohibit certain rental setups.

4. Moving to a Lower‑Cost Market

- Who’s considering it: 47% of buyers surveyed

- Ideal for: Remote workers, flexible buyers, or anyone priced out locally

- Not so great if: You’re committed to one school district, job site, or tight-knit community

The rise of telecommuting means almost half of young buyers are eyeing more affordable regions where their dollar goes further.

Why it pays off

- More living space within your budget

- Lower property taxes and overall expenses

- Faster wealth-building through appreciating, less‑expensive homes

What to watch for

- May need a new job or longer commute if remote work shifts

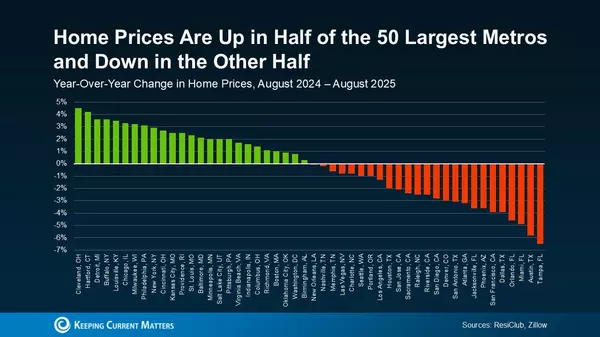

- Some areas have fewer amenities or slower price growth

- Difficult to tour properties in person when relocating far

Talk to your agent about emerging suburbs or overlooked towns just beyond the hottest markets—you might uncover a hidden gem with strong upside.

Closing Thoughts: Innovate with Insight

Homeownership today offers more creative avenues than ever—so take advantage, but don’t go in blind. Whether you’re splitting costs with a friend, tackling a fixer‑upper, or exploring a new, budget‑friendly market, run the numbers, research your options, and choose the strategy that fits your goals.

Categories

Recent Posts

GET MORE INFORMATION